Mario was generous in sharing his covered call writing trades with SPDR S&P Biotech ETF (NYSE: XBI). The trades were executed over a 2-month time-frame, the last of which was a 4-day Weekly option.

Mario’s trades with XBI

- 4/17/2019: Buy XBI at $84.95

- 4/17/2019 – 6/2019: Sell calls and “hit doubles” to lower cost-basis (breakeven) to $81.93

- 6/18/2019: Current share price is $86.92

- 6/18/2019: Sell 6/21/2019, 4-day $87.00 call at $0.89 (after commissions)

4-day returns on the Weekly option

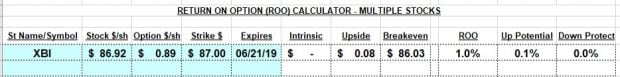

XBI: Calculation Results with the Ellman Calculator

The Ellman Calculator reflects a 4-day 1% initial time value return with a possible additional 0.1% return on share appreciation. This annualizes to 100.4%.

The big picture

- After the sale of the Weekly option, the new breakeven point is $81.04 ($81.93 – $0.89)

- If share price remains the same and the option is not exercised, unrealized share profit is $5.88 ($86.92 – $81.04) = +6.92%

- If the option is exercised and shares sold at $87.00, the total 2-month gain is realized at 7.01% which annualizes to 42%

Discussion

Covered call writing is a cash-generating strategy that can be viewed from a short-term option-selling perspective and a longer-term overall perspective. As option-sellers we must focus on the former and factor in the latter when analyzing our long-term success with these conservative option-selling strategies.

***Many thanks to Mario for sharing his trades with our BCI community. These are critical to the education process and benefits us all.

HOLIDAY DISCOUNTS THROUGH DECEMBER 18th (EXPIRES WEDNESDAY):

Stock Investing For Students Book: $5 discount:

discount code: bcis5

*** Great gift for those not near retirement

———

COVERED CALL WRITING ONLINE STREAMING DVD PACKAGE: $25 off:

discount code: bcic25

*** The most comprehensive covered call writing program found anywhere

Money Answers Radio Program: Replay of Alan’s interview

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Dear Alan Ellman,

Keep up the good work. This is the best site on the web. Thank you for all the information and continuous training you provide

Merry Christmas!

Nicholas A

Upcoming events

1. February 6th – 9th 2020 Orlando Money Show

3- Hour Masters Class Saturday February 8th 1:45 – 4:45 PM

BOOTH 306

2. Tuesday March 10, 2020 Long Island Stock Traders Meetup Group

7 PM – 9 PM

Plainview- Old Bethpage Public Library

Covered Call Writing Blue-Chip Stocks to Create a Free Portfolio of Large Tech Companies

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 8 of our mid-week ETF reports.

*********************************************************************************************************************

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 12/13/19.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The Blue Collar Investor Team

[email protected]

Alan, Barry,

I am a new member and studying all the information in the stock report that came out last night. One thing I am not clear about is why you include stocks with an “N” in the OI column meaning it lacks enough option liquidity. Thanks for providing such a huge amount of information helping us retail investors to achieve higher returns.

Stan

Hi Stan,

The Open Interest is as of the close on Friday. In the typical month, the OI is constantly changing, so it may be OK during the next trading week. In addition, there are many reasons that a subscriber will trade a particular stock and we want to provide the most up to date information available.

Best,

Barry

Hi Alan,

it’s me again with another question: I presume that volatility in the stock market, due to the flattening of the treasury yield curve, might be riding over the next months. What would that mean for our covered call writing?

Thanks for your attention.

Regards

Dietmar

Dietmar,

Concerns over inversion of the yield curve can definitely impact market volatility. We have all seen how the China trade deal has also resulted in a volatility roller-coaster ride. When it comes to market volatility there are a mosaic of factors that must be considered, yield curve being one of many.

I look at the CBOE Volatility Index (VIX), also known as the “investor fear gauge”. It normally is inversely related to the performance of the S&P 500 and is currently historically low (12.39).

I view a low VIX as a positive despite the fact that our premiums will be lower in a low-market volatility environment. We can still generate monthly 1% – 4% initial time-value returns and, at the same time, have less concerns of markets gap-downs.

When the VIX is low, it is one of the factors that motivates me to favor out-of-the-money call options. When accelerating, I favor in-the-money calls. Below is a screenshot I created last year highlighting this concept.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Thank you Alan.

According to some research I found in Germany at the end of bull markets, sometimes high volatility and a stock rally can go hand in hand. They mentioned amongst other examples 2008. If I am able to extrapolate the graph, I’ll send you a copy.

Regards

Dietmar

Alan,

Here’s the chart.

Thanks,

Dietmar

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Dietmar,

I respectfully disagree with the conclusion come to by the provider of the graph you generously shared. It clearly shows an exponential spike in the VIX which corresponds to the market crash from the latter part of 2008 through March 2009. Subsequently, the VIX fell to historic low levels which correlated with the extraordinary market increase we are still enjoying to this day.

Since, 2009, we see spikes and troughs in the VIX as it remained at low levels. I created a comparison chart which shows that when the VIX moved up, the S&P 500 declined (red arrows). There may be a few exceptions, but this is a generalization we can safely abide by.

To sum up: For the conservative option-selling strategies we use, a rising VIX is not our friend.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Premium members,

The Blue Chip Report of the best-performing Dow 30 stocks for the January 2020 contracts has been uploaded to your member site in the “resources/downloads” section (right side).

With the Dow 30 under-performing the S&P 500 lately, only 6 of the 30 Dow stocks currently meet system criteria.

Alan

Hi Alan,

Thanks for the information.

I have one contract with QQQ and was going to open a second contract but on your recent ETF report XBI is doing good and the option returns are better than the QQQ.

I can but 2 contracts for XBI will a less money than one contract for QQQ and the return is almost twice as much for a one month option.

I decided to leave the one QQQ contract as it is and instead of a second contract I will buy two with XBI more money!!!

On the ETF summary you specify if they have weekly options,

that’s for persons that would do weekly options but do you

prefer and advise more as it says on your books that the one

month options are better? Less commissions etc.

I read Marios Analyzing 4-Day and 2-Month Trades with XBI.

Thanks

Julio

Julio,

Here are a few points to consider regarding your inquiries:

1. A security that generates higher returns has higher implied volatility. We must be sure that meets our trading goals and personal risk-tolerance. For me, it’s 2% – 4% per month in normal market conditions for initial time-value profit.

2. I believe impressive returns can be generated with both Weeklys and Monthlys. My preference is Monthlys. Better liquidity and more opportunities for exit strategies are 2 of the reasons.

3. Commissions are less of a reason to favor Monthlys now that most online discount brokers have moved to $0 commissions for stocks and ETFs.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

Also included is the mid-week market tone at the end of the report.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Alan,

This has been a very good month for me having sold mostly out of the money options. With expiration tomorrow many of my options will expire in the money. My question is how do I know if I should roll the options when I won’t have your report until Saturday or Sunday?

Thanks a lot,

Marsha

Marsha,

We first check to make sure there is no upcoming earnings report during the January 2020 contract month. Assuming no report, we then check the calculations using the “What Now” tab of the Ellman Calculator to make sure the initial time-value returns meet our goal range. If both of these thresholds are met, rolling-out or out-and-up can be considered.

We do so with these 2 assumptions:

1. Stock fundamentals can change after earnings reports… not a factor if we are considering rolling.

2. Chart technicals are generally positive, at worst mixed, when share price is above the strike. Based on the chart, we can roll-out (more defensive) or out-and-up (more aggressive).

Glad to learn of your recent success.

Alan

Dear Marsha,

You are beautiful. Congrats with you successful trades.

I do not see any reason for you to roll.

When you roll, you are always losing in the spread to the market maker.

If you let your options to be assigned to you, you will make your deserved profit, and you can always enter again on monday.

There are two advantages : First, of all you will see where the market is headed on monday, and second, you will have the brand new BCI report to guide your decisions.

Last, but not least, if the stocks you traded in the last options cycle surpassed your OTM options, they may be ripe for a pull back..

Take care – Roni

Dear Friends,

Well, since tomorrow will be the last day of this thread and next week many will be away on Holiday I want to wish all a very Merry Holiday season with family and friends!

I participate on other blogs but there is none more respectful, smarter or kinder than this one. Alan, Barry and each of you have created a warm community. I thank everyone for how much I learn here every year! And I am an old buzzard who has been here a while: yet even old buzzards need to keep learning :)!

Kindest regards and best wishes to all for a happy and prosperous 2020! – Jay

Jay,

Thanks for your invaluable contributions to our blog over the years. Barry and I get all the credit but, in reality, it’s you, our members who have made the blog a beneficial learnings tool over the years.

Happy holidays to one and all,

Alan, Barry and the BCI team

Jay,

Thank you for your kind words. Happy holiday to you and your loved ones.

The BCI Team works to make sure that we can provide the best possible learning experiences.

Best,

Barry

Hi Alan

As i continue monitor my stock AXSM that i told you it gap up to 45.00 now it continue to gap up to 96.08 so my 32.50 strike price is very deep in the money. the cost to buy back of the call is now at 65.80. I don’t think I can buy back but I try to roll to March 20 2020 with net credit of .80 cent/share but it does not get fill. If I roll to same month on different strike price. like 40 I will get net debit of 7.30 and I think it will get fill. If you are in this situation, what should you do.

Thanks

Quan

Quan,

As I recall, your option expires on 1/17/20. Although early exercise is possible, it is rare and unlikely. Given the stats provided, of the $65.80 cost-to-close, $63.58 is intrinsic-value and will be negated by additional share value. That leaves $2.32 as the time-value cost-to-close. That’s a 7.1% cost (on a basis of $32.50, the original ITM strike). Can we generate more than 7.1% in a month by closing and moving to another stock? Probably not.

Rolling? Most of the time, we roll closer to expiration.

Alan