Options trading basics teaches us that the VIX or CBOE Volatility Index reflects the market’s expectation of the upcoming 30-day volatility. It measures market risk and is also known as the investor fear gauge. With this in mind, covered call writers are faced with a dilemma. Increased market volatility will translate into higher option premiums because the time value component of the premium is directly related to volatility. On the other hand, a high overall market volatility increases our risk as share value can plummet and erase our initial gains. So, is a higher VIX a positive or a negative?

Evaluating the VIX from a covered call writing perspective

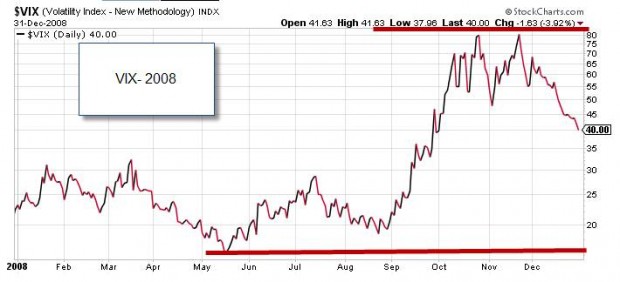

One question that is frequently posed to me is that if the VIX is low do we stop selling calls because of lower premiums? This implies that a high VIX is a positive for covered call writers. Let’s take a look at an extreme example in 2008 when the VIX went from the 20 – 30 level to the 70 – 80 level in the last 4 months of the year before it ultimately moved lower:

VIX in 2008

As a general rule, the VIX and the performance of the overall market (S&P 500) are inversely related as demonstrated in the chart below where the market takes a dive in the last 4 months of 2008:

S&P 500 in 2008

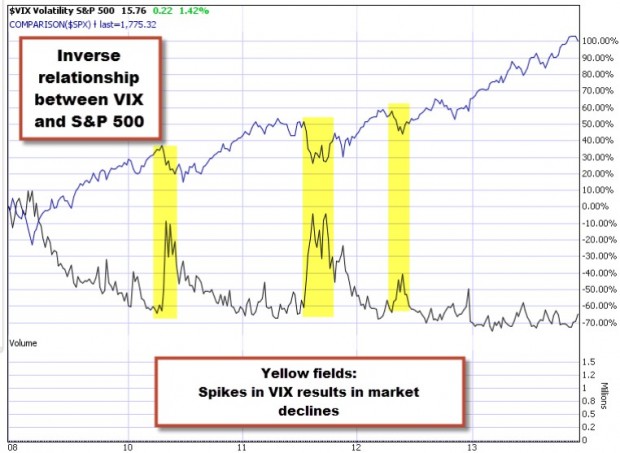

To confirm this relationship, let’s look at a comparison chart of the VIX and the S&P 500 in the 5 years after the 2008 recession. In the chart below, note how when the VIX (black line) declined, the overall market (blue line) accelerated and vice-versa. Whenever there was a short-term spike up in the VIX, there was a corresponding decline in the market performance (yellow fields):

VIX vs. the S&P 500 from 2008 – 2013

The VIX in 2018

Inverse Relationship of the VIX and the S&P 500

VIX and covered call writing

Covered call writing is a conservative strategy and those who use it are generally conservative investors looking to generate cash flow with capital preservation in mind. As such, a high VIX is no friend of covered call writers although we can use our common sense principles to manage those scenarios. A low VIX (under 20) is usually a positive for us because it means a more stable market and oftentimes a rising market as we experienced from 2009 through 2017 and into 2018.

How to manage a high VIX:

We can “stay in the game” by selling in-the-money strikes (purple field), using options with lower implied volatility (set goals at 1 – 3% instead of 2 – 4%) and use low beta stocks from our premium reports and ETFs.

How to manage a low VIX:

This is one of the factors that will give us the confidence to take a more bullish stance and sell at-the-money and out-of-the-money strikes (yellow field) with higher beta stocks and higher implied volatility options.

The exit strategies selected in these environments are detailed in my books and DVD Programs.

Discussion

The VIX is a factor that should be considered in our covered call writing decisions. It should neither be feared nor embraced but rather managed using the fundamental, technical and common-sense principles of the BCI methodology.

New covered call writing DVD program now available with early-order $50 discount expiring soon

Our objective was to create the most complete and comprehensive video program on covered call writing found anywhere. The 4-set video curriculum takes us through the 3-required skills: stock selection, option selection, and position management. The 4th section highlights special circumstances like writing calls against long-term buy-and-hold portfolios.

You Will Learn:

– How to locate the greatest performing stocks for option-selling

– Which Is the best option to sell

– How To calculate your returns

– How To utilize exit strategies – Decrease losses & enhance gains

The program is based on 25 years of actual trading options, not on computer models. All the rules and guidelines presented are based on these real-life experiences. This series will benefit both beginners and more experienced investors and addresses all scenarios that can arise before, during and after trade executions.

https://thebluecollarinvestor.com/minimembership/covered-call-writing-package-4-dvd-series-workbook/

Use this promo code for a $50.00 discount off the $149.00 price:

newdvd50

The program also includes a downloadable workbook.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Encyclopedia book review on Amazon.com:

Hello Alan,

Thank you very much for all the knowledge you teach, it really changed my life.

Sincerely,

Garoda

Upcoming events

September 14, 2019: Charlotte Chapter of The American Association for Individual Investors

“Converting Non-Dividend Stocks to Dividend-Like Securities”

Live webinar (link to follow)

Saturday from 10 AM – 12:PM ET

September 27, 2019 at 1:30 PM ET: Philadelphia Money Show

“How to Select the Best Options in Bull and Bear Markets”

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports.

***********************************************************************************************************************

Alan,

Does higher VIX results in wider bid/ask spreads?

Sunny

Hey Sunny,

That’s a good question and I look forward to Alan’s reply. I am pretty sure the bid/ask spread is a function of the liquidity of the underlying security and not volatility.

So an ETF like SPY that trades millions of shares and contracts may have a penny wide spread while lesser traded stocks and ETF’s will have wider spreads regardless of where VIX is.

What VIX will do is change the value of the option itself so we get more premium for the same option at the same strike for the same expiration if the VIX is at 20 then if it were at 15. But the spread will still be a function of how liquid it is and how many shares/contracts are traded. So it is always helpful to follow Alan and Barry’s guidelines on open interest. – Jay

Sunny, Jay,

It looks like you guys don’t need me anymore! Great response Jay.

Alan

Thanks Alan,

We will always need you and Barry. Yet I suspect I speak for many in thanking you guys for helping me stand on my own two feet! – Jay

Jay,

I’m asking this because I have some TLT ITM calls that I roll and my broker states that TLT historical volatility is 8.82%. However now TLT implied volatility is up to 17-18% (52 week highs). 08/23 137 Call bid/ask spread is $1.80 (open int. 220) and 09/27 137 Call bid/ask spread is only $0.35 (open int. 0).

GLD historical volatility is 9.78% and it’s up to 17% now, but most ITM 08/23 calls have spreads of $0.35. So why near term TLT spreads are so wide compared to GLD? TLT is less liquid, but not that much and volatility is about the same.

Sunny

Hey Sunny,

Thank you for that added context. I apologize if I wrote a reply you did not need.

It is clear you and your broker are much better at numbers than I am :)!

My simple brain looks at TLT and GLD – I own both – and asks where do I think they will be a month from now? I say higher. The world is a mess not getting any better. I will over write stocks but not bonds or gold this month.

And I sure as heck am not buying anything now. Cash is King. One man’s opinion. – Jay

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 08/16/19.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The Blue Collar Investor Team

[email protected]

Isn’t it better to sell OTM cash secured puts in such wild and volatile times?

You earn less Premiums but you are “protected” up-to a certain extend from the downside movement of the stock.

Andrey,

Good point. Another way of protect ourselves in bear and volatile markets is to sell out-of-the money puts before entering covered call trades. We can then combine the protection of both OTM puts and ITM calls. This is why mastering both strategies will be an asset to our overall success.

For members not familiar with this strategy, see the PCP (put-call-put) section of my book/DVD program, “Selling Cash-Secured Puts”

Alan

Here I am broadcasting live from the San Francisco Money Show For those of you who watched this live event, I hope you enjoyed it and will benefit from it.

At the airport and heading home.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Hey Andrey,

I really don’t need to have this many posts this early in a new thread but what you ask is very central to me in how I do business in my accounts. And I find it helpful to regard accounts as businesses you run so please pardon me for chiming in.

When I get the least bit fussed with the woman in my life for buying something she inevitably says “But it was on sale”. I should let her do my stock buying. She would never buy over priced stuff everyone else wants. She would wait for when it is marked down :)!

CSP’s are a great way to get paid to wait for an even better buying opportunity. I use them all the time. The primary thought to have in mind is “do I want to own this?” If so, wait for a Chicken Little Day when the sky is falling, markets are tanking, put prices are soaring and sell a few CSP contracts further under it. My favorite on this is QQQ. Rarely hurts to have shares of that lying around. And if exercised start a call writing campaign.

Any stock would do but please make certain it is one you believe in and has good open interest liquidity. – Jay

Hey Jay,

I agree with you 1000%,if not more!

Chicken Little Days are quite a few these days.

And nothing pleases my lonely heart than to own some TOP S&P 500 at a discount price.

Thanks

Andrey

I really do appreciate the quality of the teachings in your book and website. Could you please include me in your mailing list for any upcoming webinars ?

I am especially interested in better understanding the rolling out strategy for covered-calls and rolling down for cash-secured puts.

I also would like to ask a question for which I have not found a direct answer in your books (unless I missed it):

Assuming I have $10k at my disposal, and find a great stock for which both the fundamentals and the technicals show a sideways market trend, instead of buying $10k’s worth of stock and then writing a covered call on it (maybe slightly ITM for downside protection), would you see any advantages in choosing the following method instead:

1/Buy only $5k worth of stock,

2/Write a covered-call on it for a given expiration date,

3/Write a $5k cash-secured OTM put option on the same stock, for the same expiration date.

It seems to me you mention either writing calls or puts on a stock, always sequentially, but never simultaneously on the same stock/same expiration date. I am wondering if there are any advantages with that approach over writing the $10k calls, in your experience.

Thanks again

Cedric

Cedric,

A couple of points:

1. If the $10k is in addition to a larger account, focusing in on 1 stock is acceptable. If it represents an entire option-selling portfolio, I would prefer an exchange-traded fund(s) which would represent a broader diversification.

2. Both covered call writing and put-selling are outstanding cash-generating strategies once the 3-required skills are mastered. We can be successful with both. My personal preference is for ccw in normal to bull markets and put-selling in confirmed bear markets where I combine put-selling with covered call writing (PCP strategy). Each investor must decide on which strategy is best in the current market environment. Using both implies a degree of uncertainty and there’s nothing wrong with that. Most of the time, we should have a stronger opinion as to which should be our go-to strategy given the current market conditions and our personal risk-tolerance.

Alan

Alan,

Recent subscriber. Late to the game, but just read you exit strategies book. Loved it.

My question: In trying to decide whether to roll out or roll out and up, if you are underwater on the specific option (i.e., your purchase basis in the shares is above the strike price), shouldn’t you take credit for the loss avoided in rolling out or out and up? Maybe I missed something, but I did not see any credit for the loss avoided if you get out of an underwater option.

Looking forward to following you and reading more of you

materials.

Charles

Charles,

If the strike is in-the-money at expiration we have maximized our trade results for that contract. It’s a positive.

Now, rolling the option represents a new trade and the analysis of the stock and the calculations will determine if we should move forward with rolling.

We take the net credit for rolling out and divide by the original strike and see if those calculations meet our goals. If yes, it’s time to roll. If no, we either roll out-and-up or allow assignment.

When rolling out-and-up, we take the net option rolling credit or debit, add in increase in share value from removing the original strike and determine if the net percentage gain meets our stated goals.

Note that the original option profit plays no role in these decisions. That is money in the bank and we are deciding to roll the option or allow assignment. Use the “What Now” tab of the Ellman Calculator to generate calculation results.

Alan

I love put-call-put. I’m not sure what’s up with me and the letter “M”, but right now I’m in OTM puts in MA, MCD, and MSFT. These markets are definitely bipolar lately.

Joanna,

I don’t think it’s possible to sell CSP’s on three better “M” stocks than the ones you picked and achieve better diversification?

If you want to press the mojo sell OTM CSP’s on MMM :). Jay

Hi Jay and Joanna,

I agree, and will enter all these M trades before the end of the week, including MMM.

Roni

Alan

Among the tools I use to evaluate strike prices is Probability Analysis, & while it is by no means the only input I use, I do find it most helpful & informative when comparing various available strikes to gain an insight into the chances of success.

However, it appears from some of your past references to such analysis that you don’t find it all that helpful. If my impression is correct, I would find it most interesting to hear your comments on the subject.

Thank you & the BCI team as always for an outstanding job!

Paul

Paul,

This is a question that has more than 1 answer. Probability analysis relates to the probability of a certain event occurring. As it relates to stock options, it usually means the probability of the strike expiring in-the-money. This is the options Delta. If this is the measure you are referencing, we then must determine how much the Delta aligns with our trading goal. Do we really want the option to expire in-the-money? For those using the “portfolio overwriting” strategy, expiring in-the-money is a negative or an annoyance at the very least. In many cases, we can be impressively successful without the option expiring in-the-money.

Over the years, I have received numerous questions asking me for the best Delta to use when selling options. There is no 1 specific Delta… it depends. In bear markets, appropriate Deltas will be high. In bull markets, low.

For those who find probability analysis a useful adjunct, keep using it. For me, I determine the “moneyness” of the option based on overall market assessment, charts technicals and initial time-value return goals and then select the option that generates those goals… in-the-money or out-of-the-money.

That option will have a Delta as do all options but its selection was the result of a well-thought-out plan, not on a single number.

For those who use probability analysis, I like the way you use it… as one of many parameters evaluated.

Alan

Hi Alan,

I’m looking to generate 5-10%/ month on portfolio margin account. Do you have strategies/mentoring in line?

Sanjay

Sanjay,

An annualized return goal of 60% – 120% implies using high-risk investment strategies. At BCI, we favor low-risk, conservative strategies where we lower cost-basis to beat the market on a consistent basis. My baseball analogy: singles and doubles, never grand slam homeruns.

In extremely strong bull markets, I have come close to 50% annualized returns but those are aberrations. Beating the market every single year is not.

Margin accounts will magnify gains but also magnify losses and we also have to factor in interest costs.

Covered call writing and selling cash-secured puts are amazing strategies for conservative investors but may not align with your strategy goals.

Alan

Hi Alan and members,

I bought the 2 encyclopedias for covered call writing and read them very carefully, I love them! I have a question, if you are considering several stocks to buy and write covered calls on as safely as possible, how would you prioritize these 5 metrics: perfect IBD score, low beta, low implied volatility, bullish chart, and large downside protection (say 10% or more). It seems that having all of these at once isn’t possible most of the time, so I’m wondering what is their order of importance in protecting your money, thanks!

Steve,

Given the key words in your question, “as safely as possible”, I would prioritize downside protection and low implied-volatility. We do this by writing in-the-money strikes with an initial time-value return goal in the 1% – 2% range for near-the-money, 1-month expiration strikes.

Alan

Alan,

What do I do with a trade that I have on and that stock comes off the Screen and Watch list? By that I mean I have a trade on in TEAM it is doing OK but I may need to sell another Call next month because the stock is down from where I bought it. It has now come off the watch list. Do I sell the stock and go to another stock on the list or do I play continue to play out the TEAM trade. Then move on.

When do I get rid of trades once they come off the Screen and Watch List?

Thank You for all your help

Jim

Jim,

Once we enter a trade, it is managed as detailed in the exit strategy sections of my books and DVDs, NOT on its removal from our premium stock reports.

If we decide to sell a stock based on our system criteria, a replacement stock is selected from our most recent report. If the stock is held to contract expiration, we decide if it will retained in our portfolio for the next contract month if it still meets our system criteria (fundamental, technical and common-sense screens).

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

BCI’ers,

From time to time, we like to update current online brokerage fees –

Interactive Brokers:

Equity Trades – $2.28

Options Trades – $0.70 per contract

E-Trade:

Equity Trades – $6.95

Options Trades – $6.95 Base + $0.75 per contract

Fidelity:

Equity Trades – $4.95

Options Trades – $4.95 Base + $0.65 per contract

Schwab:

Equity Trades – $4.95

Options Trades – $4.95 Base + $0.65 per contract

TD Ameritrade:

Equity Trades – $6.95

Options Trades – $6.95 Base + $0.75 per contract

Trade Station:

Equity Trades – $5.00

Option Trades – $5.00 Base + $0.50 per contract

One point to note is that you can negotiate the commission rate based on the size of your account or the number of trades that you execute.

Best,

Barry

Barry,

Thank you, this is extremely helpful. Brokers are in a business. They know there are a dozen of them out there, they know their prices and they will work with you on fees. I was originally at Options House which was bought by E-Trade. But I was grandfathered at the $3.95 rate for equity trades of any size. I saw a commercial for Interactive Brokers so I called E-Trade and asked them for lower rates on equity and options trades and higher rates on my cash balance. They worked with me on the spot. So it never hurts to pick up the phone :)! – Jay

Barry,

Thanks for the info.

I really don’t get it with E-trade. I have been with them since the creation. I have constantly told them to list their commissions and fees as $4.95 and $0.50 per options contract. I have had a couple of grandchildren and grandchildren-in-laws recently open accounts and those are the fees and commissions they charge them even though they post $6.95 and $0.75 per option contract.

E-trade really does a good job and they have an excellent trading platform they acquired when they purchased OptionsHouse. It has been renamed Power E-Trade and is excellent. It is absolutely amazing what info you can put on the options chain. Deltas, IVs etc. Right there on the options chain. Probability analysis with one click. Order builds very easy and order placement very easy.

I just don’t understand why they don’t publish more competitive rates.

I think they all are getting ready to really drop commissions and fees. It’s coming for sure.

Thanks for all you do.

Hoyt

Alan,

I have played with your decision model and used the “What Now” tab (roll out or roll out & up or allow assignment) at length. I had developed a similar decision spreadsheet model, and I like that you take into consideration more than just the new premium minus the BTC premium in making the decision.

What I do not find is any consideration of the fact that if the original c/c is at a s.p. that results in a loss (vs. the cost of the shares that will be assigned) you are “avoiding” a loss if you roll out or roll out & up. In my mind that is money in your pocket that would not be there if there is assignment, and that should be included in the decision model. I think your “bought up” credit in the roll-up is similar.

I’m still struggling with using the SP as the basis (vs. what I actually paid for the shares involved), and that too may be involved.

Thanks,

Charles

Charles,

When we roll-out an ITM strike, we do not capture any share value above the initial strike. When we roll out-and-up, we capture share appreciation to the lower of current market value or the next-month strike. When we do capture additional share value when rolling out-and-up, we pay for it in the form of intrinsic value when we buy-to-close the near-month option.

The reason we use the strike as the cost-basis in these calculations is because that is what our shares are worth at that point in time… when we are deciding to either roll the option or allow assignment. It allows us to compare “apples-to-apples” when making these decisions.

Alan

Alan,

I always had this question in my mind. What is the economic value added by a covered call writer?

I can think of only one answer:

Covered call writers provide liquidity in the secondary market, thereby enabling the efficient use of capital.

Apart from this, I cannot think of any other.

What do you think is the value added by us, the covered call writers?

Sagar

Sagar,

Interesting question. Where do I begin?

We buy and sell stock. We buy and sell options. This creates a need for market-makers, for the Options Clearing Corporation employees, for brokerages and all associated workers needed to support these markets.

Covered call writing specifically enhances our overall economy by giving retail investors opportunities to build capital and spend money that otherwise wouldn’t have been available. It is not a zero-sum plan because we are in 2 positions, long stock and short call. It also allows us to build a nest egg for retirement which benefits the entire economy.

So, job-creation, wealth-building are my initial thoughts. I’ll bet seasoned economists can add more clarity and perhaps different perspectives.

Alan

Sagar,

What a fascinating question! I’m not a seasoned economist but I agree with Alan: whenever money changes hands jobs are created and that always helps.

I perhaps view it too selfishly. I feel like when I sell options I am helping my economy. Yet if that has spin off value elsewhere I am fine with that also. As the late great comedian Rodney Dangerfield joked “Look out for #1 but don’t step in #2” :)! – Jay

Alan,

What is your opinion about selling an ITM covered call for below the price of the underlining stock? e.g GE is $8.18

9/20 $8.00 is .52

9/20 $9.00 is .13

Thank you.

Bill

Bill,

I love ITM strikes in bear and volatile markets. I favor OTM strikes in normal to bull market conditions. Using the “Multiple Tab” of the Ellman Calculator we can clearly see the advantages of each (see screenshot below).

For the $8 ITM strike we generate a 1-month initial time-value return of 4.3% with 2.2% downside protection of that time-value profit (different from breakeven).

The OTM $9 strike generates a 1-month initial time-value profit of 1.6% with the possibility of an additional 10% of upside share appreciation potential.

The calculator shows clearly the pros and cons of each strike.

Congratulations on giving consideration to ITM strikes.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Alan,

I was checking the put options side of an option chain for a European market index, and I was surprised to see what looks like an anomaly in one of the ask price (circled in the print screen below), as you’ll see, the expected value for that particular strike price seems way higher that it should be,

It is the first time I see anything like it, how should I interpret that information ? Have you already come across such anomalies in the past and how does that influence your decision making process ?

Thank you.

Cedric

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Cedric,

This is a perfect example why we should avoid options with low liquidity (open interest).The wide bid-ask spreads result in poor price executions for our trades. I would move on to a different underlying that has associated options with more reasonable liquidity.

Alan