The Poor Man’s Covered Call (PMCC) is a covered call writing-like strategy where short calls are sold against LEAPS options. There are pros and cons to this trading approach but the main advantage is that these trades can be executed at a lower cost than traditional covered call writing. Options (LEAPS, in this case) are cheaper than the shares themselves. This article will highlight two of the main factors we must consider before executing a PMCC trade.

Critical structuring factors for successful PMCC trades

- Since covered call writing is a strategy where generating cash flow is our main goal, we want to be sure that the initial time value returns meet our (monthly) goal

- We also want to structure the initial trade such that, if share price rises substantially forcing closing of the trade (short call deep in-the-money), early closure will result in a profit

Real-life example with The Coca-Cola Company (NASDAQ: KO)

On 11/21/2018, KO was trading at $48.81. The option chains were examined for deep in-the-money LEAPS and slightly out-of-the-money 1-month expiration options. We want to confirm that the initial short call premium divided by the cost of the LEAPS option falls within our 1-month time value return goal (2% – 4%, in my case). We also want to calculate that early closure of the trade will result in a profit. This means that the difference between the strikes (LEAPS and short call strikes) plus the premium generated from the short call sale is greater than the cost of the LEAPS option.

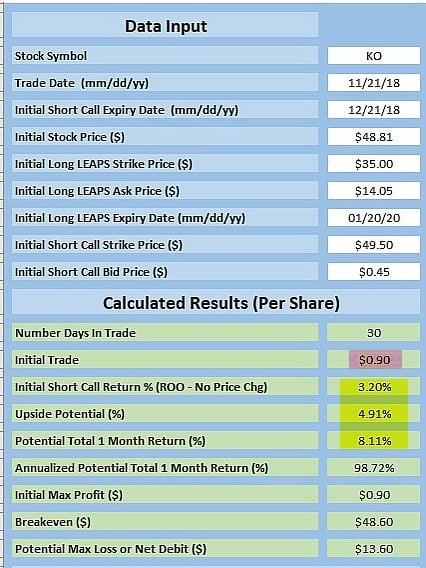

The BCI PMCC Calculator results for KO

PMCC Calculations for KO

The cells highlighted in yellow, show that, based on a cost-basis of $14.05 (cost to purchase the $35.00 LEAPS option), there is a 3.20% 1-month initial time-value return with 4.91% upside potential (if share price moves up to the $49.50 strike) with a total 1-month potential return of 8.11%. This is a very reasonable initial return setup.

The pink-highlighted cell shows that if the trade is closed as a result of substantial share appreciation, there will be a credit of $90.00 per-contract. This is calculated by taking the difference between the 2 strikes and adding the short call premium and then subtracting the cost of the LEAPS:

[($49.50 – $35.00) + $0.45] – $14.05 = $0.90 per-share

Both factors meet our reasonable criteria for entering a PMCC trade.

Discussion

Before entering a PMCC trade, we must confirm that the initial time value returns meet our (monthly) goals as well as verifying that, if the trade is closed early, it is closed at a profit.

For more information on the PMCC strategy

Covered Call Writing Alternative Strategies

The BCI PMCC Calculator or Calculator package

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

Thank you for generously sharing your knowledge and resources. I purchased your Complete Encyclopedia for Covered Call Writing last year. You have an easy-to-understand teaching style.

Regards from North Bellmore!

Best,

Lori

Upcoming event

July 22: Chicago Traders Expo

1:30 – 2:15

Hyatt Regency McCormick Place

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports.

***********************************************************************************************************************

Alan,

In your example ‘Initial Trade’ and ‘Initial Max Profit’ are both $0.90. When I use PMCC calculator I always get these numbers the same too. What is the difference between ‘Initial Trade’ and ‘Initial Max Profit’?

Sunny

Sunny,

The 1st tab of the BCI PMCC Calculator is designed to make sure the initial structuring of our trade meets the BCI system criteria. If the trade is forced to be closed due to significant price increase of the stock leaving the short call deep in-the-money, the trade will close at a profit.

The “initial trade” shows a net credit or debit (if debit, do not follow through with the trade) and “Initial Max Profit” confirms the fact that if the trade is closed before another short call is written that will also be our max profit.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 06/21/19.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The Blue Collar Investor Team

Alan,

I noticed that Amazon has been on our stock list recently but it is way too expensive for me. Is there another way we can take advantage of stocks like this with covered call writing or selling puts? ((I know the pmcc is another way).

Thanks for your help.

Marsha

Marsha,

One way to take advantage of Amazon and large tech companies like Amazon at a much lower cost-basis is to consider the ETF Invesco QQQ Trust (QQQ). It consists of 100 of the largest non-financial companies that trade on the NASDAQ exchange. Amazon represents the 2nd largest holding in the fund (see screenshot below).

Over the past 10 years, QQQ has been the ETF that has appeared most frequently in our premium member ETF reports.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

I don’t understand the amazingly low price of the leap. Do dividends come into play? 48.81 current vs implied of 49.05 (35+14.05) in 24 months?

The leap isn’t going to appreciate at the same rate as the short term call if the stock price goes up. A short term $1 increase in share price won’t be proportional between the leap and short call correct? I see an early increase in share price getting you upside down in this trade. Can you point out my mistake?!?

Thanks for all of your advice!!

Eric S

Sorry, 14 months not 24

Hi Eric,

I learned the value of using LEAPS as stock replacement from Alan and Barry. It is now a core part of what I do. Most of the time I do not use the PMCC tactic because all I am fishing for is appreciation with a pre set risk.

When things were gloomy late last year I bought a handful of LEAPS just using parity, ATM, 50 deltas on CSCO, MA, DIS, PG and HD to diversify out into 2020. In the first quarter recovery they all doubled so I sold half to make the trades risk free and still hold the rest. Sounds wonderful and easy, huh :)?

Well, this year I thought after the airline tragedy the BA decline was a temporary news event so I went out into 2020 and bought LEAPS. I thought the beat down of banks was over done so I did the same thing on BAC. And finally I did not think the China stuff would last this long so I bought BABA. All of those are below where I bought them. And even though they are LEAPS they still bleed theta fractionally every day.

So there remains no “free lunch” I can find :). Using LEAPS you can put together a portfolio of solid high liquidity stocks for far less than buying them outright profiting at an accelerated rate if the market goes up. Just know the downside is also accelerated and manage/budget accordingly. – Jay

Thanks Jay! I’ve experimented lightly with Leaps. Sounds like more learning is in order!

Jay and Friends:

No “free lunch”

No “Fountain of Youth”

No “sure thing”

but I Appreciate your sharing and contributions to the pool of ideas.

Been reviewing those ETFs as well…. Lot of cyclical changes this year…. particularly with the following:

EWA

VNQ

XHB

XLRE

KSA

INDA

So this business is not “duck soup”…

“Duck Soup”

duck soup. An easily accomplished task or assignment, a cinch to succeed, as in Fixing this car is going to be duck soup . This expression gained currency as the title of a hilarious popular movie by the Marx Brothers (1933). The original allusion has been lost. [ Early 1900s]

Going to look up that movie…

Mario

Eric,

One of the characteristics of deep in-the-money calls is that the premium is almost all intrinsic value and usually very little time-value especially for a blue-chip stock like KO.

I took a pre-market screenshot this morning before I headed to the gym (see below) and a you can see that with KO trading at $51.55, the January 2020 $35.00 LEAPS had an “ask” price of $16.85. That premium breaks down to $16.55 in intrinsic-value and only $0.30 in time-value.

You have identified one of the advantages of LEAPS in that they have Deltas near 1 and behave much like a stock regarding price movement and they can be purchased at a much lower price. Of course, there are disadvantages and we must weigh the pros and cons before using LEAPS.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Thanks Alan. You’ve been a great source of information on this subject. I really appreciate your willingness to help!

Alan,

It has been my experience that even when I renew at the time when there is hardly any Time Value, still it is very hard to capture the “bought up value”. This happens to me when I am selling an OTM option with a 4 week or 5 week contract. I mean the stock would jump 10% yet, when I renew the contract for the same period as the last one, you hardly get any free “bought up value” without having to have a debit.

A lot of your examples have a better scenario than I am experiencing unfortunately. The effort continues 🙂

Many thanks,

Mazin

Mazin,

The “bought up” value is never “free” It represents the intrinsic value component of the premium we pay to close the initial short call. So the stock value moves up from the original strike to current market value. So, it’s a wash…the intrinsic value spent is equal to the share appreciation resulting from removing the original strike obligation. The actual cost-to-close is the time value component of the premium.

Send over a specific example with all the elements of the trade and perhaps we can analyze it for a batter understanding.

Alan

Alan,

Thank you very much for the quick response but I am still unclear a bit. My objective when I move forward and up (in a situation where a stock has moved up say 12 to 15% in a 4/5 week period), is to eliminate any debits and still capture a decent amount of bought up value. Here is an example with FB:

Stock Purchase Price on May 24, 2019: $181.92

Stock Price at time I sold covered call June 5: $165 (stock dropped after I bought)

Price of Call Sold: $5.92 on June 5, 2019

Strike Price: $165

Expiry Date: June 28, 2019

Option Price as of June 25: $24.15

Today’s stock price as of June 25: $188.90

Size: 25 contracts

So in the example, above, if I wanted to move forward and up for another 4 or 5 week period, from the June 28 expiration, I can barely (1%) get any free “bought up value”. The only way, I can capture free “bought up value” is if I move “forward and up” for a much more extended period, say until Dec 2019, where I can be in the 180 Strike Price option and hardly any debit.

I would have imagined that I can capture at least 3% to 5% of bought up value from my initial strike price of 165, at no cost, if I move forward and up for another 4 or 5 week period — especially in light of such a move in the underlying.

In some of your real life examples, I recall that you were frequently able to move forward and up a bit, at no cost, and still capture free “bought up value.”

Thank you very much Alan.

Mazin

Mazin,

Let me re-emphasize that the “bought-up value” of the stock is NEVER “free” We pay for it in the form of intrinsic -value of the BTC (buy-to-close) premium when the strike is in-the-money as in this case with FB.

With FB trading at $188.90, the $165.00 strike is $23.90 in-the-money… this is the intrinsic-value of the $24.15 BTC premium. This means that the time value cost-to-close is $0.25. Once the original short call is bought back, the stock is now worth (or “bought-up” to) $188.90… it is not free… we paid for it in the form of intrinsic value… it’s a wash.

Now, as of pre-market on Thursday, let’s look at an option chain for the July 19, 2019 $190 out-of-the-money strike. It didn’t use the 7/26 expiration because of the 7/24 earnings report. The “bid” column shows a time-value premium of $6.60 which nets to an initial time-value profit of $6.35 ($6.60 – $0.25). With shares worth $165.00 prior to rolling out-and-up, this would represent a time-value return on option (ROO) of 3.8% and upside potential of 0.07% for a possible 22-day return of 4.5%.

The key takeaway from my response is that “bought-up” value is never free. We always pay for it in the form of intrinsic-value. From there, we focus on the time-value aspect of the premiums.

Alan

Alan,

From one of your videos…2009 I believe:

When you bought Marvel at 31.xx and sold the 30 call and the stock dropped to 26.xx you B-T-C and then sold the 25 call.

How do you decide after you B-T-C whether to wait for the stock to go up again and sell the same strike in this case the 30 call or to not wait, and drop down to the next lower strike the 25 call and sell the call?

Thanks,

Jack

Jack,

I don’t recall this specific video (I’ve produced over 400) but I can give a general response.

We are more likely to wait to “hit a double” in the first half of a contract and more likely to roll down in the second half of a contract. Overall market assessment and chart technicals play supporting roles in our decisions.

Alan

Hi Alan,

I have been writing Covered Calls for about 15 months and the result has been phenomenal. Lately, I realized I have been tracking my winners/losers using the option premium only, and not the stock price. So, I decided to re-score my trades, but my result has become mixed and confusing. Some trade which I thought was a winner is now scored as a loser, and some was a loser is now scored as a winner. I spent the past 2 weeks recalculating and reexamining my scoring method. I am still very confused and would like to get your feedback.

Mainly, I calculate the Option P/L and Stock P/L. The Winners/Losers (or Profit/Lost) would the sum of these two.

Option P/L = Open Option Price – Close Option Price

Stock P/L = Close Stock Price – Open Stock Price

* The Close Stock Price would be the Strike Price is the Call option is assigned

The most confusing part is the Stock P/L. Had I brought the stock on the day I wrote the option and sold on the day I closed the option, the Stock P/L would be clear and straight forward. However, I am a long-term investor, so I hold on to the stock for a long time and sold options against it.

Let’s take this trade as an example:

• On 5/20/2019, I sold 5 x XLE 190621C for $1.00. XLE was trading at $63.78 on that day.

• On 6/3/2019, I brought back the option at $0.02. XLE was trading at $59.52.

If I look at the option premium alone, it was a great trade. I made $492 or 1.53% in 2 weeks or annualized at 36.8%. A clear Winner.

However, if I include the ETF share price, it went from $63.78 to $59.52 which means a lost of $4.26 per share or $2,130 in total. Even with the option premium, it was still a lost of $1638. So, it was once a Winner is now looking like a Loser.

Now, as of this writing (6/23/2019), XLE closed at $63.56, back to where it was on 5/20/2019. In total, I am still up $382 ($492 – $2130 + $2020 = $382). Again, what looks like a Loser a moment ago is now looking like a Winner again.

The question is how should one evaluate a trade? Option Premium only? Option Premium + Stock Price? In the above example, XLE did rebound from $59.52 to $63.56 fairly quickly. So, you can argue it was a good trade. What if it stays at $59 for a while before it bounces back? Or it never bounce back at all?

P.S.: For the record, the above trade was scored a Winner initially. Now, it is scored a Loser even though in net-net (as of this moment), I am up $382 or 1.19%.

Thanks and hope you can provide some guidance

Van

Van,

Since your plan is to hold the underlying security for the long-term, selling options against your positions will be winning trades. Now, if share price moves above the strike by more than the option premium, more money could have been made (on paper) had the option not been written but it will still have been a positive result.

The strategy you are using is “portfolio overwriting” and we typically use only out-of-the-money strikes based on our initial time-value goals. Ex-dividend dates must also be monitored.

For tax purposes, each option trade stands alone assuming the option is not exercised (check with your tax advisor for accuracy of my statements relating to taxes). Use the Schedule D in the Elite version of the Ellman Calculator for these results.

If you wanted to factor in stock price for each time frame (contract), the formula you are using is accurate (Unrealized stock credit or debit + option credit or debit).

One easy way to evaluate our results is to keep all our covered call positions in account(s) dedicated to this strategy and compare the results to the S&P 500. If we have mastered the 3-required skills (stock selection, option selection and position management), we should beat the market every single year.

Alan

Van,

I keep track of all my trades and know my Gain and %G at all all times as I trade covered calls. The trick is to keep track of the following:

Return Cost Basis – for your original purchase, stays a constant throughout your trades. (Stock purchase only = price after commissions, OTM Covered Call – Stock price after commission, ITM covered Call = strike price)

Your current Breakeven Point (adjust for each trade, including the effect on dividends per share)

You can then calculate your Gain for your position and %Gain = ROO%.\ for you position before and after the trades.

Since we are at the end of this week and busy the rest of this week, , I will cover this in more detail for next week’s blog,

Leaving at 1pm for a dance with my beautiful wife to attend a “Uncle Sam and Besty Ross” July 4th Dance at our Community center.(Tamarac, FL). It’s also my birthday June 28, tomorrow. Sometimes the annual dance falls on June 28 and I “hit a double”.

What brokerage do you use? I have Fidelity and Etrade.

Mario

deta

Ok….confessional time. I have been cheating on the BCI strategy in the last few months, and have been dabbling in a couple other methods. Needless to say, I have lost money. Big Bummer. I am now going to humbly crawl back to the BCI methodology because it’s the one true slow but steady way to actually make money consistently time after time. What was I thinking?!

Joanna,

That is really funny and true :). Thanks for posting it!

But depending on the degree options are a hobby – dare I say “passion” :)? – for you I encourage you to continue to explore different ways to use them. It never hurts to keep learning and no where is it more true than in what we do with our money.

I think about options trading as a pyramid: the base should be the cash flow generating conservative strategies of covered call writing and cash secured put selling. Then as you move up the pyramid you may want to dabble in buying a few and using limited risk spreads when you have a strong hunch about a stock or a sector just to follow your nose for fun and maybe profit! It’s like splurging on dessert every now and then :). – Jay

Joanna and Jay,

this is the BCI fan club. We know that Alan has developped the methodology after years and years of experience, and was kind enough to share it with us, fortunate few.

It is hard enough to learn all the skills he teaches, so why increase the chalenge by trying other methods?

Thank you for sharing your bad experience. It helps me to reinforce my belief in the BCI methodology.

Roni

Hello Alan;

Your advice in this matter will be greatly appreciated.

I’ve owned CVS (bought back when it was at $75 per share) for some time now. I wrote several covered calls with a nice return, then CVS became a pain for me and today it is priced at $53.27.

I hate thinking of liquidating a position at a loss. CVS thus far has CC’s available sometimes for a much smaller premium than it offered 4-6 months ago.

My thought is to keep writing smaller CC’s rather than sell the shares, or even to sit on the sidelines with this position.

I also have a few lesser quality stocks that also have lost value this year.

When faced with such challenges, I always think to myself… WHAT WOULD ALAN DO?

Thank you for sharing your thoughts. I continue to look forward to your weekly educational discussion pieces.

Jim

Jim,

I hope you can understand that I cannot give specific financial advice in this venue but I can make some general statements that you should find useful.

When we purchase a stock, it is because we have evaluated it from fundamental, technical and common-sense perspectives and have a bullish assessment. It is critical that we remove emotion from our decisions whether we are buying or selling.

Now, when a trade turns against us, we ask ourselves: “where is the cash I currently have invested in Stock A best placed… in Stock A or in a different stock?”

If we invested $7,500.00 in stock A and now have $5,000.00 worth of Stock A…we are now deciding what to do with $5,000.00. It’s all about the cash, not the stock.

If we decide that the share decline was temporary and still bullish on a stock, writing out-of-the-money calls makes sense. If we decide that the reasons we were bullish on the stock no longer exist, we should consider finding another home for the cash we care about.

I’ve created a comparison chart of CVS and the S&P 500 over the past 1 year. The left side shows a bullish trend and the right side represents the current status.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Hi Jim,

this happens to all of us…. untill we learn to remove the emotion from our trading, as Alan explained.

But it is not easy to do it. IT TOOK ME MANY YEARS.

It means that we must think of a stock as just a ticker, in a list of hundreds of other tickers. You must remove “love” or “hate” from your decisions.

When a ticker you selected goes down, the best decision is always to get out before it goes further down, because the odds are against you. I mean, why should it bounce back?

Get out and forget it. Never look back. Your remaining cash is better placed on a ticker that is going up, and while you are waiting, you are wasting precious time which you could use to recover your loss with a better ticker.

Roni

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team