Feb 22, 2020 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Put-selling, Stock Option Strategies

Exit strategies for our covered call writing and put-selling portfolios allow us to mitigate potential losses and enhance gains to even higher levels. In my books and DVDs, I detail the 20%/10% guidelines as one of the exit strategies available to us for both...

Aug 31, 2019 | Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution

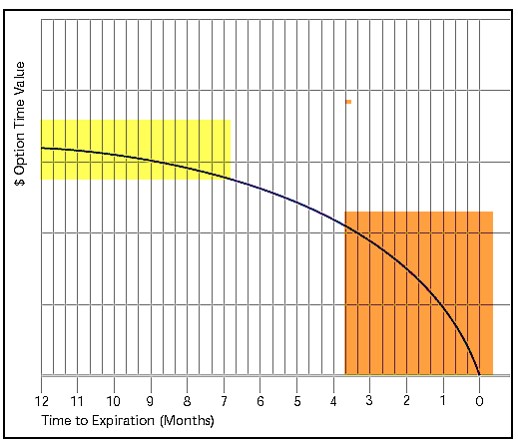

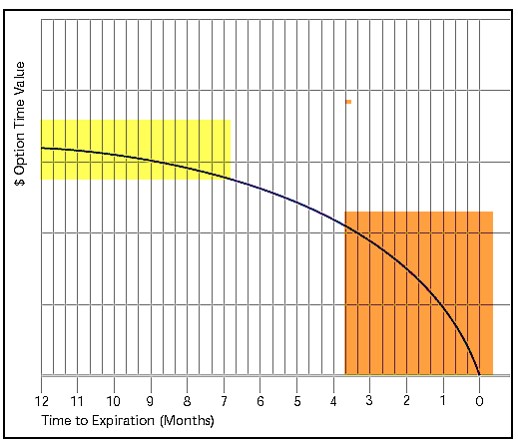

The goals of covered call writing include generating monthly cash flow and preserving capital. We use every fundamental, technical and common-sense principle available to maximize our profits and protect our cash. Paul A. previously sent me an excellent question that...

Apr 13, 2019 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Trade Execution, Stock Option Strategies

Exit strategy opportunities must be taken advantage of with our covered call writing and put-selling trades. When there is a significant overall market decline in the short-term, there will be losses. Our job, as option-sellers, is to mitigate those losses using our...

Apr 6, 2019 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Stock Investing, Stock Option Strategies

The 3-required skills for covered call writing and selling cash secured puts are stock selection, option selection and position management. We can also add timing of our trades as a secondary factor in enhancing our overall returns. These considerations are different...

Sep 15, 2018 | Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

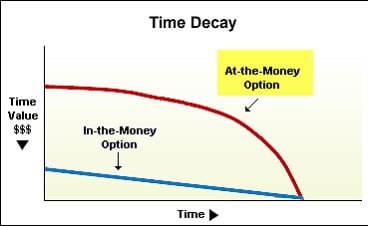

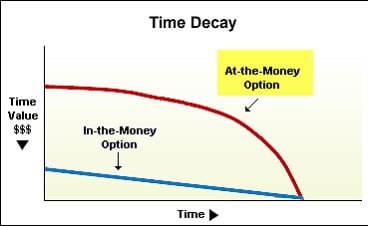

Covered call writers hold two positions. We are long (own) the stock and short (sold) the call option. It is intuitive to investors that it is to our advantage if the stock price accelerates or at least does not decline in value. There are five possible outcomes in...