When we sell covered calls or cash-secured puts we understand the factors that go into the premiums we receive:

- The option’s exercise price

- The current price of the underlying

- The risk-free interest rate over the life of the option

- Dividends, when applicable

- The amount of time remaining until expiration

- The volatility of the underlying

It is also important to understand the relationship between call and put options and the underlying securities. The value of a call option, at one strike price, implies a certain fair value for the corresponding put, and vice versa. This relates to the arbitrage opportunity that results if there is discrepancy between the value of calls and puts with the same strikes and expirations. Arbitrageurs (the “big boys”, not us) would step in to make profitable, risk-free trades until the departure from put-call parity is eliminated. Understanding these relationships and the reasons behind them will make us all better investors.

European and American style options

Put-call parity relationships generally apply to European style options but can also apply to American style options (the type we use when selling calls and puts) by adjusting for dividends and interest rate:

- If the dividend increases, the puts expiring after the ex-dividend date will rise in value, while the calls will decrease by a similar amount. This is because a dividend distribution results in a decline of share value by the dividend amount on the ex-dividend date

- Rising interest rates increase call values and decrease put values

Synthetic positions and arbitrage opportunities

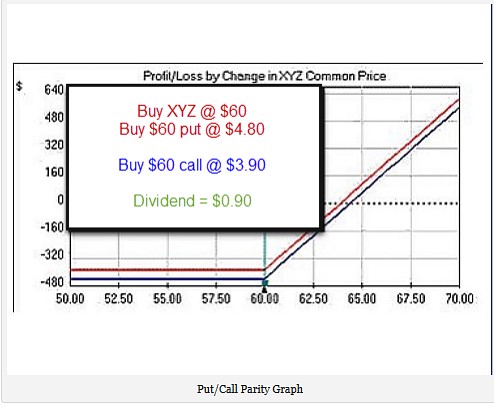

Every basic position with a stock or option has a synthetic equivalent. Arbitrageurs look to find a divergence between a position and its synthetic equivalent, buy one and sell the other for a risk-free profit. Acting on any such discrepancies quickly eliminates any such differences. Let’s look at a hypothetical example for a call option. Now we sell call options but let’s view this example through the eyes of the call buyer. The maximum loss is the price of the call option while the maximum gain is infinite. Next, let’s look at its synthetic equivalent:

Buy call = buy stock + buy put (one of the six put/call parity rules)

If we purchased a $60.00 call for a stock trading at $60.00 for $3.90, our maximum loss is $3.90, our breakeven is $63.90 (any price below $63.90 at expiration represents a loss for the call buyer) and our maximum gain is infinite. Our synthetic equivalent of buying one hundred shares of stock and one $60.00 put for $3.90 would create the same risk/reward profile. Should the value of either option price diverge, there would be an arbitrage opportunity that Wall Street insiders would jump all over…buy the cheaper option and sell the more expensive one.

What if is there is a dividend ex-date prior to expiration and the dividend amount is $0.90? The share owner would collect the dividend, not the call buyer. This would seem to create an arbitrage opportunity. Here is a risk/reward profile chart depicting this scenario:

Put/Call Parity Graph

The long stock/long put combination would seem to be a better choice because of the upcoming dividend distribution but the laws of put-call parity will make the necessary adjustments decreasing the value of the call option and/or increasing the value of the put option, thereby aligning the two positions and eliminating any arbitrage opportunities. In this scenario, although the share buyer pays more for the put, the dividend distribution will make both positions equal ($4.80 – $0.90 = $3.90).

Discussion

Put-call parity is one of the cornerstones for option pricing. It helps us understand why the price of one option will not move very far without the price of the corresponding options changing as well. If parity is violated, an opportunity for arbitrage exists. These are not a practical source of profits for average retail investors, but understanding synthetic relationships will help us understand options while providing us with even more educational tools.

***Premium members: Check out all six put/call parity rules in the “resources/downloads” section of your member site (right side of page scroll down to “P”)

Kindle edition of The Complete Encyclopedia for Covered call Writing Volume 2 now available on Amazon.com

Next live appearance

Milburne, New Jersey

October 13, 2015

6:45 PM – 8:30 PM

Market tone

US markets had rose on positive US economic data until the Federal Reserve’s decision Thursday to leave interest rates unchanged due to concerns about global weakness. That led to a selloff in stocks and a rally in Treasuries. This week’s reports:

- The Fed acted as some predicted by leaving interest rates as is for now although Fed officials see the central bank raising rates before the end of the year

- Fed Chair Janet Yellen cited low inflation, “recent global economic and financial developments” and “heightened uncertainties abroad” as deterrents to a September rate rise

- The US Consumer Price Index fell 0.1% in August. Over the past 12 months, the CPI has increased just 0.2%

- Building permits rose 3.5% in August to an annualized rate of 1.17 million, above expectations

- Permits for single-family homes rose to 699,000, the highest since January 2008

- Housing starts fell 3% in August, slightly more than expected, after the expiration of an affordable housing tax credit boosted multifamily home construction in June and July

- Retail sales rose 0.2% in August after July’s gain was revised upward to 0.7%

- Weekly US jobless claims fell to 264,000

- Initial jobless claims decreased 11,000 to 264,000 for the week ending September 12th, the lowest reading in two months

- Continuing claims dropped 26,000 to 2.24 million for the week ending September 5th

For the week, the S&P 500 declined by 0.15% for a year to date return of (-) 4.90%.

Summary

IBD: Uptrend under pressure

GMI: 2/6- Sell signal since market close of August 24, 2015

BCI: The US economy continues to outperform the other major global economies. Since the globalization of the world finances has impacted our stock markets as much as individual corporate events, we must have a broader view of how we should manage our investments. I understand that many of our members are reluctant to actively participate in the stock market at this time and we must all follow our own personal risk tolerances. I did not sell options during the September contracts but plan on entering the October contracts extremely conservatively using in-the-money calls and deep out-of-the-money puts. My monthly goals for these positions is being lowered from 2 – 4% to 1 – 3%. I plan of filling half my positions early next week and the remaining positions mid-to-late week.

Wishing you the best in investing,

Alan ([email protected])

I know this is off-topic but I’m hoping for an explanation. It seems that volume and open interest never line up day to day. For example, if on Tuesday volume is 100 and open interest in 1000, shouldn’t open interest begin Wednesday at 1100? It never does! HELP!!!

Kim,

Open interest is calculated on the basis if the buyer and seller are opening or closing positions. For example, if both are opening, OI goes up by 1. If both are closing, OI goes down by 1. If one is opening and the other closing, there is no change in OI. It is also important to note that OI is cumulative whereas Volume is a daily stat.

Alan

Premium Members,

The Weekly Report for 09/18/15 has been uploaded to the Premium Member website and is available for download.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the BCI YouTube Channel link is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The Blue Collar Investor Team

Thank you Alan.

Most important to me is the BCI information in the the last paragraph of the Summary.

You indicate what you will be doing with your investments, and I intend to do exactly the same with mine.

As for the FED, I truly believe that they are potponing rate hikes to avoid further strengthening the Dollar, because it hurts American manufacturers export competitivity.

My company here in Brazil is an importer, distributor of several American manufacturers, such as Eaton for example, and we have reduced our purchases about 85% since our currency, the Real (pronounced ree-al) has lost half of it’s value in Dollars this year.

Our European and Chinese competitors, are eating our lunch.

Those are the facts from horse’s mouth.

Roni,

Thanks for sharing this great first-hand information.

Alan

Alan, Thanks for your last weeks answers to mine, and that one about the influence of ER’s from a larger stock, at the time I was thinking of the stock – ‘Apple’, as I think it’s ER disappointed and took down the market(?). I just thought any smaller company would have been pretty badly affected too, and I don’t know if there are any other stocks that can have an affect on the overall market as much as Apple can,- maybe there are(?)

Need to ask you about using ETF’s:-

1. When the market corrected the other week you had mentioned that we could use some low volatility ETF’s, but not sure how I know from the ETF lists which ones are of ‘low volatility’?, – are these the ones with an I.V that is lower than what the S&P500 I.V is saying?

2. Also would there even be much return in low volatility ETF’s? (I’m guessing you would only really want to use them within the 1st contract week or face dismal returns after that,or could I be wrong?)

And to report that I think my paper return for last contract was quite good, with 4 stocks ending positive and ITM with only a slight loss on EBAY. My thought of entering in the 2nd week as the market was making a low seemed probable and so I did.

I had used put protection on some of them and will use puts for this contract just in case needed.(we are also in October, but I now know from you that doesn’t always mean anything awful will befall the market!) Thanks

Adrian,

You are right about the impact of AAPL on the market. It has a huge influence in all the major market indexes. Years ago it was GM, now its AAPL. My responses:

1- Correct. The reason we added IV stats to the ETF Reports is so our members can measure risk versus the overall market. Some members assumed (understandably so) that all ETFs had low IV but that is not always the case (remember ASHR, a Chinese ETF?). An IV lower than the S&P 500 generally means lower risk to market changes.

2- Correct again (you’re on fire this week!). Lower IV translates into lower premiums so best to enter these trades early in the contract month.

CONGRATS on your recent success!

Alan

Department of Labor comment period ends 9-24-15

Feel free to post comments regarding changes to use of options in IRA accounts:

Send comment to;

[email protected]

Sample response (thanks to Jay)

Dear DOL Official,

I would like to add my voice to the chorus of retired investors vehemently opposed to any new restrictions on how we manage our IRA accounts. Specifically the possible restriction of options transactions.

Selling options in the form of covered calls, puts and credit spreads is an integral and low risk part of my retirement strategy. In fact, my ability to do so was a baseline assumption in my decision to retire. Any restriction on that

ability would be a hardship for me.

Brokers go through a diligence when granting option trading approval levels to clients. I have taken the time to educate myself on retirement investing and see absolutely no interest served in taking away from me vehicles I understand and rely on for providing my retirement income.

It is my sincere hope and strong recommendation that no new restrictions be added.

Thank you for your consideration,

_________________________

Alan talking: My contacts tell me that these changes will impact advisors and not us but many of our members still want to weigh in and make sure they do everything possible to keep things status quo.

Alan,

I appreciate you sharing with this note and contact info I shared with you this morning. Naturally my note is only reflective of my circumstance and concerns. There is some urgency as the public comment period ends Thursday.

I am relieved to read your attached note this might only impact advisors. I read from a source likely not as well informed as you it would prevent individuals from doing what I currently do with options in my IRA. Or require I pay much more to do it through an Advisory Service. That triggered my alarm this morning.

If true it would be a game changer for me, as I tried to convey to the DOL. I do 100% of my options transactions in my IRA’s. I keep only enough in cash accounts for short term needs. So we shall see….

Thanks for your updates on this important issue. – Jay

My source at FINRA tells me that it is possible that rates to advisors may increase and that may be passed onto us. However, with the trend to lower commissions and the fierce competition for our investment dollars, online discount brokers may be reluctant to raise rates. Time will tell.

Alan

Alan,

One of your guidelines is to “Reinvest profits immediately”.

I am not sure how to implement this guideline as the technical’s of the stocks and/or market (SPX) may not suggest taking on risk at that time. As you say, the risk is in the stocks, not the options. I would appreciate your more specific ideas on this issue.

Thank you,

John

John,

Our guidelines apply to normal market conditions and re-investing initial profits and the concept of compounding is an important financial principle. However, in volatile markets as we have now each investor must make investment decisions based on personal risk tolerance. Based on emails I have been receiving from our members, some are on the sidelines, some fully invested and some are partially in cash.

Good point.

Alan

In the Complete Encyclopedia on Page 210. You say, “leave a small percentage (2-4%) of cash for potential exit strategy execution…”

For me, Rather than setting the money aside upfront for potential exit strategies then re-investing the initial profits. I fully invest all my allocated money then I set aside the profit which is about 2-4% for possible exit strategies. Re-investing instantly does sound great but in the end you still need some money aside for exit strategies and it seems to me however you classify it you still have the same money in the same account. Is this a case of “tomato tomAto” or am I missing something?

Nate,

It is semantics. If you have a $100k account and set aside $3k for potential exit strategy executions, that cash may or may not need to be used. If we rolled down, “hit a double: or used the mid-contract unwind exit strategy, that $3k figure could go higher. The following month, the cash set aside can be identified as the same $3k used the previous month or you can identify it as cash generated from the sale of the next month premiums.

Tomato, tomato analogy is appropriate.

Alan

Alan

Makes sense. I guess to get a more pure re-investment you could use margin. One could max out their cash purchases in stock then invest the profits immediately. Then if an exit strategy is necessary one could use margin to implement it. You shouldn’t incur much interest because it’s a little amount and in most cases it is paid back quickly.

Roll down: buy at a lower price, then sell for a higher premium; paid back

Hit a double: buy at a lower price, wait a few days, sell for higher price, Paid back with a little bit of interest.

Mid-contract unwind: buy at a higher price, sell the stock, paid back almost immediately.

As long one doesn’t get carried away with margin and pick up too much risk it could work out. I know it’s safer and more conservative to just use cash and most should. I’m just thinking through the material.

Nate

To toss a penny into this pond the simplest method I have found for market timing is the S&P 200 day moving average. Be in when it crosses above and out when it crosses below. Many whip saws on the border but that is the nature of the beast. No method is perfect. – Jay

Jay,

Simple or exponential moving average?

Thanks,

Chris

Hi Chris,

I just use the simple. I tried using the 50 day but get too many whip saws. – Jay

Premium members:

This week’s 7-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

With the S&P 500 down 9% in the past three months the number of eligible ETFs that have increased in value or at least broken even in that time frame was minimal. We were able to identify 12 such securities but 4 of those were inverse ETFs. We have found over the years that our stock and ETF reports are a reliable reflection of the overall market. In these market conditions, it is more important to identify the elite-performers.

Look for the report dated 9-23-15.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

If I want to buy apple should i buy a cash secured put instead to possibly get the stock at a discount and make money (premium) to boot? If yes should i take this approach every time I want to buy a stock??

TY

Gary,

If your intention is to buy AAPL at a price lower than current market value by setting a limit order and if you are buying in 100-share increments, selling out-of-the-money cash-secured puts is a wonderful way to go. The downside is if AAPL does not decline in value below the put strike you will not get exercised. On the other hand, unexercised options still result in cash flow from the put premium.

Alan

Alan, thanks again and I may just turn to those low-volatility ETF’s if need be.

I have been quite interested in the portfolio overwriting strategy as it seems like quite simple to try, yet I do have some things I need to know about it, nothing too much here:-

1. So for this strategy I am wondering how do these investors get through the ER’s?, do they buy put options maybe ATM or lower if not wanting to sellout?

2. Isn’t it perhaps better to use very large-cap stocks(APPL, FB, AMZN, etc)?, I am thinking they may be safer and less volatile – or would you disagree?

3. I am guessing this strategy is less time-consuming to use each week than your buy-write one, would you agree?

4. Also the question just above from ‘John’ got me wanting to ask you an old one I still have.

I once did a study program with a lot of DVD’s to watch, and there was a covered call DVD with the guy on it stating that we should save the first 6 months of profits, before then re-investing the amounts after that. He said he did this in case if there was a large market fall, where he says a stock would then need to have dropped between 12-24% (if making 2-4% /month for 6months), before he would start to make a loss.

Do you not think this is a good plan to do when first just starting out, so to then have this cash reserve just in case a market correction were to come early on when starting off investing?

I hope this isn’t all too much for you this week, but I will next need to email you some about the calculations and then a whole lot more after a little break. Thank you.

Response moved to next week’s blog

Fed Chair Janet Yellen’s comments yesterday regarding the likelihood of an interest rate hike before year’s end has resulted in a strong uptick in market futures pointing to a strong market open.