Exit strategies for covered call writing is the 3rd required skill that must be mastered to achieve the highest possible returns. In January 2020, a member shared with me a trade she executed with BlackRock, Inc. (NYSE: BLK). The stock was trading at a cost-basis of $500.00 when the February 21, 2020 deep out-of-the-money (OTM) call was sold for $5.59. Shortly after entering the trade, shares moved higher ($570.00) resulting in the ask price cost-to-close rising to $23.40. The question posed to me was should the option be re-purchased since this BCI member wanted to retain the shares.

Initial structuring of trade

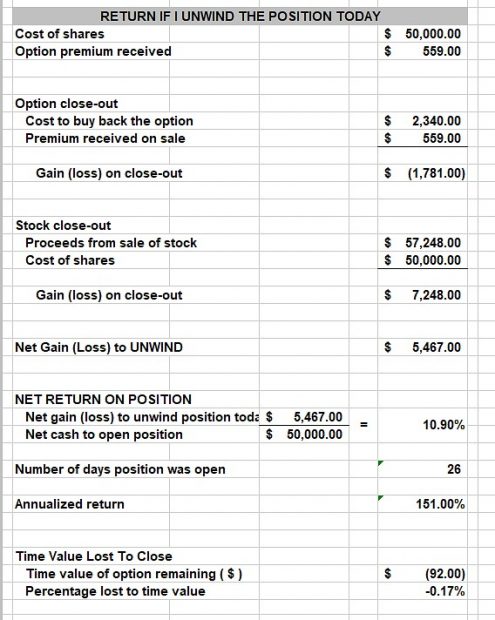

The spreadsheet shows an initial 1-month time value return of 1.1% with a possible additional 10% return if share value moved up to the $550.00 strike. With the stock trading at *$572.48, a maximum return of 11.1% was looking good.

*The original article had current market value at $570.00 but it had actually moved up to $572.48 when the image of the spreadsheet was created.

Time value cost-to-close

The option cost to buy back the $550.00 call is $23.40, $22.48 of which is intrinsic-value. If we close the original short call, our share value moves from the $550.00 strike to the current market value of $572.48. This results in a 0.17% time-value cost-to-close as shown in the

Unwind Now” tab of the Elite-Plus and the Elite version of the Ellman Calculator.

When would we opt to close early in the contract?

If we were willing to part with the stock, using the mid-contract unwind exit strategy (MCU) would make sense. This involves closing both legs of the covered call trade and using the cash to enter a covered call new position with a different underlying security and the same expiration date. As long as that new position would result in an initial time-value return of 1.17% or more (1% greater than the time-value cost-to-close), the MCU exit strategy would be beneficial.

What if share retention is a priority?

In this case, we wait until expiration approaches and roll the option prior to 4 PM ET on expiration Friday. We can roll-out to the same strike or roll-out-and-up depending on overall market assessment and calculation goals. We use the “What Now” tab of the Ellman Calculator to assist with these decisions.

Discussion

When our covered call strikes move deep in-the-money early in a contract, we have the following courses of action to consider depending on our goals:

- Mid-contract unwind exit strategy

- Rolling options as expiration approaches

- Take no action and allow assignment

Investment club program board members

If you would like to schedule a private webinar with Alan and Barry, send an email to:

Include:

- Contact email

- Contact phone #

- Club website URL

- Put “private webinar” in the header

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Hello Alan,

Thanks for putting on this webinar during the coronavirus stay-at-home period. I saw you at The Money Show Las Vegas in 2019 and liked your presentation then and all the info you put into your weekly newsletters since. It is clear to me that your motivation is to educate people on investing, not to get rich yourself.

Keep up the great work.

Best,

David Y

Upcoming event

1: Private webinar (California investment club)

Covered Call Writing with 4 Practical Applications

Saturday September 19th

9 AM – 12PM PT

2: Money Show Virtual Event

Master Class (2-hour)

Creating a Covered Call Writing Portfolio Start to Finish

I am invited speaker for this event. The Money Show charges a fee to attend ($139)

September 16, 2020

3:45 – 5:45 ET

3: Free webinar for entire BCI community (October)

The feedback from our August 13th webinar was so positive, the BCI team decided to schedule another in the fall. I have written over 50 webinars over the years and will select one or write another based on your feedback regarding the topics you are most interested in. Send your ideas to: [email protected]. We will publish the topic, date and time in the near future.

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************

Alan,

Do you see any flaws in this strategy?

• One week income by selling CSP should be sufficient to pay annual loan interest, and then I can use the cash free for the rest of the year. No margin call.

• Sell ATM CC and CSP can provide us double income. Assuming we have 100 share of AAPL, and has round 11500 cash in the brokerage account:

○ Sell weekly ATM CC can bring us around 3.5% return

○ Sell weekly ATM CSP can also bring us additional 3.5% return (Based on current market IV).

• CC and CSP can hedge each other perfectly regardless of the market direction.

• For Weekly ATM CC, if my stock is assigned, I can buy it back immediately and continue to write CC.

• For Weekly ATM CSP, if I end up buying underlying stock (e.g. AAPL), I can sell it immediately, and continue to write CSP. Weekly CSP reduces this risk.

I am a long term investor with only 3 positions of stock, AAPL, MSFT, and NVDA. They are all quality stocks in SP500. I will hold them for at least 10 years regardless of selling CC or CSP,

However writing CC and CSP can reduce the risk of holding those stocks, while bringing me more weekly income. Why not?

In my opinion (not test it yet), it is the best strategy. Based on my description above, do you see any flow in my plan?

Thank you very much, and enjoy the weekend,

Yuqi

Yuqi,

Before implementing this plan, I urge you to study and analyze the following:

1. The pros and cons of margin versus cash accounts

2. The advantages of retaining “moneyness” flexibility. Using ATM, ITM or OTM strikes based on overall market conditions, chart technicals and personal risk-tolerance.

3. Master position management for both strategies as trades can turn against us:

-Put assignment can result in a losing trade

-Call assignment and then share re-purchase can result in the

need to add significant cash to our portfolio.

4. Analyze the importance of adequate diversification. The more positions we hold, the less of an impact a declining stock will have on our overall portfolio returns.

5. Consider the advantages of re-assessing our bullish assumptions of a security. Pillars of our economy can fall out of favor (Bear Stearns, Enron…).

Take your time evaluating these matters and you will have an opportunity to craft these strategies to meet your trading style, goals and enhance your success potential.

Alan

CC plus CSP is a straddle with long stock, the gain is capped on the upside but a double loss on the downside and it could be unlimited!

Hi Yungchi,

you are right, of course,

but if you focus on monthlies, diversified well-researched stocks, and non-emotional exit strategies, you can get a significant advantage and consistent gains.

Some of your positions will be losers, and you must mitigate or unwind before the loss is too heavy, but the odds are in your favor, and you will sleep well.

Roni

Hi Alan,

Hope you’re doing well!

Over the last two months, every time I went with a mid-contract unwind, it turned into a substantial loss. I may be choosing stocks that are to to volatile, but they seemed to be reasonably stable. I do admit to trying to get a healthy premium when looking for the new stock and selling a call. Regardless, do you ever just pass on doing a mid-contract on wind even though the calculator points in that direction?

Thanks,

Steve H

Steve,

I believe you already have this figured out. For a monthly covered call trade, the MCU exit strategy gives us the opportunity to generate a 2nd income stream in the same contract month with a new security. it is “icing on the cake”

Since we are midway through a contract, Theta has eroded the time-value of our premiums so our expectations for this 2nd income stream should be much lower than our initial time-value return goal range. We should only use securities that meet our personal risk-tolerance and avoid the enticement of highly-volatile securities that return juicy premiums.

Furthermore, since we have less time left to manage this position before expiration, my preference is to use an ITM strike for this 2nd position that generates at least 1% more than the time-value cost-to-close. See pages 266 – 273 in the 2019 printing version of The Complete Encyclopedia- classic edition.

I will pass on executing a MCU trade if I cannot generate at least an additional 1% net profit.

Alan

Thank you Alan! I think I’ve been trying to go to big on the premium….. more risk. Enjoy your Sunday!

Alan,

Do you think that the recent market decline was to be expected because it had been up so much this year? Profit taking?

Thank you for your opinion.

Dennis

Dennis,

COVID-19 has placed us in unprecedented times. Assessing short-term movement of the market is difficult enough in normal conditions. Now, it’s extremely challenging.

In my humble opinion, we have 2 forces at work. In favor of an accelerating stock market we have incredibly low interest rates and trillions of dollars infused into the global financial community by the Fed. There simply is no other place to make money.

Working against the market we have the realization that a V-shaped recovery is not supported by the recent economic data, historically high unemployment, Congress not taking action many folks desperately need and the realization that a safe, reliable medical solution to the virus is not imminent. Let’s hope for sometime next year.

Volatility has come down quite a bit since the March crash but is still historically high, warning retail investors like ourselves to invest with caution (BCIers do that anyway).

To finally get to your question, it is much more than profit-taking. It is extremely rare for me to be only 50% invested in the market but that’s been my comfort level for the past 6 months to this day.

Finally, I want to comment on the descriptions by the talking-heads we listen to regarding this “incredibly appreciating stock market” I created a year-to-date chart(below) for the price movement of the S&P 500 and the Dow Jones Industrial Average. It shows the S&P 500 up 3.12% (slightly below historical levels when annualized) and the Dow 30 (-3.42%) well below historical market return levels.

I am not saying we should fear the market but rather proceed with caution and not overstate the reality of the situation. We can still make money in the stock market. My portfolios are still “beating the market” as they have been doing consistently for over 2 decades of option-selling. We should all recognize our personal risk-tolerance and proceed accordingly.

Short question, long (maybe too long) answer.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

UNBELIEVABLE !!!!!!

There is so much wisdom in Alan’s responses to Yuki and Steve.

Roni

Sorry, my mistake, I mean Yuqi

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 09/11/20.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

On the front page of the Weekly Stock Report, we now display the Top 10 ETFs, the Top Performing SPDR Sector Funds, and the 4 single Inverse Index Funds. They are sorted using the 1-month performances from the Wednesday night ETF report and the prices from the weekend close.

Best,

Barry and The Blue Collar Investor Team

[email protected]

Alan

One quick question

For exit strategies on covered call writing, do you still maintain your 10% limit order to buy back the option in the final week and few days of the contract or do you cancel and simply allow the option to expire if you are planning on selling stock. I have read your books and may have missed a specific reference to this.

I am just curious because as the clock ticks to the end of the contract, time decay sets in very quickly and could trigger the buyback on OTM strikes. This is assuming the stock is sold and you do not intend to roll out or up and out.

Thanks!

Tony

Tony,

I will generally leave the 10% BTC limit order in place even if the original strike sold is OTM and my plan is to sell the stock.

Share price can decline in the final week of a contract and then to take action, we must first close the short call. 10% of the original option premium is a small percentage of share price decline while still allowing us to retain 90% of the original premium. If the threshold is reached, we have opportunities to roll-down or sell the stock before we take an even greater “hit” on the stock side.

I recently published trades I executed where I rolled-down in the final days of a Monthly option. Once, I even “hit a double” in the last 2 days of a contract because market volatility was so high.

We must protect ourselves against share decline even in the final week of a Monthly contract.

Alan

Alan

Thanks for the explanation, makes perfect sense. With the volatility this month, I have had success with hitting a double and buying back and rolling down to cut loses.

Thanks again.

Tony

Members:

The BCI team has firmed up the date for the next free webinar for the entire BCI community:

Thursday October 15th

8 PM ET

Detailed topic (new webinar) and Zoom login information to follow on this site.

COVID-19 will not stop us from sharing information and learning from each other.

Alan

Hi Alan

I read your book “Covered Call Writings Alternative Strategies” on PMCC. What would be the ideal expiration for buying SPY LEAPS. You mentioned 1-2 years expiration with Delta above 0.75.

SPY Sept 2022 (2 years out) deep ITM calls do not have much option interest.

Sept 2021 or March 2022 has better liquidity.

In terms of the strike price, the deeper in the money, the lower risk for PMMC, correct. I understand more capital would be needed.

Please advise.

Thanks,

Lisa

Lisa,

Use the first tab of our PMCC Calculator to make sure our initial trade-structuring requirements are met. There will usually be several combinations that work. Let me give you one as of this morning:

SPY: $339.64

3/18/22 $225.00 LEAPS: $120.04

10/16/2020 $343.00 short call: $6.37

Formula:

[($343.00 – $225.00) + $6.37] > $120.04

$124.37 > $120.04

Note that the time-value for the short call ($6.37) is greater than the time-value of the LEAPS ($5.40)

This is an example of a combination that works, not a specific trade recommendation.

Alan

Hi Alan

The exit strategy mentioned in your book “Covered Calls Alternative Strategies” is to BTC the short call and then Sell the LEAPS if the stock price appreciates. Could buying the stock by exercising the call before expiration and convert the call into an equity holding position be another exit option?

What happens when the stock value is lower than the LEAPS strike price? For deep ITM LEAPS, the stock drops below the strike is less likely but possible. When to get out of the LEAPS if the stock movement is again us? Assume the stock still has strong fundamentals.

Thanks

Lisa

Lisa,

If share price moves up and we exercise the LEAPS to own the shares, we still have a contract obligation for the short call to provide those shares at the strike which is ITM (if share value has accelerated).The long LEAPS can only be used for 1 purpose.

If share price ultimately moves below the (once) deep ITM strike (now OTM), we would have executed several exit strategy maneuvers, perhaps re-evaluated our bullish assumption on the stock and mitigated losses. This is the main disadvantage of the PMCC… a long-term commitment where parameters can change dramatically. Much like traditional covered call writing, we must be prepared to take non-emotional action to protect our hard-earned money. Keep an eye on the difference between the current strikes + the call premiums collected in relationship to the cost of the LEAPS. Sometimes we must simply cut our losses.

Alan

TYPO:

In the original article, I wrote that the current market value moved to $570.00 when it should read $572.48. I corrected my error and made a note. The spreadsheet calculations and stated results are accurate as originally published.

Alan

Alan,

One more question. I was drawn to your video this week on weekly put selling as I sell a lot of puts as well for income, though I’m not adverse to using them to buy a good stock at a discount. These put sales are mostly 3 to 4 weeks out, but I did a few weeklies back in March/April. All of my put options trades, so far, have been placed with strike prices out of the money, sometimes well out of the money. Most of the underlying I have been using have been previously well beaten down and are now trading in horozontal channels. I’ve been placing my strikes below the floor of those channels.

The foregoing said, I’ve still had three trades recently where the underlying has sunk through my strike price prior to expiration. In all three cases, I rolled out and down. In two of those three I still made money on the original premium after subtracting the cost of buying back the option. On one I lost money, but still rolled out and down.

Anyway, I’m wondering if you have some material on managing put option sales that have sunk beneath their strike prices. I looked at your video collection title file and did not see one that speaks directly to it.

Thanks,

John

John,

Both my book and online DVD program on “Selling Cash-Secured Puts” have critical exit strategy sections. More specifically, for the scenarios you describe, we apply the 3% guideline where we close our put position when share value decline 3% or more below the (once) OTM put strike. There are also specific guidelines when rolling the put option benefits our positions.

Alan

Alan:

I would appreciate your help in understanding the correct way to account for the increase in Equity Value when establishing the 20/10 Buy Back Points.

In your Exit Strategy Book, on Page 44, a treatment is suggested to account for the Equity Increase resulting from the Buy Up. It would seem that the 20/10 rule for establishing the Buy Back Point would be applied to the resulting value.

But, if that is the case, I have a question about the BCI Portfolio Overwriting Calculator found in your “Alternative Strategies Book”, which seems to suggest applying the 20/10 rule to only the Option Ask Price, with out accounting for the Buy Up Equity Increase.

So is it correct in all cases when Buying Up to an OTM Strike to apply the 20/10 rule ONLY to the cost to buy back the option?

As Always Thanks,

Paul

Paul,

Let’s review the trades on pages 43 – 44 of “Exit Strategies for Covered Call Writing”

Buy XYZ at $78.00

STO Sept. $80.00 call

Current price on expiration Friday is $83.00

Value of the shares capped at $80.00 (our contract obligation)

BTC the $80.00 call at $3.10

STO October $85.00 call (roll out-and-up to an OTM strike) at $4.20

Net option credit = $1.10 ($4.20 – $3.10)

Unrealized share gain by removing $80.00 sale obligation = $3.00 ($83.00 – $80.00)

Unrealized total position gain after rolling out-and-up = $4.10

On a cost-basis of $80.00 = 5.1%

Upside potential = $2.00 per share (an additional 2.5%)

______________________________________

As you astutely pointed out, once we roll the option and establish our next contract month position, we must then enter our 20%/10% BTC limit order. Since this relates to the last option sold for $4.20, we enter the order at $0.85 and change to $0.40 – $0.45 mid-contract.

View this defensive broker order as if we just purchased shares at $83.00 and sold the $85.00 call. We should never allow “old data” skew our current trade decisions.

That said, your emphasis on position management is admirable and a sure recipe for success.

Alan

Alan:

Thanks again for your prompt & concise response. It has been most helpful.

Paul

Hi Alan,

I am going to retire soon and wants a more sustainable income source while having a more structured way to spend my time. I have specific questions on the followings:

1: Do you use technical analysis on top on the methodology you demonstrated. If so, can you point me to those discussions?

2: How do you manage or avoid very high volatility such as the March event this year or what we have experienced in the last few weeks including the upcoming election?

Thanks,

Hubert

Hubert,

1. The 4 technical parameters used in the BCI methodology are:

20-day and 100-day exponential moving averages

MACD histogram

Stochastic oscillator

Volume

The screenshot below shows how I set up a technical chart for short-term option-selling on http://www.stockcharts.com, a free site. Checkout the technical analysis sections of my books and DVDs to see how we integrate this information into our trading decisions.

There are so many steps we can take to protect ourselves in bear and volatile market conditions. Here are a few:

1. Use low-implied volatility securities

2. Use ITM call options

3. Use deep out-of-the-money put options

4. Sell OTM puts before entering covered call trades

5. Use protective puts

6. Use more conservative ETFs instead of individual stocks

Keep in touch a let us know how you’re doing and congrats on your upcoming retirement.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Premium members,

The Blue Chip Report of eligible Dow 30 stocks for the October contracts has been added to the member site on the right side of the page.

We now have added implied volatility stats to this report.

Alan and the BCI team

What is a website that can be used for graphs of implied volatility? Have you ever looked at what is called implied volatility rank or percentile?

Thanks;

Terry

Terry,

An excellent free site for implied volatility information is: http://www.ivolatility.com. IV rank and percentile, I believe, are available from their paid service but many of the larger online discount brokers do provide these stats. Interactive Brokers and Schwab are 2 such examples (see the screenshot below).

These stats put the current IV into historical perspective, either in relationship to its 1-year high-low range or by the % of days below current IV in the past 1-year. It is certainly a positive to understand and be familiar with these terms but basing our trading decisions for short-term option-selling on them may be a case of “analysis/paralysis”

More importantly, we must define our personal risk-tolerance by creating an initial time-value return goal range which is directly related to the stock’s implied volatility. Since we are undertaking only weekly or monthly obligations, we can re-assess on a frequent basis.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Premium members:

This week’s 4-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options, mid-week market tone as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Alan,

Let’s be social..

Llook at this…

CRWD….Call $135…10/16/2020..

Dr Lonnie

Dr. Lonnie,

Assessing CrowdStrike Holdings, Inc. with a few of the BCI screens:

Mixed technical chart

So-so fundamentals

Median analyst rating: very good

On balanace volume: good

The $135.00 call returns a ROO of 5.4% with an additional 2.7% upside potential. This reflects an above-average implied volatility.

Depending on personal risk-tolerance, If an investor uses this security for covered call writing, significant initial time-value returns will be realized with both ITM and OTM strikes.

Use the “multiple tab” of the Basic Ellman Calculator, the Elite Calculator or the Elite-Plus Calculator for final trade decisions.

Alan

Hello Alan,

I am a new subscriber (10 minutes ago) and almost as new stock trader. haha. I am 62 years old, semi-retired building contractor who never owned a stock until 3/30/20. I did really good the first month or two. Of course everything was going up. My questions will reveal my ignorance. I would appreciate your patience.

1) Do you always choose a stock that pays dividends when selling a covered call option? Why not avoid dividend stocks in selecting a stock for a covered call and avoid the ex-d date?

2)My stock budget limits my covered call stock selection to $30 stocks or less. Is there a minimum stock price that you would consider not worth messing with? If so, why?

Thanks for your help. Do you do consulting on the phone on an hourly basis, etc.?

Thanks again,

John W

John,

Welcome to our premium member community. At BCI, all questions are important.

1. No. Dividends are “icing on the cake only. Our decisions are based on fundamental analysis, technical analysis and common-sense principles as well as share price and diversification factors. If we capture dividends as well, even better but our decision to use a security is not based on that dividend. There are strategies I have discussed where dividends are included but that represents an offshoot of traditional covered call writing.

2. Rarely will we find a quality stock priced under $15.00 per-share. There are some exceptions. If a stock is located on our premium stock list that is priced under $15.00, you can make the assumption that it is a quality security. We can also turn to exchange-traded funds (ETFs) for diversification at lower prices.

Here is a link for information on our online mentoring program:

https://www.thebluecollarinvestor.com/investment-coach/

Please keep in touch.

Alan

10% guideline:

I’ve had several inquiries recently regarding the benefit of retaining the 10% guidelines through expiration. With the market down the past 2 days, 5 of my 10% BTC thresholds were reached when the market opened this morning. I rolled-down on all positions to generate additional time-value premium.

Alan