“Covered call writing and put-selling are exactly the same strategies” Now you haven’t heard that from me but we have all heard it often enough to wonder why so many believe this. The main reason, the theory goes, is that the risk-reward profiles for both strategies are precisely the same and so that means that the strategies as a whole must be clones. In my humble opinion, they are related, cousins, if you will, not identical twins. In my fifth book, Selling Cash-Secured Puts, I devoted Chapter 15 to this topic, comparing the two strategies, with a comparison chart on page 214. This chart includes both similarities and differences. Whether we are writing covered calls or selling puts, our nemesis is the decline in share price. In both strategies if share price remains the same, rises or declines slightly, we win. We only can lose when share price declines significantly. This computes to more than the call premium or more than the out-of-the-money strike minus the put premium, depending on which strategy is being employed. In this article we will hone on these worst case scenarios and how the inverse impact Delta has on our exit strategy execution for declining stock prices in both strategies.

Staples chart

We will view a 3-month chart for Staples ((NASDAQ: SPLS) from September, 2015 through November, 2015:

SPLS: 3-Month Price Chart

Note the following SPLS price points:

- October 7th: $12.50

- November 3rd: $13.25

- November 16th: 12.60

Exit strategy requirement for a declining stock

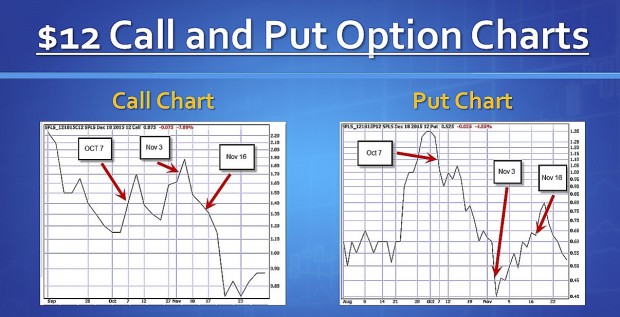

The BCI methodology stresses the importance of remaining pro-active during the contract, buying back the options when opportunities arise for mitigation of losses or enhancement of gains. Since we are focusing on worst case scenarios, let’s view the option charts for the $12.00 in-the-money call option (lower than current market value) and the $12.00 out-of-the-money put option (also lower than current market value):

Call and Put Options for Staples

It is clear from this comparison chart that Delta has an inverse impact on call and put options and frequently can overcome the effect of Theta (time value erosion). In this example, the stock price declined from November 3rd to the 16th of November, a week before expiration (November 20th). If we needed to buy back the option the week prior to contract expiration, it would have been less costly for covered call writing than put-selling because of the impact of Delta on our option premiums.

Discussion

Covered call writing and selling cash-secured puts are similar strategies but have several nuances that also make them different. The inverse relationship that Delta has on option premiums for the two strategies and that impact on exit strategy execution is one such example.

Panel discussion with Alan and experts from the Options Industry Council (Free)

For our members who missed this event, I was invited to participate in a discussion of option basics with experts from the OIC. Below is a link to the event. Just fill in the required fields and you’re in. I was also interviewed by the OIC in a separate taping and will provide that link to you once I receive it. Here’s the link to the panel discussion:

Upcoming live appearance

New York Stock Traders Expo

February 21st – 23rd

Marriott Marquis Hotel, NYC

http://www.newyorktradersexpo.com/expert-details.asp?speakerID=891071A

Market tone

Global markets rebounded late in the week as the Bank of Japan endorsed a negative interest rate policy. Markets seem to be pricing in expectations for additional action from the European Central Bank in March and a more gradual Fed rate-hiking implementation here in the US. Market volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX) declined to 20.5 late Friday from 23.5 a week ago. This week’s reports:

- The US economy grew at a modest 0.7% annual rate in the fourth quarter of 2015, reflecting the impact of a strong US dollar, modest global demand and an inventory surplus. Growth slowed from a 2% rate in the third quarter

- For the full year, GDP rose 2.4%, matching 2014’s growth rate

- The Federal Open Market Committee left rates unchanged, as anticipated

- The outlook for future rate hikes is unclear as the Fed acknowledged

- The Fed, however, also pointed to sturdy labor markets in its statement.

- Prices for crude oil rebounded late in the week on rumors of a meeting between OPEC and Russia to discuss a production cut of around 5%

- Earnings season: Thus far, nearly 73% of the companies reporting in the S&P 500 Index have beaten expectations and 47.4% of companies reporting have beaten revenue predictions

For the week, the S&P 500 rose by 1.75% for a year-to-date return of – 5.07%.

Summary

IBD: Market in confirmed uptrend

GMI: 0/6- Sell signal since market close of December 10, 2015

BCI: 1/3 of my stock investment portfolio remains in cash short-term. Favoring only deep out-of-the-money puts and in-the-money calls on active positions. Although the market is showing signs of a bottom as focus moves to corporate earnings, a bottom is not confirmed in my view. Caution remains a focus in my current investment portfolio probably at least through the February contracts. Plan to get more aggressive when markets calm perhaps for the March contracts.

Best regards,

Alan ([email protected])

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 01/29/16.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

I have read your books with the exception of the encyclopedia, and have tried to follow your exit strategies. I open a covered call position, and the stock goes down. At expiration, the option is worthless and I receive the full credit. My sentiment is that the stock will continue to down, so I sell another call for a credit, which further reduces my cost basis. And I continue to do so, until I find my strike below my cost basis. Then the day comes that the stock gaps up and passes that strike. If I allow the option to expire, I lose.

How do I recover? Do you place mental stops in cases where the underlying trends bearish?

Thanks,

Mike

Mike,

There are several points to be made in your hypothetical:

1- There are position management maneuvers that must be taken if a stock is declining. We have the 20%/10% guideline to provide framework for this. If a stock is declining, rolling down or closing the position to enter a new one are choices available to us.

2- At expiration, if a stock has declined and further decline is anticipated, why stay with that stock? It’s the cash invested in the security, not the security itself that we care about (assuming no tax issues). Many retail investors feel that recovery must be with the same security. I was guilty of this myself many years ago. We must ask ourselves “where is the cash currently in this declining security best placed moving forward? Let’s throw old-school thinking out the window.

3- If a stock gaps up, we can take advantage of the “Mid-Contract Unwind Exit Strategy to generate higher than maximum returns (see pages 264-271 of the classic Complete Encyclopedia…and pages 243-252 of Volume 2 of the complete Encyclopedia…

Alan

Mike,

At the end of your posting you mentioned “…mental stops…”. You might want to consider setting alerts…at the 20%/10% levels per the BCI Exit Strategies as well as above your strike. This way you will be alerted by your broker platform and you will be able to respond with an appropriate move more quickly. The alerts can be sent to you via email or messages to your smart phone.

Best,

Barry

Alan,

I’m studying the technical analysis chapters in both encyclopedias and really learning a lot. You’re right when you say education is power. One point I would like clarified. If the macd is below zero but the macd histogram is above zero, is this a bullish or bearish signal or mixed.

Thanks a lot.

Susan

Susan,

The critical signal is the Histogram. That is the signal that we look for to be above or below zero.

I hope this helps.

Best,

Barry

Susan,

Let me add this to Barry’s spot-on response:

We prefer the Histogram to the MACD itself because it will provide quicker changes to price movement. The Histogram subtracts the 9-day exponential moving average from the MACD and is more relevant (in my humble opinion) as an indicator. Have a look at the chart below and note that the Histogram has moved above zero (#2) while the MACD remains below zero (#3). The Histogram represents the difference between the MACD and its exponential moving average.

Bottom line: The Histogram is faster responder to price changes and therefore more relevant to short-term option-selling.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Alan,

What is the meaning of a risk reward rank of n/a as shown for QIHU tin this weekend’s report.

Thank you.

Juan

Juan,

The “n/a” means that our data provider didn’t have a value for that stock for the given week. This usually happens with foreign stocks. In this case, QIHU is a Chinese stock and is not followed by our casa provider. This doesn’t rule out the stock, just consider it as “mixed technicals” and proceed accordingly per Alan’s guidelines

I hope this helps,

Best,

Barry

Hi Alan,

I am new to Covered Calls but have been learning about it for a while now. I am ready to start executing some trades and really start taking action.

I only have a small amount of cash but enough to get started. Can you please guide me in the right direction.

Warm Regard,

Shantesh

Shantesh,

A great place to start is with our free beginners Corner tutorials. The link is on the top right side of our web pages…click…enter email address and you’re in. After that, check out the BCI store for educational products to take your knowledge and skill to the highest levels. If you need guidance in that regard, send me a direct email ([email protected]) Always paper-trade (practice first) before risking your hard-earned money.

Alan

Though it will be less important and difficult to parse from oil prices, Asia markets overnight and where gold and Treasuries are in the morning some where in the mix will be a reaction to Iowa tonight. Should Cruz and/or Sanders win I suspect a down reaction. Trump and Clinton are already assumed.- Jay

Allan,

My broker (Fidelity) says it uses NBBO pricing for options. What does that mean?

Thanks,

Raymond

Raymond,

This Fidelity’s way of telling you that you are getting the best price executions. The letters stand for: National Best Bid or Offer (NBBO) price, which is determined by the best prices on a single market from any of the seven option exchanges. This is pretty standard for the major brokerages.

Alan

Alan:

When convenient, I sometimes use a weekly option contract essentially as a monthly by simply treating it’s expiration date as the end of a conventional 4 week cycle & selling it 4 weeks ahead of the expiration date. I have not encountered any problems doing so, but I would be interested to learn if you see any downside to that approach.

Thanks,

Paul

Paul,

This absolutely is a plausible approach and kudos to you for the observation. As time goes on and more Weeklys are added to the pool based on supply and demand, there will be more choices to write Monthlys that expire in “off-weeks”

Of minor concern is the fact that weekly expirations tend to have lower option liquidity (open interest) and therefore wider bid-ask spreads which may lead to less favorable price executions. That aside, I see nothing adverse to be concerned about.

Alan

Morning,

I have enjoyed your lessons on selling naked puts and set up a paper trading account at thinkorswim but became concerned with the downward movement of the market. Would appreciate suggestions on a way to make money in a bear market since that seems to be where we are headed. Of course, any educational tools to learn this trading strategy would also be appreciated.

Blessings

Marcia

Marcia,

This very important topic is addressed in detail in my books and DVDs. I’ve also written on this subject extensively in my journal articles. Here are a few of those links:

https://www.thebluecollarinvestor.com/covered-call-writing-and-inverse-etfs-generating-cash-in-extreme-bear-markets/

https://www.thebluecollarinvestor.com/comparing-covered-call-writing-and-put-selling-in-bear-markets/

https://www.thebluecollarinvestor.com/how-to-generate-10-per-year-in-bear-markets-by-selling-stock-options/

https://www.thebluecollarinvestor.com/using-out-of-the-money-puts-and-in-the-money-calls-to-manage-bear-markets/

Alan

Alan,

I find it interesting many of your excellent articles of late have taught something about dealing with down markets and bearish times. Marcia’s question above highlights that.

Much of the financial press is taking the same tone. I feel like the old “push-me-pull-you” animal from Dr. Doolittle at times like these: not sure whether the bearishness will be self fulfilling or provide the depth of negative sentiment from which rallies are born.

So in my investing I am using your ATM/ITM over writing tactics on core holdings and not buying anything new. All the options selling in the world will not save a rapidly falling stock and at least 75% of them follow the market.

But if anyone can find stocks in that 25% or so minority that rise these days I am certain it is Barry!

I saw an interesting segment on how utilities out performed the S&P by 12% in January, a harbinger of a lousy S&P year. I also find the higher my cash level the better my sleep these nights:).

This is supposed to be the best time of year for stocks yet as I write this oil is up while the S&P is down so something is awry.

But we are not rudderless ships floating aimlessly. There is always a way to extract money from the market. I appreciate the breadth of your writing covering all scenarios. – Jay

Jay,

I want to personally thank you for your insightful and valuable commentary on this blog. I am certain that I speak for the entire BCI community.

Alan

These are probably stupid questions, but I want to ask them anyway:

#1 SELL RULES: Do you have any sell rules for a stock you’ve bought and targeted for a covered call (especially during unpredictable markets with 100-300 point swings like we’ve been experiencing lately)? Or do you in most cases keep it, knowing you’ll be able to repeatedly sell the calls and make your money back?

#2 TIMING: At what point during any month do you pull the string and sell the calls? Immediately? Towards the end of the month? Some other criteria?

#3 YOUR STRATEGY: For an option price to drop to 20% of its initial value during the early days of a contract, it seems to me that the stock price would have had to have taken a steep drop. I’m wondering what the rationale is for waiting to buy back your options when so much damage to the stock price has been done. Or are you saying you do this when most of the time value is used up?

e.g. I bought ITC at $39.53, then sold the Feb $40 calls. The stock soon dropped ~$5/share and still the option price was $1.40—nowhere near 20% (0.39). What should I have done?

#4 Does rebound or breakout potential play any role in your selection of covered call candidates?

Thanks for being accessible.

Paul

Paul,

The only questions we get on this site are great ones…including yours:

1- We use the 20%/10% guideline to close the short option position first. The stock side is based on its performance compared to the overall market and chart technical…all detailed in my books and DVDs.

2- At the beginning of a contract (shortly after expiration Friday. This will avoid time value erosion if we wait too long (impact of Theta).

3- I have found over the years, this guideline will generally keep us out of trouble…I’ve tried all different percentiles and these work best.

4- Please re-check the stats on ITC…currently trading higher than your cost basis…looks like a great trade thus far.

Alan

Wide World of Options Radio Network: Alan’ interview:

http://www.optionseducation.org/tools/wide_world_of_options.html

My segment begins at about 22 minutes and lasts about half an hour.

Enjoy,

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options. Note that after a long absence, two gold ETFs have earned their way back onto our ETF Report.

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Hi Alan,

I have a question regarding the portfolio that employs cash secured put exclusively.

I have heard many investment gurus who say that this is a very bad idea in that we are using only this strategy for the entire portfolio because the Delta value of the portfolio will be very highly positive.

I presume that what is meant by this is that the portfolio is not hedged and we don’t have a Delta neutral situation therefore if the Black Swan effect happens we would lose very heavily.

With The Blue Collar, how can I sell the cash secured puts for my entire portfolio and expect to sleep peacefully at night?

Sean

Sean,

Perfect question for this article.

Excellent point that put-selling (as is covered call writing) is a Delta-positive position. Selling negative Deltas as we do with puts results in a Delta-positive position. With covered call writing, we are long the stock (Delta positive) and short the call (Delta negative). Both are Delta-positive positions. In simple terms, if we sold an ATM put with a Delta of-0.5, a resulting position of +0.5 Deltas would result because we sold the put. If we bought a stock and sold the ATM covered call we would have a positive Delta of 1 on the stock side (all stock shares have a Delta of 1) and a negative Delta of -0.5 on the option side resulting in a positive Delta of +0.5. Let’s bring this into perspective: if we just owned a portfolio of stocks as most investors do, our portfolio Delta would be +1.0.

If we are concerned about a Black Swan scenario (unexpected catastrophic event) the following steps can be taken:

1- Sell deeper out-of-the-money puts to get additional downside protection and a lower overall positive Delta portfolio.

2- Be diligent and prepared with all exit strategy executions

should the need arise.

3- Diversify with other strategies like put-buying to lower the positive degree of Delta.

4- Consider a collar (covered call writing with a protective put) where you set both a ceiling and floor.

5- Consider selling cash-secured puts on inverse ETFs. If there is a market decline, the underlyings will appreciate in value leaving the put strike out-of-the-money and allowing you to capture the entire premiums. Continue to do so until you have more confidence in the overall market.

There is so much we can do to mitigate risk but we cannot eliminate it totally if we aspire to generate more than a risk-free return.

Alan