I recently published an article titled Managing Implied Volatility Risk by Establishing an Initial Time-Value Return Goal Range. This article served as a catalyst for several inquiries from our members asking if the BCI 20%/10% guidelines applied to high volatility securities in terms of the protection we receive from declining share values. This article will present a case that our 20%/10% guidelines do have broad application as a diverse group of implied volatility securities will be highlighted to show the relationship between IV and Delta.

Definitions

Implied volatility: This is a forecast of the underlying security’s volatility as implied by the option’s pricing in the marketplace. It is generally stated in 1-year terms and based on 1 standard deviation (accurate 68% of the time).

Delta (as defined for purposes of this article): This is the amount an option value will change for every $1.00 change in share value. The greater the chance of the strike expiring in-the-money (with intrinsic-value), the higher the Delta.

20%/10% guidelines: Sets up protocol as when to buy back the short calls and is based on the total option premium originally generated. We buy-to-close (BTC) when premium declines to 20% or lower of the original sales price in the 1st half of a contract and 10% or lower in the latter half of a contract.

Click here for other definitions of Delta

Technical reason the 20%/10% guidelines have broad application among a wide range of IV securities

High IV securities tend to have high Deltas resulting in a quicker movement to reach the 20%/10% thresholds. This is precisely what option-sellers want when highly risky securities are declining in value as it allows us to take more immediate action.

Securities to be evaluated

- Amplify Transformational Data Sharing ETF (NYSE: BLOK)- high implied volatility

- Vanguard High Dividend Yield Index ETF (NYSE: VYM)- low implied volatility

- SPDR S&P Oil & Gas Explore & Prod. ETF (NYSE: XOP)- moderate implied volatility

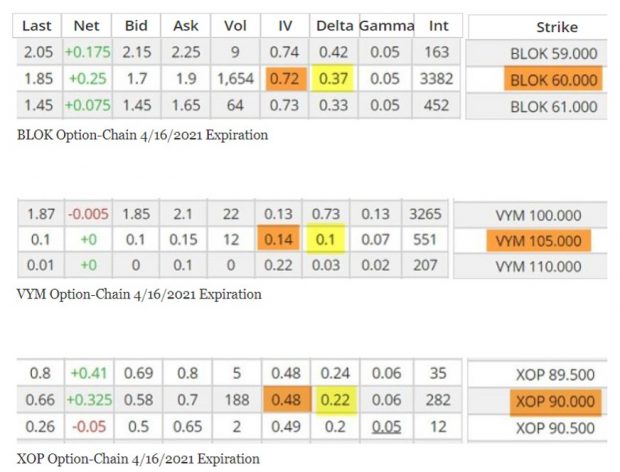

Option-chains for BLOK, VYM and XOP for similar out-of-the-money (OTM) strikes

3 Option Chains from www.cboe.com

- Brown cells on the far right indicate the OTM strike price

- The brown cells in the middle of the screenshots indicate the implied volatility ranging from 14% to 72%

- The yellow cells represent the Delta stats ranging from 0.1 to 0.72

Takeaways

Higher implied volatility securities tend to have higher Deltas and vice-versa. This will allow us to take more immediate action relating to our position management arsenal when share price of risky securities begin to decline in value.

A change in implied volatility should not be confused with these conclusions

A rise in the implied volatility of a call will decrease the Delta for an in-the-money option, because it has an increased probability of moving out-of-the-money, while for an out-of-the-money option, a higher implied volatility will increase the Delta, since it will have a greater probability of finishing in-the-money.

Discussion

Our 20%/10% guidelines have broad application among a wide variety of implied volatility securities. This relates to the fact that Delta plays a mitigating role.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Hi Alan,

I honestly believe of all the programs out there, yours is the best. I also appreciate the helpful emails.

Thanks again,

James C

Upcoming events

1- BCI-Only Webinar: Free Webinar Covered Call Writing and Selling Cash-Secured Puts

Covered Call Writing and Selling Cash-Secured Puts: 2 New Strategies Developed by BCI

The VOLQ-covered call strategy and Weekly 10-Delta Put-Selling strategy

August 19, 2021 (Thursday)

8 PM – 9:30 PM ET

- Here is the link to login on August 19th just prior to 8 PM ET:

https://us06web.zoom.us/j/81198595854?pwd=cHVvVmdhNUZkek9yNXZqbTZnSmpOQT09

- No pre-registration needed

- Our platform allows the first 500 attendees to access the webinar

To join our mailing list and receive our free newsletter go to our blog page

Subscribe to our Mailing List here

2- Mad Hedge Traders and Investors Summit: Free webinar

September 15, 2021

11 AM ET – 12 PM ET

Information and registration link to follow.

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 08/13/21.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them on The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

On the front page of the Weekly Stock Report, we now display the Top Performing ETFs, the Top SPDR Sector Funds, and the 4 single Inverse Index Funds. They are sorted using the 1-month performances from the Wednesday night ETF report and the prices from the weekend close.

Please make sure that you review the new feature that we’ve added…Implied Volatility or IV. This is the At The Money (ATM) Implied Volatility for all of the stocks in the report.

Since we are now in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The Blue Collar Investor Team

Hi Barry

I believe IV stats are from August 15th. Where do I find at the money IV stats for today? Looks like IV is up for all the equities.

Please make sure that you review the new feature that we’ve added…Implied Volatility or IV. This is the At The Money (ATM) Implied Volatility for all of the stocks in the report.

Delta & Greek Information

• https://www.cboe.com/delayed_quotes/

• Click on “I agree”

• Quotes Dashboard

• Enter ticker symbol & search

• Options

• IV, Delta, Gamma and Open interest will appear

Alan,

Do you have a rule when to close the short call if the price of the stock goes up way past the strike?

Thanks for providing us retail investors with these tools.

Thanks,

Warren

Warren,

Yes, it’s called the “mid-contract unwind exit strategy” (MCU exit strategy).

When share price moves up exponentially, we consider closing both legs of our covered call trades as the “time-value” component of the option approaches zero. As share price accelerates, time-value will decline although intrinsic-value will increase. The latter is neutralized by share value increase if we close the short call.

The guideline is to consider the MCU strategy if we can generate at least 1% more in a new position by the same contract expiration after closing both legs of the initial covered call trade.

For more information on MCU:

Complete Encyclopedia-classic: Pages 266 – 273

Complete Encyclopedia-Volume 2: Pages 243 – 252

Alan

I sold four contracts for 34.5 calls for Chemours, symbol CC, expiring Friday 8/13. Stock closed at 34.49 which is one cent out of the money. One contract was exercised anyway but not the other 3 contracts leaving 300 shares of stock. I find this strange.

Terry,

I have had that happen to me.

For retail investors, like us, the $0.01 rule for automatic execution will be enforced UNLESS the owner of the contract contacts his/her broker and tells them not to execute. This needs to be done before the bell for us.

However, market makers and professional traders can wait until 5:30 pm to make a decision to exercise or not. Those decisions can have various rationales. Primarily, though, it often is whether or not there is after the bell news that the market maker or trader believes will move the stock on Monday morning. If they believe the stock will fall they will not exercise the call but will usually exercise a put that is $0.01 ITM. Depending on what they feel may happen they may exercise a call or put that is OTM.

I have had both things happen to me. I had SHOP assigned to me at $0.50 OTM. It moved $6 the following Monday morning.

My take away is that I always close my short positions unless the position is a short call, is ITM, and I want it called.

I typically close my shorts no later than Tuesday of Expiration week, if not before.

On my CSPs I use a formula where if the percentage of max profit is greater than the percentage of days of the trade length I close the trade. For example if the trade starts with 30 days to expiration and after 14-15 days I have 65% of the max profit, I close the trade and move to another trade.

Hope this helps.

By the way, the closing info is just one guy’s opinion. 🙂

Hoyt

Terry,

I tried to find an explanation for what happened to your trade, and the only fact I noticed was that two minutes before the bell, the price was at 3.45, and then there was a short spike to 34.51 exactly at 4 o’clock.

Maybe there was not enough time to seal the deal for all of your calls?

Roni

Hi Alan

I have been trading options since last April and after reading your books. I use 20-40% of the capital to trade and save the remaining capital for option management or market correction/crashes. As we have such a long bull market which the valuation is at all time high, the market correction or even crash has been always on my mind. I came out fine during a few small market sell offs in the past 14 months, but never experienced 20-35% decline. I rolled out and down the short puts in the past small market sell offs and close out put positions occasionally. Nowadays, I earn good income from selling market Index or ETF iron condors (leg in) on SPY, SPX, QQQ, NQX, DIA, IWM, etc. I only sell spreads for defined risk.

I wonder the strategies you have used when caught in the market sharp downturn as the recent March 2020.

Thanks,

Lisa

Lisa,

Your timing is perfect. This Thursday, I will be hosting a free webinar where I will be discussing 2 ultra-low-risk option strategies I developed after March 2020. Here is the information:

BCI-Only Webinar: Free Webinar Covered Call Writing and Selling Cash-Secured Puts

Covered Call Writing and Selling Cash-Secured Puts: 2 New Strategies Developed by BCI

The VOLQ-covered call strategy and Weekly 10-Delta Put-Selling strategy

August 19, 2021 (Thursday)

8 PM – 9:30 PM ET

Here is the link to login on August 19th just prior to 8 PM ET:

https://us06web.zoom.us/j/81198595854?pwd=cHVvVmdhNUZkek9yNXZqbTZnSmpOQT09

No pre-registration needed

Our platform allows the first 500 attendees to access the webinar

Hope you can make it.

Alan

Hey Alan,

I’m going through your YT channel and also your paid courses and have a question for you.

Would the following trade make sense and what downsides are there to structuring something like this?

Buy 200 shares of AAPL at $149.10.

Sell 1 covered OTM $150 August 20 covered call for $1.08 in weekly premium. Do that 48 times a year for a total of $51.84 in premium (This is the premium showing on Yahoo on Sunday night. 5 days till expiry. So I’m assuming this $1.08 premium was probably more on Friday).

For the other 100 shares, don’t write calls at all but buy a put to protect the downside. For instance September 2023 $145 put costing us $23.10 in premium. Now our max downside for our cost basis for the second set of shares is only 2.8%.

We take in premium on a weekly basis writing near the money or slightly out of the money calls on the first 100 shares with a large downside of course and limited upside but great annualized premium.

This premium also more than covers 2 years worth of security that we are buying for the second set of shares. And also the second set of shares doesn’t have a cap in terms of appreciation. We take in large premiums plus have potential for big appreciation within those 2 years.

Is this completely dumb?

Really appreciate you taking the time to respond. Love your teachings so far!

Thanks,

Antonio

Antonio,

There is no such thing as “completely dumb” in our BCI community. Both of your strategy proposals are worthy of analysis.

Let’s start with this: These are 2 completely different strategies, neither of which is dependent on the other.

Selling weekly near-the-money calls on AAPL is reasonable and allows for a significant annualized return. We must factor in the possibility of adding additional cash to the position if an in-the-money option is exercised and we need to re-purchase AAPL at a higher price. As a strategy, it is perfectly fine.

The next, completely separate strategy proposed, is buying a stock and a protective put as well (married put). Nothing wrong with this approach either as long as we have a handle on our cost-basis and risk-reward profile. Our cost (breakeven) is $172.20 ($149.10 + $23.10) over 2 years and we have the right to sell AAPL at $145.00 so our potential maximum loss is $27.20 per-share worst case scenario (if AAPL drops below the $145.00 strike in 2 years). This is unlikely but possible.

There are so many ways to make money in the stock and option markets and you present 2 of them. Both have their pros and cons and once we have understood all factors, we will be guided to the appropriate decisions based on our trading style, personal risk-tolerance and strategy goals.

Alan

Alan….. hoping you will cover some or all of the following on Thursday:

Selling puts and calls seem to have the same ROI on many option charts. Over your years of experience, do you find you profit more with puts or calls? Why? Do market conditions influence your choice?

This answer may already be in the reports you have already given. If so, where would I find it?

Many thanks….. Pete

Pete,

Tomorrow’s webinar will focus in on ultra-conservative approaches to covered call writing and selling cash-secured puts. These are best for bear and volatile markets as we are taking defensive positions that still offer the opportunities for significant annualized returns.

I have a slight preference for covered call writing in normal-to-bull markets as it allows us to generate 2 income streams/trade when we utilize OTM strikes. The max return for puts is the put premium (exit strategies aside).

Market conditions do influence our decisions… one size does not fit all and crafting the strategies to “what’s happening today” will allow us to achieve the highest level of returns.

After tomorrow’s webinar, let me know if you need additional clarification.

Alan

Premium members:

This week’s 4-page report of top-performing ETFs and analysis of the top-performing Select Sector SPDRs has been uploaded to your premium site. One and three-month analysis are included in the report. Weekly performance has also been incorporated into the report although not part of the screening process. Weekly option availability and implied volatility stats are also incorporated.

The mid-week market tone is located on page 1 of the report.

New members check out our ongoing and never-ending training videos (“Ask Alan” and Blue Hour webinars). We add at least one new video each month. Only premium members have access to the entire library of these training tools.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Premium members,

The Blue Chip Report of eligible Dow 30 stocks for the September contracts has been added to the member site on the right side of the page.

Alan & the BCI Team

XLY double:

I “hit a double” with XLY today as the 10% BTC limit order was reached and then the stock rebounded. The original options were sold at $385.00 per-contract with a purchase price of $175.16. With the double, as of today, the 1-month return is 2.4%, 28.7% annualized for this conservative Select Sector SPDR.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Alan,

very nice.

Congrats – Roni

Hi Alan,

Great presentation. Can I get the formula to convert annualized IV to monthly and weekly?

Thanks!

Ashok

Ashok,

Sure:

To monthly: Divide IV by 3.46

To weekly: Divide IV by 7.21

General formula: IV/ [Square root of (365/days to expiration)]

Alan