When we enter our covered call trades, we make our stock and option selection based on our initial time-value return goal (2% – 4% for 1-month expirations in my case). If the strike moves deep in-the-money as share price accelerates, we may consider closing both legs of the trade or rolling the option out or out-and-up. Rolling options is generally reserved for scenarios close to 4 PM ET on expiration Friday. Mid-contract, we may consider the mid-contract unwind exit strategy where we close both legs and enter a completely new trade with a different underlying. On June 19, 2019, Mazin shared with me a trade he executed involving 25 contracts of Facebook, Inc. (NASDAQ: FB). This article will evaluate whether the time-value cost-to-close aligns with the initial time-value return goal.

Mazin’s trade

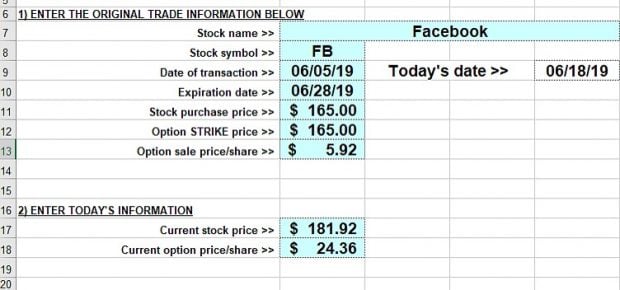

- 6/5/2019: FB trading at $165.00

- 6/5/2019: Sell-to-open the June 28, 2019 $165.00 call at $5.92

- 6/19/2019: FB trading at $181.92

- 6/19/2019: The $165.00 call has an ask price of $24.36

Initial trade construction using the multiple tab of the Ellman Calculator

FB: Initial Trade Calculations

The goal is to generate a 23-day return of 3.6% (ROO) with the understanding that there is no downside protection of that option initial profit (there is a breakeven at $159.08) and no opportunity for additional income resulting from share appreciation. That’s how the trade was constructed… period. Now, with FB trading at $181.92 and 9 days until contract expiration there is an excellent chance that the goal will be realized. The question that remains is whether it makes sense to close the trade or roll the option. Let’s turn to the “Unwind Now” tab of the Elite version of the Ellman Calculator to determine the time-value cost-to-close.

Elite Calculator data entry

FB: Entering Data into the “Unwind Now” Tab

Elite Calculator closing results

FB: Unwind Calculations

The spreadsheet shows a time-value cost-to-close of $744.00 per-contract which represents a 4.51% debit, greater than the initial time-value profit generated when the trade was constructed (3.6%). This makes no sense for either rolling the option or closing the entire position (both legs).

Discussion

In most situations, we reserve rolling in-the-money options as we approach contract expiration so that the time-value cost-to-close approaches zero. We also want the cost-to-close near zero when closing the entire position. In the case, 4.51% is way too expensive. The question we should pose to ourselves is this: Can we generate at least 1% more than the time-value cost-to-close by contract expiration? In this scenario, can we generate at least 5.51% in the next 9 days? Probably not.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

I’ll be in Orlando for the show. I want to shake your hand. I’ve been following you for two years. One of the smartest men in the industry. Your info is so helpful.

Rich D.

Upcoming events

1. Tuesday March 10, 2020 Long Island Stock Traders Meetup Group

7 PM – 9 PM

Plainview- Old Bethpage Public Library

Covered Call Writing Blue-Chip Stocks to Create a Free Portfolio of Large Tech Companies

2. Wednesday April 8, 2020 Options Industry Council (OIC) Free Webinar

4:30 ET

Covered call Writing to Generate Monthly Cash-Flow:

Option Basics and Practical Application

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 8 of our mid-week ETF reports.

*********************************************************************************************************************

Hi Alan,

I read the entire book “Selling Cash-Secured Puts” written by you.

I have a use case which has raised the following question:

1) Sell a cash-secured put of Microsoft (MSFT)

Today’s stock price: $184.66

Selling a OTM of 1 contract (100 shares)

Strike Price: $177.50

Expiration Date: 03/20/2020

Premium: $67 (for 100 shares)

As per your statement, the Put buyer has an option to exercise his right to close it from today to March 20th.

Now, stock prices fluctuate all through the day.

So, let us say on next Tuesday, it fluctuates to $176, will the stocks be automatically be assigned to the Put buyer (or) buyer will explicitly go and have to exercise his rights?

That is something i did not understand and was not able to see any relevant information around that (may be i missed it).

Can you please provide some insights?

Thank you

Murali

Murali,

The option buyer makes the exercise decision in the scenario you describe. Option buyers have rights… the right to exercise… not the obligation to exercise. Option-sellers (us) have obligations to buy or sell shares at the strike price by the expiration date.

Generally speaking, early exercise is rare. Option-buyers want to be option-sellers and aspire to be directionally correct. There are exceptions. I abide by the BCI 3% guideline when share value declines and put value accelerates.

Bottom line: Exercise decisions mid-contract are made by option-buyers and are not automated.

Alan

Thank you for the clarity

Hi Alan:

I have already been through the Covered Call Writing Package, and found it very helpful. I also went partially through the options course that is available with TD Ameritrade on their Think or Swim platform, and have placed a couple of paper trades.

I’m exploring how to place buy orders concurrent with selling the calls, which trigger when the option values hit 10% or 20% of the original purchase price, figuring that this will help organize the process. Sorry to keep bothering you on Saturday!

Thanks,

Michael

Michael,

This action can easily be automated. Once buying the stock and selling the option, immediately place a buy-to-close limit order based on the 20% guideline. Change to 10% mid-contract. Make sure the order is executed as a GTC (good until cancelled) as opposed to “day only”

Alan

Alan,

I’m sure someone must have already asked this question so sorry for the repetition….Now that trading is pretty much free in most brokerage accounts, what is your opinion of selling weekly options every week? I recall that one of the reasons you tell people not to trade weeklies every week is because profits will be eaten away by commissions. What say you now?

Thanks,Joanna

Joanna,

Yes, quadruple the trading commissions has been one of the disadvantages of Weeklys. That negative has been greatly reduced (still small commissions on the option side… non-events, in reality because they are so small). I still prefer Monthlys in most circumstances:

Greater pool of stocks with Monthlys compared to Weeklys

More exit strategy opportunities with Monthlys

Less rolling decisions with Monthlys

Frequently more option liquidity with Monthlys and therefore tighter bid-ask spreads and better price executions.

As an example (there are exceptions):

REGN now at $399.55

The $400.00 2/21 Monthly has a bid-ask spread of $0.40 with 675 contracts of open interest

The $400.00 2/28 Weekly has a bid-ask spread of $0.70 with open interest of 37 contracts

I do like Weeklys when seeking to avoid earnings reports and/ or ex-dividend dates.

Great returns can be obtained with both Monthlys and Weeklys.

Alan

Hi Alan,

I’m not sure what to do in the situation – attached – concerning Blackrock.

I’m not sure if it’s best to wait and get closer to the expiring date of 2/21 OR to simply BTC now as my strike is deep ITM. If the stock continues to rise, it will be more expensive to BTC and I’d rather keep the stock.

It goes without saying, I never expected it to rise this much so quickly!

Perhaps I should take your Puts course and learn the Collar strategy. Is that covered in your online video Puts course?

What would you do in this situation?

Thanks!

Lisa

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Lisa,

Generally, we look to roll options as close to 4 PM ET on expiration Friday as possible so that the time-value cost-to-close is approaching zero. It is currently 0.17% as shown in your screenshot.

The precise path to follow depends on the goals when the trade was first set up. The maximum return as structured is 11.1% (see screenshot) and that is realized and safe as long as share value remains above $550.00 so congratulations on a very successful trade.

Now, if BLK is in a non-sheltered account and of a low cost-basis such that its sale will result in negative tax issues, we roll the option. This is “portfolio overwriting” and we are forced to pay to buy up the value of the stock from the sold strike to current market value.

If that scenario is not in place, then we ask ourselves… would we buy this stock today. If yes, rolling makes sense. If not, allow assignment and move on with the cash generated from stock sale into another security.

Depending on the specific situation we find ourselves in will dictate the action or non-action best for our portfolio success.

The collar strategy is not related to this issue. Check out our book, “Covered call Writing Alternative Strategies”, to study portfolio overwriting. We also have a PO Calculator dedicated to this strategy.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Hi Alan,

I hope the show went well in Florida last week. I wish I could have made it. I have a quick question with a screenshot below.

I placed my first “buy/write” order. My question is regarding the limit order aspect. Rather than place the entire order as a market order, I placed it as a “net debit order.” The debit order placed at $43.15. The order placed but as you can see in the order with fill section I bought the stock for $44.33. That must be my cost basis. Did I execute this order correctly? How does the $43.15 limit price relate to the $44.33.

I am also exploring the “what now” portion of your calculator. I am guessing I should use the $44.33 as my purchase price.

Thanks always for any guidance and clarification you can offer.

Warm regards,

Patrick

Trade image

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Patrick,

You’re off to a great start. The screenshot below shows an initial time-value 36-day return of 2.7% with an additional 1.5% of upside potential. This represents a possible 4.2% return, 43% annualized.

The brokerage statement breaks down the stock price and option premium for our analysis. In this case, shares were purchased for $44.33 and the option sold for $1.18, resulting in the $43.15 net debit you indicated in your broker order.

When using our spreadsheets for management decisions, $43.15 is the figure entered for stock price.

Keep up the good work.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Hi Alan,

Thank you for your response and continued guidance. I am so enjoying this journey and I’m very grateful for you and the BCI system!

Warmest regards,

Patrick

I just now realized after re-reading your response that you can combine the ROO with upside potential to realize a total possible return! A lightbulb just lit up. Thank you!

Alan,

very timely article.

02/21/20 options cycle has been favorable for all my 9 positions, some went deep ITM like ADBE for example, and I was considering unwinding yesterday afternoon

But, as there are only 4 trading days left to expiry, and when calculating the trade return, I found out that I would have 10% less gain than expected to get by waiting till next Friday, I decided to wait.

Roni

Roni,

You made my day!

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 02/14/20.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The Blue Collar Investor Team

[email protected]

Thanks Barry,

We appreciate all you do.

Have you heard about Art Cashin? He was in an automobile accident on Thursday. His hip was broken and he underwent surgery. From what I read the surgery was a success.

I will never forget his story on the 1987 crash. “…those of us who are about to die, salute you.” I know you remember this and that is why I shared this with you.

Let’s keep Art in our prayers.

Hoyt T

Hey Alan,

Your erstwhile student continues to swim through the options markets. If I was a college student, I would be a second semester freshman. But I’ve been getting B’s and A’s. Mostly A’s. You teach well. However, I settled on what might be considered an unconventional set of strategies. But then again, they are not that unusual. My real problem? I’m not used to being this successful. — It gives the appearance that I am doing things right, but I worry that I could be doing things wrong.

I read that professionals using covered calls for their clients add around 5-6%/yr to the portfolio. I think that is 1/2% per month. That seems pretty low. I’m averaging at least 4%/month. I still need to do a thorough analysis of my trading history. It comes down to this: Sell covered calls on stocks I own, sell puts on stocks I don’t own. That’s it, and it has worked very well – so far. This works for stocks that are rising or trendless. I still have to master dealing with declining stocks.

I trade around a small set of stocks – AMRN, NVDA, AMD, BBBY and a few others. Then there is a subset of losers and oddballs. CHK, SWM, ARWR. I insist on holding on to a few shares of XOM and RDS.A. They pay pretty good dividends. Pretty much all them are down 5-15%. But I have been able to trade around them and get my money back plus some.

But when I look at all this, I don’t know what to think. Should I risk more? Is this approach sound? What are the flaws? At the end of the day, it is still about stock picking.

I would like get a critique from you on this simple trading strategy, and what I should work on next. Thanks, Prof.

Best,

Cort

Cort,

A 4% monthly return is amazing. I’ve only been able to accomplish this 2 – 3 times on an annualized basis over the past 20+ years of option-selling.

Financial advisors may use “portfolio overwriting” for their clients where only deep out-of-the-money calls are used to add 5% – 6% annualized returns over and above share appreciation and dividends. It’s a sound strategy for those looking for those returns and retaining shares as a key goal. I have written about this approach in our book, “Covered Call Writing Alternative Strategies” and created the BCI Portfolio Overwriting Calculator.

Therefore, writing calls on a portfolio of long-term stocks you own does align with this strategy., Congrats on your success doing so.

Next, selling puts to own a stock at a discount and subsequently (perhaps) write a call is precisely the “PCP Strategy” discussed in my book, “Selling Cash-Secured Puts” (pages 231 – 237).

The aspect of you portfolio management that you may want to reexamine is retaining shares that are losing 5% – 15% but generating decent dividends. Can outstanding returns become even more exceptional by adjusting this portion of the portfolio?

Continued success.

Alan

Hi Alan,

I had a session today with my wealth advisor and he mentioned possibility to trade warrants on portion of portfolio.

I looked warrants and it seems to me that they are same as options except:

– they are issued by company instead of traders

– company knows what is going on within company (insider knowledge?)

I assume you can not earn dividends on warrants unless you also own the stock.

Do you trade warrants? Pro Cons

Peter

Peter,

I do not trade warrants so I am not the appropriate resource to assist you in making this decision. Furthermore, we can buy call or put warrants but cannot sell-to-open and since I am on the sell-side of options, warrants do not meet my trading style needs.

That said, I do know the following about warrants:

1. They are issued by a company and do not trade on exchanges.

2. They represent a way a company can raise capital.

3. Like options, holders do not have voting rights and do not collect dividends.

4. Most are longer-term than options, over 10-year expirations in many cases.

5. Frequently tied to corporate bonds as a “sweetener” to accept lower rates.

6. Offer the leverage advantage similar to options.

7. They are not standardized as are options so terms must be understood for each warrant purchased.

Options and warrants are similar but certainly not the same. For options, I feel strongly that the 3-required skills must be mastered before risking our hard-earned money. The same due-diligence must be applied for those who want to endeavor into the world of warrants. I cannot offer that level of knowledge.

Alan

To our BCI community:

Yesterday, I accepted an invitation to speak at the Seattle Money Show June 12th – 13th. I’ll post details when they are finalized.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Hi Alan,

I am excited to note that i did sell two cash secured puts first time paper trade in ThinkorSwim and got both of them sold.

I will watch to see if this gets assigned/expired.

Based on the lessons learned here, i am planning to execute similar approach in my Vanguard portfolio after may be 3 months.

This will ensure i best understand the process end-to-end from a practical perspective.

Thanks

Murali

Murali,

Congratulations on paper-trading and going about the learning process in a rationale way that will help protect our hard-earned money. Once we select the underlying security and the option, we then must be prepared to take advantage of exit strategy opportunities should they present themselves.

Keep up the good work.

Alan

Yes, I sold 7 cash secured OTM monthly puts yesterday and made $575 in paper trade in one day.

Now I can understand how this can be translated to monthly income by also later selling covered calls on assigned puts.

I will keep you posted.