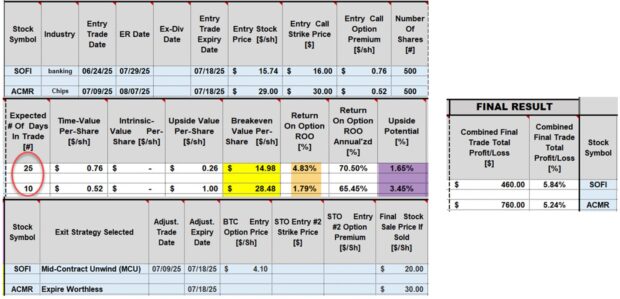

It is not uncommon to attain greater than maximum returns when implementing our covered call writing exit strategies. In this article, a series of trades will be analyzed where the mid-contract unwind (MCU) exit strategy was employed to perfection. The stocks used in this 25-day series of trades were SoFi Technologies, Inc. (Nasdaq: SOFI) and ACM Research Inc. (Nasdaq: ACMR).

What is the mid-contract unwind exit strategy for covered call writing?

Both legs of the trade are closed and the cash generated from the sale of the shares is used to craft a second covered call trade during the same expiration cycle with a different underlying security. This means, we are creating a second income stream. When share price rises exponentially, we have maximized our initial trade returns and now can create yet another cash flow.

Real-life trades with SOFI & ACMR shared by Jim

- 6/24/2025: Buy 500 x SOFI at $15.74

- 6/24/2025: STO 5 x 7/18/2025 $16.00 calls at $0.76

- 7/9/2025: BTC 5 x 7/18/2025 $16.00 calls at $4.10 (as SOFI shares move up to $20.00)

- 7/9/2025: Sell 500 x SOFI at $20.00 (this closes the initial trade)

- 7/9/2025: Buy 500 x ACMR at $29.00

- 7/9/2025: STO 5 x 7/18/2025 $30.00 calls at $0.52

- 7/18/2025: 500 shares of ACMR sold at $30.00 by “allowing” exercise of a slightly ITM call strike

Calculating all trades, start-to-finish, Using the BCI Trade Management Calculator (TMC)

- Per-share gain on SOFI = $4.26 ($20.00 – $15.74)

- Per-share loss on SOFI options = $3.34 ($4.10 – $0.76)

- Per-share gain on ACMR shares = $1.00 ($30.00 – $29.00)

- Per-share gain on ACMR options = $0.52

- Realized cash profit on SOFI trades = $460.00

- Realized cash profit on ACMR trades = $760.00

- Combined 25-day realized cash profit = $1220.00

- Cost-basis = maximum investment = $14,500.00 (cost of ACMR shares)

- Final 25-day realized return = 8.4% ($1220.00/$14,500.00)

Discussion

After entering our covered call trades, we immediately prepare for potential exit strategy opportunities. In these trades with SOFI & ACMR, Jim did just that and converted a 6.48% maximum return to a final 8.40% realized return. Nice going, Jim.

Alan Ellman’s Complete Encyclopedia for Covered Call Writing- Classic Edition

This contains all the basic and advanced material you need to know to truly master covered call writing. It also addresses the questions you have sent to me over the years on subjects peripherally related to covered call writing like the use of cash-secured puts, for example.

- Over 500 pages packed with solid information, no useless filler material

- 151 charts and graphs most of which are in color for better visualization

- Chapter outlines to summarize the material located in each chapter

Click here for more information.

Free training resources

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to publish several of these testimonials in our blog articles. We will never use a last name unless given permission:

1. BCI Educational Webinar #9

Thursday January 15, 2026

8 PM ET – 9:30 PM ET

Watch an intro video overview of the webinar.

Topic:

Using Conservative Stock Options to Create a 3rd Income Stream in Stock Portfolios

Renting your stocks on a short-term basis

You have owned shares of stock in your non-sheltered accounts for many years. Share value has been appreciated significantly over time. This has put a smile on your face. Many of these securities have also generated dividend income. This, too, has pleased you. However, there is a 3rd income stream that you can activate right now, leveraging these same stocks, using a strategy known as covered call writing.

This is a low-risk option selling strategy analogous to generating rental income with a real estate investment property. Yes, renting out your stocks for limited periods. We have 2 goals: generate a 3rd income stream + retain the underlying shares to avoid negative capital gains issues.

This presentation will analyze how to implement this form of covered call writing, known as Portfolio Overwriting, always with capital preservation in mind.

Reserve a seat and register now by clicking here.

2. Long Island Stock Investors Meetup Group: Part I

Thursday February 12, 2026

7:30 PM ET – 9:00 PM ET

Topic, description and registration information to follow.

3. Las Vegas Money Show- 2 presentations

February 23 – 25, 2026

The Collar Strategy: Covered Call Writing with Protective Puts

Protecting covered call trades from catastrophic share loss

This is the strategy Bernie Madoff pretended to use. He called it the split strike conversion strategy, but it was simply a collar. The covered call sets a ceiling on the trade and the protective put guarantees a floor on the trade

Topics discussed

- What is the collar strategy?

- Uses for the collar

- Entering a collar trade

- Option basics for calls

- Option basics for puts

- Real-life example with NVDA

- What is an option-chain?

- Real-life example using the BCI Trade Management Calculator (TMC)

- Strategy pros & cons

- Educational products & discount coupon

- Q&A

Selling Cash-Secured Puts to Buy a Stock at a Discount or to Enter a Covered Call Trade

2 outcomes & 4 applications

Selling cash-secured puts is a low-risk option-selling strategy which generates weekly or monthly cash-flow. This presentation will detail how to craft the strategy to generate cash flow, buy a stock at a discounted price or to initiate a covered call trade. Topics included in the webinar include:

- Option basics

- The 3-required skills

- 4-practical applications

- Traditional put-selling

- PCP (Put-Call-Put or wheel) Strategy

- Buy a stock at a discount instead of setting a limit order

Real-life examples along with rules, guidelines and calculations are included in this presentation.

Time, date & registration link to follow.

4. Long Island Stock Investors Meetup Group: Part II

Thursday March12, 2026

7:30 PM ET – 9:00 PM ET

Topic, description and registration information to follow.

5. Hollywood Florida Money Show

The Put-Call-Put (PCP) or Wheel Strategy

Using Both Covered Call Writing and Put-Selling to Generate Monthly Cash Flow

Selling stock options is a proven way to lower our cost-basis and beat the market on a consistent basis. Two such low-risk strategies are covered call writing and selling cash-secured puts. This presentation will detail how to incorporate both strategies into one multi-tiered option-selling strategy where we either generate cash-flow or buy a stock at a discount. I refer to this as the Put-Call-Put (PCP) Strategy, also referred to as the wheel strategy.

The basics and pros and cons of low-risk option-selling strategies will be discussed as well as an analysis of a real-life example and introduction into the BCI Trade Management Calculator (TMC). This seminar is appropriate for those who look to generate modest, but consistent, returns which will enable us to potentially beat the market on a consistent basis while focusing on capital preservation.

More details to follow.

Hi Alan,

I’ve purchased several of your courses and have immensely enjoyed the material.

In your content, you mention that you aim for a portfolio of 20–30 stocks as a manageable range. I currently manage seven family accounts (including Joint, IRA, Roth, and HSA) with balances ranging from $22,500 to $575,000, totaling approximately $1M.

My question is: if you were in my position, would you maintain 20–30 stocks within each account, or would you spread those 20–30 holdings across the entire seven-account portfolio?

Additionally, does your strategy change when considering tax-advantaged vs. taxable accounts? For instance, would you prioritize certain types of stocks for the Roth or IRAs while keeping the overall 20–30 stock limit in mind for the total $1M?

Best wishes and Happy New Year!

Russell

Russell,

The # of positions that are “manageable” will vary from investor-to-investor.

For me, it’s between 125 – 150 contracts per month involving 25 – 35 positions (+ a few in my mother’s account).

We should avoid over-burdening ourselves by attempting to direct more positions that aligns with our comfort level. The greater the # of stocks & ETFs, the better the diversification. So, find your comfort level and stay within those boundaries.

The type of securities we select are only elite performers no matter the type of account. These are the stocks & ETFs we provide to our premium members.

It is also important to craft our trades based on our strategy goals (2% – 4%/month for me) and personal risk-tolerance.

I wish you a happy, healthy and lucrative 2026.

Alan

Premium Members,

This week’s Weekly Stock Screen and Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 12/26/25.

Be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them on The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

https://www.youtube.com/user/BlueCollarInvestor

Barry and The Blue Collar Investor Team

Premium members:

This week’s 4-page report of top-performing ETFs, along with our sample trade of the week, has been uploaded to your premium site. The Select Sector SPDR section is now crafted to align with our streamlined (CEO) approach to covered call writing. The report also lists Top-performing ETFs with Weekly options, mid-week market tone as well as the implied volatility of all eligible candidates.

We have also included a sample trade taken from one of our BCI watchlists.

Premium member video link:

https://youtu.be/EXMO-KwZuJs

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team