Latest Insights in Stock Market Investing

Covered Call Writing ETFs: Do They Deserve to Be So Popular?

click ↑ 4 Featured Covered call writing ETFs are exchange-traded funds consisting of a portfolio of stocks that are leveraged to generate income by selling call options against those shares. As investors strive to generate high yield returns, these securities have...

BCI PODCAST 164: The Poor Man’s Covered Call (PMCC) LEAPS Selection

The Poor Man's Covered Call (PMCC) is a covered call writing-like strategy where a LEAPS options acts as a surrogate for a long stock or ETF position. The time-value component of the LEAPS price is a key factor in determining how we should structure our initial...

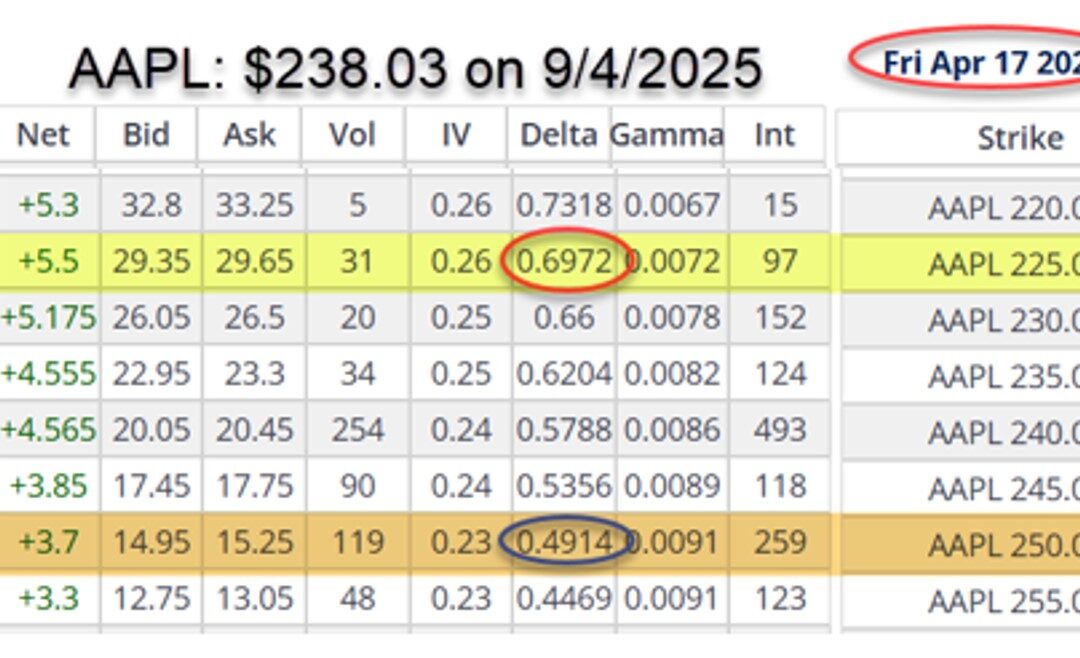

Unlocking the Mystery of Longer-Dated Call Options & Delta

click ↑ 4 Featured Covered call writers (put sellers, too) may analyze Delta stats prior to executing option trades. This article will explore the relationship between Delta and time-to-expiration. Who thinks Delta goes up over time? Who believes it goes down over...

Ask Alan #238: Why consider Rolling-Out?

Hello Alan, I am new to BCI, but I have read your books, and I am now paper trading to test what I have learned. I could not be happier with what I am learning from your books and from paper trading using your methodologies. After my first month of paper trading, I...

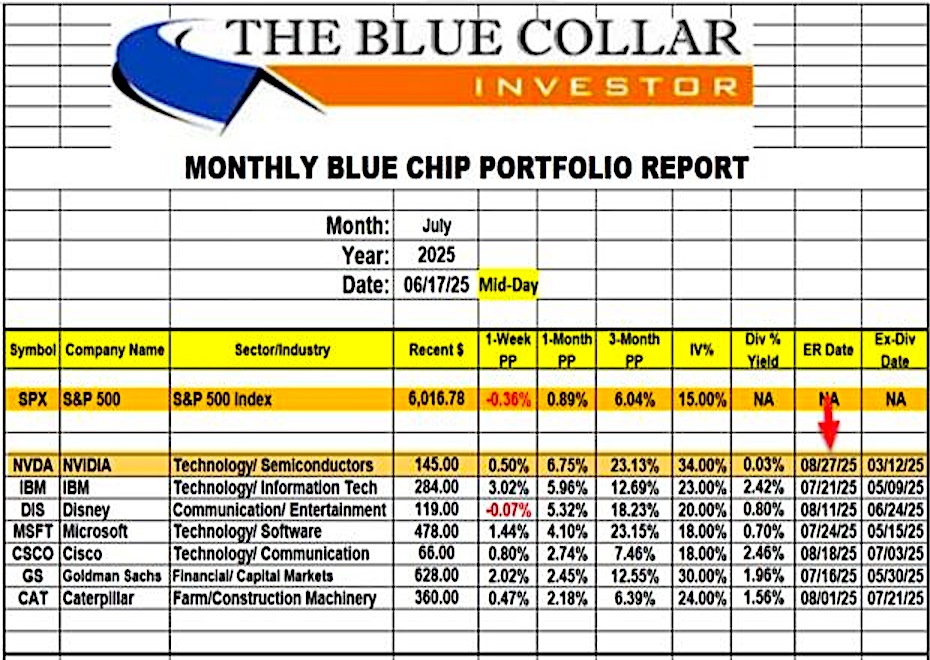

Setting Up Option Portfolios Using Stock Selection, Diversification, Cash Allocation and Calculations

click ↑ 4 Featured When establishing our covered call writing & cash-secured put portfolios, there are several metrics we should use to minimize risk and enhance our overall returns. This article will identify and explain these critical resources. Checklist for...

BCI PODCAST 163: Making a Great Covered Call Trade Even Better

This podcast demonstrates how to integrate the 3 required skills (stock selection, option selection and position management) that resulted in an annualized 145% return. Free Resources: https://thebluecollarinvestor.com/minimembership/bci-free-resources/...

Using the Capital Adjustment Section of Our Trade Management Calculator (TMC) to Generate Precise Total Portfolio Calculations

click ↑ 4 Featured When we execute multiple exit strategies in the same contract cycle using the same cash investment, the TMC will provide us with accurate individual trade calculations. But, what about total portfolio calculations? Yes, our TMC will also afford us...

Using the Mid-Contract Unwind Exit Strategy to Achieve an 8.4%, 25-Day Return

click ↑ 4 Featured It is not uncommon to attain greater than maximum returns when implementing our covered call writing exit strategies. In this article, a series of trades will be analyzed where the mid-contract unwind (MCU) exit strategy was employed to perfection....

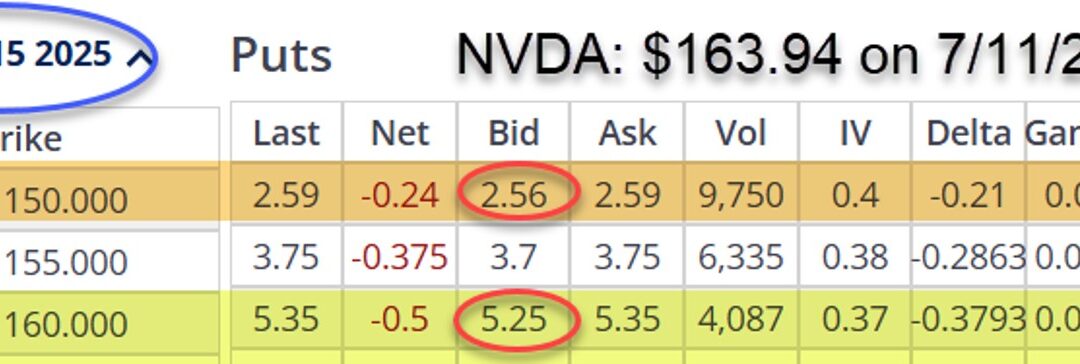

Lowering Cash-Secured Put Breakeven Price Points Means Greater Protection to the Downside with Lower Premium Returns

click ↑ 4 Featured When executing our cash-secured put trades in bear, volatile or uncertain market conditions, it is reasonable to structure our trades with lower breakeven price points. This will come at the expense of lower initial time-value returns. It is...

Explore Investment Topics

Covered Call Exit Strategies

Exit Strategies

Our Journey and Mission

The Blue Collar Investor was founded with a simple mission: to empower everyday individuals with the knowledge to invest wisely in the stock market. Our blog focuses on demystifying stock options, providing readers with the tools they need to succeed. We believe that anyone can learn to invest effectively, regardless of their background or experience.

Our story began when our founder Dr. Alan Ellman, realized the lack of accessible resources for average investors. Determined to bridge this gap, we created a platform that offers comprehensive guides, expert tips, and real-world strategies. Today, The Blue Collar Investor is a trusted resource for thousands of readers seeking to enhance their financial literacy and achieve their investment goals.