Covered call writing and put-selling involve the buying and selling of stocks and options. When executed in non-sheltered accounts, taxable events are created. Since the BCI community is populated with savvy investors, the topic of wash sales has come up frequently and some have used the term wash trading interchangeably with wash sales. This article will discuss the differences between the two terms.

Wash Sale

A wash sale loss is not deductible. A wash sale occurs when you sell a stock for a loss and, within 30 days before or after the trade, buy back the same stock or substantially the same stock (like an option). Stocks of one company are not considered substantially identical to those of another. For example, if you sell a stock for $35 for a loss. And then buy a $35 call option, you have a wash sale and cannot deduct the loss on the stock. In essence, the tax code considers the loss transaction and the purchase of the replacement security a “wash” so there aren’t any deductible tax benefits to offset capital gains. Wash sales apply only to losses.

Wash sales also apply to options that are substantially identical.

Wash sales are not negated if you sell a stock in one account and buy it back in another or even in the account of your spouse. A tax loss is also disallowed if the stock was sold in a sheltered account and re-purchased in a non-sheltered account and vice-versa. The IRS has all bases covered!

What happens to the loss? All is not lost

The loss gets added to the basis of the replacement security so that when you sell, that disallowed loss either reduces the gain or enhances the loss. Also, the holding period of the wash sale is added to the holding period of the replacement security which increases the chances of qualifying for more favorable long-term tax rates.

Example when there is an equal amount of shares sold and re-purchased:

- 3/1/2-15: Buy 100 x BCI @ $3000.00

- 7/1/2015: Sell 100 x BCI @ $2000.00 for a loss of $1000.00

- 7/10/2015: Buy 100 x BCI @ $2200.00

In this example, the $1000.00 loss is disallowed but added to the cost basis of the replacement shares which becomes $3200.00 ($2200.00 + $1000.00). The holding period of the disallowed loss (3/2/2015 – 7/1/2015) is added to that of the replacement shares. Had the purchase of the replacement shares taken place after the 30-day period, there would be no wash sale and the tax loss would be permitted.

***Wash sales apply to all investment accounts you own including those of your spouse.

Wash Trade

Wash trading is an illegal process of repeatedly buying shares of stock from one broker and selling similar shares through a different broker. This leaves the impression of high volume activity despite the fact that the shares remained with the same owners. The purpose of doing this is to motivate other investors to buy shares of a stock that appears to be of great interest to the market. In essence, this is a form of price manipulation that US regulators are investigating especially as it relates to high-frequency traders.

Conclusion

The terms wash sale and wash trade are similar but have completely different connotations. The former relates to tax issues which impact retail investors and the latter to illegal price manipulation. Wash trading is one of the scams that should motivate retail investors to be extremely careful when it comes to buying and selling penny stocks.

This email from Kevin brought tears to my eyes

Alan,

It was great to finally meet you at the Charlotte, NC AAII meeting. You did a great job, I hope your message got through.

In your presentation you mentioned writing calls for your Mom. I would like to share with you a personal story regarding covered calls and my Mom. In 1991, I suggested to my mother that she needed Long Term Care Insurance. Her response was that it was too expensive. I decided she needed it and that I would pay for it. I cooked up a lame excuse that she would be covered as extended family with my company. The premium was $ 2,500/Yr. Each quarter I wrote CCs to cover the quarterly premium and I did this from 1991 until 2012. In 2012, mom had a stroke. I found the best LTC facility for her. The monthly charge to be in the facility was $4500/month. Her LTC policy covered $3,000/month. So once again I wrote CCs calls to make up the difference. Mom died one year from the date of her stroke, but I had the peace of mind knowing that she lived her final year with the best of care and with dignity and respect, because money was not an issue because of covered calls.

I am sure you have heard similar type stories, but I wanted to share mine with you, since you have been doing this for your mom as well.

Thanks for all that you do,

Kevin

Ask Alan videos and website enhancement

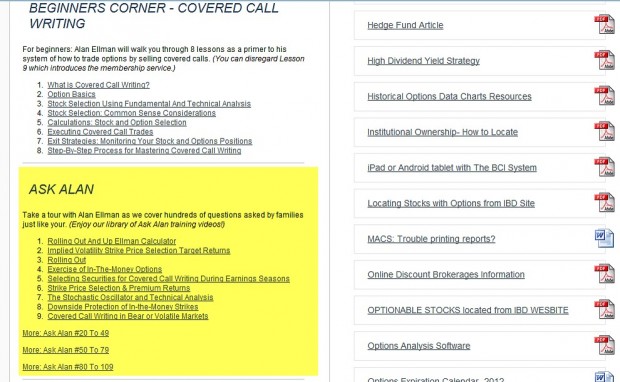

In the next few months we will be enhancing our website to accommodate all the new articles and videos we’ve added since our last upgrade. In preparation for this and several exciting new investment tools we are working on, we have made the Ask Alan videos available in two locations:

General site

10 selected videos are accessed by clicking on the link on the top black bar of our web pages:

Premium site

The entire library of over 100 Ask Alan videos are located in the premium site by scrolling down on the left side:

Ask Alan video library on Premium Site

Next live seminars:

Tuesday April 21st

7 PM – 9:30 PM

***Brand new seminar on selling cash-secured puts.

2- Denver, Colorado

Monday May 18th…click for details.

7 Pm – 9 PM

Market tone

The increasing chance of a Greek debt default negatively impacted the markets on Friday. Also, weakening Chinese economic growth increased the possibility of additional central bank stimulus. Thus far corporate earnings have been mixed, a bit better than I anticipated. This week’s reports:

- Standard & Poor’s Ratings Services cut the credit rating for Greece to CCC+ with a negative outlook, as S&P expects Greece’s debt and financial commitments to be unsustainable without serious economic reform

- US industrial production fell by 0.6% seasonally adjusted in March, worse than the expected 0.3% drop. Impacted by oil industry cutbacks and a stronger US dollar, industrial output contracted at an annual rate of 1% for the first quarter — the first such decline since 2009

- The National Association of Home Builders/Wells Fargo homebuilder confidence index rose to 56 in April from a revised 52 in March, the first gain in five months

- US housing starts rose a less-than-expected 2% in March to a seasonally adjusted annual rate of 926,000. Single-family units increased 4.4%, while multifamily units fell 2.5%.

- The University of Michigan consumer sentiment index rose to an April reading of 95.9 from a final reading of 94.0 in March

- US retail sales increased 0.9% in March, the biggest monthly gain in a year, but less than the predicted 1.1% increase

- Initial claims for US unemployment benefits rose 12,000 to 294,000 for the week ended 11 April

- Continuing claims fell 40,000 to 2.27 million for the week ended March 28th

For the week, the S&P 500 fell by 0.95%% for a year to date return of 1.1%, including dividends.

Summary

IBD: Uptrend under pressure

GMI: 6/6- Buy signal since market close of January 23, 2015

BCI: I am maintaining my defensive posture and favoring in-the-money strikes 2-to-1. An alternative would be to sell out-of-the-money cash-secured puts. This site remains long-term bullish and expects a resurgence of our economy in the second half of the year.

Wishing you the best in investing,

Alan ([email protected])

Alan:

On Wed., 4-15-15, 2 days before expiration, my 40 EEM April 17 Call was unexpectantly assigned when the underlying reached 43.27. I had planned to buy back the position on Thur 4/16/15. & was surprised at the early exercise. At the time of exercise, the Time Value had declined to .08. I guess I waited too long.

Paul

Paul,

Early exercise is rare and usually associated with an ex-dividend date. It appears that there is no consistent pattern to when dividends are distributed with this security. The last ex-date was 12/17/14 and the previous one was 5 months earlier. If we were to project 5 months out we would be in mid-May. It’s possible this played a role especially if the option holder wanted to own this security anyway. Buying back EEM on Friday would have been a slight debit over rolling the option but not much.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 04/17/15.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

Premium Members,

The Weekly report has been revised, updated, and uploaded to the premium member website. The ER date for ZBRA has been revised. Thank you Joseph.

Look for the report dated 4/17/15-RevA.

Best,

Barry and The Blue Collar Investor Team

UTHR Earnings Report:

The company just announced a new date of 4-28-15, several weeks before the date published on earningswhispers.com and only 2 months since the last published earnings report. The previous ER release date appears to have been late. Here’s the story:

http://www.marketwatch.com/story/united-therapeutics-corporation-to-announce-first-quarter-2015-financial-results-before-market-open-on-tuesday-april-28-2015-2015-04-21

Thanks to Dan…

Alan:

As a matter of interest as well as a confirmation of your often-stated rule regarding avoiding Earnings Reports, I have been following & considering Harley Davidson (HOG) for some time now. But, heeding your advice, I held off taking any position when I noticed that their ER was scheduled for today. A quick look confirms the wisdom of your rule & I thank you for helping me avoid a mistake.

Paul

I have been a member for the past few months. I have had a positive return every month for the past 3 months since I started your system. My account is up 7% since then! Which I find amazing during current market conditions. I haven’t made so much so fast without major risk and stress. Thanks for sharing your knowledge!

This month I am finding it hard to find trade candidates. There are zero eligible candidates this week and the ETFs don’t seem to have very many returns over 2% especially if I go ITM which I like to do. Any help on finding something this month?

Nathan

Hi Nathan,

Glad to learn of your recent success.

This is a challenging week because we are now in the heart of earnings season and last week the down market impacted chart technicals. There are a few eligible candidates (look in the white cells in the “running list”) and there are 8 stocks that report earnings this week that will become eligible when the report passes. Be patient and only use eligible candidates even if it means staying in some cash until market conditions improve and the risk of earnings passes. Also, settling for 1-2% for ETFs may be a consideration.

Keep up the good work.

Alan

New webinar added:

I’ve been invited to be a guest presenter for the Las Vegas E-Money Show:

MONEY SHOW WEBINAR

May 21st @ 4:30 PM .

“How To Generate Monthly Cash Flow And Purchase Stocks At A Discount Using Low-Risk Option Strategies”

Covered call writing and selling cash-secured puts are low-risk option-selling strategies geared to retail investors with capital preservation a top priority. In this presentation you will learn how to use these strategies to achieve significant monthly cash flow, purchase stocks and exchange-traded funds at a discount or develop a multi-tiered option-selling strategy where both goals can be accomplished.

Link and details to follow.

Alan

Premium members:

This week’s 6-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

***The entire library of 109 Ask Alan videos has been uploaded to the premium site. Login and scroll down on the left side. We will be adding one additional video each month to the member area only.

With appreciation for your support,

Alan and the BCI team

Alan,

What is the percentage of stock price drops after the earnings report? Also if price drops, what method can we use to see if that is a good buy due to big “discount”?

Keith

Keith,

Over the years there have been more “beats” than “misses” I’ve seen stats reporting 60+% beats and the rest misses and “meets expectations”

If a company disappoints, check the reasons why. A great site for stock news is:

http://www.finviz.com

If the stock still meets our system criteria and the news is not egregious (like loss of significant # of contracts or extremely negative guidance), it is still an eligible candidate. As short-term option-sellers, our concern is about the next month and then we re-evaluate. I would not use a disappointing ER as a reason to buy a stock at a discount. For that, we can sell a put.

Alan

I am a member of AAII in Denver and have made reservations to hear your speaking engagement. I also purchased a Kindle Copy of your book on sell cash covered puts. I have been selling puts on the S&P futures since 1982. At age 82 I will consider selling puts on stocks and subscribing to your service.

My question is this?? How many member are following your suggestions? Does it cause a problem with too many traders trading the same options?

I am willing to let you do the work, but I don’t want to compete with too large a group doing the same thing.

Bob

Hi Bob,

I look forward to meeting you in a few weeks. Although we do have a substantial membership, we are not the ones moving the markets. Its the institutional investors…banks, hedge funds, mutual funds, insurance companies. That said, significant option liquidity (I follow open interest) is a positive for us because if we have to buy back an option with substantial liquidity, the spread is usually tight and we get a favorable price execution.

Please introduce yourself to me at the presentation.

Alan

Hi Alan,

What do you think of the covered put strategy?

Thanks,

Greg

Greg,

Most investors do not realize that covered puts is NOT the same thing as selling cash-secured puts.

I prefer cc writing and selling c-s puts but I believe most strategies can work successfully in appropriate market conditions when mastered. Covered puts is a strategy that works best in bear market environments and we would want to short stocks that we expect to decline in value or at least not move up. It may be appropriate for more experienced investors who have a bearish market outlook.

Alan

I have been a Premium member for over 2 years now and have enjoyed using the BCI Weekly Stock Screen list.

I do, however, have a question for you concerning how to use the Beta metric more efficiently.

Is it best to find companies that are close to 1.00 or just above or below?

I am confused how to best use this metric.

Could you help me with this?

I appreciate all that you do.

Dr. O

Dr. O,

Beta stats are secondary parameters to consider in our option-selling decisions. Implied volatility is much more important in my view for our short-term trades but beta can be a useful stat as well. We have included beta stats in our stock reports over the past several years based on member request.

Beta is the historical volatility of the underlying security as it relates to the market benchmark for a specific time frame. We use the 1-year figures and compare it to the S&P 500 but other sources may use different time frames and or benchmarks. For example, Value Line uses the NYSE as the benchmark and a 5-year time frame. Google, Yahoo and Zacks also use 5-year time frames. I prefer the S&P 500 as my go-to benchmark and a 1-year time frame which I believe is more relevant (than a longer-term time frame) to our trading style.

Here’s how this stat may be useful: If you are deciding between a few securities that seem similar in all the parameters we provide to our premium members, beta may break the tie: Use higher betas in a bull market and lower betas in a bear market environment.

Generally, I would hang my hat on implied volatility over beta…use higher IV stocks in bull markets and lower in bear markets.

Alan