The Greeks play a major role in both covered call writing and selling cash-secured puts. Understanding these factors and tailoring our strategy based on this insight will allow us to elevate our returns to the highest possible levels. In today’s article, we will focus in on Delta and Theta and discuss when they are an asset or a liability in our investment positions. We will also examine how to best take advantage of mastering this information.

Definitions

Delta: The amount an option value will change for every $1.00 change in the price of a stock. Deltas range from 0 to 1 for calls and 0 to (-)1 for puts.

Theta: The amount the theoretical value of an option will change with the passage of one calendar day, all other factors remaining the same. Theta is a negative number for both calls and puts.

Theta: Asset or liability?

Once we’ve established our position, Theta is our friend. Once we execute the option-selling trade, Theta goes to work eroding the time value of the option much like buying a car and pulling it out of the show room parking lot and boom…it goes down in value. This is a positive for us because we may want to take advantage of an exit strategy opportunity and buy back the option. Because of Theta we may be able to sell high and buy low.

Theta also teaches us to sell our options early in the contract to capture as much premium as possible. Most of us sell Monthlys (options with 1-month expirations) so our obligation is only four or five trading weeks depending on the contract month. So while Theta is assisting us, Delta is weighing in as well and Delta may also be our friend but it could also turn against us.

Delta: Asset or liability?

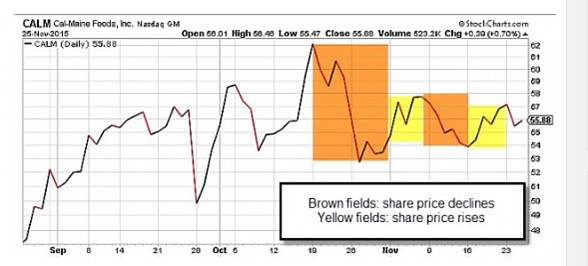

For both covered call writing and selling cash-secured puts, we are okay if share price rises. Puts will not be exercised and calls, if exercised, will result in sale of our shares at a price we felt was favorable to us when we entered the trade. Plus we can always roll the option if we want to retain our shares. Our main position concern is share value deterioration. When selling calls, we start to lose money when share value declines more than the option premium received from the short call. For put-selling, the option may be exercised and the shares “put” to us at a higher price than current market value leaving us in an unrealized losing position. Both of these scenarios assume no exit strategy intervention. But, as we all know, exit strategies are crucial to our success so we may benefit from buying back the short options. To visualize the impact Delta has on option value, let’s first look at a price chart for Cal-Maine Foods, Inc. (CALM) from 8/25/2015 to 11/25/2015:

CALM Price Chart from 8/25/2015 through 11/25/2015

- Brown fields show share price decline which should decrease call premium value and increase put premium value

- Yellow fields show increases in share price which should increase call premium value and decrease put premium value

With CALM trading at $60.00 near the start of the November contracts (October 16, 2015), I focused in on the December $57.50 in-the money calls and December $57.50 out-of-the-money puts. My conservative positions were the result of an upcoming Fed meeting in December where interest rates may be hiked.

Price chart of the December $57.50 call option

CALM: December $57.50 Call Option

As price value decline (brown fields), our biggest concern, option value also declines making it more cost effective to buy back an option if position management techniques are called for. If stock price rises (yellow fields) we have the choice of buying back the option or allowing assignment and selling our shares at a price we deemed favorable at the start of the trade.

Price chart of the December $57.50 put option

CALM: December, 2015 $57.50 put option

If share price rises (yellow fields), option value declines and we may be presented with an opportunity to close our position at virtually no cost and use the “freed up” cash to secure another put, a second income stream in the same month, if you will. If share price declines (brown fields) put option value will increase, making it more expensive to close out a potential losing situation. Now there are times we must do this to prevent substantial losses but there is one silver lining in these situations…while Delta is rearing it’s nasty face, Theta is helping us out by decreasing the time value of the put option each calendar day.

Discussion

Understanding the Greeks is critical to our success. Once we enter our option-selling positions, Theta is generally our friend while Delta is Dr. Jekyll and Mr. Hyde. When Delta represents an asset we should know how and when to take advantage of it and when it is our enemy when need to manage our trades and mitigate losses.

Live interview

On March 15th at 9 PM ET, I will be interviewed live on blog talk radio (Solutionsology Radio). I will provide the link to this event once it is available. The focus of the conversation will be about my third book, The Complete Encyclopedia for Covered Call Writing.

Market tone:

Global equities rose again this week, strengthening the position that a bottom has been established. The Chicago Board Options Exchange Volatility Index (VIX) remained steady at about 17. This week’s reports and global news:

- European Central Bank President Mario Draghi announced an aggressive package of additional measures to ease monetary policy in the eurozone but suggested that he will not move further. The euro ended the week higher than it was before the ECB meeting

- Although China’s foreign exchange reserves declined $28.6 billion in February, that drop was not nearly as steep as the $99.5 billion decline in January. Exports fell sharply in February, declining 25% year over year

- Production cuts in the United States and a slower ramp-up in Iran’s production are helping to stabilize oil prices, according to the International Energy Agency. US production will decline 530,000 barrels per day in 2016, the agency said. It does not expect balance to return to the global oil market until well into 2017

- Two members of the US Federal Reserve Board spoke publicly this week and came to different conclusions on the inflation outlook. Vice Chair Stanley Fischer said that inflation may be stirring whereas Governor Lael Brainard said she wants the Fed to put “a high premium on clear evidence that inflation is moving higher” before tightening monetary policy further

- Markets do not expect the Fed to hike rates when the Federal Open Market Committee meets in Washington next week

- Former Brazilian president Luíz Inácio Lula da Silva was charged with money laundering and concealing ownership of assets as the Operation Carwash scandal spread

- The Reserve Bank of New Zealand also cut its policy rate to a record low 2.25% from 2.5%. Further policy easing may be required, said RBNZ governor Graeme Wheeler

- Nasdaq agreed to buy the International Securities Exchange, an options exchange operator, for $1.1 billion from Deutsche Boerse

Coming up next week

- The Bank of Japan holds a rate-setting meeting on Tuesday March 15th

- The United States releases retail sales data on Tuesday March 15th

- The US Federal Open Market Committee meets on Wednesday March 16th

- The Bank of England’s Monetary Policy Committee meets on Thursday March 17th

For the week, the S&P 500 increased by 1.11% for a year-to-date return of (-)1.06%.

Summary

IBD: Market in confirmed uptrend

GMI: 4/6- Buy signal since market close of March 2, 2016

BCI: After four winning weeks, I am moving to a more aggressive position of an equal number of in-the-money and out-of-the-money strikes.

Wishing you the best in investing,

Alan ([email protected])

Alan,

Do you consider delta and theta the two most important greeks we should focus on?

Thanks,

Marcia

Marcia,

These are two of the “big 3″ in my view. We must also focus ‘like a laser” on Vega or the impact that implied volatility has on option value and its role in the risk we are incurring. When we sell options with similar expiration dates, we are, in essence, selling volatility. The more volatility, the higher the premiums and the greater the risk.

Alan

In the grand scheme of things, do you have any thoughts on exiting the stock itself, i.e., certain % decline from price of purchase, etc. that would not wipe out the income generated from selling the calls?

Brian

Brian,

In my books and DVDs, I set up specific criteria regarding when to sell the stock, roll down the option, roll out and take no action…so there are multiple factors to consider.

For members looking for a range when to sell a declining stock aside from these factors, I would say between 8-10%.

Alan

Alan,

Trading covered calls seems like a very low risk opportunity, particularly if you have LOTS of Shares. I’m 53 and have about $300k in one of my IRA accounts that’s a role over. Meaning it was established years ago. My returns are rather lousy. Doubled in 11 years. It’s very diversified. I guess I am not sure why it don’t transition to a spx or QQQ which are also diversified ETFs’ and trade the covered calls monthly to generate income. Doesn’t seem that complicated but my financial adviser tells me to leave it all alone and let the professionals handle it. However, in that case I only benefit from the general rise in the stock and market and the rare dividend attached to any of the stocks that are part of the holdings.

Maybe I’m stupid but I’m inclined to buy $300 k of AAPL and sell the out of the money options each month. what is my risk that I’m not seeing? $.50 cents to $1 on approx 3000 shares each month or so looks pretty good method to earn income.

What am is missing?

Regards,

David

David,

Thanks for a great post!

I can not wait for Alan’s reply :).

Sounds like you have reached that Epiphany moment we all do: who manages my money? Me or someone else?

If it is going to be you – which I highly recommend – you will need to do some homework first.

You would not at all be stupid buying $300K of APPL and selling OTM calls. You would just be bold :)!

If you want to make that kind of bet on one ticker do it with SPY. If you want to do it with individual stocks pick at least 10 of them to have no more than 10% in any one holding. Make them in different sectors. An easy way to do that is look at the SPDR Sector ETF’s and buy/write the largest holding in each.

Given this is a bullish time you should start by selling an OTM put for April expiry on each. You may just keep a lot of premium and not own anything in a month but the summer correction is coming and you can probably do it again for May.

If you already bought your AAPL let it run. Only sell calls against half at most OTM.

OK, David, you got me going! I am sure this will make for lively conversation this week in the community :). – Jay

David,

Your comments and questions are so important to retail investors and I appreciate the opportunity to address them as well as the remarks by your adviser.

Let me start by saying that Jay’s comments are spot on and I’ll try not to be too redundant. My responses:

1- Covered call writing is a strategy geared to generating a monthly cash flow. The education is critical (stock selection, option selection and position management). From there, paper-trading and then starts the cash-generation trades. While going through the learning process, retail investors will be able to make an informed decision if this is the right strategy for our families…it has been for me for 25 years and going strong.

2- Diversification is critical and I will defer to Jay’s comments regarding multiple stocks in different industries or broad market ETFs in lieu of one stock which may let us down, yes even Apple.

3- The risk is in the share value declining more than the premiums generated. If we bought AAPL when it was trading at $130 and sold options through today, we would be losing money. That said, AAPL has made a ton of money for the Ellman family over the years but I didn’t put all my eggs in one basket and did maneuver in and out of AAPL based on our screening criteria.

4- Now for your adviser’s comments…deep breadth…I am going to take the high road and assume your adviser meant “let the educated handle it” There I will agree. Anyone who says that only professional advisers are capable of learning and executing a strategy and retail investors like us are not, are way off the mark. I would ask such an adviser to refer me to a scientific double-blind study that concludes that only financial advisers are genetically predisposed to learning covered call writing. What makes their DNA so superior to ours?

The answer, of course, is that financial advisers have taken the time to learn these strategies and most retail investors have not. That’s all changing now. So if your adviser meant “leave it to the educated”, I agree…let’s assume that’s what he or she meant.

This is not a knock on financial advisers…there are many very good ones available who provide a great service. But retail investors who do their due-diligence are just as capable and should not be discouraged from the education process. Education is power and no one cares more about our money than we do…exhaling now.

Thanks for sharing,

Alan

David,

If it were that simple, everyone would be doing it, right?

Alan emphasizes in his books that “the risk is in the stock”. You have to know how to pick stocks, and determine what the market as a whole is doing, in addition to knowing how to sell calls. So start with that.

Recommend reading Investors Business Daily at your library, and look for books by Toni Turner, William O’Neil and Van Tharp.

Paper trade or start very small first. You will make mistakes and learn from them. There’s a lot to know about risk/reward, how to set stops, position sizing (that’s what you’re not seeing in your proposed purchase of $300 of AAPL), implied volatility, market types, etc.

David,

Watch out.

Be very careful.

There is a huge difference between not gaining much, and LOSING.

Losing hurts like hell.

If I were you, I would start with 100,000.00 first, and do not spend much more than 10,000.00 on a each individual stock or market segment.

Than, watch your results during the next 5 years, while learning the ropes.

The market is full of pitfalls.

Maybe you will be good at it and become a pro, like Alan and Jay.

I wish you lots of luck – Roni

Thanks for your always kind words, Roni! But Alan is the only real pro around here, I am just an appreciative student :). – Jay

Jay is being humble…on this site we’re all equal as we learn from each other. Thanks to one and all for your participation…Alan

Hey David,

Sorry, me again. I suspected your great post would inspire great conversation :)!

You will notice a very important distinction in the words Alan uses to describe the premiums we receive when selling options. You referred to it as “income”. I used to think of it as income too. The less sophisticated articles you read will call it income as well.

Alan calls it “cash flow”. That is because it is not “income” until you keep it after closing a profitable trade or having a profitable expiry. If your stocks go down it is just loss protection pending exit strategies.

I look at dividends the same way. Some investors hold them up as Manna from Heaven. They are nice. But what good is a 4% yield on a stock that goes down 40% and damages a portfolio for years when the cash could be better used elsewhere?

So never let the Siren’s call of dividends and/or options premium steer your boat onto the rocks ignoring the real driver of your success: the health of the under lying security and the health of the overall market. – Jay

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member website and is available for download in the “Reports” section. Look for the report dated 03/11/16.

Be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar Investor YouTube Channel. For your convenience, the link to The Blue Collar Investor YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The Blue Collar Investor Team

Alan,

I see FIVE has earnings coming out 3/22/16 and the date is in red but the row is not gold. Does that mean it’s ok to sell the April monthly call option since expiration is not for several weeks after ER?

Godspeed,

Brian

Brian,

In our premium stock reports, red/bold means that the report date has been confirmed. FIVE is not in the gold rows because we are still in the March contracts and Five reports during the April contracts (3/22). We frame it by contract, not calendar, months. March contracts expire on the 18th and then FIVE will appear in the gold rows until the report passes.

Alan

Hi Allen,

Your report state that “Select Sector SPDRs are unique ETFs that divide the S&P 500 into nine sector index funds”. But I could not see XME in the 9 sectors that you mention. I also did some research on selectspdr.com and they state that there are 11 sectors. However, XME is still not among them.

Is XME a subset ETF of XLB?

Kind regards,

Alex

Alex,

There are 9 SelectSector SPDR ETFs that breakdown the S&P 500. They all start with the letters XL__ as shown in the screenshot below. The ETF, XME, is specific for Metals and Mining and is not broad enough to be considered one of the SelectSector SPDRs. Now there are certain venues that add additional breakdowns of the S&P 500 like telecommunications, for a total of 10 but the generally accepted breakdown is for the 9 ETFs shown in the screenshot and those are the ones BCI includes in our ETF reports

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Hi Alan

I just subscribed to your premium report after having read your recent book on selling puts and your complete guide to writing covered calls. Most of the material makes sense to mean and I am eager to place my first trades. However, I have a couple of questions of clarification.

1. Following your preferred approach of selling monthly options with four weeks to expiration, I would aim to invest my funds for the upcoming options cycle, which ends on April 15, this week and next. Is that right?

2. When you have stocks that pass most or all of the technical and fundamental criteria, do you try to time your entry? Specifically, do you look for chart patterns such as a MACD cross or divergence before entering or do you just rely on the bullish technicals?

Thanks,

Steve

Steve,

Welcome to our premium membership.

I enter my trades within the first few days of a contract cycle and roll options on expiration Friday or the day before if I am traveling. I trade predominantly Monthlys. For those who trade Weeklys, positions can be entered mid-contract. As an example, with March contracts expiring this Friday, I will enter new positions next Monday or Tuesday for the April contracts.

All of the stocks on our premium watch list are re-screened for technicals each week. I favor out-of-the-money strikes when charts are bullish and confirming and in-the-money strikes when technicals are mixed. I also factor in overall market assessment. Because Theta (time value erosion) is logarithmic in nature (declines slowly at first and then dramatically later in the contract) it is in our best interest not to wait too long to enter new positions…therefore in the first few days of a contract and manage from there.

Alan

Alan,

Thanks for sending the report. I would like to know what is your recommendation for the following scenario:

Starting a covered call position for one month according to the information at the table “PASSED PREVIOUS WEEKS & PASSED CURRENT WEEK ”

· A week later the above stock appears at table ” PASSED PREVIOUS WEEKS & FAILED CURRENT WEEK”

I would like to know if your recommendation is to close immediately the position or to continue it till the end of the option’s period (i.e. do the exit strategies). In other words, the question is if the table “PASSED PREVIOUS WEEKS & PASSED CURRENT WEEK” refers only for starting new covered call positions and not for people that already have covered call positions with those stocks.

Thanks in advance,

Amir

Amir,

Once stocks are selected from our Premium Watch List and positions are entered, they are managed as per the BCI exit strategy rules and guidelines NOT by their disappearance and re-appearance from our stock reports.

You are 100% correct that if a new position is entered mid-contract, the underlying should be selected from the most recent stock report.

Alan

how would you consider the current market scenario? Is the bull still enforce or are we on a sucker rally ?

alex

Alex,

No one knows for sure but I have made it clear that I am bullish on the overall market and have been so since March, 2009. At the end of my weekly blog articles and on page 1 of our Premium Stock Reports, I publish my market analysis, that of IBD and Dr. Eric Wish’s GMI Index so our members can get 3 perspectives.

In addition, on our Premium Stock Reports, we recently added another feature regarding the analysis of the charts of the broad market indexes (S&P 500 and the VIX) as shown below.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

if i wrote a covered call, i can’t buy a put can I? i mean if the stock sinks, i still have the obligation to sell it at the agreed price on the agreed date,

if i sold a 30$ call for the 15th of April for example, I can’t buy a protective put for the same date.. wouldn’t that create a naked option? or? sorry, i’m a bit confused.

Alex,

You can absolutely do this…it’s called the “collar strategy” and is a defensive position that protects against catastrophic share depreciation. Let’s set up an example:

Buy a stock for $30 and sell the $30 call

Buy a $28 protective put

Now, we have only one obligation…to sell at $30 if the option buyer decides to exercise.

Let’s say share price declines to $25:

The call option expires worthless and the put option is worth at least the intrinsic value of $3 ($28 – $25). If share price moved to $20, the put would be worth at least $8. We can sell the put, sell or hold the stock.

Alan

Alex,

An easy way to think of it is when you sell an option you get paid. I don’t know about you but every time I have gotten paid in life I incurred some obligation :).

But when you buy an option you own it and have no obligation whatsoever – just like walking out of the store! Your only obligation is to yourself understanding what you bought and why. – Jay

Last night’s radio interview:

http://www.blogtalkradio.com/everydayradio/2016/03/16/live-interview-with-legendary-investor-alan-ellmanpres-of-blue-collar-investor

Running list stocks in the news: RGR:

Sturm Ruger and Co. has been benefitting from the huge demand for firearms. In its most recent earnings report a few weeks ago, earnings expectations were beat by 17.3%. Growth projections year-over-year come in at 17.9% for the upcoming quarter and 23.8% for the full year.

Our Premium Stock List shows an industry rank of “A” (Business services), a Scouter rating of “5”, an upcoming earnings report date of 5/25/16, a beta of 0.81, a % dividend yield of 1.70, adequate open interest for near-the-money strikes and the last ex-dividend date of 3/9/16.

This is just one of many elite performers in our most recent stock report.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

***Notice the significant decrease in implied volatility of our eligible ETFs as the market recovers from January losses.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Hi Alan, been a little late this week as I have been out of time a bit. Now most of my papertrades so far this contract seem to be positive apart from with the stock “COTY”.

I sold the $28C on 22nd Feb, but on 2nd March there was investor alert news concerning ‘possible breaches of fiduciary duty by the board of directors’. Since then the price has gone down/ s-ways, and so I just recently rolled down to the $27C.

I am wondering if it would have been better to have closed-out this position the next day after reading this news, as you have said that we “should immediately close-out positions that have any concerning information attached to them”? (I hadn’t closed-out because I saw support around $26 and thought price may bounce up a bit.),- what would you suggest?

As expiry nears I want to know about possibly using the report for rolling out stocks, so here below is what I mean:-

– When thinking of rolling out a stock at end of contract, I am wondering if I should up until then be looking right through each weeks premium report to see that a particular stock has passed certain screening criteria to even be entitled for a roll-out.

What I mean here is how am I to know at expiry whether some stock I intend to use has passed the smartselect fundamental scan, or isn’t now rated a “D” for industry rank, or even if it passed the R/R scouter test unless I see it maybe has failed in one of these scans leading up to expiry? Because if over the 4-5 weeks it had failed a scan or few, then wouldn’t it be best not to go ahead with any roll-out?

– Also if upon seeing a failed screen for a stock you are already trading then are you more likely to close this stocks position if it is also falling in price(rather than rolldown)?

I will need to post out more questions again from next week onwards. Thanks

Adrian,

1- Yes, legal issues with a Board of Directors is a valid reason to close a position even if share value has not significantly declined in value. We are all about avoiding unnecessary risk.

2- Once a position is entered, it is managed with our exit strategy arsenal, not by its appearance/removal from our Premium Watch List. If we need a replacement stock, then we would select from our most recent report.

3- Rolling out: When considering this strategy, the strike is in-the-money by definition. This means that technicals are most likely favorable. If we roll out ( not out-and-up) we are rolling to an in-the-money strike and have downside protection of the time value initial profit. If the calculations meet our goals, this is a valid and reasonable approach even without the upcoming earnings report.

Alan

Alan,

In the premium report, you note a ratio of defensive positions to more aggressive ones. For example, If you’re positioning 3:1 in defensive positions, does that imply that you have 3 positions in ITM calls to each OTM call?

Also help me to better understand the concept of routinely buying the underlying securities in leading sectors. It seems like you’d always be buying at the highs and then when it falls out of the lead, you’d be selling the securities at a loss.

Godspeed,

Brian

Brian,

1- Yes, you have it right on the stats I give relating to the “moneyness” of the current positions in my portfolios.

2- We are undertaking a 1-month obligation. Some of our members undertake 1-week obligations. In my view, the stronger the chart pattern, the better. Overall market assessment and personal risk tolerance play roles as well. Technical analysis is always open to discussion but I prefer an uptrending chart with bullish momentum indicators over one that is declining towards support. For longer-term trades, I may buy at a different price point.

Alan