Understanding option calculations is a necessary skill to become an elite covered call writer. The Ellman Calculator will do all the legwork but accurate and meaningful results are dependent on appropriate inputs. To highlight this point, let’s look at a real-life trade sent to me by Catherine who trades on the Toronto Stock Exchange:

Catherine’s trade

- Stock price at purchase of BNS (Bank of Nova Scotia) at $61.75

- Sell the $58.00 call at $2.10 (8 months to expiration)

- Current stock price $62.00

- Cost-to-close (buy back option) is $5.75

Why these stats make no sense

Let’s start with our basic premium equation:

Total premium = Intrinsic value + time value

Now, if the above stats are accurate, the $58.00 call generated $2.10 while BNS traded at $61.75 This cannot be because there is $3.75 intrinsic value + a time value component (with 8 months remaining to expiration) so a premium of $2.10 is impossible. I would expect a premium well over $5.00 depending on the implied volatility of BNS. I’ll bet most of you have figured this out. I checked back with Catherine and sure enough the shares were purchased at a $61.95 but the covered call was sold after share depreciation to $58.00. Let’s say Catherine bought BNS 10 years ago for $5.00 per share which has now appreciated to $58.00 and then the $58.00 call was sold for $2.10. Does that mean her return for the 8-months remaining is 42% using a $5.00 cost basis (hint: rhetorical question)?

What is our cost basis when we write a covered call?

Tax issues aside, our cost basis is the price of the shares at the time the call is sold. Although Catherine paid $61.95 for the shares initially, the day the call was written the shares were worth $58.00. Had she paid $30.00 initially, the shares would still be worth $58.00 for purposes of covered call calculations. We cannot cloud our calculations by using irrelevant figures that have nothing to do with current positions.

Initial returns using current cost basis

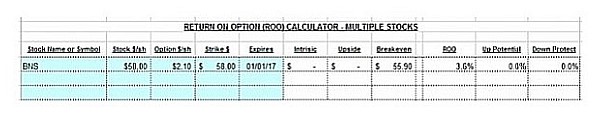

BNS Calculations with the Ellman Calculator

The Ellman Calculator shows an initial 8-month return of 3.6% and a breakeven of $55.90. This annualizes to 5.4% which doesn’t get me very excited. It does, however, demonstrate the value of accurate calculations which will guide us in making the best covered call writing decisions in a given point in time.

Buying back the option when share price is at $62.00

The cost-to-close (buy back the option) is $5.75 which will move share price from the original $58.00 strike ceiling to current market value of $62.00. We have a share price credit of $4.00 and an option debit of $5.75 resulting in a net loss of $1.75 or 3% of our real current cost basis. This may be something to consider to get out of this “deal” and start using the cash for more productive investment trades. Lesson learned.

Discussion

Although the Ellman Calculators (and others) do the heavy mathematical lifting for us, inputting accurate statistics will result in meaningful calculations which will go a long way in guiding us to appropriate trades that give us the greatest chance of achieving high levels of success.

Upcoming live events

September 23, 2016

3 PM – 4 PM

“All Stars of Option Trading”

CBOE (Chicago Board Options Exchange)

Chicago, Illinois

Link to follow

September 29th, 2016

9 PM ET

Blue Hour webinar 2: “Using Put Options to Buy and Sell Stock”

FREE to premium members and available for purchase to general members

Registration links and more information to follow

October 17th, 2016 (originally 10/24)

Austin, Texas

Registration link to follow

November 5, 2016

Plainview, New York

Saturday morning 3-hour workshop at the Plainview Holiday Inn. I am the only speaker and plan an information-packed presentation covering 5 actionable ways to make money or buy a stock at a discount using both call and put options. Discounted fee through 8/31/16.

Just added:

July 15, 2017

Washington DC

All-morning workshop with Dr. Eric Wish also speaking

Information to follow

Save the date: Our next Blue Hour webinar, FREE to all Premium Members, will be broadcast on 9/29/2016 at 9 PM ET. The topic is Using Put Options to Buy and Sell Stock. This a new presentation which will be presented for the first time on September 29th. Registration will open in a few weeks. You will receive notification.

Market tone

Global declined this week on growing concerns that the accommodative monetary policy has reached the limit of its effectiveness and interest rates will be increasing in the near-term. The Chicago Board Options Exchange Volatility Index (VIX) rose to 17.5 from 12.11 last week, most of the increase occurring on Friday. Crude oil prices advanced on the week, with West Texas Intermediate crude rising to $46.50 per barrel from $44.00. This week’s reports and international news of importance:

- The European Central Bank made no changes to its policy mix, defying market expectations that the ECB Governing Council would extend its bond buying program beyond its scheduled end date in March 2017

- The Reserve Bank of Australia and the Bank of Canada left policy unchanged, though the BOC warned that economic risks are tilted to the downside, suggesting that a cut in policy rates is possible later this year

- Despite market skepticism, several members of the US Federal Reserve Board members this week reiterated calls to hike rates gradually in the coming months

- The United Kingdom’s service sector purchasing managers’ index surged by the most on record in August, rising to 52.9 from 47.4 in July

- Last week, the UK’s manufacturing PMI rebounded sharply as well, suggesting that the UK economy will weather the Brexit event

- The US service sector performed less well in August, with the Institute for Supply Management’s nonmanufacturing index slumping to 51.4 from 55.5 in July. The August reading is the lowest since February 2010 but still reflecting expansion

- Retail sales in the eurozone jumped 1.1% in July and 2.9% on an annual basis. The solid showing in July pushed retail sales volumes above their prior 2008 top

- Chinese imports rose unexpectedly for the first time in nearly two years in August and exports fell less than feared, suggesting to some analysts that the worst of the Chinese economic slowdown may be behind us

- South Korean markets fell on Friday after North Korea conducted its fifth nuclear test. The Kospi benchmark fell 1.1

THE WEEK AHEAD

- EU finance ministers meet on Saturday, September 10th

- China reports retail sales and industrial production data for August on Tuesday, September 13th

- ECB president Mario Draghi speaks in Italy on Tuesday, September 13th

- The Swiss National Bank holds its quarterly rate setting meeting on Thursday, September 15th

- The Bank of England Monetary Policy Committee meets on Thursday, September 15th

- US retail sales data are reported on Thursday, September 15th

For the week, the S&P 500 declined by 2.39% for a year-to-date return of +4.10%.

Summary

IBD: Uptrend under pressure

GMI: 6/6- Buy signal since market close of July 1, 2016 (prior to Friday’s decline)

BCI: Friday’s 2+% market decline does not imply a trend and it is important not to react emotionally. It may turn out to be a smaller version of the Brexit decline and rapid recover. I am managing my September positions and will decide on a ratio for the October contracts as next week’s action dictates.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

Alan ([email protected])

Alan,

the BNS trade example is really strange.

OK, she bought the stock at 61.75, and after it drpped to 58.00 she sold the ATM call for 2.10. Why do that ?

Maybe she wanted to recover a part of her loss ?

Maybe she thought the stock would drop further and she would then buy back the call at a lower cost ?

Maybe she wanted to hold the stock for another 8 months ?

As you say, it really makes no sense.

But it highlights the risk of buying a stock and waiting for it to go up before placing the covered call sell order.

It is a 50/50 gamble.

I will always prefer the buy/write trade to protect my investment and permit the exit strategies at reduced loss if it turns bad.

Roni

Roni,

The aspect of the trade that made no sense was the calculation aspect until I realized that the call was sold after the shares were purchased and then declined in value. Once that was clarified, then the numbers made sense.

Now, the moneyness of the option sold and the length of the contract can be debated based on personal risk tolerance and goals. Those are all other issues that can be discussed.

I do agree with you that if shares are purchased for purposes of covered call writing, it is best to buy the shares and then immediately sell the option thereby capturing the premium that meets our goals.

I should add that I made these rules and guidelines after making these very same “mistakes” early on in my option-selling career.

Trades that don’t work out can be opportunities that allow us to become better investors.

Alan

Roni and Alan,

I certainly thank Catherine and others who have shared trades that did not work out as planned.

I learn much more from my many strike outs than I do my rare home runs. It’s easy to trot around the bases. Much tougher to pick yourself up and resolve to do better next time!

Fortunately with covered call writing you can not lose any more than any other investor, usually less, and the underlying stock/ETF is the driver not the sold call which is protection.

We have all the makings of an interesting market in this ever lively fasten your seat belts month known as September! – Jay

Hi Jay,

yes, you are right, generally we learn only from our mistakes.

September looks dangerous, and the Trump/Clinton election uncertainty will probably make October and November even more volitile.

I will be following Alan’s indication, selling ITM calls 2 to 1.

Good luck

Roni

Thank you Alan,

I feel reassured by your guidance.

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 09/09/16.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The Blue Collar Investor Team

After intense studying of your videos, I am still confused on exactly where & how to buy the option back during “exit strategies”. Understanding that my background is ONLY ever doing “straight ” options, I understand the 20 & 10% rule, but not exactly how to buy an option back. I really want to learn how to (master) trading Cover Calls.

Terrence,

There’s nothing like an example to clarify a question like this:

Let’s say we buy stock XYZ at $48 and sell the $50 call (sell-to-open or STO) and $2. The 20/10% guidelines tell us to buy back the option if the option premium drops to $0.40 or less in the first half of the contract or $0.20 or less in the latter half of the contract. To do so, we set a limit order at those prices under the dropdown “buy-to-close or BTC).

So to sell the option initially we STO and to buy back the option we BTC.

Alan

Alan,

I’ve been playing with Think or Swim’s PaperMoney to learn Covered Call Writing and have some questions with the following assumption: I’m purchasing stock from the Weekly Stock Screening specifically for covered call writing. They’re not stocks I particularly want to keep — in fact, their only purpose is for generating income with covered call writing. So with this in mind…

1. How often do you monitor your positions during exposure to the market before the exercise date?

2. If there’s a stock that’s dropping quickly in value before the exercise date, specifically below the break-even point, how long do you wait before dumping the stock, especially if it fails to pass the criteria for being on the current week’s stock screenings and is off of the running list? Do you set up a “good-til-cancelled” trade to sell the stock? Or is there another option strategy, other than covered call, you use for a stock like this to attempt to generate income or do you simply offload the stock?

3. I assume that if the stock is no longer on the running list, that you ought not keep it or continue using it for covered call writing — is this correct?

4. Regarding the “Risk/Rewards” ratings column on the Weekly Stock Screening, what do the numbers in that column signify?

Alan, thank you for all your help.

Joel

Joel,

My responses:

1- I monitor my positions at least once a day but a good deal of position management can be automated by placing good-til-cancel limit orders to buy back the options at the 20/10% guidelines. This information with examples is detailed in the exit strategy chapters of both Encyclopedias.

2- Selling a stock mid-contract is executed when the options have been re-purchased and the security is under-performing the overall market. For those looking for a specific guideline range, an 8-10% price decline is reasonable to sell the stock.

3- If a stock falls off our watch list when the next month contract begins, we know that there are stronger candidates available. If we decide to keep a stock that has been bumped from our watch lists, selling in-the-money strikes should be given strong consideration although using a security on the current list is generally a better approach.

4- The Scouter or risk/reward rating is an algorithm based on 10 years of historical data. The stocks are ranked 1-10, 10 being the best. We require a rating of 5 or higher. The higher the rating, the more likely a stock is to outperform the market over the next 6 months and with the least amount of volatility. This rating is currently not available to the public but we are receiving the stats from the developers of the algorithm and sharing in our premium reports. For those who are not members and therefore cannot access risk/reward rankings, if you use all other BCI screens, you will still have an outstanding watch list of option-selling candidates.

Alan

I like the BCI Summary of not reacting emotionally. Just stick to your rules and respond appropriately. With Friday’s decline no 20/10% was triggered for me so nothing was to be done. Now the market is gaining back again like was suggested as a possibility. It could change tomorrow who knows.

I like the non emotional level headed approach here. From time to time I peak my head in Stocktwits and that place is running rampant with emotions based on day to day action. Great to see the views everyone has here.

Alan:

Thank you so much for all of you and your team’s work and dedication. Each contract month, I feel like I keep learning more through experience about all the various skills related to Cash Secured Put and Covered Call Writing.

I have included a screenshot of the current option chain for TREX.

I purchased TREX for $59.75 and sold the 9/16 NTM 60-strike for $2.40.

Two things:

1) It seems that option volume is low (poor liquidity) for this security post-initial trade which makes me wonder if it’s worth continuing with this security (on that basis, but admittedly it’s a good diversifier for other portfolio positions).

2) I have two observations at this point (mid-contract)

a) I am neutral on this security. I feel like it’s in consolidation after a run-up and it may be a bit before it challenges the $65 strike.

b) It’s surprising, but it looks to me that if I were to roll this option now (at the market makers worst offers) that I would collect nearly the same credit for rolling-up-and-out as merely rolling forward when considering the “bought-up value”. Thus, my break-even point would be the same but the appreciation potential with the $65 strike would make that more appealing.

I’m really enjoying trading options, and I’m also extremely surprised at how fast things can compound.

Forgive the old information above. This was written on 9/1, but I neglected to send the message along.

As of this writing, the liquidity is all-but-gone so I will decide whether to just pay the MM ask to close out or ride it to expiration Friday. I do see some other good looking trades, so it may be worth closing. I’ll have to do the math for sure!

Geoff

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Geoff,

(This question was submitted before I left for California last week and just catching up with emails):

Poor liquidity is definitely a concern especially as it relates to exit strategy execution. After factoring in today’s price decline, you are at about a breakeven thanks to the option premium. As expiration approaches, the cost-to-close (if in-the-money) is mostly intrinsic value which is mitigating by share appreciation from near month strike to current market value.

Keep up the good work.

Alan

Alan, I have just a couple of questions I would like to over here:-

At the bottom of a past article you have stats that show there is interest in a report specifically geared to the Dow-30 blue chip stocks for option-selling strategies.

Do a lot of your current members now think that these are better stocks to use, than the IBD stocks you have always talked about and incorporated into each premium report?

– If by what someone in a past article said about the FED meetings over interest rates – being as risky to CC’s as to the selling of CC’s during an ER month, then wouldn’t it have been a good idea to buy put options on all positions if there is no reason to not sell CC’s?(I have put options on 2 ETF’s out of my 4 positions and it was just as well I had!)

– In that 3rd answer to ‘Joel’ above you say – “If we decide to keep a stock that has been bumped from our watch lists, selling in-the-money strikes should be given strong consideration”.

So for any Stocks/Etf’s I hold on expiry day that I am wanting to use again for the following month’s contract, then are you saying that I should check back over the last Premium report/Etf report to see whether I still see them listed, and if not to then sell ITM strikes over these Stocks/Etf’s I wanted to use again?

– For the above, how would the ETF’s become bumped off its list?- would they then have to be completely removed from those Top-3/Top-6 lists that are shown or go even further?

Well I thought that the stocks/etf’s off your watchlists do seem to perform quite well, rather than be in need of considering more other types. A lot of them have good chart trends and they also outperform the market on most occasions, which I do find is important to have in order to get a positive return. Thanks

John,

My responses:

1- We are fortunate to have a large membership that receive our premium reports. Most use our stock and ETF reports, some our high dividend yield reports and some have inquired about using only large cap (blue chip) companies. The added report is produced to accommodate the needs and trading style of those members.

2- Protective puts is definitely one approach to hedging against possible negative market news. See my response to Richard below.

3- If you have a stock in your portfolio that was on the previous eligible lists but not the current one, we usually will close that long stock position. If, however, we decide to keep that equity, selling in–the-money strikes is a prudent, safer approach.

4- ETFs get eliminated from our eligible reports when they are under-performing the S&P 500 over the past 3 months (main reason), have RS (relative strength) ratings under 60, have inadequate trading volume or have inadequate open interest.

The fact that some members prefer one list or another does not measure the importance of those lists but rather reflects the trading style of our large membership (I trade differently in my accounts than I do in my mother’s).

Alan

Dr. Ellman.

All of your BCI members know you try to avoid the stock-specific uncertainty surrounding an earnings report. My question is: how do you think BCI members should position their overall covered call portfolio ahead of the upcoming Federal Reserve meeting? The analogy I see is that the Fed meeting is a known event that could produce a “surprise” from whatever they decide to do (or not do) if it is not what “the market” is expecting. And that surprise could move the entire market instead of just a single stock.

This is a particularly important question because the Fed meeting is coming just a few days after monthly options expire. So, to the extent we have cash from assignments, should we wait until after the Fed meeting to reinvest it? And should we liquidate otherwise acceptable stock positions ahead of the Fed meeting in those cases where the monthly options expired out of the money? [My own portfolio is in a tax-advantaged account, but I suspect your answer will be a bit different if a taxable account is being used.]

Your thoughts?

Sincerely,

Richard

Richard,

Much depends on personal risk tolerance. There are 8 Fed meetings each year so basing our trading solely around Fed meetings would dramatically impact our trading capabilities. However, you bring out a valid concern as we have seen recent market volatility due to speculation of a September rate hike. It so happens that the September meeting falls within the first few days of the October contracts so we can keep some cash on the sidelines until after the meeting passes and still generate decent 1-month time value returns. Many meetings are not so favorably placed.

We know that rates will be increased at some point in time and probably this year and most likely by 25 basis points…that’s what all the fuss is about.

Our economy is performing well on a global outlook and corporate earnings are respectable. Could be better, agreed but not translatable into panic.

We can hedge with in-the-money strikes, protective puts, some cash on the sidelines (I was 1/3 cash pre-Brexit) or totally on the sidelines.

I plan to remain fully invested with a mix of in-the-money strikes. Those with higher or lower risk-tolerance can adjust accordingly.

Alan