Generally speaking, the main focus of this column is for Blue Collar Investors to share information that will be useful in generating substantial income into our investment portfolios. In normal market conditions we locate the greatest performing stocks in the greatest performing industries and use these stocks as vehicles to generate great returns under the safest of conditions. There are certain market conditions that dictate we not sell options and we are currently experiencing such an environment (see figure 1, page 4 of my book, Cashing in on Covered Calls). I am a firm believer, however, that there is never a bad time to learn from our experiences and become better investors even from the horrific predicament our economy is currently experiencing. I recently wrote an article entitled MACROECONOMICS-The Government’s Influence Over our Investment Success that has received national attention from Reuters. This exposure, along with the feedback that I have received from you (thanks for all your kind words) has led me to this current exposition which is sort of a prequel to that one.

Before the government determines its fiscal and monetary policies, it evaluates certain economic indicators and the coordinates of the business cycle our economy is in.For example on Wednesday we were exposed to the following headline: Consumer prices (CPI) fall record 1% on record energy drop. On October 30, 2008 the Bureau of Economic Analysis notified us that the third quarter GDP (Gross domestic Product) decreased by .3 percent (from the second quarter). Media outlets everywhere we turn are announcing that the U.S. has slipped into a recession. Recession…..don’t ever say that “R” word. Life as we know it will come to an end if we’re in a recession! Won’t it? The reality of the situation is that even if we are in a recession, it is a normal part of the business cycle and has been for decades and decades.

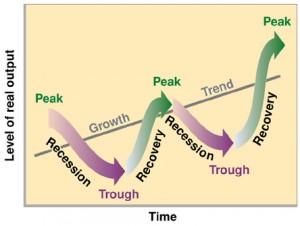

Let’s first review the definition of the Business Cycle: The recurring and fluctuating levels of the GDP growth rate over time. On a graph, this is demonstrated by a series of hills and valleys corresponding to the expansion and contraction of business activity.

GDP (Gross Domestic Product) is the total value of all consumer goods produced within the U.S. during a given period. It adds up all consumer spending, investments, government spending, and net exports to find the total amount of money spent on goods and services.If the economy is growing at a significant pace, corporate profits will rise thereby causing our equity values to increase. This would be the expansion phase of the business cycle. If, on the other hand, economic growth was contracting, the reverse would be expected to occur.

The Five Stages of the Business Cycle:

1- Early expansion– Production of goods and services increase rapidly. Interest rates and inflation are low as consumer confidence rises. People tend to borrow and spend more. Blue Collar Investors are more bullish during this phase.

2- Late expansion– Demand for goods and supplies surpass supply causing prices to increase. Heavy borrowing leads to increased interest rates. Stocks prices continue to rise but may be nearing a top.

3- Peak– Economic growth rate peaks and begins to drop. We usually see a decline in consumer confidence oftentimes due to increased interest and mortgage rates. We should be more conservative in our investment strategy (sell in-the-money strikes for example).

4- Recession…the “R” word- Two consecutive quarters of negative GDP is the most adhered to definition. We are always in a recession long before we know it or until the previous quarters GDP figure becomes public. Consumer demand declines as does corportate production and employment.Needless to say, stock prices decrease and we are bearish investors during this phase.Recessions normally last between 6to16 months with an average of about 10 months. Should a recession last 18 months or more, the economy is said to be in a depression.

5- Recovery– The economy hits bottom and begins to grow. Interest and mortgage rates have dropped causing increased consumer confidence and spending. The stock markets are geared to take off and we must be prepared to take advantage. We’re getting that bullish (out-of-the-money strikes) feeling again.

Most economists would agree that we are somewhere in phase 4 (recession perhaps) and anxiuosly awaiting recovery.It is virtually impossible to precisely predict the future turning points of the business cycle but we do our best by looking at key economic indicators.One that we hear about all the time is inflation.

How Inflation and CPI factors into the Business Cycle concept:

Inflation is the general increase in prices for goods and services. It is measured by the Consumer Price Index (CPI) which I alluded to at the beginning of this article. It is an average of the prices of a basket of goods and services. Changes in CPI are used to evaluate price changes associated with the cost of living. Because inflation normally occurs during periods of economic expansion, stock prices tend to rise at the same time that inflation rates increase. Oftentimes, the government needs to step in to control inflation during periods of economic expansion via its fiscal and monetary policies. For more information on this subject, see my article on macroeconomics.

In summary, a Blue Collar Investor can do his (her) due-diligence in several ways. We locate the greatest performing stocks in the best industries; we identify short-term market tone; and finally we identify the macroeconomics by analyzing the business cycle. Currently, most of us are completely turned off to investing in any segment of our current economy…understood. However, it is never a bad time to learn from even the most eggregious of circumstances; lessons that can make us better investors down the road. What do you think?

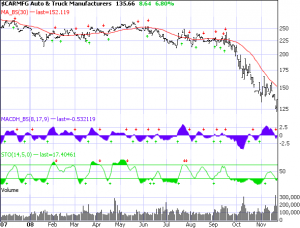

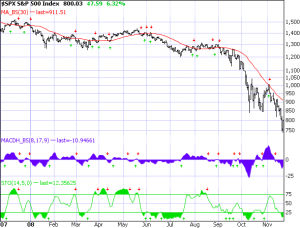

Are there any decent looking charts out there?

Hardly, but here’s one that’s pretty good:

Charts Showing Market Tone:

_________________________________________________________________________________________

______________________________________________________________________________________________

HI ALAN, I DID FIND ONE IN RESEARCH FOR THIS MONTH..AXYS

PRICE 61.83 AS OF 11/21

Earning due in Feb.

Stock Scouter 10

Meets most of our prameters in IBD except for group fundamentals. AXYS fundamentals are A being 3rd out of 15.

Est growth rate for next year around 18%

STO Dec 6o @ 4.20 for a $2.37 return

Monthy yeild about 3.7% with downside

protection of around $1.83 or 2.8%.

Six prior quarters of EPS > 15%

Assuming I did all the math correctly.

Bob,

It is quite a challenge to find any equity that comes close to meeting our system criteria. AXYS is one of the better choices. Nice going!

Alan

Fellow Blue Collar Investors,

I was just notified that Reuters picked up another one of my journal articles, this one on mutual funds. I am humbled that such a well-regarded news-based service has opted to give my publications international exposure. Here is a link to that article:

http://www.reuters.com/article/blogBurst/investing?bbPostId=B9b7vAvj8nu1CzDX4MhufERAjBEfU8hVwSxPQB2VOBRQBXvNm

Alan

what do think of a married put 3-4 mounths out

Tom,

This is an appropriate question in this declining market. For my readers who are unfamiliar with married puts, let me define:

The purchase of stock and simultaneous PURCHASE of the corresponding put option. This allows the stock owner to sell his shares at the strike price. For example, you buy 100 shares of XYZ @ $35 and BUY the $35 put @3. If your shares drop to $25, you can still sell them for $35, the strike of the put. In essence, you are buying insurance. In order to make money, in this case, your stock price must surpass $38 per share (the 35 you paid for the stock and the 3 you paid for the put).

There are a lot of ways to make money. If an investor masters this strategy he has a good chance to be successful.

I prefer cc writing because:

1- Profits are generated into your account immediately on the sale of the call option. You can then compound your money in minutes.

2- Married puts place you in the negative column from the start. You have to climb a hill to break even.

3- You can accomplish the insurance issue by using a stop-loss type of strategy. In the case of cc writing, put in a “limit order” to buy back the option. It costs nothing. plus we have exit strrategies at our disposal.

4- CC writing allows you to make money on stock appreciation AND the sale of the options (O-T-M strikes) ; married puts allow you to make money on share appreciation only.

That being said, I have been predominently using cc writing as my sole option strategy for the past 10 years. I haven’t traded married puts in a long time. If you are considering utilizing this strategy, I suggest you consult with someone who has had more recent hands on experience.

Best of luck,

Alan

Recent email question:

John Hicks // Nov 25, 2008 at 8:29 am

Alan,

I read your book and was very impressed with it. I do have a concern about covered call investing which I haven’t seen addressed in any books I have read, including yours.

What do you do when you sell a covered call on a stock that doesn’t get called out because the price falls drastically below the strike price and remains there at expiration?

For example, if I paid $20 for a stock, sell a $22.50 CC and suddenly the stock falls to $15 and remains there at expiration. Next month, the stock continues to hover at $15. The question is, what happens if you sell a $17.50 CC and the stock gets called at $17.50? It appears that I would lose money since I originally paid $20 for the stock.

If I try to avoid the situation by buying back the $17.50 prior to expiration and then selling another $17.50 CC one month further out, I am at best just hoping that the stock doesn’t get called out.

On the other hand, if I try to avoid getting called out by buying back the $17.50 CC , and then instead, selling a $20 CC would result in a net loss since $20 is the price I originally paid for the stock and buying back the CC results in a loss.

How do you avoid taking a loss in this situation?

John Hicks

John,

I faced this same dilemma when I started using this strategy…couldn’t stand the thought of a loser. Even if you follow all system criteria in a normal market environment, some of your stocks will go down in value (most will not).

These are managed with exit strategies which I discuss in chapter 11 of my book (more about that in a moment).

In your example you sell a 22.50 call; then a 17.50 call; and eventually lose $2.50 on the sale of the stock. Now your next door neighbor has lost $2.50 per share as he doesn’t sell options. You have lost $2.50 minus the amount generated from the sale of the 2 options. Maybe you didn’t lose any money at all.

Also, you can buy back the 17.50 call and roll out and up to the 20 if the parameters dictate

When you have a stock that is not behaving like a good financial soldier we need to manage that position, perhaps even dump the stock at a loss and move on to a better warrior.

I am currently writing a book totally devoted to exit strategies for cover call writing that will give you a cookbook approach to handling these and similiar scenarios.

Alan

Hello Alan,

I found a few stocks that meet our criteria:

CBST

EBS

FDO

DLTR

EZPW

The first two are biotechs, the next two are retailers…but…they are a special class of retailers that are doing well in this economy – “dollar stores.” The last stock is also an economy play…they are pawn brokers.

The best…

Barry

Barry,

All great selections. But one of these is NOT eligible for option sales. Who can figure out which one and why? I’ll give the answer tomorrow if no one comes up with it.

Alan

Alan,

Ihe “banned stock” in FDO (see pg. 138 in your book…stocks reporting same store sales). I included it because of the current economic climate. I thought it might make sense when just about everyone is tightening their belts.

the same can be said of DLTR as well although it didn’t make the “banned list.” Both FDO and DLTR are rated very highly on IBD.

Barry

Barry

Barry,

It makes perfect sense that in this declining economy, “dollar” retail stores are flourishing. My wife, Linda, has been commenting to me over the last several weeks that these stocks have some of the best chart patterns she has seen of late.

You have located some of the best performers, no doubt. FDO reports same store monthly sales; as far as I know DLTR does not .

Thanks for your important and helpful comments.

Alan