Jun 29, 2019 | Investment Basics, Option Trading Basics, Options Calculations, Stock Option Strategies

Meaningful option calculations are essential in determining if the premiums meet our covered call writing goals. To this end, we must understand the mathematics of these calculations to become elite option-sellers. Now don’t worry…we don’t have to become Albert...

Dec 8, 2018 | Covered Call Exit Strategies, Exit Strategies, Option Trading Basics, Options Calculations, Stock Option Strategies

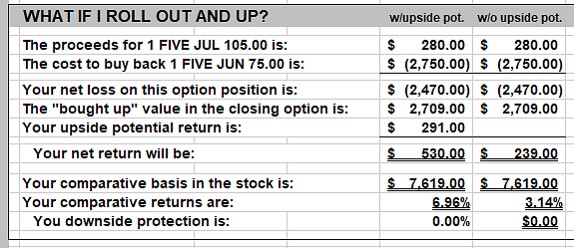

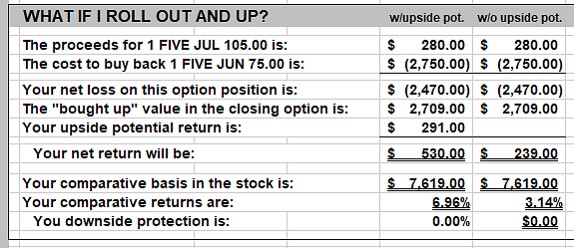

One of our covered call writing exit strategies when the strike is in-the-money on expiration Friday is rolling out-and-up. This is when we buy back the near-month call (buy-to-close) and sell the next month’s higher strike. There are times when share...

Oct 20, 2018 | Covered Call Exit Strategies, Exit Strategies, Investment Basics, Option Trading Basics, Options Calculations, Stock Option Strategies

Covered call writing is a low-risk option-selling strategy typically used to generate monthly cash flow. When we capture call premium into our brokerage accounts, we are lowering our cost basis thereby increasing the opportunities for successful trades. This strategy...

Aug 4, 2018 | Investment Basics, Option Trading Basics, Options Calculations, Stock Option Strategies

Whenever a covered call trade results in a maximum return, it is a successful trade…period…end of story. To most, this statement appears nonsensical and self-evident. But I’m here to tell you that there are a lot of covered call writers that question...

Jul 28, 2018 | Investment Basics, Option Trading Basics, Stock Investing, Stock Option Strategies

For covered call writers and put-sellers, the option Greeks play a major role in our understanding of the risks and value of our option premiums. We know our option premiums consist of intrinsic value (for in-the-money strikes) + time value. Our initial time value...