Why should we spend the time to educate ourselves on how to implement and manage covered call writing trades? The answer is simple: Once the 3 required skills (stock selection, option selection and position management) are mastered, we will put ourselves in a position to beat the market on a consistent basis. This article will break down the reasons why this great strategy allows us to accomplish investment returns that most mutual funds are incapable of achieving.

Cost basis

When we buy a stock and then sell a corresponding call option, we are lowering our cost basis. For example, if we buy stock BCI at $33.00 and sell the $35.00 1-month call option for $1.50, our cost basis is reduced from $33.00 to $31.50. Who has a better chance of success; an investor with a cost basis of $31.50 or one with a cost basis of $33.00 (a rhetorical question). This is the main philosophical reason we write covered calls and are willing to cap the upside… reducing our cost basis increases our chances for success.

Pool of stocks

The overall market (S&P 500 is generally the benchmark most investors employ) consists of securities that are performing at different levels…the good, the bad and the ugly. By establishing a portfolio of only elite-performers from fundamental, technical and common-sense perspectives, we are creating an environment to out-perform this benchmark.

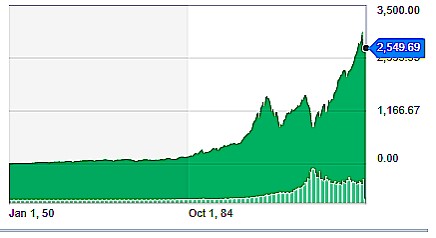

S&P 500- Historical Performance from 1950 – 1918

Impact of market performance

The overall market will move up and down in the short-term and up in the long-term. Since covered call writing represents 1-month obligations (weekly obligations for some of our members), portfolios can be adjusted on a monthly basis to reflect the most appropriate investment decisions for that specific point in time.

Option selection based on market assessment

The option strike price will dictate premium (ROO) return, downside protection of the initial time value profit or upside potential when out-of-the-money strikers are sold. Every month, we can determine which strikes to select and therefore how much to reduce our cost basis versus allowing for higher share appreciation. This will give us an edge over the S&P 500 in that our portfolios can be tailored to mitigate losses and enhance gains on a monthly basis.

Avoiding risky events

Disappointing earnings releases are the main reasons for significant share decline. Our covered call portfolios always avoid earning report risk. Also, by calculating option returns, we can also avoid risky, highly volatile securities. I look to generate 2% – 4% per month for near-the-money strikes. I will consider returns as high as 6% in bull markets but no higher due to the risk in high volatility stocks.

Position management

Our covered call writing portfolios represent 2 positions: we are long the stock and short the option. All exit strategies begin by buying back the short call and thereby creating scenarios to re-sell options or sell the underlyings. When markets decline our portfolios can be managed to break-evens or even profits in many situations.

Discussion

After mastering the 3-required skills, implementing covered call writing portfolios will allow us to beat the overall market on a consistent basis. The main reason for this success relates to the fact that the strategy lowers our cost basis but many other factors come into play.

Upcoming event

February 7th – 10th, 2019

Orlando Money Show

Omni Orlando Resort @ Champions Gate

February 7th – 10th 2019

Speaking schedule:

1. Getting Started with Stock Options: Creating Monthly Cash Flow with Covered Call Writing

February 8, 2019, 3:10 pm – 3:40 pm

2. Getting Started with Stock Options: How to Select the Best Options in Bull and Bear markets

February 9, 2019, 2:00 pm – 2:45 pm

New seminar just added

Charlotte North Carolina:

September 14, 2019

9:30 AM – 12 PM

Your generous testimonials (new feature)

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

Really love your work Sir. I honestly think you are the best resource for covered call education, and you come across as a genuine, kind personality.

This Thanksgiving, I am thankful to have you on the internet.

Thanks and regards,

Satinder

Market tone

This week’s economic news of importance:

- ISM nonmanufacturing index Dec. 57.6% (58.7% expected)

- NFIB small-business index Dec. 104.4 (104.8 last)

- Job openings Nov. 6.9 million (7.1 million last)

- Consumer credit Nov. $22 billion ($25 billion last)

- FOMC minutes

- Weekly jobless claims 1/5/19 216,000 (227,000 expected)

- Consumer price index Dec. -0.1% (as expected)

THE WEEK AHEAD

Mon Jan. 14th

- None scheduled

Tue Jan. 15th

- Producer price index Dec.

- Empire state index Jan.

Wed Jan.16th

- Retail sales Dec.

- Import price tax Dec.

- Business inventories Nov.

- Home builders’ index Jan.

Thu Jan. 17th

- Weekly jobless claims 1/12

- Housing starts Dec.

- Building permits Dec.

- Philly Fed index Jan.

Fri Jan. 18th

- Industrial production Dec.

- Consumer sentiment index Jan.

For the week, the S&P 500 moved up 2.54% for a year-to-date return of 3.57%

Summary

IBD: Market in confirmed uptrend

GMI: 2/6- Bearish signal since market close of November 13th, 2018 as of Friday morning

BCI: With volatility settling, I am taking a more aggressive stance and favoring out-of-the-money strikes 3-to-2 compared to in-the-money strikes.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to an improving market tone. In the past six months, the S&P 500 down 6% while the VIX (18.19) moved up by 33%, both improvements over last week.

Wishing you the best in investing,

Alan and the BCI team

Hi Alan,

Are you looking at profit taking any differently when following the BCI Methodology by selling more ITM calls as downside protection in these mixed markets?

The reason ask is that I put two trades on January 3, 2019.

One example:

I spotted Salesforce (CRM).

Jan 3, 2019 Bought 100 shares CRM at $133.31 Sold $130 Feb 15 19 Call at $9.35 Break even $123.96 Potential Profit after buy down: $675 ROO 4.6%

Jan 9, 2019 Good problem, CRM shot-up to $146.36 And of course my $130 Feb 15 19 Call was now at $18.20

Note 1: My Whatnow Tab shows a Roll Out & Up to $150 strike with Upside potential, $925 or 7.12%

Note 2. My Unwindnow Tab shows a $420 gain or 3.10% (same as my brokerage statement)

That 3.10% ($420 gain) on my brokerage statement, corroborated by the Ellman Calculator (THANK YOU!) made me pause and think. Instead of viewing my profit(s) of the Call as we do during a Bull Market this Mixed Market has me looking at both sides of the transaction as a package. After all we do want the underlying price to go up but then our ITM Call gets very pricey.

Thus, I ended up closing the complete trade at a ‘3% package gain’ or a $420 win for just 6 days time. I felt much better about booking profits now rather than waiting for the $725 (7.12%) by rolling out & up to the next cycle. (Given the market tone and crazy ass politicians I just am not comfortable [and my December getting burned]).

I had the same success with Visa (V), instead of waiting for the $570 (4.2) potential gain, I closed at $366 (2.5%) 6 days after putting the trade on. (Gave me $786 for 6 days of holding CRM & V, I’ll take it!)

As I look at my current 7 other securities I am monitoring the total ‘package performance’ of each instead of solely the Call performance. I will exit as a package anywhere from 2% to 4% gains. Only 1 is currently in the red at – 1.5%

I’m sure the answer is that we all discover what works best for each of us and go from there. I was curious as to whether you viewed your ITM Calls in this way or not? (and I must tell you the Ellman Calculator is a godsend for getting this done without making very poor decisions)

Thank you Alan,

Jim

Jim,

First, congratulations on these successful trades to date.

There is no need to roll an option when we are 5 weeks from contract expiration. We are still ‘ in the driver’s seat” with an unrealized maximized return and a lot of downside protection of that profit. As in the case of CRM, there is nothing wrong with a 4.6% 5-week return. Rolling out-and-up to the (say) March contracts would mean anticipating continued share appreciation, not to mention the earnings report risk incurred in this case. So let’s leave rolling-out-and-up off the table when we are this far from contract expiration and with the ER due out prior to expiration of the March contracts.

Now, closing the entire position is something we should look at. This is our “mid-contract unwind” exit strategy and is calculated by the “unwind now” tab, you alluded to, and found in the Elite version of the Ellman Calculator. How much time value will it cost us to close?

According to these stats you presented, the1-week time value profit moves from 4.6% to 3.1%, both outstanding returns. The key question we ask ourselves when considering executing this MCU exit strategy is ” can we generate a higher return than 1.5% (our time-value cost-to-close…4.6% – 3.1%) by closing both legs of the trade now and using the cash in a completely new trade with a different underlying by February 15th. This is a close call but I would lean to closing and entering a new trade…in-the-money, unless our market assessment is strongly bullish in which case I would use out-of-the-money in this 2nd trade.

Excellent thought process to your inquiry.

Keep up the good work.

Alan

Ken,

Jan 3, 2019 Bought 100 shares CRM at $133.31 Sold $130 Feb 15 19 Call at $9.35 Break even $123.96 Potential Profit after buy down: $675 ROO 4.6%

How did you calculate the $675 ROO?

Jack

Jack,

This is a response to Jim’s post (not Ken):

I believe there is a typo but the calculations are correct:

Of the $9.35 premium, $3.31 is intrinsic value (not profit), so the initial time value profit is $6.04 (not $6.75). The intrinsic value “buys down our cost basis from $133.31 to $130.00. The initial time value profit is: $6.04/$130.00 = 4.6% as stated in Jim’s post.

Thanks for pointing this out.

Alan

Alan,

I certainly enjoy reading about the Poor Man’s Copveed Calls. Thanks. But there is a quick question: Why do you not mention doing weekly calls. Your examples are always about 1 or 2 month calls for both regular CC and PMCCs.

Thanks again.

Ken

Ken,

In our book, “Covered Call Writing Alternative Strategies” Weeklys are addressed as we prefer stocks that have both Weekly and LEAPS options that are associated with them.

That said, Weeklys offer the advantage of allowing us to circumnavigate around ex-dividend dates and earnings reports. Generally, though, there are some disadvantages that may make us lean to Monthlys when Weeklys aren’t needed. One disadvantage if quadruple the number and amount of trading commissions.

We can be successful with both expirations but it is important we understand the pros and cons before making final decisions.

Alan

Ken,

Beware.

Most weeklies have little OI and therefore large sapreads.

Roni

Premium Members,

This week’s Weekly Stock Screen And Watch List, the first of the New Year, has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 01/11/19.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The BCI Team

[email protected]

You may have addressed this before but why not always sell an equivalent PUT option at the same strike price. It involves fewer transactions going in or out with the same payoff

George,

Selling cash-secured puts is also a terrific investment strategy but like all the others has its pros and cons. I use this strategy predominantly in bearish and volatile markets but lean towards covered call writing in normal to bull markets because the latter allows for additional share appreciation profits when using out-of-the-money strikes Put-selling profits are limited to the put premiums.

See pages 20 -21 of my book, “Selling Cash-Secured Puts” for a complete list of put-selling pros and cons.

Both strategies are excellent ways to generate cash flow and put-selling can also be used to purchase stocks “at a discount”

Alan

Alan,

I wanted you to ask do you have some buy&hold positions you intend to hold long term, or you are all in options and covered calls and constantly rotate stocks depending on their technical and fundamental analysis?

Sunny

Sunny,

90% of the stock portion of my portfolio is dedicated to option-selling. That’s where I’ve had my greatest success…by far.

About 10% is for longer-term holdings without the option component. These are mostly technology-related, large cap stocks.

Alan.

Alan:

I have had the situation where I sold an ITM call , which was say $10 in the money because the market action looked as if would be weak based on futures and prior action.

Then the stock price shot up way past the sum of the ITM option price and the strike price of the ITM option.

My response was to do the following:

1.) Buy back the ITM option which is obviously much more expensive than the premium I initially received.

2.) Sell the ITM option which is one increment LESS in strike price than the ITM option I just bought back.

For me this does two things:

a.) I do not lose money on the option because the further in the money option that I sold, is higher priced than the one I just bought back.

b.) Raises the total possible price per share that I will receive to slightly greater than the current much higher price because the the new ITM option premium received plus the new strike price is much much closer to the current share price than the old option price plus the old strike.

I have found that usually this means I get assigned but instead of losing perhaps $10 per share I might get assigned wherein the sum of the new ITM call price plus the new strike is only very slightly less (say 30 cents) than the current share price.

Is this a valid strategy? It looks to me that it can be and appears to allow you to true up back to the much higher price after a big gap up, rather easily. So instead of getting for example 320 plus the original 7 dollar premium you het say 317.50 plus a 18 dollar premium for example. The stock at this point is at 335 and change maybe 335.70 , but sometimes it has been less .

To me this is much better than buying back the original ITM option and then trying to sell a call at a higher strike because you lose money on the switch of options when you buy back your now much more expensive ITM option followed by selling an option with a higher strike , whose premium is less than that you paid to buy back the original ITM call option.

The high run up in price of the stock shifts the entire option chain, which is why this approach appears to be a reasonable one.

I recognize that it might be possible to buy back the first sold ITM call and sell an option at a higher strike and not lose all of the original premium , but you will still lose some. I find that when the entire chain moves the sum of the strike and any given call option does not change dramatically when moving one strike so I prefer to make money on the switch of option as opposed to losing it.

What is your opinion of this strategy. Or am I missing something?

Thank you.

Ed

Ed,

My understanding of this hypothesis is that when share price rises significantly, leaving the strike deep (er) in-the-money (ITM), we roll down to a lower strike in an effort to generate additional premium to counter-balance the share appreciation we did not enjoy…is this correct?

If yes, please look at the time value component of the option equation. When a strike moves deeper ITM, the time value component moves to zero and we are dealing with mainly intrinsic value. This means that the additional premium received is negated by lowering the maximum share price we will receive…it lowers the value of our shares by the intrinsic value amount. Any time value component will be less for a deeper ITM strike.

See the screenshot below:

If we bought back the $45.00 strike for INTC (trading at $48.76), the cost-to-close is $3.80. Selling the $43.00 deeper ITM strike generates $5.75 resulting in an option credit of $1.95. However, our share value has been diminished by $2.00 ($45.00 – $43.00) for a net debit $0.05 + trading commissions…an exercise in futility!

The best strategy in these (very positive, by-the-way) scenarios is the mid-contract unwind exit strategy discussed in detail in both versions of “The Complete Encyclopedia for Covered Call Writing”

I admire members like you who think outside the box but also want to be sure we stay focused on strategies that will benefit us the most in the long run.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Hi Alan!

Quick question. I know we don’t sell CC’s during earnings reports. I have shares of Apple that I sell calls against each month. Apple “pre-announced” a downward earnings trend and the stock got whacked. The ‘official earnings report’ will happen on 2/7. Do you think the market has already responded to their news and its okay to sell calls for February?

Jim

Jim,

“Never sell an option when there is an upcoming earnings report prior to contract expiration”. There are no exceptions to this rule.

You can, however, write Weekly options up to the report week, skip that week, and continue to sell options once the report passes.

Alan

Hi Jim;

Earnings Whisper has Jan 29th as the ER date for Apple.

I have a question regarding PMCC. If we sell PMCC call and it expires ITM, do we need to buy back the call and sell LEAPS option or is it better to let the assignment happen and exercise LEAPS option? I have never done PMCC before, don’t know how to act if the call we sell expires in-the-money.

Sunny

Sunny,

Smart of you to ask this question before entering a PMCC trade. It is critical to plan for all possibilities prior to executing the trade so we can manage our positions unemotionally.

If the strike is deep in-the-money as expiration approaches, we may want to close both legs of the trade. This scenario has been accounted for by following the initial structuring guidelines in our BCI methodology for PMCC requirements. Because this was planned for prior to entering the trade, we close at a profit.

If the strike is slightly in-the-money, we should consider rolling the option, one of our exit strategy possibilities available to us.

In our latest book, “Covered Call Writing Alternative Strategies” we address both initial trade structuring and exit strategy arsenal in chapters 16 and 19. We also have a PMCC Calculator to assist in trade decisions.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Where is whatnow and unwindnow tabs.?

Raghu,

The “What Now” tab is located in the Basic and Elite versions of the Ellman Calculator.

The “Unwind Now” tab is located in the Elite Covered Call Writing Calculator only. The Elite version is available for free to premium members (“resources/downloads” section) or for purchase in the BCI store.

Alan