Mar 16, 2013 | Option Trading Basics, Options Calculations, Stock Option Strategies

Several of our Premium Members have requested we provide sample portfolios based on the CURRENT Premium Watch List as a guide to assist in mastering the strategy of covered call writing. In today’s article I will use the watch list dated 3-8-13 (stats taken on...

Jan 12, 2013 | Option Trading Basics, Stock Option Strategies

When we sell a covered call option, we are undertaking an obligation for which we are well paid. Should the option holder decide to exercise that option, we must sell our shares at the specified strike price at or prior to the expiration date. This is the nature of...

Sep 8, 2012 | Covered Call Exit Strategies, Option Trading Basics

When considering covered call exit strategies on or near expiration Friday we compare the market price of our stock to the strike price sold. If the share value is even one penny above the strike, the option will most likely be exercised and our shares sold. We may...

Jun 9, 2012 | Option Trading Basics

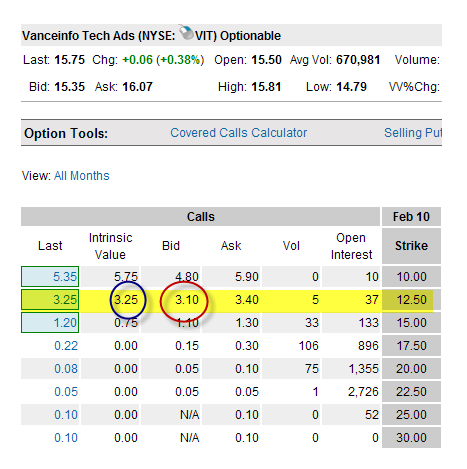

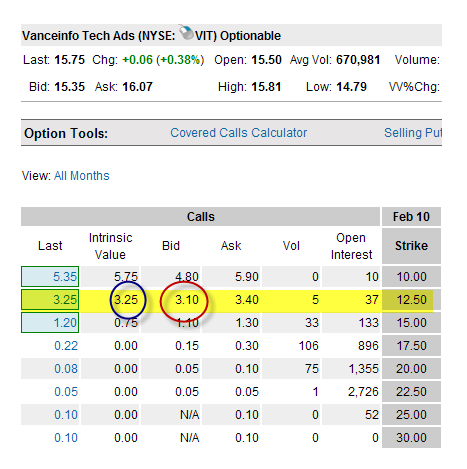

As covered call writers, we have all looked at options chains. That’s where we determine how much cash will be generated into our accounts when we sell our options. It’s fun! We first inspect the current price of the underlying security (stock or ETF). Then we check...

Oct 1, 2011 | Option Trading Basics

So how much cash can we generate selling options on the stocks that have passed our fundamental and technical screens? The answer lies in the option chain. This is a list that quotes option prices for a given security. For each underlying security, the option chain...