When we write a covered call, our breakeven is stock purchase price – entire call premium. If we buy a stock for $48.00 and sell an option for $2.50, the breakeven is $45.50. In June 2019, John shared with me a series of trades he executed with Planet Fitness, Inc. (NYSE: PLNT) where he wrote a call and then rolled that position out-and-up. He was trying to decide what stock price to use when rolling the option and where his breakeven (BE) was in the second month of these trades. Let’s evaluate the stock cost-basis and BE over the 2-month time frame.

John’s trades with PLNT

- 6/3/2019: Buy PLNT at $75.58

- 6/3/2019: Sell-to-open 6/21/2019 $75.00 call at $2.70

- 6/21/2019: PLNT trading at $76.01

- 6/21/2019: Buy-to-close the June $75.00 at $1.10

- 6/21/2019: Sell-to-open the July $77.50 call at $2.00 (roll out-and up)

Stock cost-basis and breakeven on 6/3/2019

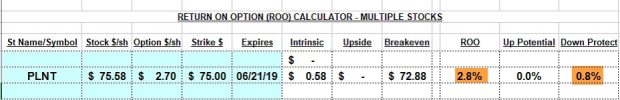

PLNT: Initial Calculations with The Ellman Calculator

- The stock purchase price is $75.58

- The cost-basis when calculating initial time-value returns is $75.00 (deducting the premium intrinsic-value ($0.58) from the stock purchase price

- The BE is $72.88 (purchase price – entire premium: $75.58 – $2.70)

- The initial 18-day time-value return is 2.8% with 0.8% downside protection of that time-value initial profit

Stock cost-basis and breakeven on 6/21/2019

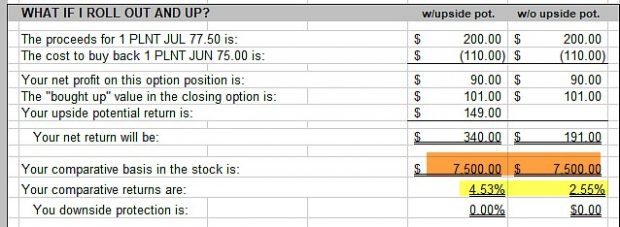

Rolling out-and-up information entered (“What Now” tab of the Ellman Calculator)

PLNT: Rolling Out-And-Up: Information Entered

Rolling out-and-up calculations

PLNT: Rolling Out-And-Up Calculations

The stock cost-basis is $75.00 (brown cells) because that is what the shares are worth on 6/21/2019 because of the contract obligation

Based on this cost-basis, the initial return on option is 2.55% and with upside potential (share price moves up to the new $77.50 strike) the maximum return is 4.53% (yellow cells).

Overall breakeven on 6/21/2019

- Shares were purchased at b$75.58

- Option credits: $2.70 + $2.00 = $4.70

- Option buy-to-close debit = $1.10

- Net option credit = $3.60

- Overall trade breakeven = $75.58 – $3.60 = $71.98

Discussion

When viewing our stock cost-basis and BE, there are 2 sets of calculations. One is used to make the best trading decision at that point in time as we used a $75.00 cost-basis when rolling the option and the other when viewing a long-term analysis of a series of trades with a specific security ($71.98 overall breakeven).

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Dear Alan and Barry,

I just wanted to take a moment to thank you both for the BCI program and your patience. I continue to learn quite a bit. My wife and I wish you and your families a Happy Holiday Season and all of the Blessings of 2020!

Ted S.

Upcoming events

1. February 6th – 9th 2020 Orlando Money Show

3- Hour Masters Class Saturday February 8th 1:45 – 4:45 PM

BOOTH 306

2. Tuesday March 10, 2020 Long Island Stock Traders Meetup Group

7 PM – 9 PM

Plainview- Old Bethpage Public Library

Covered Call Writing Blue-Chip Stocks to Create a Free Portfolio of Large Tech Companies

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 8 of our mid-week ETF reports.

*********************************************************************************************************************

Hello Alan,

I plan to join your org next week (start of new year). Happy New Year.

I am 68 years old and am using my 401K to invest in the market but I am possibly not doing good – losing big in NCV and OXY.

Yesterday, I dumped OXY witha loss of $26K (per advice from Charles Schwab) and am left with a balance of $206K. I would like to invest in a stock/ETF (or Covered Call/Put Option) to make some money and keep my life saving safe.

Since I am still working full time, I can save every month to gain experience in Options trading. Schwab recommended selling Cash-secured Puts.

Please advise.

Sincerely,

Khurshid

Khurshid,

Welcome to our BCI community and happy New Year to you..

Both covered call writing and selling cash-secured puts are outstanding low-risk option-selling strategies that allow us to beat the market on a consistent basis. My personal preference is covered call writing in normal-to-bull markets because it allows us to generate 2 income streams (option premium + share appreciation up to the strike price) per trade when selling out-of-the-money strikes.

I lean to put-selling (out-of-the-money) in bear and volatile markets which adds an additional layer of protection to the downside as I incorporate put-selling with covered call writing (PCP strategy).

There is nothing wrong with put-selling only. Both are appropriate for conservative investors with capital preservation in mind who look to beat the market every year.

Take your time mastering the 3-required skills and then you will have years and decades to benefit.

Alan

Alan, I don’t comment often but I enjoy reading your blog and comments. The one thing I’d add to your “take your time” reply to Khurshid, is to practice in a paper money account. He just sustained a “big loss” and wants to “keep my life savings safe” and I wouldn’t want him to lose more “real” money during his learning phase. Keep up the good work! Steve

Steve,

Absolutely. A critical component to mastering the 3-required skills must include paper-trading. Thanks for highlighting this important point.

Alan

Hey Khursid,

Welcome to our group!

I don’t know what your account configurations are but if Schwab is saying sell cash secured puts you must have options clearance ?

I will make a leap here and suspect you can not trade options in your company sponsored 401K? So you may be talking about a self directed IRA with Schwab? I do all my trading in an IRA where I have sufficient options clearance.

I use cash secured puts all the time. It is a bullish strategy. But please be sure you would be perfectly fine buying the stock you pick at the lower price even if it goes further below and you get early assigned. It happens.

Selling covered calls is an inherently bearish strategy. You assume the stock will not go to the moon in the time frame you chose leaving you back on the launch pad :)! Sideways or downward movement plus theta decay will reward you. If you think a stock will go up cover it OTM, only half your position or not at all.

If you are risk averse please consider the index ETF’s like SPY, QQQ, GLD and TLT. There is not much premium there but over writing them OTM can add monthly yield to a balanced retirement portfolio insulated from individual stock risk. – Jay

Hello Jay,

The year is really ending now, and I have just entered my last trade.

I am now fully invested (monthly CCs only), and hope that 01/17 options cycle will continue with the bull.

My 2019 results total was 10.5%, which I consider very fortunate.

I hope you, and everybody else in this club did well too.

Happy New (trading) Year – Roni

Thank you Roni, nice work in 2019! And thanks for our chats about the market. As importantly thanks to Alan and Barry for providing this forum!

I am not Karnac but I have a feeling 2020 will be a bit tougher to make a buck though I doubt Trump will let the US market go down much in his re-election year. It will likely be a “buy the dips sell the pops” year in my opinion. – Jay

Hi Alan,

I have really enjoyed and profited from your BCL videos, the 3 Ellman books I purchased, the BCI Resources/Downloads, your BCI blog articles, BCI internet videos, etc.

#1. When you individually analysis of your approximately 45 to 60 on average prospective stocks from the BCI Weekly Stock Screener for technicals and fundamentals purposes, using slow stochastics, MACD, Volume, Moving Averages (say 20/50/100); do you only basis your analysis on a “one year time frame chart” or do you also key in on say… a three month time frame chart and a one month time frame chart and if so, to what degree and when?

#2. I have added a DO NOT DO to my BCI stock purchases and options selling strategy as follows:

#2A. No stock purchases involving companies where their heavy business emphasis is on new drug discoveries such as ticker symbol: CORT. Do you agree?

#2B. I “pass” on stocks where there has been several huge gap(s) or large price movements up and/or down in the stock’s price as shown on charts, especially during the last one year or in the last three years. Do you agree?? Too much volatility??

#2C. I was “stung” on a major large cap stock due to an financial analyst downgrade “out of the blue”… I know of no way to avoid this completely. Do you????

#2D. While I continue to learn more and more about the BCI way…. I am during this bullish market probably 50% to 75% “In the Market” with my stock options sales, to be conservative until I learn more. Do you agree with that idea??

Thanks!

Come to Las Vegas again!!

Tay, Retired Mortgage Banker

Tay,

My responses:

1. I use the time-frames detailed in my books and DVDs for each of the 4 technical screens used in the BCI methodology (12, 26, 9-day exponential moving averages for the MACD histogram as an example). I use a 1-year chart so I can view post-earnings price action in the rare event that I am considering holding a stock through an ER prior to writing the call. I use no other charts. Technical analysis represents 1/3 of the BCI screening process along with fundamental analysis and common-sense principles.

2A and 2B. The appropriate volatility of the underlying security depends on our initial time-value return goals and personal risk-tolerance. One size does not fit all. I use a range of 2% – 4% for my initial time-value return goal and up to 6% in a strong bull market. This approach will keep us invested in stocks that are appropriate for our trading style and goals. In my mother’s account, I use 1% – 2%.

2C. I agree. There is no way to account for unexpected bad news. We can mitigate by mastering the 3rd required skill… position management or exit strategies.

2D. Yes, I agree. We should start of slowly and allow our portfolio size to grow along with our skill and confidence levels.

Vegas: In the infamous words of Arnold… “I’ll be back”

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 12/27/19.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The Blue Collar Investor Team

[email protected]

Premium Members,

There was a typo in this week’s report. The stock, RGEN, does NOT have weekly options. The report has been revised and uploaded to the Premium Member site. Look for the report dated 12/27/19-RevA. Thank you, Ed, for finding this.

Best,

Barry

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

Also included is the mid-week market tone at the end of the report.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

FROM THE BCI TEAM:

Our heartfelt thanks for your amazing support and loyalty over the years. YOU put us on the financial map.

Happy, healthy and prosperous 2020 to one and all.

Alan, Barry and the BCI team

Alan,

I’m paper trading some momentum strategies, short term trades just holding long option positions and, sometimes, vertical spreads. I use ‘take profit’ and ‘stop loss’ for my orders, for example 50% for ‘take profit’ and 50% for ‘stop loss’. Initially I tried to use GTC (‘Good to cancel’) orders, because I don’t want to enter new sell order each day. But here seems to be a problem with GTC orders… I noticed that sometimes ‘stop loss’ gets executed within the first minute of the trading session. The ‘filled’ price is usually much higher than the stop price, but the security is sold anyway. It seems that there is wild bid/ask option price fluctuations within the first few minutes of the trading session and ‘stop loss’ level is often touched and order gets executed. I think this problem might apply to those who use GTC orders instead of day orders for 20/10 exit rule too.

Do you have any suggestions how to overcome this?

Thanks and have a prosperous New Year!

Sunny

Hi Sunny,

As you probably know, the first 30 minutes of trading is the most volatile period of the day. Market makers are setting prices based on Asian and European overnight trading. Initial prices may be gapping due to overnight or premarket news.

Looking at your trading, it is hard to make any comments or suggestions without knowing more information on your trade set-ups, how close to the money the trades are, your trading strategies (i.e.: straight options, credit spreads, debit spreads, or other strategies, etc.). A deeper discussion of this is beyond the scope of this brief blog discussion. If you like, you can email me at: [email protected].

However, there might be a problem based on the type of exit orders that you place. There are some really good blog articles on this topic. You can look at:

– https://www.thebluecollarinvestor.com/covered-call-writing-types-of-customer-orders/

– https://www.thebluecollarinvestor.com/types-of-customer-orders-plus-update-on-bcsi/

– https://www.thebluecollarinvestor.com/covered-call-writing-should-we-use-stop-loss-orders/

– https://www.thebluecollarinvestor.com/covered-call-writing-setting-up-a-stop-loss-order/

– https://www.thebluecollarinvestor.com/what-is-slippage-and-how-does-it-impact-our-trading-success/

Other articles that might help are:

– https://www.sec.gov/fast-answers/answersstopordhtm.html

– https://www.diffen.com/difference/Limit_Order_vs_Stop_Order

– https://www.schwab.com/resource-center/insights/content/stop-orders-mastering-order-types

– https://ibkr.info/article/255

I hope this helps. It is hard to give you any answers without knowing more about the type(s) of trade(s) that you are executing. As I mentioned earlier in this response, please email me if you would like to discuss this further.

Best,

Barry

Thanks Barry, that was helpful.

I think this problem might be because I use simulated account. I noticed that on my broker’s simulated account orders are executed differently than the ones on real money accounts. For example sometimes sell order is not executed even if it is placed below the bid price. This will never happens in real money accounts where even ‘midpoint’ price order often gets filled. I think I will use the day orders avoiding the first 30 minutes of trading session instead of GTC orders.