So you have a money market account and invest in a money market fund. You feel that your money is safe and you can access it quickly but the interest rate is nothing to write home about. That’s about all most of us know about these money market instruments so as educated Blue Collar Investors we need to explore this subject in greater detail.

The money market is a segment of the financial market where businesses, institutional investors and the U.S. Government meet to buy and sell highly liquid (easy to buy and sell), short term debt securities. The money supply is controlled by the Federal Reserve Bank by buying and selling certain negotiable securities.

Retail, Blue Collar Investors can only participate in this market indirectly by investing in a money market fund established by broker-dealers, or by saving in a pension fund that purchases money market instrumenmts. This is because it takes huge sums of money to enter this market.

Money Market Savings Account:

This is a bank liability. We deposit our cash in the bank and the bank owes us money. This money is not specifically aligned with any particular assets that the bank invests in, it simply is an obligation of the bank and therefore our risk is with the bank and nothing else. However, much like checking accounts, these accounts are insured by the FDIC. There is usually a limitation on the number of transactions that can be made in a money market savings account and a minimum balance must be maintained. From the bank’s perspective, our money is used to provide loans to other bank clients. The interest rate charged for these loans is higher than the interest paid to us in our money market savings accounts and the bank therefore realizes a profit.

Money Market Fund:

This is a mutual fund wherein investors do not acquire shares in the underlying assets but rather in the fund itself. These shares are maintained in $1 denominations. Based on the returns that the fund is earning, interest is paid in the form of additional $1 shares. If we write a check for $1000, the fund simply sells 1000 shares. Certain rules regarding the type of securities (high-quality, liquid debt and monetary instruments) are allowed to be held in these funds and the diversification of them must be adhered to. Our risk lies in the actual assets, not the bank or brokerage behind these funds. These funds hold 26% of mutual fund assets in the U.S. because of the low-risk, high liquidity features.

Assets in a Money Market Fund:

1- Commercial Paper– Unsecured, short-term debt (promissory notes) issued by corporations and banks. They mature in 270 days or less and are usually issued by highly regarded firms with outstanding credit ratings.

2- Jumbo CDs– Also called negotiable certificates of deposit, these instruments pay interest to the investor. These are not the same CDs we are used to. The minimum size is $100,000, but amounts of a million or more is common. These are the favorite vehicles for money market managers.

3- Banker’s Acceptances– These are time drafts written by a business and guaranteed by its bank which enables the business to export or import goods. In essence, the bank is lending money to the business to pay for the imports against the collateral that those goods provide.

4- Repurchase Agreements (Repo)- This is where the seller of a debt security (usually a Treasury security) agrees to buy the security back within a short time frame for a specified amount. The buyer makes a profit by setting the “sell-back” price higher than the original purchase price.

Conclusion:

The money market world is a relatively safe haven for our money wherein we can readily access the cash. In return for our money, we receive a slightly higher interest rate than a typical savings or checking account but much lower than that of higher risk investments (stocks and corporate bonds). We can put our funds in a money market savings account which is backed by the particular bank and also insured by the FDIC or into a money market fund which is backed by the actual assets purchased by the fund. The concept of asset allocation and diversification makes this vehicle a viable option in our overall portfolio. However, to place all our eggs in this basket will subject us to inflation (earn 2% but cost of goods goes up 3%) , purchasing power and opportunity risk (money lost by not investing in other, higher-yielding investments).

Industry in the Spotlight- Computer Networking Stocks:

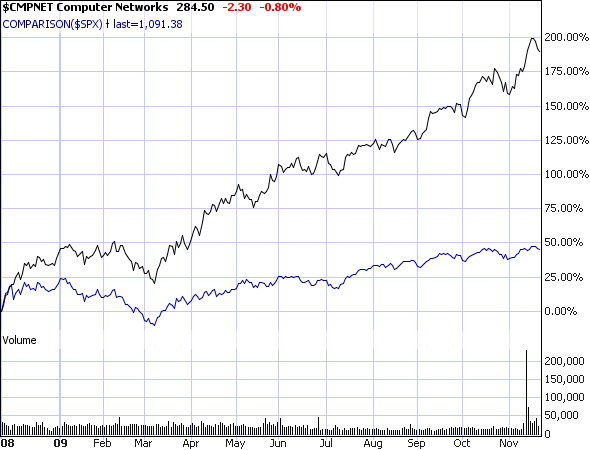

In the past we have discussed the Gold/Silver Group as an industry that has caught the attention of the “big boys”or institutional investors. In the last 10 weeks, this group has gone from out of favor to a top industry in terms of new institutional money flowing in. Coal stocks now top this group and has been a favorite for several months. So I decided to seek out an industry that has been gaining momentum but in an inconspicous manner. Computer networking stocks fit that bill. Here is a chart of that group versus the S&P 500:

Since March, this industry (depicted by the top line) has far outperformed the broad market benchmark. Here are a few stocks in this group that are performing well:

- FFIV

- RHT

- BCSI (this one keeps coming up!)

- ARST

Here is a chart showing the 2009 charts for BCSI, FFIV and the S&P 500:

- BCSI- TOP GREEN

- FFIV- MIDDLE BLACK

- S&P 500- LOWER BLUE

Last Week’s Economic News:

New home construction fell to a 6-month low in October but leading economic indicators as reported by the Conference Board rose for the seventh consecutive month (0.3% in October). The Consumer Price Index (CPI) rose slightly, mainly due to higher fuel oil prices while the Producer Price Index (PPI) rose less than expected, allaying inflationary fears. Retail sales increased in October, thanks, in large part, to an enhanced demand for cars. For the week, the S&P 500 fell 0.2% for a year-to-date return of 23%.

This Week’s Economic Reports:

- Monday: Existing home sales

- Tuesday: Consumer confidence, FOMC release of meeting minutes, GDP

- Wednesday: Durable goods orders, new home sales, personal income spending stats.

Video now playing on homepage (NEW!):

Calculating Option Returns Using the Ellman Calculator

Wishing all our readers and their families a wonderful Thanksgiving Holiday,

Alan and Linda Ellman

Hi Alan…

I have read the first 80 or so pages of your first book so far…

Its been very informative and Im very happy with the information…

I did a screening of the first 30 stocks of the IBD100, and only about 7 or 8 passed your ‘fundemental analysis’ test…

Out of those I liked the look of VIP in order to perform “technical analysis” on. One of the reasons I liked this stock was due to the good “option premium” available…

I did notice that the technical analysis on this stock was “positive to mixed”…

*There is an up trending 20 day EMA

* The price location was above the 20 day EMA, with EMA acting as support.

* The EMA20 is above the EMA100

* The stock has NOT broken through a trading range. There is very low volume.

*The MACD is “just” above the EMA 9

*The MACD is well above the zero line (positive territory)

*Not sure about stochastics at this stage…

Personally, I’d say the stock is good to trade on… BUT, I’d love to hear your perspective on this chart.

Would you trade this chart? Why? Why not? What is your take on the technical indicators?

Thanks Alan

Dave (Melbourne Australia)

Dave,

It seems that you’re off to a great start- congratulations! Here are a few thoughts on your commentary and questions:

1- I would concur with your technical analysis of this stock (note that the relationship between the MACD and its 9-d ema mirrors the MACD Histogram).

2- The stochastic oscillator recently turned below the 80% for the second time since late October, a bearish signal.

3- I would evaluate this chart as mixed, leaning to positive and would give it consideration for an I-T-M strike sale (discussed later in my book). HOWEVER……………………

4- When you get to chapter 12, you will see that I strongly recommend not selling CC options on stocks reporting earnings in that contract period and VIP is (November 24th). This increases stock and option volatility and is a major reason you can generate a 5%, 1-month return with the At-The-M call. After the ER, recheck the screens and if they still pass, and you like the returns (which will be less due to the decreased volatility and time value) it would be okay to consider a CC buy-write at that time.

Bottom line, I WOULD trade this chart in general BUT not when there is an upcoming ER.

Keep up the good work and let me say thanks to you and your fellow Australians as we have an incredible following from your great country.

Alan

Alan,

What happened with your BCSI shares? Were they sold? Just curious because you thought they might be even though it closed so close to the strike price.

Amy

Amy,

(for those who haven’t read last week’s comments): BCSI was previously purchased and many BCIs sold the November $25 calls. The stock closed the contract cycle @ $25.02 and the question was would the shares be assigned (sold).

Okay, now my response: YES they were. As I mentioned in my previous comment from last week, I expected this to occur because it represented an opportunity for the brokerage to collect a premium for selling the stock. This is understandable and I have no problem with it as they are entitled to make money also.

Please note that I would have sold my shares anyway due to the upcoming earnings report. Had there been no ER due out, there is a good chance I would have rolled out to the December $25 contracts.

Alan

Alan,

Here is where you are a gift from above. Referring to your advice against doing a CC in advance of an ER, I would have gone ahead and simply re-bought the BCSI & written again. So thanks much.

On another angle tho, what would make an individual who had bought that Nov 25 call want to exercise it when it was only 2 cents over the strike? Is there any logic in him doing so? Does not seem that he could have gained anything!

Don

Don,

In most cases you are correct that an individual would not act to exercise @ $25 for an equity selling @ $25.02. However, a brokerage may do so to collect the commission which would be significantly more than $.02 per share. Lots of contracts mean lots of commissions! Case in point: my shares are gone but I’m happy to pay $6 in commissions after earning a 1-month 7.5% return! In fact, I would have incurred this expense anyway as I was going to sell the shares prior tho the ER.

Alan

S&P Futures:

This comment relates to the article I wrote last week. Prior to market open this morning, the futures as they relate to fair value are looking strong. This could generate computerized institutional buying, causing stock price appreciation.

For those who sold November options that expired with the stock price UNDER the strike, you still own those stocks and may be considering selling the December options on those same equities.

With a 4-week contract with holidays, today may be the best opportunity to sell those options, especially if your stocks move up in price due to market conditions.

For example, if you bought BCI Corp. for $24 and sold the November $25 and the stock closed Friday @ $24.75, you still own the BCI shares. Now if BCI Corp moves up to $25.50 this morning, selling the same $25 call will generate more income and give you downside protection. This is a subtle way of taking advantage of strong futures after expiration Friday. If the market opened flat or down, you may opt to wait a day or two before acting.

This comment is posted @ 8AM and pre-market news can alter the futures but I wanted to give you a feel for some of the thinking that will enhance your returns.

Alan

Alan –

I just bought PCLN for 212.85 and sold the Dec 210 contract for 9.80 which gives me an ROO of $695 or 3.3%. All of the fundamentals and technical’s look good, however in looking at the chart again it seems to be a bit extended in price. I normally do not buy a stock that is so far extended, but recent earnings were pretty decent including a 30% increase in sales and a 44% increase in EPS. It seems they are doing a good job growing the top number and not just cost cutting to improve EPS which could be unsustainable long term. I guess I just wanted to get your take on it.

Thanks

Eric

Eric,

Great company. I’ve generated significant returns with this one over the past few years. As the price has gone up, you will note that despite a relatively low beta, it has a tendancy to drop 10% in price from time to time (late October) and that has caused this conservative investor to shy away of late.

I agree with your entry into an I-T-M strike and now you must be diligent to take action if there is profit-taking. This has been another stock that I have “hit a double” with in the past.

Alan

Alan,

I never understood how these money markets worked and your article cleared that up for me. Thanks for all your good work.

Beth

Alan Ellman’s Radio Interview:

For those who haven’t listened to my interview on the Business Author’s Show, it will be playing for the next two weeks an the following link:

http://www.thebusinessauthorsshow.com/

Also, I have been invited to speak on Jordan Kimmel’s financial radio program in January. I will publish the particulars when I receive them.

Alan

Earnings reports:

Despite the fact that we avoid ERs when using the strategy of CC writing, it is possible to use a stock that reports early in the contract cycle. For example, VIP and BCSI report this week. If they still pass all system criteria after the report, they would be eligible for buy-write for the December contracts if you are satisfied with the returns. (ER information will be provided in the upcoming premium membership opportunity- a few weeks away).

Alan

I am sitting on 300 shares of EDZ at avg price of 7.75 after few months CC’s I have written. What do you recommend here – EDZ is currently at 5.41 and don’t look very positive about beating my avg cost anytime soon. currently its not tied up in any options so i could write them again but want to see what your thoughts are? thx in advance. You’re doing a faboulous job by the way.

I like this place very much.

This is such a outstanding website.

And it is not like other money bound place, the content here is genuinely important.

I am definitely bookmarking it as well as sharin it with my friends.

🙂

Joshua,

Without knowing more about you and your portfolio, it would be irresponsible of me to make a specific recommendation. However, allow me to make the following points which you may find useful:

1- If you are a proponent of my system and purchased this ETF for purposes of CC writing, our rules would require you to sell it and move into a different security.

2- I strongly believe that you must have rules in place for both buying and selling in any asset class. If you purchased EDZ for another reason other than CC writing, does it still meet those criteria. Here is the question I ask myself: “Would I purchase this security today at this price level and circumstances?” If yes, it’s a hold. If no, it’s a sell. Put another way, where is the best place to put your $1600 today? Once your rules are in place, you will act appropriately.

Alan

Alan –

Looks like BCSI EPS came in 7% above last year while sales came in only 1% above last year. They guided higher for Q3 EPS to between .31 – .36 vs est. .30. Would you be a buyer of this stock tomorrow in order to sell a Dec. contract?

Thanks

Eric

Eric,

We need to view an ER from two perspectives:

1- First we need to make sure that this report hasn’t changed the fundamentals that made this equity appealing to us origianlly.

2- If it passes this test then we need to see how the market reacts to the report. This is determined not so much from the numbers themselves but rather how those figures relate to the market expectations. Any surprise (up or down) can result in price volatility. If this occurs and I want to use this equity, I always wait for the volatility to settle before entering my position. Another factor to think about is that today is the day before a holiday and trading volume may be low. This will make price change less reliable. When this occurs I oftentimes will lean to waiting another day or two or entering into another position.

Alan

Alan –

Thanks! Great point about the holiday. I’ll keep this on on my watch list for now. Have a great Thanksgiving!

Eric

TUP:

This stock, frequently mentioned on this site over the past few months, continues to produce stunning statistics.It has bested the S&P 500 by 150% for the year, appreciating 8% alone since the last ER. It’s ROE stands @ 33% compared to its industry average of 19%. The net profit margin is 8%, double its industry average. Its dividend was recently increased to 2%. Many investors have expressed concern that the price will soon fall back to reality but it continues to defy gravity. Isn’t this a great stock for mutual fund managers to insert into their portfolios by year end to look like geniuses when the annual report is publicized?

Alan

I have had several off-site emails from investors holding stocks that have appreciated significantly in the last few months. The concern is that perhaps a sell-off or profit-taking is inevitable. This is a valid consideration but remember we are only making a 1-month commitment to our equities and a negative trend would begin to show up in the technicals (MACD histogram will give the earliest signal) and some of the SmartSelect grades (RS Rating). An additional point to bear in mind, however, as we approach year-end, is that institutional managers want these winners in their portfolios so their brochures look stellar going into the first quarter of 2010. This is called “window dressing” and I refer you to an article I published two years ago:

https://www.thebluecollarinvestor.com/blog/beware-of-window-dressing/

Wishing all my fellow BCIs a happy, healthy and safe Thanksgiving holiday,

Alan, Linda and the BCI Team

S&P futures down nearly 3%:

Those of us waking up to the news about a potential debt crisis in Dubai are reminded of how intertwined our economy is with global issues. My recent article about fair value describes how institutional computerized programs (selling in this case) will kick in when market open and stock values will plummet:

https://www.thebluecollarinvestor.com/blog/fair-value-and-sp-500-futures-how-are-they-related/

In situations like this, I check to see if any options premiums meet our system 20% rule. If so, I will buy back the option and initiate one of the mid-contract exit strategies. Since this is a general market issue, not an individual equity problem, my first choice is to wait to “hit a double”. Today is November 27th and options expire on December 18th. A lot can happen between now and then. Remember, U.S. markets

close 3 hours early today (1 PM EST).

Alan

Hi Alan,

I’m rereading your book on Exit Strategies. On p95 you discuss the stock CHRW along with its chart. In looking at the last entry in the chart (11/21) the price is below the MA, MACD is negative, and STO is falling at the 25% line. Your text says that technicals are mixed to positive. Can you comment on that as I would have expected you to say they were negative.

Thx,

Dave

Dave,

Sure will. I have had a few inquiries from readers who thought that the charts in the “Exit Strategies…..” book were also reprersentative of the charts I use for technical analysis of the stocks. THAT IS NOT THE CASE. These 30-d charts are used to show the relationship between stock price and option premium ONLY. We need to use an 8-12 month chart as set up on page 85 of “Cashing in on CCs” for technical analysis. In the initial printing of the book I reference the purpose of the charts on the top of page 56, #4. In response to the inquiries I mentioned, I added in bold lettering the following at the bottom of the page:

“These 30-d charts are NOT appropriate for technical analysis of stocks but are to be used exclusively to show the relationship between share price and option premium.”

Please continue to use the parameters as set forth in my first book for TA of your stock.

Alan

Thanks Alan. In “Cashing in on CCs” you list the bullish technical signals on p82. Are these listed in any particular order or is it simply more is better?

Dave,

The order of the bullish signals on page 82 are based on the chart (as set up on page 85) from the top down. I do emphasize moving averages more than the confirming indicators but use them all to “paint a picture” as to the technical health of the security.

Alan