Contract adjustments to the terms of our covered call writing and put-selling options are due to corporate actions like mergers and acquisitions, special dividends and stock splits.

This article will highlight the contract alterations resulting from special dividends and equity distributions.

Special cash dividends: 2 adjustment techniques

1. Ticker remains unchanged

- Number of contracts: Unchanged

- Deliverables: Unchanged (1oo shares)

- Strike price: Reduced by the dividend amount

- Multiplier: Unchanged (remains 100)

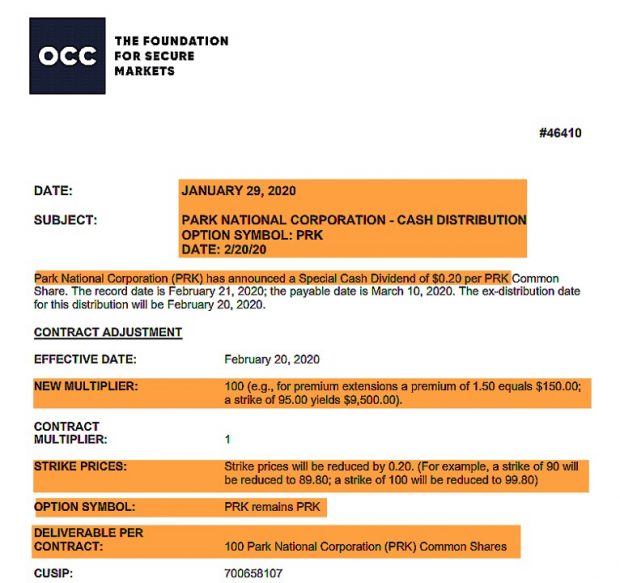

Real-life example with Park National Corp. (NYSE: PRK)

PRK: Special Cash Dividend

A $100.00 strike will be reduced by the special dividend amount of $0.20 to $99.80. The ticker symbol remains PRK.

2. Ticker symbol changes

- Number of contracts: Unchanged

- Deliverables: Adjusted to reflect both share and dividend distribution

- Strike price: Unchanged

- Multiplier: Unchanged (remains 100)

Real-life example with Loral Space & Communications Inc. (NYSE: LORL) (NYSE: PRK)

LORL: Special Cash Dividend

Each contract will deliver 100 shares of stock plus $550.00. The ticker symbol changes from LORL to LORL1.

Special stock dividends

- Number of contracts: Unchanged

- Deliverables: Increased to reflect the special equity dividend (A 3% dividend will result in a deliverable of 103 shares per contract)

- Strike price: Reduced. Divided by 1 + dividend percent (A 3% dividend will result in all strikes divided by 1.03)

- Multiplier: Increased by the dividend amount (A 3% dividend results in a multiplier of 103

- Option symbol: Adjusted to highlight contract adjustments

Real-life example with Tootsie Roll Industries, Inc. (NYSE: TR)

TR: Special Stock Dividend

The ticker symbol changes from TR to TR1 to reflect that adjustments to the option contracts were made due to the corporate action of declaring a stock dividend.

Discussion

There is no single formula for all contract adjustments. But they do fall into certain categories. This article highlights the basic contract adjustments for special cash and equity distributions. When these events occur, we must understand the terms of the adjustment so we can make the most appropriate investment decisions.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

Thanks to you I survived this extraordinary year really successful. At the beginning it was quite frightening, but keeping your videos in my mind and holding on to your strategies helped a lot to get through this crisis in the first half of the year and helped me at the end of this year to make it one of the most successful ones of my career as a “CEO of my own money”

Really thank you: without your confidence you spread in your videos by explaining the bits and pieces of covered calls. I trust in you and hope that you will live forever … or at least as long as I live 😉

Again: many thanks to you and your great team – especially Barry – for all the help during this year and the 20 years before. I hope we can see us somewhen/somehow as I am living in Switzerland and you in US

Marc

Upcoming events

1.Wealth365 Summit

January 18th – 23rd, 2021

Information to follow

2.Long Island Stock Investors Group

February 9, 2021 at 7:30 PM ET

Zoom webinar- details to follow

3. AAII Research Triangle NC

April 10,2021 at 10 AM ET

Zoom webinar- details to follow

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************

Alan,

I’ve made a decision about 4 months ago and caught a stock on the up swing.

I’m basically in one stock. Its gone up about 137%, or 256K, so I’ve got about 400K in one position.

The stock is PLTR. I’ve got 15,000 shares.

I’ve been writing covered calls, mostly weekly.

I know their quiet period ends around the 10th of February. They also have a presentation

scheduled for the 26th of January to demonstrate to the public the ability of their platforms.

The stock is trading for $27.75, my cost is 11.01.

Short term profits are taxed at 40% on all proceeds not passed on to beneficiaries.

I’m wanting to hold till October of 2021 to get to long term gains.

So I was thinking of buying some puts, such as the Nov 2021 puts @ 10.00 for a cost of .77.

It would cost me $11,500. Or, since I’m up so much just bank on getting out before it would get to

$10.00 and save the cost.

I don’t want any leverage or very little of it. I’m only leveraged at 6% and each covered call reduces that amount.

I’ve bought 20 calls for 19 Nov 21 @ 32 and 20 calls at 19nov 21 at 35. If I took those profits I would have no

leverage.

So based on what I’ve read so far. I should be more diversified. I’ll do that after I get out of this position.

I’m curious about selling puts as well as the covered calls.

How many of the covered calls would you write against the 150 calls that I have available?

I have long margin available of $400K plus. I was thinking I might sell a Cash secured put against my margin, but

I really don’t like the down side.

I’m thinking I need to just stick to the covered calls and roll out of any positions that might get exercised.

Other than the covered call being exercised is there any danger in just selling all 150 covered calls?

Currently, I’m staying around 40-60 calls,

I’m typically getting 4-7% on the premium and taking any OTM strike price giving an upside of 12-15%.

Merry Christmas, Be safe!

Charles

Charles,

I cannot give specific financial advice in this venue but I can make some general comments you should find useful.

1. Diversification of our portfolios is critical to our overall and long-term success. This must be established when making our investment decisions.

2. When share price accelerates substantially resulting in significant unrealized capital gains, a percentage of those shares can be sold such that our original investment plus the tax implications of the sale can be generated. Now, “we’re playing with house money”.

3. Remaining shares can be invested based on our original strategy parameters that were set up prior to the initial trade. That is, based on sound fundamental, technical and common-sense principles, our security and market assessment, personal risk-tolerance and return goals.

4. Outside of investing in sheltered accounts, if possible, I do not base my investment decisions on tax implications. In other words, I’m more focused on making a dollar than losing $0.40.

5. We should always seek advice from our tax advisor when concerned about tax-related issues.

So glad the trade is working out so well.

Happy holidays,

Alan

Hi Alan,

I have been watching your webinar on poor man’s covered calls. In it you say we generally want to hold onto the LEAP long term and keep selling calls against it.

Why is this a good idea? Could we just sell it after, say, a month if it has increased in value, thereby securing appreciation in the LEAPS and the premium from the selling the call, then move onto another trade?

Also, do you have a typical expiry for the LEAPS (like over a year out)?

Any advice appreciated.

Best,

Andrew

Andrew,

The PMCC is a type of spread trading where call or put options are simultaneously bought and sold on the same underlying. It is technically a long call diagonal debit spread.

It is traditionally a long-term position where we use underlyings that we like as a buy-and-hold security for our portfolio. The position can be closed early and that is one of the reasons we set up an initial structuring formula that must be adhered to when establishing a PMCC trade… if the stock appreciates substantially, leaving the short call strike deep in-the-money, we can close both legs of the trade at a profit.

My preference for those using this strategy is to use 2-year expirations for our long LEAPS positions because the cost per month per contract to roll will be lower. All this is detailed in our book (“Covered Call Writing Alternative Strategies) and online video course (The Poor Man’s Covered Call).

Bottom line: Yes, the trade can be closed early but it is generally considered a long-term commitment.

Alan

Thanks for clarifying that Alan. I look forward to trying it.

As I understand it – and I could be mistaken – you can buy 1 deep in the money LEAPS and sell 1 call against it, securing a premium. If our goal is securing the premium, that seems relatively straightforward.

I understand we can also aim for appreciation in the long LEAPs call. I gather you need to buy quite a lot of the long leaps calls to get any significant profit should it increase in price. I’m thinking that because the further out the call, the higher the price and subsequently, any upside moves are, as a percentage of cost basis, smaller. Is that correct?

If that is correct, how does the number of LEAPS call we hold impact the number of calls we sell?

Happy holidays and grateful for your advice.

Kind regards,

Andrew

Andrew,

The main reason for using 2-year expirations is that the cost-to-roll the LEAPS option per-month, per-contract will be lower. Entering our PMCC trades in low implied volatility environments will also increase the chances of selling in higher IV environments.

The focus of our PMCC trades should be based on our initial trade structuring formula, trade management and premiums generated from the short calls.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 12/24/20.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

On the front page of the Weekly Stock Report, we now display the Top 10 ETFs, the Top SPDR Sector Funds, and the 4 single Inverse Index Funds. They are sorted using the 1-month performances from the Wednesday night ETF report and the prices from the weekend close.

Best,

Barry and The Blue Collar Investor Team

[email protected]

Dear Alan and Barry,

I have been with your service for 2 months, and it’s been terrific.

I am a small player.

Two ‘rules’ don’t make sense to me: (i) how to avoid expirations during ‘earnings season’, and (ii) 20%/10% for initially ITM Calls.

(i) EARNINGS SEASON … Every stock in the Dec. 24th Weekly Stock Screen for Jan. 15th expiry reports earnings between Jan. 18th and Feb. 15th (earnings season), and very few have Weeklys. The next monthly contract expires Feb. 19th, and the rule disqualifies the entire report from the Feb. 19th. Selling Calls for the Feb. 19th after the earnings report leaves just a few weeks, and is suboptimal due to decaying time value.

Does this mean that the first advisable contract is the March 19th expiry (i.e. Jan 15th and Feb 19th are dead expiries).

Can I enter the March 19th position anytime after the Earnings date in January?

(ii) 20%/10% WHEN INITIAL POSITION IS ITM .. If the initial position is ITM, does the rule apply to the Time Value component of the Ask Premium when the buy-to-close decision needs to be made.

For example, if I sell the 90 Strike for 14 when the stock is trading at 100, then the intrinsic is 10 and the time value is 4. The 20% / 10% rule says to buy-to-close the Call when the Time Value of the Ask is at or below $0.80 (20%) or $0.40 (10%), 1st or 2nd half of contract, respectively.

Thanks for everything.

Greg

Greg,

Excellent questions and observations. My responses:

1. Earnings season can be challenging but like all scenarios of this type, there are ways to manage and keep the income-generation intact.

On this week’s report, there are 2 eligible stocks that report after expiration of the February contracts. Also, there are several stocks that report in the first week of the February contracts Once those reports pass, they become eligible and there will still be 4-weeks of time-value available to us since this is a 5-week contract. The main available pool of securities is from our ETF report which usually has about 20 eligible securities. Before you know it, our portfolios are fully populated.

2. The 20%/10% guidelines apply to the full premium for all strikes, ITM, ATM and OTM. The reason is that ITM strikes have higher Deltas and therefore greater erosion of time-value if share price declines. In your example, the 20% guideline is set at $2.80 and changed to $1.40 mid-contract.

Alan

Alan,

Thank you for your response.

If not for your response, I would have waited forever (and lost money) for the buy-to-close Ask price to drop to 20%/10% of the sell-to-open Bid time value … and worse, I never would have understood my mistake ..

Re: Earnings Season .. I’ll look more diligently at the BCI ETF and Stock lists … but ..

Psycology .. I tend to swing between extremes .. wanting the ‘excitement’ of active positions vs. patient sellection caution ..

Thank you, again ..

Maybe see you at a seminar in south Florida after I return ..

Greg

Alan … Your thoughts on the following..owning stock for all components of an ETF… selling short the ETF… you are completely hedged… writing covered CALLS, ATM each month and writing covered PUTS, ATM each month… and taking advantage of the paying dividend…

Jan

Jan,

I always admire members who think outside the box so congratulations for that.

The best way to determine the efficacy of a strategy is to actually (paper) trade it with real-life examples. Here are some of the data points that will be required:

1. Select an ETF that meets our system requirements.

2. List all the stocks included in that ETF.

3. Determine the cost to buy at least 100 shares of each security..

4. Select a covered call strike and determine the premium it will generate.

5.Calculate the composition of each stock within the ETF to determine if, in fact, shorting the ETF will represent 100% hedging. Frequently, the percentage is based on market capitalization.

6. For the covered put aspect, are you referencing a traditional covered put which involves shorting a stock or a cash-secured put? Either way, data for this aspect of the strategy must be determined.

7. After obtaining all this information, if we decide that the strategy still seems appealing, we begin paper-trading.

Alan

Poor Man’s Covered Call Calculator video tutorial:

In response to the request of several of our members, we just added this video to our website:

https://thebluecollarinvestor.com/minimembership/poor-mans-covered-call-calculator/

Alan & the BCI team

Premium members:

This week’s 4-page report of top-performing ETFs and analysis of the top-performing Select Sector SPDRs has been uploaded to your premium site. One and three-month analysis are included in the report. Weekly option and implied volatility stats are also incorporated.

The mid-week market tone is located on page 1 of the report.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Thank you for making 2020 the best year ever for BCI.

Happy New Year,

Alan and the BCI team