Exit strategies for covered call writing and selling cash-secured puts all start with buying back the option. Frequently, the cost to close our short option positions will be less than the premium generated initially from the option sale. This is because of the impact Theta (time value erosion) has on our option premiums. However, students of options know that there are other factors that influence our option premiums collectively known as the Greeks. So while Theta is causing premium to decrease in value, Vega (changes in implied volatility of the underlying security) and/or Delta (changes in the share price) can actually cause the premium value to accelerate. On the surface, it would appear that if we bought back an option for a higher price than initially generated in order to initiate an exit strategy, we will have lost money but that is not necessarily the case. Specifically, I am referring to the mid-contract unwind exit strategy (pages 264 – 271 of the Classic version of the Complete Encyclopedia and pages243 – 252 of Volume 2 of the Complete Encyclopedia) and rolling options on or near expiration Friday. In this article, we will focus on the calculations and strategy philosophy of rolling options where we buy back an option for a higher price than originally generated. A case will be presented for why we are not losing money.

The initial trade

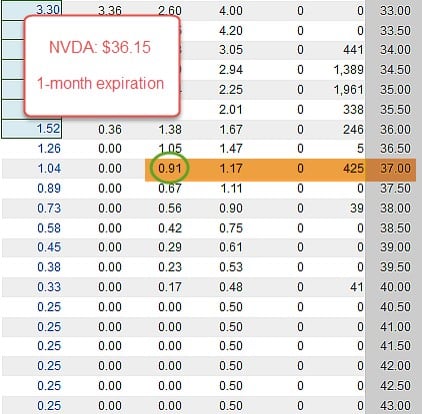

Nvidia Corp., a stock on our Premium Watch List at the time this article was crafted, was trading at $36.15. Let’s have a look at the 1-month options chain:

NVDA Options Chain

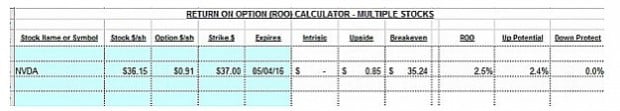

We see that the 1-month out-of-the-money $37.00 call option generates an initial return of $0.91 per share without negotiating the bid-ask spread. Let’s use this published stat as our worst-case-scenario return and feed this information into the multiple tab of the Ellman Calculator:

NVDA Initial Calculations

Our initial 1-month return is 2.5% with the possibility of an additional 2.4% if share price moves up to the $37.00 strike by expiration. This represents a potential 4.9%, 1-month return.

Evaluation of the “deal” we just entered into

Prior to entering into this trade, we agreed to sell our shares at $37.00 at any time prior to contract expiration. We know our shares cannot be worth more than $37.00 while we are obligated to the option parameters. In return we receive an unrealized initial profit of 2.5% with the potential for a 1-month total return of 4.9%. This is what we agreed to.

What if the share price is greater than $37.91 by contract expiration?

The formula for option premium is:

Premium = Intrinsic value + Time value

This means that if the stock price is greater than $37.91, the cost to close will be greater than the premium initially generated ($0.91). On the surface it would appear that we should not buy back that option and suffer a loss. But let’s dig deeper and evaluate our choices. First, if the strike is in-the-money (lower than current share market value), we have maximized our initial trade a realized the 1-month 4.9% return. So far so good. There are two paths we can take from here:

- Allow assignment and use the cash the following week to enter a new covered call position

- Roll the option (buy back the near month $37.00 and sell the next month same or higher strike option)

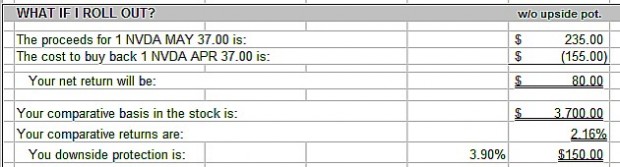

***When deciding between these two choices, the original option premium amount is never factored in. That is history as we had a successful outcome in month #1. Now it’s contract month #2. Since Theta has eroded almost all the time value of the $37.00 near-month call option, there will be an option credit if we sell the next month $37.00 call since Theta has not as yet had the opportunity to erode that month’s time value. As an example, if the price of NVDA at expiration is $38.50, the cost-to-close would be $1.50 + a few pennies of time value. Let’s say $1.55, more than the $0.91 originally captured from the initial sale (remember, we do not factor this in now…just a reminder). The next month’s $37.00 call option will generate $1.50 of intrinsic value + time value greater than $0.05, let’s say $0.85 for a total premium of $2.35. Our cost basis when making this (rolling) decision is $37.00, the maximum our shares can be worth during the initial contract. Let’s now feed this into the Ellman Calculator:

Rolling Out with NVDA

The “What Now” tab of the Ellman Calculator shows us that by rolling out, after having maxed our original trade, we can capture a 2.16%, initial 1-month return with 3.90% protection of that profit (different from breakeven). If this return meets our goals, we roll the option. If not, we allow assignment (take no action and our shares will be sold the day after contract expiration).

Discussion

Buying back an option at a price higher than the original option sale frequently does NOT represent a net loss. In this article, we explored a scenario wherein the original option trade generated a maximum return and the ensuing closing of the short option position was tied into an option sale the following month resulting in a net initial gain the next month as well. The decision to roll the option versus allowing assignment should not be clouded by factoring in the initial option sale.

***For a free copy of the Basic Ellman Calculator, click on the “Free resources” link on the top black bar of our web pages.

Upcoming live events-

July 28th, 2016 9 PM ET

The first ever Blue Hour webinar and Q&A- FREE event for Premium members only

To register, login to the member’s site and scroll down on the left side below the store discount link. Then click on the Blue Hour sign-up link and fill out the short registration form. For members who cannot attend the event live, my team will be recording the webinar and it will be posted on the member site the following week.

September 10th, 2016

8:30 AM – 12 PM

I am the 2nd of 2 speakers

Registration link to follow

Silicon Valley (San Francisco) California

___________________________________________________________________

Market tone

Global stocks appreciated this week on hopes for further global monetary and fiscal stimulus. The Bank of England did not cut rates this week but indicated that an easing policy is likely. Oil prices moved up as well. The Chicago Board Options Exchange Volatility Index (VIX) declined to 12.67 from 13.68 last week. This week’s reports and international news of importance:

- Retail sales in the US rose 0.6% in June while May sales were revised down to a 0.2% rise from an initially reported 0.5%

- This week’s Beige Book from the US Federal Reserve stated that economic activity increased at a modest pace in most regions

- The S&P 500 Index set intraday records each day this week, the first time that has happened since 1998

- Theresa May was appointed Conservative Party leader and prime minister of the United Kingdom this week

- Japanese Prime Minister Shinzo Abe laid out a plan to boost domestic demand with a $100 billion fiscal stimulus

- Also boosting Japanese markets this week was a 90% jump in shares of Nintendo after its Pokemon Go game became an international sensation

- Well-planned fiscal stimulus helped China maintain its 6.7% growth rate in the second quarter of the year

- Ireland’s 2015 gross domestic product figures were revised this week to 26.3% from an earlier 7.8% estimate

- 84 people were killed and over 200 injured in Nice on Thursday as a gunman drove a truck into a crowd watching Bastille Day fireworks along the French Riviera. The attack is the seventh in France since January 2015

THE WEEK AHEAD

- The UK reports June retail sales on Thursday, July 21st

- The European Central Bank’s Governing Council meets to set interest rates on Thursday, July 21st

- Global flash purchasing managers’ indices are released on Friday, July 22nd

For the week, the S&P 500 rose by 1.49% for a year-to-date return of +5.76%.

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Buy signal since market close of July 1, 2016

BCI: Moderately bullish. I plan to favor out-of-the-money strikes 2-to-1 for the August contracts, a bullish stance. Since we are in the heart of earnings season we look to the eligible stocks in “white” cells of our member reports and all ETFs. There will also be several stocks that will report during the first week of this 5-week August contract time frame and thus become eligible after the reports pass (assuming no egregious report results). There should be adequate eligibility to fill our portfolios given the bullish market environment. There are so many events, concerns and even some distractions that we deal with as we invest our hard-earned money. For me, corporate earnings is still the most important factor to consider.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

Alan ([email protected])

Alan, I have been paper trading for a # of months now with some success. I’M GOING LIVE MONDAY. AM I CORRECT TO ASSUME GDX & SLV ARE TOO CLOSELY CORRELATED AND I SHOULD NOT BE IN BOTH ETF’S ? THANK YOU

VERY MUCH FOR YOUR ADVICE , DAVID

David,

Yes, I agree that GLD and SLV are highly correlated in their price movement as shown in the 1-year chart below. Therefore, I would combine the two in factoring in the percentage of our portfolios they represent. Using both may be appropriate in larger portfolios.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

WASHINGTON DC SEMINAR:

Thanks for a packed room, your generous feedback and the opportunity to meet so many BCI members:

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan,

Thanks for a timely post in the context of the market upsurge since the February lows.

If a covered call writing friend told me they never regret selling a covered call on a stock that proceeds to go straight up I would throw the “B.S.” penalty flag :).

We have all done that. And felt silly, regretful or at least under nourished by the fact that if we never wrote the call we would be “better off”.

Yes, on that trade, in that month, before considering roll outs, in hindsight. But who knows the future :)?

It is only when we step back and look at the opportunities we missed in the past to better manage similar trades to the ones we have on now – rather than kick ourselves for executing them in the first place – that we truly improve at this game. – Jay

Jay,

Very true. In all my covered call writing seminars I show a screenshot titled “Disadvantages of Covered Call Writing” I highlight that the most significant of these is that profit potential is limited by the strike. That’s why we are getting paid the premium…to undertake an obligation defined by the options contract. In essence, when a covered call writer has seller’s remorse when share price moves above the strike they are complaining that they have maxed their trade position but would have done better had they implemented a different investment strategy. In sports, that’s known as a Monday morning quarterback.

Covered call writing is not for everyone. We hit singles and doubles, never grand slam homeruns. We owe it to ourselves to determine where our risk tolerance is and decide on our monthly or annualized goals. From there we can decide on the most appropriate strategy that meets these parameters. If it’s covered call writing and we max a trade position with a 3-7% 1-month return we find ourselves satisfied and looking forward to moving on to our next successful trade.

Alan

Hello Jay,

It sure hurts when you see you missed an opportunity and left some Money on the table. Especially when it is a lot of money. :<(

When I chose to adopt Alan’s method of covered call selling, with low but consistent income, I had to change my mindset, and force myself to feel good when the underlying stock tops the strike.

I now relish feeling safer as it goes higher and higher.

I always buy a stock and immediately sell a one month call to secure it.

When you buy a stock and hold it, you can’t sleep at night because :

When it goes up, you feel excited, and wonder if you should sell now or wait for it to go higher.

When it goes down, you feel disgusted with your loss, and wonder if you should sell now before it drops further.

When it stays unchanged, you worry, and wonder if you should sell now and buy another ticker.

Besides, to me it’s no fun.

For me the fun is in trading. And preferably watching my total holdings increasing consistently.

Have a nice bullish week

Roni

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 07/15/16.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article,

“Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

Alan

I have recently brought & read your books cashing on covered calls & Exit Strategies. I am deeply impressed by the strategies & would like to thank you for being an eye opener to me.

I would like to ask that ” Do the stock price ups & downs from actual purchase price have any relevance if I want to write the covered calls on it for many consecutive years to come. I mean that suppose I brought a stock at 200 and it declined to 120 so why should I be concerned & will keep on writing the covered calls for my life time if the company has strong fundamentals & is not going bankrupt any time in future.”

Thanks & Regards,

Jitin

Jitin,

The proposed strategy would be appropriate in a long-term buy-and-hold portfolio in a non-sheltered account where the underlying is at a low cost basis and selling would create a negative tax consequence.

Outside of that, the disadvantage of the strategy is that share price can decline more than the premiums generated thereby putting us in a net unrealized negative position. A stock that has declined 40% in value will usually not have strong fundamentals and not the best choice for covered call writing. This is where our first required skill (stock selection) comes into play.

Alan

Hi Alan,

Great explanation !!

I am always tempted to buy back and roll out in such a situation, but lately my choice is in favor of allowing assignement, because there is a signifant difference when calculating annualized return.

In the NVDA example, 4.9% x 12 = 58.8%, while 7.5% x 6 = 45%.

On the other hand, 261.00 is much more than 176.00.

Also, I worry about a pull back after a significant bounce.

Roni,

Your concern regarding a pullback is valid. Another point to factor into our decisions is that when we roll out, we always roll out to an in-the-money strike that generates downside protection of the option credit (3.9% in this case as shown in the 3rd screenshot ). This is because we would not need to roll the option if the strike was not in-the-money at expiration and therefore will still be in-the-money at the time we roll that option.

Alan

Thank you Alan,

your comment is super helpful and I feel that I just learned another important lesson.

2.5% ROO with 3.9% protection, for a one month ITM call, is a great trade with a nice edge.

Especially for a stock with upside momentum.

Now I see the light !!!

Roni

Hey Roni,

Thank you for your kind reply further up the chain.

This bull is wearing out my matador cape. I am running out of those pic things 🙂

Brexit? Market goes up

Terrorism? Market goes up

Bad earnings? Market goes up

Coup in Turkey? Market goes up

Shoot the Police? Market goes up

Where does it end?

I never post questions without answers. But this time I am out in the cold. – Jay

Well Jay, this is really strange, but maybe it’s because the stock market is the only option for yeild ?

Take care – roni

Alan,

On Saturday at your AAII DC presentation, a lower risk strategy for your Mom’s account was mentioned. Is that lower risk strategy also described within the $500 package of materials I bought? I took a break from studying the materials to scan for your Mom’s strategy, but so far I have not found it.

I have my portfolio split into 3 different risk categories for different stages of my life. My main purpose in attending Saturday was to investigate your options strategies for stocks; however, after hearing about it, I would also like to investigate your Mom’s strategy for one of my other risk categories.

I am enjoying your books very much.

Bruce

Bruce,

In my mother’s portfolio, I trade exchange-traded-funds (ETFs) and target initial returns of 1-2% per month. In my own portfolio I use individual stocks and target 2-4% for initial returns in normal market conditions. The strategy is the same but the risk and returns are less, in general, using ETFs. ETFs also require less management and cash to get started because of the instant diversification and lack of concern for earnings reports.

Information on ETFs can be found in Chapter 11 of both Encyclopedias and in the covered call writing DVD Program you have.

Alan

How many ETFs do you ideally use for the covered call strategy in your mother’s portfolio? What are the most and least number of ETFs you have used in that strategy, or is it just one (e.g., SCHB and that’s it)?

Thanks. Much appreciated.

Bruce,

The number of ETFs used will depend on the portfolio size and type of ETFs selected. For example, if we have a limited amount of cash available, we can go with an ETF that follows a broad market index like the SelectSector Spdrs (2-3 will suffice) we highlight in our member reports. For portfolios with greater cash reserves, we can expand the number and types of ETFs used and focus on more specific targeted ETFs like the gold ETFs that have been dominating our ETF reports the past few months.

Alan

I made a list (small) of stocks deep-in-money with decent time value (used Sept expiration) a lote more downside protect, combine a stop loss at the deep in the money strike price; I should be safe and still make some returns?

What do you think, using larger time value to make this work.

Anthony

Anthony,

I’m all for using ITM strikes in bearish and volatile markets. My preference in normal and bullish markets is OTM strikes. If we go deep ITM, we usually sacrifice time value premium in exchange for intrinsic value protection. If an option gives a lot of downside protection plus significant time value initial profit, it will be a high-implied volatility security which can move up or down substantially and still present some risk despite the protection…there’s no free lunch.

That said, mastering ITM strikes will set us apart from the typical covered call writer.

Alan

Thanks alan,

I am now also using the stop & stop limits (with C. Schwab) to prevent lower levels of a bad loss.

Anthony

Alan,

I currently have positions that are going to report earnings, following your rule of never selling calls through earnings does this mean that I need to sell my shares and then buy them back after earnings have been reported?

Alex

Alex,

When we hold a stock in our portfolio that reports in the upcoming contract month, we have 3 choices:

1- Sell the stock prior to the report and remove the risk of a disappointing report. Use eligible stocks and ETFs to populate our portfolios.

2- Keep the stock through the report in expectations of a favorable report and then write the call after the report passes getting the best of both worlds…share appreciation from a positive report and cash generated from option premium.

3- If the stock has Weeklys, write Weeklys up to the week of the report, skip that week (holing the stock) and then continuing to write calls after the report passes.

In most instances, I favor choice #1.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Premium members:

July 28th, 2016 @ 9 PM ET

The first ever Blue Hour webinar and Q&A- FREE event for Premium members only:

To register, login to the member’s site and scroll down on the left side below the store discount link. Then click on the Blue Hour sign-up link and fill out the short registration form. For members who cannot attend the event live, my team will be recording the webinar and it will be posted on the member site the following week.

Your questions will be answered in real time while I’m presenting the webinar. Go to the “chat box” and click on “Barry Bergman” Then type your question. Barry will respond to the entire audience unless it is a personal question. I have also selected a few of your questions that were submitted when you registered for the event. These will be incorporated into the presentation itself. We have added a few more seats to accommodate our members and a few still remain.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

Alan and the BCI team

Alan,

If a stock reports early in a five week cycle, it is fair game to sell the call after it reports?

Kay,

Absolutely. It is one of our major strategies in filling our portfolios in a safe manner during earnings season.

Alan