Covered call writing ETFs are exchange-traded funds consisting of a portfolio of stocks that are leveraged to generate income by selling call options against those shares. As investors strive to generate high yield returns, these securities have exploded in popularity. This article will explore 3 of the more popular covered call ETFs and determine if this popularity is justified.

3 popular covered call writing ETFs

- JPMorgan Equity Premium Income ETF (NYSE: JEPI): Uses low-implied volatility well-diversified S&P 500 stocks.

- Global X Nasdaq 100 Covered Call ETF (Nasdaq: QYLD): Writes covered calls on the Nasdaq 100 stocks.

- Global X S&P 500 Covered Call ETF: (NYSE: XYLD) Passively managed fund that writes at-the-money covered call on the entire S&P 500 index.

Let’s talk expense ratios

One of the most important factors in determining the returns, and, therefore, success of an ETF is its expense ratio. These are administrative, marketing and management fees inherent in the security. These fees are deducted from the overall performance of the ETF. Here’s a comparison of the expense ratios of the 3 covered call ETFs and that of Vanguard 500 Index Fund Admiral Shares (VFIAX), a broad market, low expense ratio mutual fund based on the S&P 500.

- VFIAX: 0.04%

- JEPI: 0.35% (9x that of VFIAX)

- QYLD: 0.60% (15 x that of VFIAX)

- XYLD: 0.60% (15 x that of VFIAX)

These expense ratios are difficult to overcome, especially when stock selection, option selection and position management techniques are not implemented.

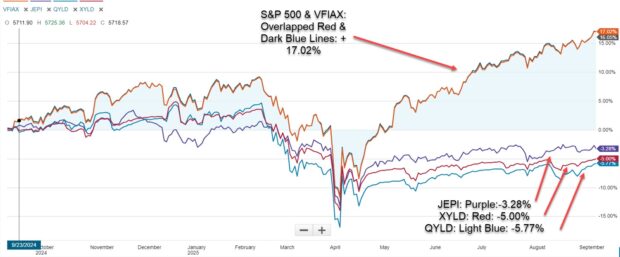

1-year comparison chart: A picture is worth a million words

The difference between the S&P benchmark and a corresponding mutual fund versus the 3 popular covered call writing ETFs is dramatic.

Discussion

For those seeking to beat the market on a consistent basis and many years significantly, covered call writing will offer that potential once the strategy is mastered. On the other hand, covered call writing ETFs do not provide such opportunities because the expense ratios are much too high and stock selectivity, option selectivity and exit strategy implementation are not maximized.

Stock Investing for Students: A Plan to Get Rich Slowly and Retire Young

Self-investing starting at a young age can ensure a successful financial future and an early and comfortable retirement. So why is nobody doing this? The answer includes such factors as the social pressures facing our youth, certain pre-conceived ideas regarding our ability to successfully self-invest and the education or lack thereof needed to motivate our youth to undertake such a long-term project. The purpose of this book is to change that way of thinking and create a goal and a user-friendly methodology that will facilitate a plan which will allow you to retire financially securely at a relatively young age.

Free training resources

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to publish several of these testimonials in our blog articles. We will never use a last name unless given permission:

1. Long Island Stock Investors Meetup Group: Part I

Thursday February 12, 2026

7:30 PM ET – 9:00 PM ET

Credit Spreads for Bull & Bear Markets

Introducing Our Latest Products, Creating New Investment Opportunities

2. Las Vegas Money Show- 2 presentations

February 23 – 25, 2026

The Collar Strategy: Covered Call Writing with Protective Puts

Protecting covered call trades from catastrophic share loss

This is the strategy Bernie Madoff pretended to use. He called it the split strike conversion strategy, but it was simply a collar. The covered call sets a ceiling on the trade and the protective put guarantees a floor on the trade

Topics discussed

- What is the collar strategy?

- Uses for the collar

- Entering a collar trade

- Option basics for calls

- Option basics for puts

- Real-life example with NVDA

- What is an option-chain?

- Real-life example using the BCI Trade Management Calculator (TMC)

- Strategy pros & cons

- Educational products & discount coupon

- Q&A

Selling Cash-Secured Puts to Buy a Stock at a Discount or to Enter a Covered Call Trade

2 outcomes & 4 applications

Selling cash-secured puts is a low-risk option-selling strategy which generates weekly or monthly cash-flow. This presentation will detail how to craft the strategy to generate cash flow, buy a stock at a discounted price or to initiate a covered call trade. Topics included in the webinar include:

- Option basics

- The 3-required skills

- 4-practical applications

- Traditional put-selling

- PCP (Put-Call-Put or wheel) Strategy

- Buy a stock at a discount instead of setting a limit order

Real-life examples along with rules, guidelines and calculations are included in this presentation.

Time, date & registration link.

3. Palm Beach Traders Club

March 10, 2026

Private Investment Club

4. Long Island Stock Investors Meetup Group: Part II

Thursday March12, 2026

7:30 PM ET – 9:00 PM ET

Ultra-Low-Risk Approaches to Covered Call Writing & Selling Cash-Secured Puts

Introducing Our Latest Products, Creating New Investment Opportunities

5. Hollywood Florida Money Show

April 10, 2026

11:40 AM – 12:25 PM

The Put-Call-Put (PCP) or Wheel Strategy

Using Both Covered Call Writing and Put-Selling to Generate Monthly Cash Flow

Selling stock options is a proven way to lower our cost-basis and beat the market on a consistent basis. Two such low-risk strategies are covered call writing and selling cash-secured puts. This presentation will detail how to incorporate both strategies into one multi-tiered option-selling strategy where we either generate cash-flow or buy a stock at a discount. I refer to this as the Put-Call-Put (PCP) Strategy, also referred to as the wheel strategy.

The basics and pros and cons of low-risk option-selling strategies will be discussed as well as an analysis of a real-life example and introduction into the BCI Trade Management Calculator (TMC). This seminar is appropriate for those who look to generate modest, but consistent, returns which will enable us to potentially beat the market on a consistent basis while focusing on capital preservation.

More details to follow.

6. Young Investor’s Club at The University of Central Florida

April 16, 2026

Private student investment club.

7. BCI Educational Webinar #10: The Put-Call-Put (PCP) or “Wheel Strategy”

January 20 @ 8:00 am – 5:00 pm

Thursday May 14, 2026, at 8 PM ET

Using both covered call writing & cash-secured puts in a multi-tiered option selling strategy. A 68-day real-life example taken from one of Alan’s portfolios will be analyzed.

BONUS: Barry will share a real-life credit spread trade using our BCI Conservative Credit Spread Management System.

Discount coupons a live Q&A session will follow the presentation.

8. Orlando Money Show

October 5 – 7, 2026

Details to follow.

Premium Members,

The report for this week has been uploaded early due to the incoming storm…I typically lose power in these types of storms!

This week’s Weekly Stock Screen and Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 01/23/26.

Be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them on The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

https://www.youtube.com/user/BlueCollarInvestor

Barry and The Blue Collar Investor Team

Reminder:

This Wednesday, the Fed will make its scheduled interest-rate decision. The overwhelming expectation is that there will be no change from the current 3.5% – 3.75% range. However, commentary from the FOMC may impact market volatility. I remain fully invested with predominantly defensive trades.

Alan