Option returns play a major role in our covered call writing and put-selling strategies. Mega-returns can be quite enticing but also very dangerous. Recently, with market volatility rising exponentially in response to global-economic concerns, a few of our members have inquired about using volatility options ($VIX) based on the S&P 500 volatility as a means of enhancing portfolio returns. The reason these securities caught the eye of our members is the generous potential returns as shown in the screenshot below (before the current spike in volatility) which represents a 16-trading day return:

VIX options chain: 2-26-15

The VIX or CBOE Volatility Index, also known as the investor fear gauge, measures the market’s expectation of 30-day volatility based on option pricing. It is a measure of market risk.

The 3-week return appears to be $230.00/1389.00 = 16.6%. In addition to this incredible opportunity (maybe not), the VIX was quite low in February, 2015 and reasonable expectations of a spike up soon was on the table. So goes the attraction and the thinking. Like most incredible opportunities, if it seems too good to be true, it usually is.

VIX options are a completely different type of security from the typical equity options we trade. The recent volatility related to issues in Greece, Russia, Japan and China is a red flag as to the risk we are taking when predicting market assessment of future volatility. That doesn’t even factor in the Fed watch for a future rate hike in short-term interest rates. We would have to master a whole new set of parameters before it would make sense to consider using VIX options although I do see a potential use for them by retail investors which I will discuss later in this article. First, let’s explore the unique qualities of VIX options compared to standard equity options:

Comparison of VIX options to standard equity options

- There is no underlying security to buy because it is based on futures contracts for an index. Therefore, covered call writing is eliminated

- Since the options are based on VIX futures contracts, it may not track the actual VIX accurately. A large spike or drop in the VIX will not be adequately represented by these options

- You must trade VIX options in a margin account and therefore cannot be used in a self-directed IRA account

- These are European style options compared to the American style options we are used to. This means that they cannot be exercised until expiration Friday

- A higher level of trading approval is required than for covered call writing

- Obtaining information on the Greeks is difficult because these options are based on futures and not the actual index. Many brokerages have inaccurate Greek stats on these securities

- These options expire on a Wednesday, not a Friday as we are used to

- Huge returns always mean huge risk. There are no free lunches out there

Discussion

Since we cannot use these options for covered call writing and the parameters are so different than equity options, the use of this strategy in our options portfolio should be reserved for more sophisticated investors who have studied and practiced the nuances and differences of VIX options compared to equity options. Also, one’s personal risk tolerance should align with the high-return/high-risk profile of VIX options.

Possible use of VIX options by retail investors

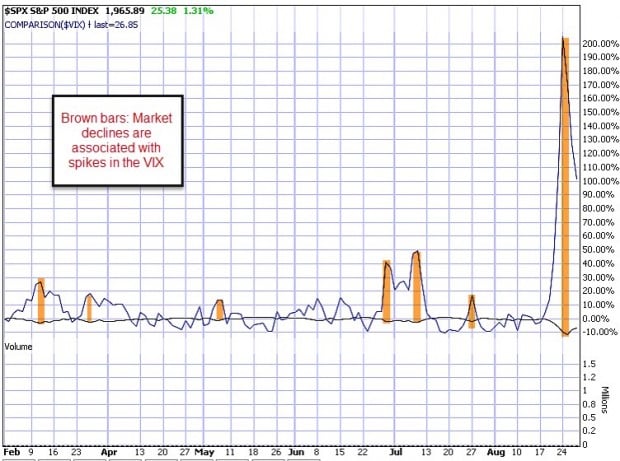

This is just a thought, not necessarily a recommendation: Since the VIX historically is inversely related to the S&P 500 (market goes up, VIX goes down and vice versa), buying deep out-of-the-money VIX call options can serve as a hedge for a portfolio in much the same way buying puts can protect a downturn in our portfolios. The chart below shows the inverse relationship between the VIX and the S&P 500 as of 8/27/2015:

Inverse relationship between the VIX and the S&P 500

DISCOUNT PROMO CODES for early-ordering the Complete Encyclopedia for Covered Call Writing- Volume 2

I am pleased to announce that we are accepting early-ordering for Volume 2 of the “Complete Encyclopedia for Covered Call Writing” I have approved final editing and the book is being printed as I type. Below are the discount promo codes to be used for $10 (through September 4th) and $5 (September 5th through the 11th) discounts. Only soft-cover versions are available at this time. Hard-cover and kindle versions will be available in the fall. Shipping will begin the second week of September based on when the order was placed. Here is the link to the information page:

Promo codes:

volumetwo10: $10 discount now through September 4th

volumetwo5: $5 discount from September 5th through September 12th

***Shipping to begin the 2nd week in September

UPDATE 1: Our initial order with the publisher has been sold out. We have placed a rush order with the publisher for more books. Orders placed after 8/29/2015 may not be shipped until the third week in September.

UPDATE 2: Many of our members have placed orders for additional books and DVDs. Those items will be shipped immediately and the new book will be shipped separately once we receive them.

WINvesting webinar registration

http://winvesting.com/marketfest/registration/

Market tone

Market volatility elevated dramatically early this week as fears about China’s economic downturn intensified. Asian markets were hit the hardest. The VIX (CBOE Volatility Index), which measures US stock market volatility, hit 53 on Monday, then dropped back below 27 on Friday. This week’s reports:

- Second-quarter GDP was revised up to 3.7% from an initial estimate of 2.3%, mainly due to increased consumer spending, business investment and exports

- Bolstering of labor and housing markets and inexpensive gasoline boosted consumer spending

- Non-defense capital goods orders excluding aircraft rose 2.2% in July. This was the largest monthly increase in more than a year and a key gauge of US business investment plans

- Total durable goods orders rose 2.0% in July

- US new home sales rose 5.4% in July to a seasonally adjusted annual rate of 507,000 units. Sales were 25.8% above last July

- The S&P/Case Shiller composite index of 20 metropolitan areas increased 5.0% in June from a year earlier

- The Pending Home Sales Index increased 0.5% to 110.9, suggesting further housing market expansion

- US consumer spending rose 0.3% in July. Spending on durable goods rose 1.1%, with automobile purchases driving half of the increase

- The personal consumption expenditures (PCE) measure of inflation rose 0.1% for the month, 0.3% for the year

- The Conference Board’s gauge of consumer confidence rose from 91.0 in July to 101.5 in August, the highest reading since January

- However, the University of Michigan’s consumer sentiment reading fell from 93.1 in July to 91.9 in August, reflecting the impact of increased financial volatility

- Initial jobless claims rose 6,000 to 271,000 for the week ending August 22nd

- Continuing claims climbed 13,000 to 2.27 million for the week ending August 15th

For the week, the S&P 500 rose 0.91% for a year to date return of (-) 3.40%.

Summary

IBD: Market in correction

GMI: 0/6- Sell signal since market close of August 20, 2015

BCI: This site remains bullish on the US economy but concerned about market over-reaction (my opinion) t0 global-economic events and the enhanced market v0latility. At this time, I am retaining all shares currently in my portfolios but not purchasing new ones or writing calls until the late week rebound appears sustainable.

Wishing you the best in investing,

Alan ([email protected])

Vix options are not for me.

There is plenty risk in the covered call method.

Last week was a sample of how ugly it can get.

I left a lot of skin on the fence (as we say here in Brazil).

I managed to go 30% into cash, and will try to get more next week.

Thanks for the market insight Alan.

Good luck everybody – Roni

Alan,

Thanks for your always timely blog article.

I echo your every caution and can only add to your wise advice by saying VIX options and the related (but not equivalent) VIX retail products like VXX, UVXY, XIV, SVXY, etc. are dangerous and can burn even the most informed of investors.

I left a post on our last blog about using SVXY I now regret. The ensuing VIX spike was so significant it put the futures curve into the uncommon condition of backwardation. I was out of that trade quickly. Until it returns to a contango condition SVXY will not behave as followers of the fund became accustomed to during a consistently rising market and a VIX futures curve in ongoing contango.

I hope that last paragraph made absolutely no sense to some friends here tempted to trade VIX futures instruments. I wrote it to make a follow up point: unless you have done enough study to explain these “investments” – they are really trades – stay away from them.

Please stick with Alan’s tried and true methods of selecting the best stocks in the best industries and begin your income journey with cash secured puts to be turned into covered calls should you gain ownership.

Even those conservative income strategies are over the heads of most investors and set us apart. All the best, – Jay

AMEN Jay. 🙂

A good fisherman makes sure certain lures are in his tackle box in anticipation and reasonable expectation certain fish will be running and thus he will be prepared for his next outing.

The time to own underlying shares the likes of UVXY, VXX, or the opposites such as SVXY is when they are completely out of favor either in overbought markets regarding the former or oversold regarding the later. Purchased in MODERATE amounts to experiment, in the foregoing stipulated market conditions, they can provide very lucrative opportunities in a volatile market. The best was to participate is by selling covered calls via weekly options.This is by far the less risky way to trade in volatile markets. Letting the profits run is neither a viable nor recommended strategy. When the hook is set you gotta reel em in.

Sounds good A.P.

Thanks – Roni

Hi Alan,

With volatility high I wonder why you made the following comment:

“At this time, I am retaining all shares currently in my portfolios but not purchasing new ones or writing calls until the late week rebound appears sustainable.”

Why are you not writing calls until the rebound appears sustainable?

With volatility high why not sell calls on the stocks you are holding? If the rebound holds, won’t volatility revert at least some and prices for the calls come in?

Since you are holding your stocks, if the rebound is not sustainable, you’ll reduce your cost basis and enhance your returns if you sell calls now. If your concern is high that the rebound won’t hold, why not sell closer to the money, or even in the money, calls for further reduction?

Thanks, Janice

Hi Janice,

Excellent question. I can tell you’ve done your homework. I view SHORT-TERM highly volatile market conditions as unfavorable for covered call writing. The perfect analogy is why I will not write calls prior to an earnings report. If we did, we would be capping the upside but not the downside when the price change is likely to move to a greater degree in either direction. The big question then is whether to sell the securities or not. My view is for a recovery which I do not want to miss out on. The talking heads are split on this issue. Some are heading for the hills, others are staying invested or even adding positions as prices became discounted. We each must trade within our personal risk tolerance levels.

Alan

That was really an excellent question and terrific reply.

I was just about to write ATM or near the money calls on my LCI and AFSI securities tomorrow, to mitigate my losses from the correction.

After reading these posts, I’ve changed my mind, and will wait and see if the rebound is sustainable, before taking action.

Thanks – Roni

Premium Members:

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 08/28/15.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and the BCI Team

Love to know your thoughts on dividing a covered call by selling half ITM (rather deep) and other half OTM by an equal or lesser amount percentage. Example: own SPY 1,000 shares at %95.00. Sell 90 and 97 strikes 5 contracts each at same time time of day and same expiration month. Maybe a weekly strategy? Method seems to give investor best of both covered call selling?

Regards,

Lance

Lance,

This is a reasonable approach to selling calls or puts especially when our market outlook is mixed. I have written about this in the past and referred to it as “laddering strikes”

Excellent point.

Alan

Alan – I love this strategy. Can you please do a video on it or let me know where you wrote about it so I can learn some more?

Thanks for all you do.

Joe,

Good idea. I’ve added a note to my “to-do” list (pretty long) and will either write an article or produce an Ask Alan video on this topic. Thanks for the suggestion.

Alan

Alan,

I am learning much from you. I am an old USAF officer.

Do you feel that USAA trading service and platform is still acceptable for writing covered calls?

Thanks,

Ken

Hi Ken,

Like yourself, I was an officer in the military and started using USAA products and services decades ago. I’ve remained loyal to USAA Brokerage. It is very good with reasonable commissions and great phone support if you run into a problem with their platform. That said, their are brokerages with lower fees and better research platforms.

Alan

Dear Ken and Alan,

I too am a former officer and every insurance need I have I cover with USAA. They are the best in the business!

I joked with Alan off line when I retired: I felt like a traitor going with Options House which has since merged with Trade Monster and gotten even better instead of USAA brokerage.

Please do the requisite homework for what works best for you….it’s a jungle out there 🙂 – Jay

You are correct in warning people about VIX options as being an entirely different kind of thing. And I agree that sparingly buying out-of-the-money VIX options (when times are good) can be like an insurance premium for a portfolio, especially if the investor likes to write covered calls. But one peculiar thing about VIX is that the upward spikes tend to be very short lived. And at such a time when VIX is spiking (still going sharply up), I think buying out-of-the-money VIX options is a bit too late and one may easily have losses that way (when it is more likely a time to sell the “insurance” VIX options bought at a cheaper price … especially if the covered call positions were closed or are being closed to prevent further losses on that side of the portfolio).

About a month ago, during a VIX-Spike panic, I thought it might be a good time to speculate and instead buy an in-the-money put option on the VIX (I didn’t buy very many) and only a few days later as the VIX dropped I sold the in-the-money put option at some profit (only hundreds of dollars). So I figure that in a big panic (such as last week) buying in-the-money VIX puts (dated out a month or two or three) might be a good strategy. Even if there was a great setback, the VIX tends to be spikey and the downside of the spike follows fairly soon afterwards (although normalcy can be delayed by months).

However, last week I didn’t do a thing since I thought too late to sell and I didn’t understand really why a strong dollar or China having problems was really going to greatly negatively impact my portfolio. The activity reminded me of 1987 when I visited my broker in his office (during the major market crisis). When he pressed the enter key of his terminal all the prices displayed significantly changed up or down and it was just not the time to do anything on that day. I sat through it then and things ultimately did get better. If the US dollar gets stronger, I figure USA based companies are merely in a better situation to be able to buy foreign companies or foreign assets at a cheaper price. Of course selling products (exporting) hurts as our products seem more expensive to foreign buyers. But I figure it can balance out when our imports are cheaper and companies can potentially buy foreign assets (capital investments on balance sheet) as well as buy foreign materials (imported cost-of-goods sold ingredients to lower expense side of income statement).

Lastly, if China did have trouble so many say we aren’t really linked that much to their market (equity markets). But we are substantially linked to their market (bonds, most notably their holdings in US Treasuries). If China sells US Bonds (as I think they have begun to do so to support their equity market prices) this may potentially actually have more of an impact on our interest rates than “the Fed”. And it may well be a reason why the Fed will have to raise rates this time (to make it look like the Fed raised the rates when in fact it might be that China did it and the Fed had almost no control). If China sells enough bonds it will decrease the price of bonds (the old law of supply and demand) and thereby automatically interest rates rise – and this would not be the result of inflation.

After September 3rd, I think the Chinese government may slow down their support of their equity markets.

John

Wednesday’s WINvesting webinar registration:

http://winvesting.com/marketfest/registration/

I am an invited speaker…not a BCI event.

Premium Members,

The Weekly Report has been revised and uploaded to the Premium Member website. The data has been updated using the the latest StockScouter report dated 08/31/15. We received the data this afternoon.

Please look for the report dated 08/28/15_RevA.

Best,

Barry and the BCI Team

Alan,

On page 219 of your Selling Cash Secured Puts you talk about the possibility of gaping down on a stock.

Let’s say I have a weekly option due to expire this Friday and I sold cash secured put at a strike price of $90 for a stock currently valued at $95 today.

I’m fairly confident the price of 95 will hold through to Friday. Now, let’s say the price tanks tomorrow for instance and drops to $85, going past my $90 strike price.

Will the trade be initiated and I get the stock that day or the next for $90 or will I have to wait till Friday?

Thanks,

Dave

Dave,

A couple of points to consider as each trade must be evaluated on its own merit:

1- Since we are dealing with American Style options, we must be prepared for early exercise even if it makes no financial sense for the option holder to do so.

2- If there is a time value component remaining on the option, the holder is better off selling the option rather than early exercise which would capture intrinsic value only. For example, if the premium in the example you discussed is $5.75, exercise would result in an unrealized credit of $5.00 for the option holder, leaving $0.75 on the table from the buyers perspective.

3- As the strike moves deeper in-the-money, the time value component of the premium moves towards zero (called trading @ parity). This increases the likelihood of early exercise.

4- If a put-holder wants to “get rid of his shares” he may forego time value to make it happen ASAP.

5- Page 219 refers to a rare situation of an unexpected gap-down. Is it corporation-specific or related to overall market decline? Check the news (www.finviz.com). We may not know if an exercise notice randomly ended up in our account until the next day. Buying back the option on a stock declining in price precipitously may be the prudent action to take. Again, this is a rare scenario.

Alan

Alan:

I recall seeing somewhere a suggestion to avoid selling calls whenever the current price is below the 50 day simple moving average (50SMA) price. Ever heard of that & if so, do you agree?

Thanks,

Paul

Paul,

Indirectly, I do because a stock trading under its 50-d SMA would never pass out technical screens as an eligible option-selling candidate.

For short-term option selling, I prefer the 20-d and 100-d EMAs (exponential as opposed to simple moving averages).

Alan

Premium Members:

This week’s 6-page (5-page this week) report of top-performing ETFs has been uploaded to your premium site. Look for the report dated 9-2-15. Aside from the four inverse ETFs, there were only four BCI eligible securities that were in positive territory over the past 3 months and four more that broke even. I am currently holding the securities that were in my portfolio when all this volatility started but not writing calls until the market unrest subsides.

________________

TO ALL MEMBERS

________________

The $10 promo discount on the early order of my new book, Vol #2 of “The Complete Encyclopedia for Covered Call Writing” ends in 2 days! And, today we’ve opened up the savings to our social media following, platform-wide. With a limited number of 1st editions available in print, we encourage you to order now using promo code volumetwo10 before they’re all spoken for.

https://www.thebluecollarinvestor.com/alan-ellmans-complete-encyclopedia-for-covered-call-writing-volume-2/

On Sat morning we’ll be closing out our $10 promo discount but you can still get $5 off using the promo code volumetwo5 from September 5th through the 12th..

An adjunct to the original Encyclopedia, Volume 2 is rich with new and enhanced information on low-risk wealth-building strategies for average investors, utilizing stocks and options to create monthly cash flow. No useless filler material here.

I have approved final editing and the book is being printed at this very moment.

Once again, here is the link to the information page:

https://www.thebluecollarinvestor.com/alan-ellmans-complete-encyclopedia-for-covered-call-writing-volume-2/

Promo codes:

volumetwo10: For a $10 discount – now through 9/4

volumetwo5: For a $5 discount – 9/5 through 9/12

***Shipping to begin the 2nd week in September

Alan and the BCI team

Alan, I have been watching your 8 part video on YouTube, twice so far. Am learning. But I’m confused a bit. When I write the call option to sell, What am I hoping “the stock price” will do? Go up a little? Remain the same? Go up a lot?

Hi Ken,

Good question. Any of the above will suffice. What we don’t want is for the underlying stock to decline significantly. That’s why we have an arsenal of exit strategies available if the trade turns against us.

As long as the stock value does not decline more than the premium generated from the option sale, we make money. Best case scenario is when we sell an out-of-the-money strike and the share price moves up to (or even beyond) the strike price.

Alan

On 7/17/15 I bought 100 shares of OUTR for $84.00 and sold an $85.00 call option for $3.70. I bought the option back for .10 during the month. My net cost was $80.40.

On expiration day OUTR was worth $61.39 for a loss of $19.00 or 24%.

Was there something that I could have done to stop the bleeding?

Kenneth

Hi Kenneth,

Whenever I make a mistake, I view it as an opportunity to learn from it which will make me money in the long run. One of the most important BCI rules is never to sell an option prior to an earnings report. In this case, you sold the August call with an earnings report due out 7/30/2015. Have a look at the chart below and the price decline after a disappointing ER.

Lesson learned! (happened to me many times before I figured this out many years ago).

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Alan,

In your recent explanation of Short Interest for options . Can you please let me know where I can find that metric?

Thanks.

Arch

Arch,

To get short interest:

http://finance.yahoo.com/

Quote-enter ticker-Go

Company (left side)

Key statistics (left side)

Short interest stats on right side of page

Alan

Hello Mr. Alan,

I’m trying to determine the market tone and I am not sure what to do.

What method do you use Alan?

Investors.com tells me on March 21, 2016 “Market Trend” Confirmed Uptrend.

How do I determine (and/or) confirm for myself as a retail investor?

In your glossary, I read this:

Market Tone

The feeling of a market (general psychology) as demonstrated by the price activity of stocks. We use the VIX and S&P 500 chart patterns to help assess this sentiment.

Could you kindly point me to an article on your web site that will help me learn to use the VIX and S&P 500 chart patterns, or is there more to it for me?

Thank you sir.

Guyina,

Type in “VIX” into the Google search tool at the top of our web pages and you will access several free articles I wrote on this topic.

Thanks for your interest in the BCI methodology.

Alan