Screening stocks and exchange-traded funds for covered call writing and put-selling involves evaluating for fundamentals, chart technicals and common sense parameters. One of the issues that can impact a position we hold from time to time is short selling.

Definition

Short selling is when we sell a stock we don’t yet own. It is borrowed from our broker who lends it to us and then sells it. The proceeds are credited to our brokerage accounts as we now have an obligation to purchase the stock in the future to repay our broker. This is known as covering the short. We also must pay a fee to our broker for this transaction. The trade benefits when share price declines and loses when share price appreciates. Hedge funds are notorious for using this strategy as the leverage derived from generating cash for a small fee creates a potential for exponential returns for which hedge fund managers are well paid.

Advantages to the short seller

- Potential for large returns from a small investment

- Benefit in bear market environments

- Can be used as a portfolio hedge against market decline

Disadvantages to the short seller

- Dividends are collected by the broker (lender), not the short seller

- Risk is limitless if share price accelerates

- A positive development may trigger a short squeeze (a situation in which a heavily shorted stock moves sharply higher, forcing more short sellers to close out their short positions and adding to the upward pressure on the stock

What happened to Ambarella (AMBA) this week?

AMBA has been a high flier since its IPO largely as a supplier to GoPro, the wearable camera maker. On Friday, June 19th, short selling firm Citron Research published a negative report on AMBA triggering short sellers to take action and triggering a short-sale related circuit breaker to kick in when share price declined 10% from its previous day’s close. The implied volatility rose 27% to 70%, a one-year high. However, the put-call ratio remained even showing that investors were still undecided. Jim Cramer, on his Mad Money Show defended AMBA, claiming that it is an even better buy at these reduced prices.

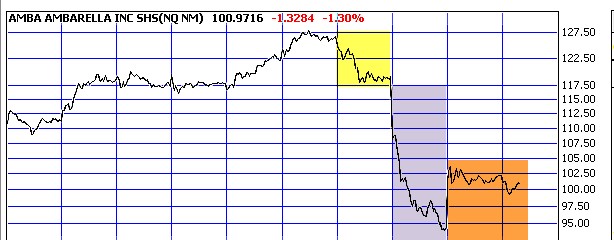

Chart showing impact of short selling on AMBA

Short selling impact on AMBA

- 6/19/2015: Yellow field: Citron Research report made public

- 6/22/2015: Purple field: Short selling has major impact on share price

- 6/23/2015: Brown field: Share price recovery begins

Exit strategy opportunities

We MUST buy back options on 6/19 or 6/22. There is no doubt that near-the-money strikes have met our 20%/10% guidelines. Early contract strategies include waiting to hit a double (favored earlier in the contract) and rolling down. Of course, closing the long stock position and moving to another security is also available.

Discussion

This is a rare, but obviously possible, scenario where short selling has such a major impact on share value. The SEC and FINRA are keeping a close watch on potential market manipulation situations but we, as Blue Collar Investors, must be prepared for all possibilities. For those who still believe in this company as I do, may decide to continue to write out-of-the-money calls as share price recovers. For members who feel that this security is now too risky, it is time to move on to another stock. Many of us have enjoyed wonderful returns with AMBA since it was priced in the low $70s. Let’s watch then price action, especially compared to the overall market, as we move forward.

52 Traders podcast from New Zealand

Podcast site, 52 Traders from New Zealand, is interviewing one trader per week for a year to help develop an elite investment style. I was invited to be of those to be interviewed:

Alan’s podcast interview

Link to show notes page:

http://52traders.com/dr-alan-ellman/

New York area members: Save the date:

I was recently invited to participate in The All Starts of Option Trading panel at the New York Stock Exchange on Wednesday September 16th from 4:20 – 5:15. I’ll provide more information once I receive it.

Next live seminar

Market tone

Negotiations on extending the Greek bailout will continue this weekend in the hopes of reaching a last-minute deal. A June 30th deadline debt repayment to the International Monetary Fund is creating global market turmoil. This week’s economic reports:

- The US economy contracted at a 0.2% annual pace in the first quarter, less than the previously estimated 0.7%

- Consumer spending was revised upward, though growth in imports offset rising exports

- The resulting trade deficit subtracted two percentage points from GDP in the first quarter. The consensus estimate for annualized second-quarter GDP growth is more than 2%.

- Sales of existing US homes rose 5.1% in May to the highest level since November 2009

- New US single-family home sales rose 2.2% in May to a seasonally adjusted 546,000 pace, the most since February 2008.

- US consumer spending grew 0.9% in May, the highest pace in almost six years

- Personal income was up 0.5% for a second straight month

- Personal consumption expenditures price index rose 0.3% for the month and 0.2% for the year

- US non-defense capital goods orders excluding aircraft, a key indicator of business investment plans, rose 0.4% in May

- Orders for durable goods fell 1.8% in May, affected by a 6.4% drop in orders for transportation equipment

- Durable goods inventories declined in May for the first time in two years

- The University of Michigan’s consumer sentiment index jumped to 96.1 in June from 90.7 in May, the highest reading since January

- Initial jobless claims rose 3,000 to 271,000 for the week ended June 20th However, the four-week moving average fell 3,250 to 273,750

For the week, the S&P 500 fell by 0.40% for a year-to-date return of 2.07%.

Summary

IBD: Uptrend under pressure

GMI: 5/6- Buy signal since market close of May 11, 2015

BCI: Cautiously bullish but still concerned over situation with Greece and how the markets respond. Until this is resolved, I am selling an equal number of in-the-money and out-of-the-money strikes but expect to get more aggressive once this matter is settled

Wishing you the best in investing,

Alan ([email protected])

I would like to touch on a strategy I have not seen addressed in any previous blog articles. Since you have a rule of not selling options on a security during earnings month, would you consider extending the expiration period into the following month by using weeklys up until the Friday before earnings report? Ex: YY earnings is scheduled on Aug 6. Instead of skipping the August contract due to the ER, one could sell the weekly expiring July 31 instead of the monthly expiring July 17. This would allow for getting more option days from an underlying while still being out of the option only during earnings week. This could also work for the week following earnings where one could sell the CC a few days following the earnings report (especially an ER in the 2nd or 3rd week of the option month). This seems especially useful for long held positions that I would never want to sell. Your thoughts?

Best Regards,

Joe M

Joe,

Yes, absolutely. One of the main advantages of weeklys is that we can write calls up to the week prior to earnings and pick it up again the week after earnings. So, in theory, we can write calls 48 out of the 52 weeks in a calendar year.

Selling weeklys several weeks into the future would limit us to stocks that are participating in the expanded weekly options program.

For more information, here is a link to an article previously published on this topic:

https://www.thebluecollarinvestor.com/weekly-stock-options-for-covered-call-writing-pros-and-cons/

Alan

Premium Members:

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 06/26/15.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and the BCI Team

Mr. Alan,

I’m reading 2 books.

1. Complete Encyclopedia of Covered Calls

2. Cashing in on covered calls

The encyclopedia says on page 77 (mixed technicals).

It shows that MACD and Stochastics both down is “mixed”.

Do you consider it “mixed” if just one (MACD or Stochastics) are downward?

In Cashing in on covered calls, on page 83, it reads, “when we get mixed signals”…

So i’m curious if 1 or both causes the pick to be labeled as “mixed”.

Thank You

Jose,

On page 77 of the Encycopedia, the chart is labeled “mixed technical signals” because the exponential moving averages are bullish with the averages uptrending, and the 20-d above the 100-d EMA. The price bars are at or above the 20-d EMA. The MACD Histogram and stochastic oscillator signals have turned bearish as you stated. If I decided to use this stock in my portfolio, these signals would encourage an in-the-money strike. If In were deciding between this and another security that had a completely bullish technical chart pattern I would favor the latter security.

Alan

The markets were down significantly today as a result of the uncertainty with Greece’s relationship with the Eurozone I’ve been expressing this short-term concern for several weeks in my blog article summaries and premium reports. It is important to take a step back and realize that our economy is still strong, corporate profits will continue to grow and the markets will recover. I take this as an opportunity to buy back options in preparation for next-step exit strategy maneuvers. Non-emotional investing is critical to our success.

Alan

Dear Alan,

If I may piggy back on your sage advice: it is days like this that test our resolve. Mike Tyson was never known for eloquence but he gets credit for the line “Everyone has a plan until they get punched in the face.”

If one is a covered call writer today was no punch in the face. We do better than the crowd whenever the market hiccups. We keep our premiums and our stocks. And today when put values sky rocketed I sold some. News related dips have a habit of retracing themselves to close the open chart gaps they create above.

I believe healthy pessimism is as essential for sanity as incurable optimism. My hunch is the market “wants” – as if it were an animate being – to separate people from their money.

No better way to foil that than sell options! Be they covered calls, cash covered puts or credit spreads once you get the hang of the first two.

Great to have this community. It is a journey. Never a destination…- Jay

Jay,

Well-stated. The BCI community enjoys and appreciates your commentary.

Alan

I would like to know if there is someone in my area (Southern California, Palm Springs) who has experience doing your system using Scottrade as a broker, and who would be willing to help me? My email address is [email protected]

Scottrade does have a paper trading platform called ScottradeELITE, which I am signed up for, but right now it all looks like Greek to me!!!

Thanks again for all your help and making a way for “the little guy”

Frank

Purchased a cash secured put for the Jun Expiry. On expiration the stock price close below the strike. I decided to keep the stock and write a covered call for July. My question is what price do I record for stock on the June cash secured put worksheet (column F) and the July covered call worksheet (column B)?

June Put CRTO strike 50

June expiration 47.1

Bob

Bob,

In this scenario, you are incorporating both option strategies into one…nice work. In essence, the put sale is used to establish your cost basis for the covered call trade:

Cost basis = Put strike price – put premium

If you received $2 from the put sale, your cost basis for the covered call trade becomes $48.

We cannot count the put premium to reduce our cost basis AND

generate cash flow. If unexercised, it’s the latter; if exercised it’s the former.

Alan

Premium members,

This week’s 6-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

My next live seminar is in Northern New Jersey on Monday, July 20th. I’d love to meet as many of our Blue Crew as possible:

http://www.aaii.com/localchapters/pdfs/Northern%20New%20Jersey%20150720.pdf

Alan and the BCI team

Hi Alan,

I finished your book “cashing in on coverd calls” Great read, thank you.

It almost seems to good to be true but if the technicals are good on a stock why cant we just write “At the money” or slighty “out of the money” Strikes month on end? If the share gains value and we get excuted on the strike price we set (that will be of greater value than we bought the stock at) We recieve the premium and also some upside gains? If it dosnt get excuted then we write another.

I may be missing some important information. But I have been paper trading and I am consistantly in the 1.9-2% range on a really safe call that im confident to do every month on my equity. Thats 24% a year.. Amazing..

Warm regards,

Martin – Australia

Martin,

Congratulations for paper-trading and for your recent success.

Technical analysis is extremely important but it’s not the only factor we use in making our decisions. Fundamental analysis, common sense screens, overall market assessment and personal risk-tolerance play roles as well.

As an example, with the recent market volatility resulting from the situation in Greece, many conservative investors are using in-the-money strikes at least to some extent (I’m trading 50% of my positions with ITM strikes).

Keep up the good work.

Alan

Running list stocks in the news: AMBA:

Ambarella Inc. develops video compression and image processing semiconductors used by such companies as GoPro, Corning International and Comcast to name a few. It has beaten consensus estimates the past seven quarters including the report from June 2nd where a revenue increase of 73.5% was reported year-over-year and gross margins of 64.8%. As a result estimates for 2016 and 2017 have been on the rise especially over the past month.

Our Premium Stock Report shows AMBA to be in the CHIPS industry segment currently ranked “A”, a Scouter rating of “5”, a beta of 1.62, has weeklys and adequate open interest for near-the-money strikes and a projected next earnings report date of 9/3/2015.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 07/03/15. For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The BCI Team