Covered call writing and selling cash-secured puts are considered conservative, low-risk option strategies. Naked option trading is acknowledged to be a more speculative approach to trading options. In the case of covered call writing especially, this is confirmed by the fact that brokerages require a higher level of trading approval for naked option trading than for covered call writing. Moreover, our government permits covered call writing in self-directed IRA accounts but not naked options. This was confirmed by a recent Department of Labor ruling. In this article we will compare covered call writing (selling call options after owning the underlying security) and selling naked call options.

Rationale to covered call writing

Covered call writers look to generate monthly cash flow by leveraging an underlying security that displays outstanding fundamentals, technicals and meets our common sense parameters (like minimum trading volume). The degree to which we are bullish on the stock or exchange-traded fund (ETF) and our overall market assessment will dictate the strike price we select.

Rationale to naked call-selling

When a call option is sold without owning the underlying security, the option seller is neutral to bearish on the stock or ETF. It’s like shorting a stock (borrowing the stock from our broker and then selling it with the expectation to buy it back at a lower price). We expect the value of the option to decline so we can buy it back at a lower price or allow it to expire worthless. Although both strategies involve selling call options, covered call writing has a bullish outlook on the underlying while naked call-selling has a bearish perspective where we want the market price to be below the strike of the call we sold, so that it expires worthless. Selling naked calls should be executed when we expect the underlying stock to fall or stay flat.

When naked calls are sold we are obligated to selling the stock at the strike price if assigned. Sincethe naked call seller does not own the shares of the stock when assigned, those shares must be purchased at the current market price. This is the reason that brokerages require a margin account for individuals who wish to sell naked calls. It is also the reason that selling calls is considered an options strategy with high risk and requires a high level of trading approval. Stock prices can go up exponentially, and so the risk of a naked call is unlimited. Most of us should avoid naked call selling.

Real-life example with SWHC

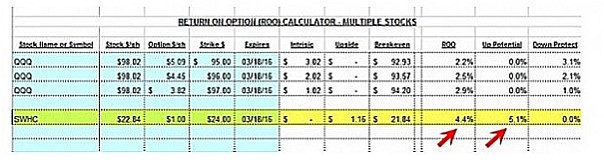

On 2/15/2016, SWHC was trading at $22.84 and the March 18, 2016 $24.00 call option had a bid price of $1.00. If we sold three contracts, our initial returns would be $300.00 less small trading commissions. Let’s first feed this information into the multiple tab of the Ellman Calculator for covered call writing:

SWHC Calculations for the $24.00 Call Option

The row highlighted in yellow shows an initial 1-month return, of 4.4% with the possibility of an additional 5.1% if share price moves up to the $24.00 strike. Note how an increase in share price results in a positive additional return.

Delta and changing option prices

If naked calls had been sold and share price started rising, the option-seller may be required to buy the shares at a price higher than the strike or buy back the option to avoid exercise. As share price moves higher, the option value will also rise by its Delta. Using a Greek Calculator, let’s have an initial look at the potential risk from a Delta perspective:

Delta of the $24.00 Call Option for SWHC

In the cells highlighted in brown, we see a Delta of 0.41 and a Gamma of 0.10. If the price of SWHC rises by $2.00, the cost to buy back the option would be about $2.00 based on current Delta and Gamma stats.

What if share price moves to $28.00 by expiration?

Covered call writing perspective

We have generated a 9.5%, 1-month return and can either allow our shares to be sold at the strike or roll the option if appropriate.

Naked call selling perspective

Uh oh…If assignment is allowed, shares would need to be purchased at $28.00 and sold at $24.00 for a loss of $1200.00 ($4.00 x 300 shares). Since $300.00 was generated initially, that would result in a position loss of $900.00. If we bought back the option to avoid assignment near expiration, the intrinsic value of the $24.00 strike would be $4.00 plus a small time value component, let’s say $0.10. This would compute to a net position loss of $930.00.

Discussion

Naked call selling and covered call writing are both forms of option-selling but they reside in two completely different risk galaxies…one conservative and low-risk; the other radical and high-risk. Of course, along with high-risk comes the possibility of higher returns. It is crucial to align the strategies we embrace with our personal risk tolerances and trading comfort levels.

Blue Hour webinar coming soon

On July 28th at 9 PM ET we will be presenting our first Blue Hour webinar, free to Premium Members. My team is working hard to create a landing page to sign up and the first 50 premium members will have access to the live presentation. This webinar will be recorded and available to all Premium Members on the member page. We plan to present at least six presentations per calendar year and they will include live Q&A, expert guest speakers, Barry Bergman, the BCI Director of Research and me. An email will be sent to Premium members once the web pages are ready for registration. There will be no increase in membership fees for existing members who will be grandfathered into the current rates.

Next live event- Workshop

July 16, 2016

American Association of Individual Investors

Washington DC Chapter

Northern Virginia Community College

9 AM – 12:30 PM

Seminar information and registration link

Raleigh-Durham North Carolina- Thanks for your gracious hospitality

American Association of Individual Investors: RTP Chapter

Market tone

Global stocks moved lower on the week in volatile trade as markets reacted to the possibility that the United Kingdom may vote to leave the European Union next Thursday. Crude oil prices fell to $47.27 per barrel from $49.31 last week. The Chicago Board Options Exchange Volatility Index (VIX) rose to 19.16 from 16.02 last week. This week’s reports and international news of interest:

- The Federal Open Market Committee this week voted unanimously to keep rates unchanged and indicated that the path for future rate hikes will likely be more gradual than the committee had forecast in March

- The Bank of Japan, the Bank of England and the Swiss National Bank (SNB) all held policy steady this week

- The Japanese central bank lowered its inflation outlook, potentially setting the stage for additional policy action in July, while the SNB warned that the franc is significantly overvalued due to safe-haven buying ahead of the Brexit vote

- Brexit concerns surged as the vote nears and a change in opinion polls in favor of the “Leave” camp put markets on edge this week

- Despite the fact that retail sales and industrial production data in China met market expectations, fixed asset investment was weak, raising concerns that China may not be able to sustain its 6.5%–7% growth target this year

- More global sovereign debt is trading with negative interest rates, with the yield on 10-year German bunds dipping below zero for the first time and Swiss 30-year bonds doing the same. UK 10-year gilts fell to a record low of 1.10%

- IMF warns on political risk to eurozone recovery relating to next week’s Brexit vote, about the EU project could derail the eurozone’s fragile recovery

- After labeling it a carcinogen 25 years ago, the World Health Organization this week reversed course and said not only does coffee not cause cancer, it may actually guard against certain cancers

THE WEEK AHEAD

- US Federal Reserve Chair Yellen delivers the Fed’s semiannual monetary policy report to the US Congress on Tuesday and Wednesday, June 21st – June 22nd

- The UK referendum on EU membership takes place on Thursday, June 23rd

- Global flash purchasing managers’ indices for June are released on Thursday, June 23rd

- US durable goods orders data are released on Friday, June 24th

For the week, the S&P 500 declined by 1.18% for a year-to-date return of +1.35%.

Summary

IBD: Uptrend under pressure

GMI: 4/6- Buy signal since market close of May 25th

BCI: Cautiously bullish but not entering new positions until a market assessment can be made after the Brexit decision later this week. I am 1/3 in cash from exercise of all in-the-money strikes. Without the upcoming Brexit decision, I would have rolled several of those positions. In addition to Brexit, Janet Yellen will be testifying before Congress this week.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

Alan ([email protected])

Alan,

I held GDXJ over the last contract cycle. Since it performed well I decided to buy the option back instead of being assigned. Since the ETF has a high volatility, would you advize to sell the stock for a more predictable one? My guess is yes.

Also, I heard Britain is considering breaking from the EU. Do you think it is still safe to hold ETFs when that decision is announced?

Apologies if these are hard questions.

Kind regards,

Brett

Brett,

GDXJ has been one of the best performing ETFs the past few months and has been at the top or near the top of our Premium ETF Reports during that time frame. On our latest ETF Report on page 1 we see that the security is up 55% over the past 3 months compared to 3% for the S&P 500 (as of this past Wednesday when the report was submitted). However, as you pointed out, on page 7 of that same report we see that GDXJ has an implied volatility of 54.49, more than triple that of the S&P 500.

With the upcoming Brexit decision this week, markets are nervous and no one knows what the result will be (not even in Britain) or what the market reaction will be. Experts are all over the map on this one and, in the end, half will be right and half will be wrong. If this was a more long-term concern, I would lean to lower volatile securities but we’ll have an answer this week. I can’t tell you what to do but I’m happy to share with you that I am currently in 1/3 cash and holding off on entering new positions until the vote is taken and market assessment can be made. By the end of the week, things should go back to a more normal level of market challenges.

Alan

Not that a conservative investor would ever need to look beyond covered calls and cash secured puts to generate income in their self directed IRA’s. But if anyone ever feels that itch I suggest studying up on credit spreads rather than get involved with naked option selling.

In a credit spread you generate cash flow without owning the under lying just as in selling a naked option. But since you take some of the proceeds from selling one option to buy another as protection while still generating a credit your margin and risk are greatly reduced.

Risk is NEVER eliminated in anything we do in the market unless we buy an insured CD or find a rare arbitrage trade :), It is just reduced. So as always, do your homework first!

Spread selling is a fun hobby and strategy in IRA’s for active market followers to make directional income bets with cash risked but not invested.

Exit strategies are as critical, maybe more so, with credit spreads as they are with traditional covered calls. And up front study and practice is imperative but worth the time. – Jay

Premium Members:

This week’s Weekly Stock Screen and Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 06/17/16.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and the BCI Team

Alan, you have stated above in the BCI summary “I am 1/3 in cash from exercise of all in-the-money strikes.”

So are you saying here that for all stocks I had which were ITM at expiry, that I should not have rolled-out any of these but instead let them be assigned, as it’s too risky to keep holding them over these coming Brexit days?

Also if within the 1st half of a contract the price of a stock has fallen to a support level, and then news comes out that says that an event (eg. FED raising interest rates) could then severely affect the sector of this stock.

Would you here still wait in hope of hitting a double within this 1st half of contract, or wait until stock breaks support and then think of selling the stock?(of course by then the stock may have dropped a further 5% or so before you can actually sell?)

Another idea is what about buying protective put options straight after hearing of the concerning news?(and if the price goes up then maybe sell these puts back?)

A little unsure what to do for these situations if you could tell me.

Thanks

Mike,

You did nothing wrong by rolling the options. I took a rare extra caution because of Brexit but I’m still heavily positioned in the stock market with shares that were not assigned. I plan to jump back in fully invested after the event with the realization that my caution could actually cost me money if the market reacts favorably to the event. No one knows for sure.

In this age of globalization, there will always be an event on the horizon that may impact the stock market. It is also a fact that the stock market historically goes up in value in the long run and currently is the best way to make money especially in this low-interest rate environment.

Protective puts: A reasonable approach to mitigating against significant losses that has its pros and cons. I do not use protective puts but some of our members do:

https://www.thebluecollarinvestor.com/protective-puts-selecting-the-best-strike-price/

Whether we use these or not we always must be prepared with our exit strategy arsenal which remains consistent in our approach with or without an event like Brexit.

Keep up the good work

Alan

In my opinion, leaving money on the table is not so important.

On the other hand, losing money hurts terribly, especially if I know before that a big event like Brexit has a 50% chance of sending the stock market sharply down.

As Jay said last week, Brexit is very similar to earnings report, and will affect my entire holdings.

I prefer to hear that Britain will stay in the EU, because we don’t need a new turmoil in the stock market.

Either way, I can get back in after this event is over.

Roni,

Thanks for the kind mention. I got a kick out of this Jim Cramer clip where his facial and body language said he was about sick and tired of Brexit :)!

https://www.thestreet.com/story/13611821/1/jim-cramer-stocks-to-buy-and-avoid-ahead-of-brexit-vote.html?puc=_htmlbooyah_pla1&cm_ven=EMAIL_htmlbooyah

I suspect it would be hard to find a CFA who recommended timing the market. Most say diversify, re-balance and hold a stiff helm into the wind.

But there are peevish imps, myself included, who sneak out of school to try and time the market. My favorite method is perhaps the most simple: the 50 day MA on the S&P.

It would have been impossible to go broke being long SPY above and long SH below that measure as far back as I can track. And both are optionable for covered calls.

We are dancing on the border now with two closes this past week fractionally below the line. A fun week ahead…..- Jay

Jay,

I watched the Jim Cramer clip, and I agree with you about his body language. Further, I believe he must have the ultimate cristal ball to be able to single out stocks, and predict what can happen.

Let’s wait and see. In 2008 the FED mishandled the Lheman Brothers affair, and the rest is history.

Let’s pray for a no Brexit …… :<(

Why isn’t NVDA on our Premium Watch List?

I had an off-site question about this security which has been on our Stock Lists frequently but not on the most recent list. This is a great stock and company that is currently showing some minor technical weakness especially as it relates to our two momentum indicators: MACD Histogram and the Stochastic Oscillator as shown below. Had we already owned this stock in our portfolio and wanted to keep it, I would favor an in-the-money strike.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Alan,

My NVDA shares were called away twice in May and June, for a total net gain of 836.00 after comissions.

I am really happy with this result.

Glad to hear you joined the NVida party along with many other BCIers…

Thanks Alan, I have only rolled out 2 of my 5 stocks/ETF’s, but for the other three I am not going to use for July because of concerning technicals.

Something I am trying to work out if you could help me is if I am making the best choices in determining if I should rollout a stock(or even buy stock, and sell call options) to a certain strike price, or to avoid the stock altogether.

I will give you some example papertrades to show you what I mean.

So for the June contract the Etf’s I held to expiration were:- ILF, XME, and AMJ.

And for these ETF’s the strikes I chose were:-

ILF = $25C(ITM), AMJ = $32C(ATM), and XME = $24C(ITM).

Now for the start of July contracts these 3 ETF’s were OTM, and I closed out ILF and AMJ because of negative chart technicals.

So that only leaves XME, with the price at $23.69 on expiry day, yet for this I was only preferably wanting to rollout to sell the July $24C if only the price at expiry was above $24, so that the $24 strike would be called ITM.

Instead I had just opted for this ‘$24 OTM-call’, and am wondering if in this type of situation I only want to sell an ITM(as I see mixed technicals), then should I have closed out and sold XME, and not have selected this strike again because it was now OTM?

Does this also go for any Stock/Etf I buy and only want a certain strike based on the charts, and if the premium too low for this particular strike then I should just pass on the stock altogether?

Hope you can comprehend what I mean above, I know it is quite a learning process to all this so I will post again.

Thanks.

Mike

Mike,

Let’s focus in on XME. It appears that the near month trade worked out as the share price ended the contract slightly under the strike and if you generated more than $0.31 of time value per share on the option sale, you had a profitable trade. Since the option expired worthless without exercise there was no need to roll the option so the decision is to sell the stock or use it in the following contract month. That decision is based on:

Chart technicals

Overall market assessment

Personal risk tolerance

This is also an unusual contract month because of the Brexit decision on Thursday.

The chart is predominantly bullish as shown below. The consensus for near-term market performance is neutral to slightly bullish looking at the 3 sources in our reports (Admittedly, I’m one of them!). Personal risk tolerance varies and is a personal choice.

I am not dodging your question but the answer will not be the same for everyone but I’m happy to share with you that this would be an example of a stock I would leave in my portfolio and write the call after the Brexit decision.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Alan,

I just subscribed and looking at your report I noticed that T has an ER date of 7/21. IBD shows a reporting date of 8/5. Do you know which might be correct.

Thanks for your help as I have a 7/22 expiration date.

Kay

Kay,

We use earningswhispers.com as our most reliable ER resource although we check other sites when a date seems odd. That site says 7/21. Looking at a free site (finance.yahoo) we find the screenshot below confirming the 7/21 date. If the report is due after the bell, some sites may list as 7/22. I also checked Investools which also has it as 7/21…the consensus is 7/21.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Thanks, yeah I hope I made the right decision with XME this contract, but only time will tell. Chart actually looked mixed at expiry but is a lot more bullish looking, for the moment at least. There too was an ex-dividend date right on expiry day of 0.078cents, so I thought it best to do a rollout in case XME was sold off to someone else, – thanks again. Mike

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Brexit polls close soon with final tally taking through the night. T

Let’s assume “Stay” wins and there is at least one more pop in the morning in our market to celebrate. At the same time the high implied volatility creating the great options premiums for those bold enough to sell lately will be fading fast.

My instinct is sell new July contracts on all positions held uncovered for Brexit that you would have otherwise covered on any strength tomorrow morning. Your stocks will likely be higher giving you more flexibility in your choices of ITM, ATM or OTM. Do a mix as Alan does. The direction of this market is far from decided.

As far as cash you sat on since last Friday expiry? I suggest not buying anything on a bounce tomorrow. The market has a way of selling good news. I have had buyer’s remorse more times than not when I chased a news event the day it happened. I’ll look for better buy prices next week. – Jay

Jay,

Your warning posts last week about BREXIT, turned out to be very pertinent. Thanks

They helped me to decide to sell my holdings and stay in cash.

I will now wait for things to settle down before getting back in.

Thanks, Roni.

But like so many others I woke up to a surprise this morning! Per the above post I was planning for a “stay” vote.

I suspect things will be as Alan suggests in his calm reasoned post below. And all the market shows will be experts asking more questions than they answer about “what’s next?”

There are always bounces after events like this. But even though I like today’s prices on some things on my watch list I am like you not getting back in just yet. – Jay

Britain votes to leave European Union:

This will create an initial volatility in the stock and currency markets globally as a “stay” vote was priced into the markets. The initial reaction will cause lot’s of “red” today as equities will decline as investors try to analyze the impact this decision will have on corporate earnings. We have to keep in mind that the UK represents 3% of the world economy and so ultimately we should see a stabilization after initial over-reactions.

This unexpected event most likely will take a Fed interest rate hike off the table in the near-term until the markets recover. History shows us that when there is an event that shakes the global markets there is short-term volatility followed by recovery and stabilization.

For those who sold covered calls, today will most likely represent an opportunity to buy back the options (20%/10%) guidelines) and evaluate next week from there.

Stock values depend mainly on corporate earnings and the question we focus on is how much will this event impact those earnings in the long run. History tells us that initial volatility will lead to calming and then business as usual.

Alan

I hope you are right Alan,

this event is far reaching and may triger a domino effect in other European countries, shaking the EU profoundly.

The global economy has not fully recovered yet from the 2008 crash, and the BREXIT is not what we needed right now.