The VIX is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which is a measure of the implied or expected volatility of S&P 500 options over the next 30 days. This implied volatility is reflected in the premiums paid for the options. It is constructed using the implied volatilities of a wide range of S&P 500 index options. This volatility is meant to be forward looking and is calculated from both calls and puts. The VIX is a widely used measure of market risk and is often referred to as the investor fear gauge.

There are three variations of volatility indexes: the VIX tracks the S&P 500, the VXN tracks the Nasdaq 100 and the VXD tracks the Dow Jones Industrial Average. In our BCI methodology we focus in on the VIX because it gives us the broadest view of the overall market.

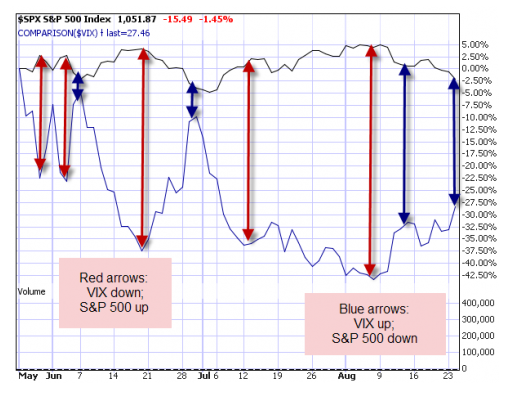

The VIX is a useful indicator for short-term investors including 1-month covered call writers. Generally speaking as market volatility increases the market pricing will diminish and vice-versa. The VIX is said to have an inverse relationship with the S&P 500. If we see a declining VIX or one that is remaining stable at a low level (below 30) along with an appreciating S&P 500, we have a favorable environment for selling covered call options. Below is a chart showing the inverse relationship between the VIX and the S&P 500 over a 3 month time frame:

- The VIX vs. The S&P 500

Inverse relationship between the VIX and the S&P 500

The red arrows highlight areas when the VIX was declining and the S&P 500 was appreciating and the blue arrows show just the opposite. This relationship is reliable but not 100% accurate. However, it does add information that will help guide us in our investment decisions like strike selection for example. Like all other technical tools the VIX should be used in conjunction with other fundamental, technical and common sense indicators.

Current VIX:

A 6-month chart of the VIX and the S&P 500 shows an accelerating market benchmark and a declining VIX. More recently the VIX has remained stable at a low level. These factors, along with predominantly bullish weekly economic reports, have painted a bullish market tone in the eyes of this investor. Below is a current comparison chart of the S&P 500 and the VIX:

Vix and the S&P 500 as of 3-30-12

-

Sell out-of-the-money strikes

-

Use high beta stocks

-

Roll out-and-up rather then just out

-

Be fully invested

Conclusion:

The VIX is a short-term window into potential market risk. The less risk implied in the stock market, the more likely investors will participate in the market. This CBOE fear gauge should be used in conjunction with our other screens to make the best non-emotional investment decisions which in turn will maximize our profits to the highest possible levels.

Upcoming events:

April 3rd:

I will be interviewed by Kerry Lutz of the Financial Survival Radio Network on the topic of covered call writing. When I receive the link to listen to the broadcast, I’ll publish it on this site.

April 14th:

I will be the keynote speaker for the American Association of Individual Investors/Atlanta Chapter at the Cobb Galleria. The meeting runs from 10AM to 1PM EST and everyone is invited. The club charges $10 for pre-registration and $15 at the door. Here is the link to register:

May 8th:

I will be the keynote speaker for the Long Island Stock Investors Meetup Group at the Plainview-Old Bethpage Library Auditorium. There is no charge to attend and all are invited. I will post additional information as we get closer to this event.

Market tone:

This week’s economic reports were mixed to positive:

-

The Conference Board Consumer Confidence Index fell to 70.2 in March from February’s level of 71.6. Despite this decline, the level shows that consumers have not lost faith in the economic recovery

-

The US economy grew at an annual rate of 3.0% in the 4th quarter up from 1.8% in February, the highest level for any quarter in 2011

-

Personal spending increased by 0.8% in February, the highest since July while wages increased by only 0.3%. This is seen as a sign that consumers are confident in our economy

-

New durable goods orders increased by 2.2% in February much better than the previous month but slightly below expectations

For the week, the S&P 500 rose by 0.8% for a year-to-date return of 12.6%.

Summary:

IBD: Uptrend under pressure

BCI: This site remains moderaterly bullish favoring out-of-the-money strikes

Welcome to our growing community of premium members.

My best to all,

Alan ([email protected])

This is re-posted from late last night…

Example of using trend lines/20 day EMA…Hitting a “double”…

BCI community,

Here is a good example of using the technical tools that Alan teaches…in this case, the use of the 20 day EMA.

3/27/12 – Entered trade for LULU

– BOT stock at $75.01

– STO Apr $75 call (ATM) for $2.52

– Initial return of 3.3%

Over the next two days, LULU was dropping. However, in reviewing LULU’s chart, the 20 EMA has been acting as solid support recently. When LULU was hovering at the 20 EMA, I BTC the call.

3/28/12 – Bought back April $75 call

– BTC Apr $75 call for $1.70

– Net on a one day trade of $0,82 or 1%

LULU bounced off of the 20 EMA today…back to the $75 area

3/30/12 – Re-sold the Apr $75 ATM call

– STO Apr $75 call for $2.50

– Initial return of 3.3%

Net so far in the trade is approx. 4.4% with three weeks for the trade to run.

So, a few take aways…

[1] The moving averages can act as support (per pg. 48 in Alan’s

new book)

[2] The price action took advantage of Beta…in LULU’s case, the

beta is 1.37, so it is somewhat more volatile than the market in

general (S&P 500)

[3] A few minutes spent looking at the chart and historical price

action yielded an additional 1% return in a very short time

Best,

Barry

Note…the chart that was attached to my last post (above) is not part of my post…it was attached by accident.

BB

Alan,

Nice article, thanks. I have read a favorable VIX is below 20. In this article you use 30 as a yardstick. Any reason for the change?

Thanks again.

Nick

Nick,

Historically a VIX under 20 was considered favorable to stock investors. However, in my view, market conditions are changing and a new look at a favorable VIX should be considered. With the advent of high frequency trading, an increasing product line of ETFs, dark pools and the like, the market has an increased volatility as a norm. Since August of 2011, we have seen a recovering market and a declining VIX. For most of that time frame the VIX dipped under 30. In the chart below I highlighted the bull run in yellow and marked the VIX 30 in green and VIX 20 in orange. This is still a “guideline” in progress and I plan to re-evaluate as we move forward. Of course, this is my opinion and others may differ but I feel that changing times call for re-evaluation of old parameters. When I assess market tone, my current guideline stands at 30 or under for a favorable VIX. I’m open to your thoughts as well. (Click on chart to enlarge and use the back arrow to return to this blog).

Alan

Alan,

I’m planning to attend your Atlanta seminar and will be bringing a friend who is new to options. Will this presentation be geared to beginners or is it more advanced?

Looking forward to meeting you in person.

Steve

Steve,

I’m glad you can make it. My presentation will be geared to beginners but there will be material incorporated for more experienced investors as well. There will also be two Q&A segments. Please introduce yourself to me before or after my presentation.

Alan

Premium Members,

The Weekly Report for 03-30-12 has been uploaded to the Premium Member website and is available for download.

Best,

Barry and The BCI Team

I was just looking at the 3/30 Weekly Report and have a question.

Here are the number of stocks listed in the Watch List for the last 4 weeks and the number in bold is in parentheses.

3/9: 74 (19)

3/16: 61 (8)

3/23: 47 (11)

3/30: 26 (1)

Given the approach you use to include stocks in the Watch List, is there anything we can conclude from this trend?

Steve

Steve,

Excellent observation. We have observed this scenario in the past and is one of the reasons we show the screening process in the first 3 pages of the premium report. When my team uploaded the report last night, the first thing I did was to look at pages 2 and 3 to see why stocks were rejected. I noted that there were 50 equities that didn’t pass the confirming technical screens (MACD histogram and stochastic oscillator). A common thread here is that all 50 passed all the fundamental screens and were trading at or above the 20-d EMA. This also shows how difficult it is for a security to pass all BCI screens. It is also related to Barry’s response to Frank (comment and repsonse # 6) and the consolidating chart pattern I alluded to in the above article. The market is in a short-term period of consolidation after rising almost 12% since the beginning of the year. I have no problem with a sideways trading market after a nice rise. It can actually be a healthy component to a recovering economy. When (if) the market continues to rise, these technicals will turn around and our watch list will repopulate.

Now, viewing this from a bearish perspective, can the deteriorating confirming technicals be a sign of a trend reversal? I don’t think so but it’s possible and those more bearish than me should take a more defensive posture by favoring ITM strikes and perhaps low beta stocks. If you own a stock in that group of “50” ( I have many) there is no reason to panic and unwind. Remember, these are still among the greatest performing stocks fundamentally and are trading at or above their 20-d EMAs. I prepared a chart for ASNA which typifies the chart pattern of many of the equities in this group (click on chart to enlarge and use the back arrow to return to this blog).

Alan

How exactly do you interpret Uptrend Under pressure?

Frank,

To help you interpret IBD’s Current Outlook – “Uptrend under pressure.”

From page 1 the 4/2/12 issue of IBD…”The Big Picture” section:

The indexes had to deal with a shift to a market under pressure on Wednesday as all of the indexes got hit with distribution. The Nasdaq suffered a second day of distribution on Thursday.

Distribution involves a sizable drop in a major index in rising volume. It points to institutional selling.

IBD’s defines distribution as:

When volume is higher than that of the previous day without any price appreciation.

Best,

Barry

How do we know that VIX is going to stay as low as now for time being ?

I am afraid that VIX is too low and it might suddenly reverse its course.

Any thought ?

Jinsoo,

You have a valid concern. It’s similar to a stock at a high price or the market in general having recent significant appreciation. In the BCI methodology our obligation is only one month. We perform a stock and market re-evaluation weekly. There is time to react if there is a trend reversal in most cases. All we can do is act on the information at hand but being cautious as your inquiry implies makes good sense. Our standard response to a bearish outlook is to use ITM strikes and favor low beta stocks. Thanks for sharing your viewpoint.

Alan

Anyone ever hear of or trade TVIX?

Thanks.

Barbara

Barbara,

TVIX is a leveraged ETN (exchange-traded note) linked to 2x the daily performance of the S&P 500 VIX short-term futures. It is EXTREMELY RISKY. If you took a long position in TVIX in October @ $110, it would be worth $7.12 today. Big upside and big downside. This security is NOT for most members of this site.

Alan

Alan,

Kudos on your Beginner Corner video series. Very easy to understand. I’m passing the link to other members of my stock club. Thanks for your generosity.

Arthur

Arthur,

Thank you. This idea was suggested to me by members of my team and it has been well received far beyond my expectations. Let me know how your fellow club members like the program.

Alan

Running list stocks in the news: PII:

PII recently reported its 19th consecutive positive earnings surprise. 4th quarter ER showed a 15% increase in earnings and 26% rise in sales. Operating income increasedby 19%. Estimates are for 21% growth in 2012 and 18% in 2013. PII recently raised its dividend by 64% to 2.1%.Our premium watch list shows an industry segment rank of “A”, a beta of 1.30 and a projected ER date of 4-18-12.

Alan

My interview today with Kerry Lutz of the Financial Survival Network:

http://kerrylutz.com/dr-alan-ellman-shows-blue-collar-investors-how-to-get-white-collar-returns-03-apr-2012/

The big picture:

The market is under pressure today apparently reacting to Spanish bond worries and a non-farm payrolls report coming out Friday while the market is closed. However, the ADP jobs report was strong this morning, economic reports continue to be positive, we just had a fabulous 1st quarter and corporate earnings remain strong. The bigger picture is still positive.

Alan

Hi alan,

In your books and dvd program you use the phrase “in normal market conditions”. Can you explain what you mean?

Thanks.

David

David,

Historically the market appreciates between 6% and 10% per year or about 0.5% – 1% per month. That, along with a VIX under 30 defines “normal market conditions” as it relates to our covered call monthly goals.

Alan

Premium members:

This week’s 6-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

Not a premium member? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

HAPPY HOLIDAYS FROM OUR FAMILIES TO YOURS

Alan and the BCI team

BCI Community,

Per IBD…”The Current Outlook changed from “Uptrend under pressure” to “Market in correction” on Apr. 4.”

Best,

Barry and The BCI Team

Thanks for the opportunity to become a Premium Member. I just joined a week ago after looking through Alan’s three books (Kindle download… that’s handy!) and looking at the blog. Actually, I started at the beginning (Dec2007) and am through 2010. What an education. I saw how freely Alan, Owen, and others share their knowledge and enthusiasm. I was impressed with Alan’s respect of others, even though their opinions may differ.

The weekly report is a timesaver! I am fairly new to covered call writing, but studied hard and joined in week 2/5 of the contract period; 7 OTM, 2 ITM. This 3rd week I now have 5 OTM, 1 ATM, 3 ITM. I am aware this can change, but I’m feeling more confident and actually excited to manage the positions and hope I become adept at maximizing earnings.

I am hoping to hit a double with QLIK. BTO QLIK at 32.89, STO C33 @ 1.00. I BTC @ 0.34. Today’s close is ~ 50 dma and this stock has bounced off its 50dma in the past. If it doesn’t, I will sell and move on.

I have a question regarding the Time Value Approaching Zero for deep ITM calls. I have ALLT, and if my math is correct, 24.31 Close – 22.50 call = 1.81 Intrinsic Value. The Ask/BTC (all 05Apr) 2.20 – 1.81 IV = 0.38 Time Value.

As I pondered unwind strategies (just to be prepared, at least to think about it), I was surprised to see the lowest TV at 0.19, not ‘zero’ The 5 and 7.5 calls, the deepest ITM are even higher at 0.29. What’s with that? So my question is: Are these nowhere near zero TVs a function of being mid contract period time? Or is the ‘approaches zero’ more of a concept, but in reality option TVs never really hit zero?

I’d like to understand so I don’t ‘wait around’ for something that will never really happen. I’m going to run my positions through the awesome Elite Calculator Unwind to try and learn more and get a different perspective of how to watch my portfolio. This empowerment feels like the start of something really good. Thanks for any enlightenment.

Carolina,

Whenever I’m asked why I devote so much of my time to this site, I just show them an email like yours. Thank you!

You ask an outstanding question which shows your education is paying off. I created a screenshot of an options chain for ALLT, April contracts. Please note the following:

Yellow field: These specific Deep ITM strikes have no open interest and therefore large bid-ask spreads. The “ask” will reflect an inflated time value. Note the relationship to the “last trades” to time value.

Purple field: This is the best example in this particular options chain. If you sell at the “ask” the TV IS $0.19 or 1%. However, if you “play the bid-ask spread” or negotiate the close price there is an excellent chance you can buy back the option for $4.40 (still favors the market maker). That will bring the TV down to $0.09 or one half of 1%. The question you ask yourself is: “Can I generate more than one half of 1% in another position if I close this one. You can also try for $4.35, the actual price of the last trade. That will decrease the TV even more.

Generally, the deeper ITM, the lower the TV. However, there needs to be liquidity in those lower strikes to keep the B-A spreads favorable.

Keep up the great work!

(Click on chart to enlarge and use the back arrow to return to this blog).

Alan

Anyone sell calls this month on INVN? If yes, what are your thoughts at the moment? Buy back the calls and expect it to go back up to sell them again for a double? Get out after the analyst downgrades this week? Other?

Steve,

I sold the 20s on this stock and already bought back the option. I’ll wait to see the price action on Monday. If it drops further, I’ll close. If not, I may roll down to the 17.50.

Good luck.

Tim

Steve Z,

I don’t hold INVN, but I did a little research for you…

– IBD 4/5/12…

InvenSense (INVN) again delivered the worst weekly performance among IBD 50 stocks.

The maker of motion-sensing chips tumbled 12%, ending the week under its 10-week moving average for the first time since its November IPO. A drop below that key level serves as a clear red flag.

– Bloomberg Article 4/4/12…

http://www.bloomberg.com/news/2012-04-04/invensense-falls-on-sandisk-sales-forecast-san-francisco-mover.html?cmpid=yhoo

– I took a look at the chart for INVN…some observations

> The stock is below it’s 20 day EMA

> The 50 day SMA has been good support in the past and INVN closed below the 50 day the last two days in a row. Although we don’t normally use the 50 day SMA, the large institutions (“The Big Boys”) do.

> MACD and Slow Stochastics are both bearish

> The stock closed below it’s lower Bollinger Band yesterday

> The stock closed on the 50% Fibonacci retracement level from it’s recent highs. Although we don’t use either Bollinger Bands or Fibonacci retracements, they show weakness in INVN at this point.

I hope these observations help.

Best,

Barry

A previous interview I had with The Business Authors Show Network is now being re-broadcast:

http://www.wnbnetworkwest.com/WnbAuthorsShowBusiness.html

Alan

Thank you, Alan for the great answer and visual. I am a ‘visual’ learner, so that was appreaciated. A few more questions (they will probably slow down as I ‘set up shop’ for cc writing…

1) Volume of calls in option quotes: Is there a multiplier involved?, I.E., does 7 really mean only 7 lonely contracts, or does it mean 700, so I can judge selling activity more accurately.

2) Is there a Search function for your blog/comments? For example, I have been saving many of Owen’s posts, as I may one day ‘expand’ to selling covered calls in a non-sheltered account versus just my IRA account. While I am painstakingly reading through the archives (now at Jan 2011!), a search function would be a great time saver to bring up comments focused in on a topic of interest.

3)Speaking of Owen, When will he be coming out with his first book, or did I miss it ? 😉 Seriously, I think many more of us would trade outside of our sheltered accounts also if the reporting/tax consequences didn’t seem so daunting (or maybe it is???)

I realize the tax codes/consequences change so that a book can become ‘outdated’ quickly… But that would mean an annual ‘revenue’ stream for Owen, and all he would likely have to do is update pertinent’s on his end, while we would gain by having another book focused more on an important housekeeping topic.

4) I think it would be helpful/interesting to see what other BCI folks are using for portfolio management. I saw a reference in a 2010 comment to Otrader, which led me to investigate it, and I am likely to try it… other software I should consider? Anyone here using Otrader? (comments appreciated).

I’ll throw out one… I was looking for an iPhone app that might just serve as a quick way to steal a look at my portfolio/watchlist if I have just a minute break while at work. I was finding it tedious to log in to my brokerage account and pull up a watch list, then to try and look at the charts with no MAs, MACD, etc. I didn’t have that much time or patience. So I looked at the iTunes store and found Portfoliomobile (by BareReef) and ponied up 19.95, because it offered charting. I’m happy with this because now, I just click on the app on my iPhone, it pulls up my portfolios (I set up manually), and it gives me an instant snapshot while the market is open. Prices are updated (Yahoo! feed) and instantly so by just swiping down on the screen, AND I can look at the charts which I have set up (you can create templates) with EMAs in the colors I pick, MACD, sloK%, volume, just like Alan suggested in his first book. This keeps me in touch with my portfolio and the market and a big picture view very quickly. $19.95 may look very steep for an iPhone App, but it has saved an immense amount of time I don’t really have while at work, gives me peace of mind, and is a bargain compared to the sticker shock of one time events like $6 for a small bag of popcorn at the movie theatres.

5)Lastly, there was a question (#45 by Eddie Q in Owen’s Guest Article of December 2010) that I skimmed further Archives up to the present and didn’t see any comments/answers to… did I miss where that was? I think it was very easy to overlook this, since Eddie posted his March 20, 2012 question in a blog entry of 2010!

Nevertheless, again because I currently view management of trades outside of my IRA daunting (yearly reporting requirements, etc), I wondered if Eddie’s question regarding paying a 6% penalty on additional deposit amounts to an IRA (he stated Roth IRA, but mine is a traditional IRA) being worth the penalty if he could more than make up for it in returns made (I presume BCI strategy) in the IRA account. This would seem a possible way to keep trading in an IRA…that was worth investigating.

Thank you for any thoughts.

Carolina,

There are dozens of iPhone and iPad apps. Take a look at these:

– Covered Call Calculator…does return calculations, slightly different terminology than Alan uses but same result

– ThinkorSwim…from the discount broker…can give you options pricing without an accoubt

– Stocks Watchlist…nice watch list app

– ezStocks Pro…nice watch list app…shows heat map of your stocks

There are many more, but you can get started with these.

Best,

Barry

BCI Team

Sorry, I see the Search function now… seems to do blog entries but not comments.

I have been reading about the VIX and know that it is a good sentiment indicator, – but can I use the put/call ratio instead?(or is this not recommended?)

-Also how many different types of sentiment indicators should I use?

-Do you also suggest we look at it(or them) before each trade?

* I am also wondering if we need to use market-breadth indicators?

If the answer to this is YES then the same questions would need to apply to this as well, which again are:-

-How many different types of market-breadth indicators should I use?

-Do you suggest we look at it(or them) before each trade?

-And also which one(s) are best to use?

To get answers to all this would really help my understanding!

Adrian,

This is an example of a great question that has no ONE right answer. It’s similar to asking which and how many technical indicators should be used when evaluating a price chart. Each investor must find the indicators that work best for him or her. I’m happy to share the ones that work best for me. For members not familiar with the market sentiment indicators Adrain alluded to:

1- Put/Call ratio: Dividing the # of put options traded by the number of call options traded. The higher the ratio, the more bearish are investors. It is used as a “contrarian” indicator theorizing that investors may be unjustly bullish or bearish.

2- Advance/Decline line: # advancing stocks – # declining stocks + previous day’s A/D value. It is used to identify changes in trend or confirm trends. If the market is uptrending and A/D line is declining, a trend reversal may be coming. If both are uptrending the trend is confirmed.

These are great indicators and used by many investors but not part of the BCI methodology. I have no problem with investors who want to include these in their market analysis. Here are the indicators used in the BCI methodology to evaluate market sentiment (tone):

1- VIX

2- Technical chart of the S&P 500

3- Weekly economic reports

As “CEO of your own money” we must each decide the parameters we are most comfortable with.

Alan

Thanks for that answer. I was already thinking of using the A/D line for seeing breadth, as I have read of its use as being quite useful for predicting trend reversals.

And I will use the P/C ratio instead of VIX, but only because it seems easier for me to understand.

I am just not too sure what moving average types to use for the

A/D line chart(or of any other indicators?),-would you know?

Finally I am presuming of using these indicators each trade,- rather than say every quarter or so – but please tell me otherwise. thanks.

sorry, don’t know how that stupid image appeared but just disregard it. thanks

Hi, I forgot to ask if it is alright for me to use the ‘A/D line chart’ instead of using the “weekly economic reports”? (if I were to also use the P/C ratio instead VIX, and either S&P500 or Dow J’s chart as well.)?thanks

Adrian,

My typical response to a (good) question like yours is that each individual investor should select the parameres he or she is comfortable with when evaluating market sentiment. There are so many ways to accomplish this. However, my personal feeling is that it is important to remain updated on the trend of current economic reports in addition to the technical indicators you have chosen. Whether you gather this information from financial newspapers, the internet or any other resources, it is all readily accessible. You can also just refer to my weekly blogs where I do the legwork for ALL members (general and premium) with the “Market tone” segment at the end of my blog articles. This information is also incorporated into the Premium Reports (top of page 1).

Alan

I think I will still use the A/D line chart, as it is recommended in a technical analysis book I had read.

The economic reports I had sort of found kind of hard to distinguish how the overall affect on the market would be. Some reports may be good while others bad, and whether I should have just focused on the most important ones to predict a trend was not what I thought would help. I will just have to see what you say in the blogs, as I will most likely be around quite a while, as I have lots of questions to ask you anyway.

I thought I may as well add something, from me now knowing I should see the market tone reports you described.

My questions I thought of are:-

– Would you put on a trade, even if there is a major market report coming up (eg. next day or so)?

– Do I need to know the “seasonality cycles” of the market?

– And would I need to backtest this strategy?, – and if so then how do I do this? thanks

Adrian,

I am almost always fully invested (2008 was a rare exception and I exited later than I should have). In volatile or bearish markets I favor low beta stocks and in-the-money strikes but keep my cash working. This is an approach that I am comfortable with. More conservative investors with less risk-tolerance may exit the market from time to time.

Major market reports come out almost weekly. If we avoided them we would rarely be fully inmvested. Seasonality cycles were quite popular years ago when setting up an investment strategy. In my view, they are less of a factor today with the globalization of our economy and I feel less predictive as to what will follow than in the past. Add that to the incease in high frequency trading, the emergence of ETFs and the popularity of new options products, many of the older parameters give us less “bang for the buck” when analyzing our investment strategies (in my view).

Backtesting older theories makes the assumption that the same parameters that influenced those results will be in place moving forward to see favorable results. With the world economy changing so rapidly and other influences alluded to above thrown in I am skeptical that this will be the case. I prefer paper trading a strategy and tweeking if necessary. In this way we can make changes if needed based on current new information.

The BCI methodology has been archived now in books, DVDs and journal articles for the past five years. Those who have followed us over the years know that we do not hesiate to maker an enhancement if the opportunity arises. That being said, you should follow your intuition and use the information we and others provide to help lead you to an approach that is best suited for you.

Alan

thanks for those answers, and it may have saved me some time by not having to worry about doing backtests over several years data.

I wasn’t quite sure if you exited the market in 08′, as you said that you had low beta stocks on at that time, – I presumed you did after using these stocks until as the downtrend got steeper. thanks

Adrian,

I did exit the market late in 2008. Looking back, I should have exited sooner demonstrating that no matter how experienced an investor is, we can always do better as we continue to learn. By selling calls, using low-beta stocks and ITM strikes I mitigated portfolio losses but had losses nonetheless.

Alan

Alan, wouldn’t it have been better to sell your shares, and just buy put options if in a downtrend, as in 08′?

-I have been thinking of the use of buying put options to protect shares when there is a correction or bear-market, and wanted to know if would you recommend us to buy them at these times- is this up to us?

-Also do you think it is always better to buy them below support levels – or does it not really matter? thanks

Adrian,

Looking back…yes I would have better off buying puts. However, the depth and length of the market decline was much greater than I anticipated. Same for most of the investment community. Buying protective puts as a credit spread is an intelligent, viable approach to covered call writing for very conservative investors. I use the methodolgy I describe in my books and DVDs but have no problem with those who use protective puts. The BCI team will be adding puts to our methodology in the near future as many of our members have been inquiring about it. Generally, the put will protect against catastrophic loss but decrease earnings in most market conditions. Here is a link to an article I published on this topic for members uinfamiliar with protective puts:

https://www.thebluecollarinvestor.com/protective-puts-the-collar-strategy/

Alan

Alan,

I actually have just seen that link page and is quite informative, and am still thinking I may use put options occasionally with your methods.

There are two things I had just thought of though that are:-

1. What do you do when you want to go away on holiday?,- wouldn’t it be best to have these protective put options in place, or do you close all positions (& sell shares) until you get back?

2. And is there still much risk if you did sell options in earnings month(even though we aren’t supposed to) but had put options. (because I thought even if the price went up alot and you sold OTM options, then wouldn’t this be a rather grateful capital gain to have.)?

Can you also confirm these other 2 questions that I had emailed you, that I was also still thinking about.

1. You say to save 2-4% of cash profits each month to buy back options.

So as an example, if I earned $1000 for the month then I should only save $20-$40 in case I wanted to buy back options? (I thought I would have to save much more, like maybe 50% or so)?

2. Also if I wanted to invest in property, then shouldn’t I be making money consistently with covered calls first, before learning about this. (this is what I heard on a DVD I saw.)?

I appreciate all your answers. thanks