Covered call writing can be beneficial to us in a variety of circumstances. This article will highlight how this strategy can be implemented to create a dividend-like cash flow for stocks that currently offer no dividend income. This can be particularly useful for those who will only purchase dividend stocks and miss out on other great stock opportunities. On August 30, 2019, Paycom Software Inc. (NYSE: PAYC) boasted elite fundamentals and technicals but generated no dividend income. Let’s see how we can create a dividend-like cash flow using covered call writing.

Fundamental review using IBD’s SmartSelect screen: Elite results

PAYC: Elite SmartSelect Rankings

Technical analysis for PAYC: Bullish price chart

PAYC: Price Chart as of 8/30/2019

Achieving an annualized 4% dividend-like return

With PAYC trading at @254.10, a 4% annualized dividend yield would generate $10.16 per-share. This would calculate to 4 quarterly cash-flows of $2.54 per-share. We would select out-of-the-money strikes on months when earnings are not due out.

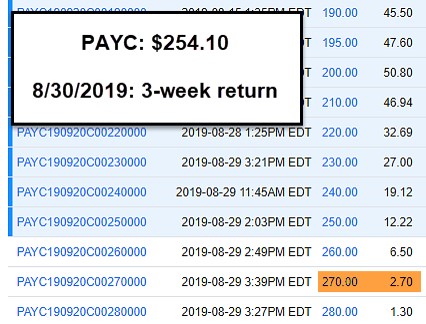

Option chain (3-week expiration) for PAYC on 8/30/2019

PAYC Option Chain as of 8/30/2019

At this point in time, selecting the $270.00 strike for a 3-week return and still allowing share appreciation from $254.10 to $270.00 will meet out goal. Three more similar trades per year would meet our target of a 4% annualized return.

Discussion

Covered call writing can be crafted to generate a dividend-like cash-flow. It involves making only 4 out-of-the-money trades per year in months when earnings reports are not due for publication. This allows investors to purchase stocks they may have otherwise avoided because of the lack of a dividend distribution.

Market update; Republished from this week’s blog commentary

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Hi Alan,

I’ve gotten through lesson 5 of the Beginners Series and the information is great. I’ve already learned a lot and will be completing the series tonight.

You’re a wonderful teacher and I look forward to continuing my education with your book and video series.

Best regards,

Mike Z.

Upcoming events

1. Tuesday March 10, 2020 Long Island Stock Traders Meetup Group

7 PM – 9 PM

Plainview- Old Bethpage Public Library

Covered Call Writing Blue-Chip Stocks to Create a Free Portfolio of Large Tech Companies

2. Wednesday April 8, 2020 Options Industry Council (OIC) Free Webinar

4:30 ET

Covered Call Writing to Generate Monthly Cash-Flow:

Option Basics and Practical Application

3. NEW: Just added- The Seattle Money Show June 12th – 13th. details to follow.

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 8 of our mid-week ETF reports.

*********************************************************************************************************************

Alan,

My question is I see that you screen all the stocks down to a few dozen which are best for the strategy but what about selecting the best call to sell against it?

Do you advise us which call and strike price makes the most sense?

Also, with this awfully volatile market is this a bad time to be starting an investment program???

Thank you,

Phil

Phil,

Strike selection is based on our overall market assessment, chart technical analysis, personal risk-tolerance and initial time-value return goal range. These parameters will vary from investor-to-investor. Let’s say we are bearish on the market… favor in-the-money calls and deeper out-of-the-money puts. If we sell an in-the-money call and look to generate a 2% initial time-value return, we check the option-chain for ITM strikes that generate 2%.

This is NOT a good time for beginners to start trading options but it is an amazing opportunity to paper-trade in an extreme market environment. The coronavirus event is an aberration that comes up rarely (thankfully) but something investors will face periodically. It is a wonderful opportunity to learn how to trade non-emotionally under the most difficult of circumstances until the bull run continues.

Alan

Hi Alan,

To remind you, I’m paper trading. I bought/wrote 5 ETF’s on Monday with 3/20 expiration.

So, the GDXJ call I sold dropped below 80% and I bought it back. Great.

At this point, due to the crazy situation with the market, I’m uncertain if the 8% underlying stock drawdown rule should apply. At this point the stock itself is down nearly 20%. Other stocks in my paper portfolio are down 7-10%.

XLK also dropped below 80% and I bought it back. XLK is down 8.7%.

Any quick thoughts on whether to hold off on action, roll down, or sell (most specifically on GDXJ)? I feel like the market is not in a normal situation so maybe you have different ideas than your normal strategies.

Thanks!

Ed

Ed,

In extreme bear market conditions, I consider moving to a much higher percentage of cash and even incorporating inverse ETFs into my portfolios.

The elephant in the room, of course, is the coronavirus fears but we also must keep an eye on the March Fed meeting as to the steps that will taken regarding the inverted yield curve. An interest rate reduction is likely but how will the market react?

Finally, technicians will look for a floor to be established and re-tested before calling a resumption of the bull market.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 02/28/20.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

IMPORTANT NOTE:

I’m making nice post-op progress. I expect that the stock report availability and timing will be back to normal.

Best,

Barry and The Blue Collar Investor Team

[email protected]

Hi Barry,

good to know you are recovering well from your surgery.

Take care – Roni

Hi Roni,

I’m doing OK. I really appreciate your concern.

The recovery is going well. I have my first surgical follow-up next Tuesday. The weekly report effort over the weekend was slow…but no pain. The recovery will be slower due to the undiscovered “rotator cuff” tear. No big deal as this is my fourth joint replacement…I know the drill.

Best,

Barry

Oh Wow,

is that from playing Tennis or Baseball ?

I am aware of your trekking prowess, but that would be hard on your knees and not your shoulders ???

Roni

Hi Roni,

No tennis or baseball..but I have spent a large part of my adult life practicing Karate… 3rd-degree black belt in Shotokan Karate, a Japanese style. This has been my love since I was 16! Yes…I essentially broke myself over the years…teaching…competition…board breaking…etc. Now I have four replaced joints.

There are a lot of similarities between karate and the BCI methodology. Both take training, practice, discipline, and a commitment to always improving. Actually, I never saw the similarities before this email…but…what an “Aha Moment” for me!

Anyway, I’m making progress with my rehabilitation and expect to start physical therapy after my post-op visit next week. Thank you again for your concern.

Best,

Barry

Barry, you are full of surprises.

Congrats on your Karate exploits. As for your joints, you sound like Charley Chang.

I am striving to become a BCI black belt.

Good luck – Roni

Alan,

I know how important having an exit strategy is when you place a trade but is there an appropriate exit strategy when the market drops 600-1000 points in a day?

Thanks,

Mark

Mark,

There is an appropriate exit strategy for every scenario. There may not be a good quick fix but there’s always a best solution.

When the market declines substantially, we have our 20%/10% guidelines to deal with the option side of the trade. Once (if) executed, we can wait to “hit a double”, roll-down, or sell the stock.

In extreme market conditions like we are now experiencing, the latter two should be given greater consideration.

Alan

Hi Alan,

I just purchased “Stock repair calculator” today. I always had some trouble understanding this strategy, but after testing various outcomes with calculator it became much more clear how it works now. This is an excelent tool to have, thanks for it.

However I have one question. In CALCULATED RESULTS there is BREAKEVEN field, and formula for breakeven is (NET COST BASIS + NTM STRIKE PRICE) / 2. In Wikipedia BREAKEVEN is defined as “Break-even (or break even), often abbreviated as B/E in finance, is the point of balance making neither a profit nor a loss.” In supplemented PDF file for GRUB trade BREAKEVEN is $142.52. But can this be called BREAKEVEN? I understand it as NEW COST BASIS AFTER THE TRADE? Does it means the trade will lose money if the price at closing date will be below $142.52?

And what will be the term for (NET COST BASIS + MAXIMUM GAIN). In GRUB trade this will be $150 ($145.03 + $4.97). Does the GRUB trade will make less money if the stock price will close above $150 compared if we have not implemented stock repair strategy? And if stock price will close below $150 implementing stock repair strategy will result in bigger gains than those that if we just hold the stock and did nothing. Do I understand it right?

Thanks,

Sunny

Sunny,

You have a good handle on the calculations:

1. The cost-basis of the original share purchase ($146.73) is lowered by the option-credit of $1.70 to $145.03. The purchase of the $140.00 call moves our BE down to $142.53. Below this, we lose, above this we win. The stock repair strategy lowered the BE from $146.73 to $142.53.

2. There is a downside to this strategy as you stated in your question. If share price rises, the strategy would return less than had the strategy not been implemented. This is the same risk (or disadvantage really) in traditional covered call writing.

Here is page 4 of the user guide which summarizes the strategy pros and cons:

What is the stock repair strategy?

• Own shares at a price higher than current market value (unrealized loss)

• Willing to forego potential profit in exchange for lowering the breakeven price point

• Not willing to add additional funds to the current losing position

• Instead of buying shares at the lower price to “average down”, an at-the-money (near-the-money) call option is purchased and funded by selling 2 out-of-the-money call options

• 2 long positions (stock and ATM or NTM call)

• 2 short positions (OTM calls covered by long positions)

• This action will lower the breakeven price point

• The strategy does not protect against additional downside loss

• The strategy does cap the upside

Alan

Hi Alan,

In the current market scenario, I was thinking of selling cash secured puts from my traditional IRA.

What kind of stocks or etf you recommend to sell puts now and then I was thinking of selling covered calls for next month?

I am planning to signup BCI membership today.

Will I get the relevant information. To sell cash secured puts mid next week?

Muraldi

Muraldi,

The same stocks that are appropriate for covered call writing are also applicable to selling cash-secured puts. We use a 3-pronged screening process:

1. Fundamental analysis

2. Technical analysis

3. Common-sense principles (lie avoiding earnings reports, minimum trading volume etc.)

membership provides 2 weekly and 1 monthly report of eligible candidates for both strategies.

Alan

Hi Alan,

What are your thoughts on investing in covered calls or cash secured puts when it is a bearish market?

Muraldi,

In a “bearish” market, I favor in-the-money calls and deeper out-of-the-money puts or a combination of both. I will also favor lower implied volatility securities.

We are currently experiencing a highly volatile market due to virus, political and interest rate concerns which represents a riskier scenario than simply a “bearish market”

I am bullish longer-term.

Alan

Hi Alan,

I had entered 3 positions week one. I took a hit on 2 of the before I could BTC. I will use the Daily Position Management

Guide and DCCC spreadsheet going foward.

The third position, CORT I tried the following:

Bought 300 shares at 13.22 and sold 3 contracts the March 20/14.00 call for .40

The stock dropped so, I BTC 3 contracts at .30

Then hopping to minimize looses I sold the March 20/10.00 call for 2.75

I figure if the stock gets called away @ 10.00 my net loss will be about $120 depending on fees. It is week 2 I may be able to do better by expiration.

One more thing. You suggested ETFs, good idea. Will work better for my port folio $$. Can you suggest a training source for that type of trade, i.e. option chain. trade setup. etc.

Sorry for being too wordy

Appreciate BCI,

Thanks,

Homer

Homer,

Your trade was structured with a 3.0% initial time-value return and 5.9% upside potential. So far, so good.

The short call was closed at 75% of the original option sale, much higher than the 20% BCI guideline.

Rolling-down to the $10.00 strike, locked in a share loss of $3.22 ($13.22 – $10.00). The net option credit was $2.85, resulting in a net debit of $37.00 per contract, $111.00 for the 3 contracts.

Had we placed a buy-to-close limit order at $010 (20% guideline), it would have been executed yesterday. At that point, we would be in a position to either “hit a double”, roll-down or sell the stock. In the current volatile market conditions, all 3 are possibilities.

It’s a big positive that you are so pro-active with position management, a sure recipe for success. We must find an appropriate buy-to-close threshold that meets our trading style and personal risk-tolerance and adhere to those standards.

Chapter 11 of both versions of the Complete Encyclopedia address the topic of ETFs. Same for our covered call writing online DVD program.

Keep up the excellent work.

Alan

Hello Mr. Ellman,

I would like to write covered weekly calls. Would the information within your paid subscription be applicable to me?

Able

Able,

Yes. The watch lists we provide to our premium members represent lists of eligible securities for short-term option-selling. These apply to Weeklys as well as Monthlys for both calls and puts. Our stocks lists highlight which stocks have Weeklys as well as Monthlys.

There are also numerous videos in the member site that focus in on Weekly calls.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

Also included is the mid-week market tone at the end of the report.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

“Hitting a Double” opportunities:

With the extreme market gyrations, those of us with inverse ETFs were presented with opportunities to close our short calls yesterday when market acceleration resulted in share price declines. Today, with market decreasing a similar amount, we were able to re-sell some of these calls. The screenshot below shows a net profit of $666.30 for the 2 positions detailed. The yellow field shows the BTC trades yesterday and the brown field highlights the STO trades today.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan