Never write a covered call or sell a cash-secured put when there is an upcoming earnings report prior to contract expiration. This is one of the most important rules in the BCI methodology. Adhering to this guideline can create challenges during the heart of earnings season when most companies publicize their financial statements. In our BCI community, when difficulties present themselves our response is “bring it on” With earnings season now upon us, we will use this week’s article to demonstrate how to use our premium member reports to circumnavigate earnings reports challenges. I am writing this article prior to production of the reports published at the end of the October contracts. I strongly urge our members to use the reports dated 10/19 and 10/21 for ETF and stock selections for the November contracts.

Eligible November contract candidates from the Premium Stock Reports

Stocks that reported during the October contracts will be eligible for the November contracts. These stocks are highlighted in gold in the previous week’s report:

Stock Selection During Earnings Season

The red arrow points to one of the five candidates with inadequate option open interest so there are four candidates eligible for the November contracts in this area. We also find two more stocks that report in the December and January contracts as we scroll down the report:

Stocks Reporting After the November Contracts

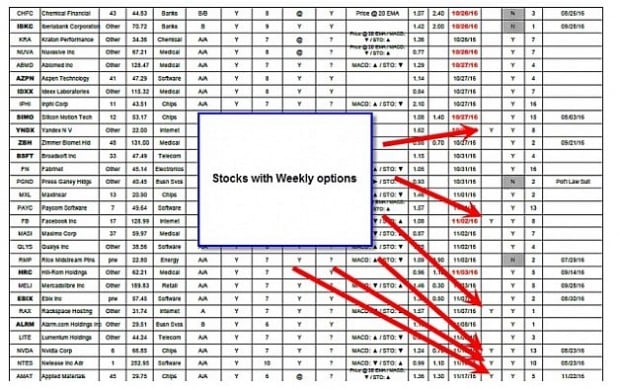

In addition to the six eligible candidates located so far, many of the stocks that report during the November contracts have Weekly options associated with them. This means that we can use the securities in the three of the four contract weeks. Granted we will lose some premium income but it will be worth it to avoid earnings report risk. The screenshot below shows some of these potential candidates with Weekly options:

BCI Premium Report: Stocks with Weeklys

Eligible November contract candidates from the Premium ETF Reports

Exchange-traded funds (ETFs) do not represent earnings report risk since they are baskets of securities with some reporting favorably and others unfavorably and they tend to balance themselves out. Each report normally produces between 20 -25 eligible candidates to select from:

BCI Premium ETF Report

Discussion

It is critical to avoid the risk of an earnings report disappointment. Since most securities report during earnings season (January, April, July and October) there are apparent challenges funding our option-selling portfolios four months per calendar year. We overcome these challenges by using stocks that report in other contract months, by using stocks with Weekly options and by incorporating ETFs into our portfolios those months.

Upcoming live events

October 17th, 2016

Austin, Texas

Registration link and information

November 5, 2016

Plainview, New York

Saturday morning 3-hour workshop at the Plainview Holiday Inn. I am the only speaker and plan an information-packed presentation covering 5 actionable ways to make money or buy a stock at a discount using both call and put options. We will also evaluate the stocks you currently own for option-selling.

December 6, 2016

Options Industry Council Webinar Summit

Tuesday afternoon…information to follow:

Market tone

Global dropped slightly this week, weighed down by a firmer US dollar and rising long-term interest rates amid concerns over the Chinese economy. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), rose to 16.12 this week from 13.4 a week ago. Oil prices held steady above $50 per barrel. This week’s reports and international news of importance:

- The minutes of the September meeting of the FOMC, the US Federal Reserve’s rate setting committee, show that several officials felt a rate hike is needed “fairly soon,” and that a reasonable argument could be made for either an increase at that (September) meeting or after receiving additional information on the labor market or inflation

- The FOMC next meets in November, a few days before the presidential election. Most observers expect the committee to wait until the December meeting to hike rates

- UK long-term yields have risen sharply in the past month, more than doubling from 0.52% on August 12 to 1.10% today. A plunging pound has increased inflation expectations, but has also boosted the FTSE 100, which is made up primarily of multinationals, many of which will benefit from favorable currency translation when overseas earnings are brought home to the United Kingdom

- Chinese exports declined 10% in September. Imports fell too, down 1.9% from the prior month

- Offsetting the trade gloom somewhat was the first rise in Chinese producer prices in nearly five years, reported Friday. Producer prices rose 0.1% year over year in September, ending a price slump that began in January 2012

- Like the UK economy, the eurozone economy appears to be taking Brexit mostly in stride, and data released this week were mostly upbeat

- German exports climbed 5.4% in August, the biggest rise since 2010. Investor confidence in Germany improved as well, with the ZEW index rising to 6.2 in October from 0.5 in September

- Eurozone industrial production beat expectations, jumping 1.6% in August

- OPEC has never pumped more oil than it did last month. According to the International Energy Agency, OPEC produced 33.64 million barrels of oil per day in September. World production peaked a year ago, at 97.2 million barrels per day, in September 2015. Over the past year, OPEC production has risen 900,000 barrels per day

- US retail sales rose 0.6% in September, while August sales figures were revised to -0.2% from an initial 0.3%. Combined with sold employment figures, this reinforces the idea that the Fed will hike rates before the end of the year

- US weekly jobless claims this week held at their lowest level since 1973, when the economy and population were significantly smaller than today

THE WEEK AHEAD

- The United Kingdom reports retail sales and consumer price data on Tuesday, October 18th

- US CPI data is released on Tuesday, October 18th

- China reports Q3 GDP on Wednesday, October 19th

- The Bank of Canada’s rate setting committee meets on Wednesday, October 19th

- The European Central Bank’s Governing Council meets on Thursday, October 20th

For the week, the S&P 500 declined by 0.96% for a year-to-date return of +4.36%.

Summary

IBD: Uptrend under pressure

GMI: 1/6- Sell signal since market close of October 12, 2016

BCI: My positions for the October contracts continue to favor in-the-money strikes 2-to-1. I’m leaning slightly defensive because of the upcoming election and Fed watch.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The charts point to a neutral to slightly bearish outlook. In the past six months the S&P 500 rose by 4% while the VIX rose by 17%.

_____________________________________________________

Wishing you the best in investing,

Alan ([email protected])

Premium members:

Several of our new members have inquired about the location of our store discount link and how to access previous Blue Hour webinars. The screenshot below will shows those links as well as a new file we added today summarizing Federal Reserve actions & consequences that many of you have been asking about.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 10/14/16.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article,

“Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

Maybe I am just old and sentimental – I am almost 60 – but it is great Bob Dylan won the Nobel Prize.

I would be astonished if he is in his PJ’s in front of his computer awaiting the market open in the morning :).

But it would not surprise me if he could tell me within reasonable proximity where the indexes are because his genius is keen observation of the world in which we live.

The DOW, SPY, QQQ and IWM are all trading below their 50 day moving averages. I will certainly not be popping out of bed in my PJ’s looking to buy anything :).

But there in lies opportunity. NTES and ULTA look good on this week’s Premium list. If they sell off early this week it will be a good chance to sell further OTM cash secured puts. – Jay

Hello Jay,

I’m older than you, and Dylan is my generation. I am a big fan since he started. 🙂

I have gained every time I bet on ULTA, from $150.00 to $220.00, but now the price is above my limit.

I agree with you. ULTA is a fine choice.

Take care – Roni

Hey Roni,

I was just writing you a note about your post below when I thought I better check the board first. Sure enough, there was a reply from you!

I did not have the chance to thank you for your kind reply last thread. If English is a second or third language for you I am deeply impressed.

ULTA sold off almost 2% this morning so I sold two put contracts OTM. It is just a trade and I hope it becomes income.

But hope is always the worst trading strategy! I sold those puts because I believe ULTA has as good a probability as any other stock on our list to go up. If it does I will buy the puts back for peanuts. If not I will eat my crow :). – Jay

Hi Jay,

thanks for your compliment on my English.

I wish you luck with your ULTA trade. I love it. You can’t go wrong, even if you eventually need to let it be exercised, it’s a great stock to have in your portfolio and write covered calls on.

By the way, your other choice, NTES, is really going strong today.

Roni – :O)

Thanks, Roni!

There are many ways to use our Premium stock lists. I like using them for cash secured puts further OTM when stocks have big down days and put prices go up. Then I take profits when share price bounces back.

All the best performing stocks in the best performing sectors have bad days. That is when I jump on them :)! – Jay

That’s very smart trading Jay.

I must add this gimmick to my toolbox.

Cheers – Roni

Thank you for your always kind reply, Roni. One thing to add before this thread expires is in my opinion it is important to have a clear distinction in mind between trades and investments.

Never let a trade become an investment and vice versa. – Jay

Understood and added to my golden rules.

Thanks again – Roni

Alan,

I was wondering on your mother’s ETF portfolio are you doing the 3 top sector etf’s and the 3 top overall etf’s equal weight unless there is a significant overlap? I will eventually use the stock list but I made a disastrous credit spread trade on NVAX which has Fidelity strongly urging I use one of their advisors and a modern portfolio asset allocation mutual fund wait and hope portfolio. Anyway, I want to lower my risk structure till I get my confidence back. Your watch list uses the screening I was attempting to use when I wasn’t seduced by huge premiums which is a great time saver.

Andy

Andy,

In my mother’s portfolio I use securities from the ETF reports that also meet my monthly goals for initial returns (1-2%) and have implied volatilities no more than double that of the S&P 500. These may or may not be SelectSector SPDRs. For example, QQQ has frequently been a security I have incorporated into her portfolio when it meets system criteria. Other members may be more or less aggressive depending on personal risk tolerance.

Alan

Andy.

If I had to tell you how many times I lost my confidence the story would take too long :).

Going back to the drawing board with sector and index ETF’s makes all the sense in the world. You may like it there and stay!

Individual stocks are fun. But they will rip your heart out faster than your favorite team losing a home game 🙂 – Jay

Alan,

I really enjoyed your last video on cash secured puts. I went back and re-read your book on the same subject afterwards. It seems that your book noted that this was a good methodology to generate income. In your talk, you mentioned that this was a good long term strategy. Are you no longer recommending this strategy as a short-medium term income strategy? I really like the fact that you can purchase stocks at a discount and then consider the stock for a covered call if filled.

Thanks for your help in clarifying this.

Brian

Brian,

Selling cash-secured puts is definitely a short-term, income -generating strategy. I favor 1-month options. Now, if we use the strategy to buy a stock at a discount with the goal of keeping the stock in a long-term buy-and-hold portfolio, that is another way to use put-selling. Bottom line: This strategy can be incorporated into both short and long-term portfolios.

Alan

Alan,

I agree with your bottom line, but I feel that for short term portfolios, your covered call selling methodology is better suited.

It seems to me that there is less risk, and more exit strategies available when managing a covered call position.

Am I wrong ?

Roni

Roni,

It’s like choosing between a 5-start Italian restaurant and a 5-star Seafood restaurant…both great and a matter of personal preference. The risk lies in the implied volatility of the underlying security which is the same whether we sell calls or puts. I do lean to ccw in my personal portfolios but incorporate selling out-of-the-money puts in bearish market environments to get both the protection of the out-of-the-money put and the subsequent protection of the in-the-money call.

Both are great strategies to consider.

Alan

Alan,

thank you for always responding with kindness and useful knoledge.

I am taking note, and will incorporate the info in my quest to refine my trading skill, which is my ultimate goal.

Roni

Alan,

How do we engage stocks that have both weekly and monthly options if we want to play the monthly options? For example ATVI.

Can I start anytime in the cycle and simply sell for an expiration date that’s 4-5 weeks away or start after the 3rd Friday of the month and only aim at expirations on 3rd Friday of next month?

Thank you,

Michael

Michael,

When using Monthlys, I would simplify portfolio management by using options that expire on the same day. Since Monthlys have greater option liquidity and therefore tighter bid-ask spreads, I would enter trades on or around expiration Friday and the few days of the start of a contract. Waiting too long into a contract will impact the premium we receive as Theta begins to erode time value.

Alan

New York – Austin -New York:

I just returned from 3 days in Texas and loved every minute of it. Monday’s seminar was a real treat for me as I had a chance to meet several BCI members as well as members from the Austin Chapter of AAII. Great crowd…thanks for the warm hospitality.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team