Inverse Exchange-Traded Funds (ETFs) use derivatives to bet against the direction of financial markets. These are known as short or bear ETFs and will make money if markets decline in value. They will lose money, however, if markets move against the bet. Covered call writers who have a bearish market outlook may find these funds useful. Inverse ETFs will UNDERPERFORM in normal market conditions. In extreme bear market environments, covered call writers and put-sellers may want to utilize these securities to generate income from both option sales and security appreciation.

Popular Inverse ETFs with adequate option liquidity (associated benchmark)

- PSQ: Short QQQ (Nasdaq-100)

- DOG: Short Dow 30 (DJIA)

- SH: Short S&P 500 (S&P 500)

- RWM: Short Russell 2000 (Russell 2000)

S&P 500 comparison chart (as of 1/20/2016)

Comparison Chart: S&P 500 vs. Inverse ETFs

Note that the inverse ETFs have appreciated in value over the past three months while the S&P 500 has declined by 8.5%.

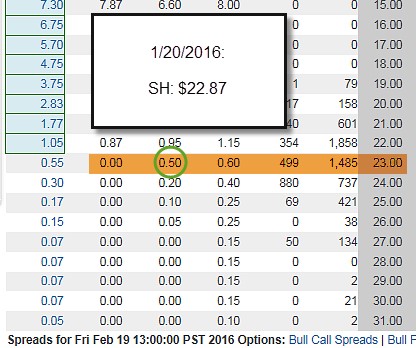

Covered call writing example: Options chain for SH (Short the S&P 500)

Options Chain for SH as of 1/20/2016

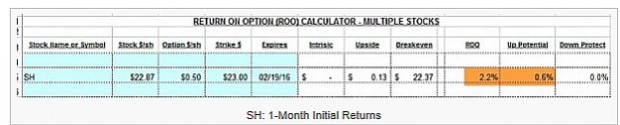

1-month calculations

Using the Basic Ellman Calculator, we see that initial 1-month returns calculate to 2.2% with a possibility of an additional 0.6% if share price moves to the $23.00 strike. This would result in a potential 2.8%, 1-month return. As always, we must be prepared with our exit strategies if a trade turns against us.

***For a FREE copy of the Basic Ellman Calculator, click on the “Free Resources” link on the top black bar of these web pages.

Earnings season

As we enter another earnings season, exchange-traded funds (including inverse ETFs) offer the advantage of not managing earnings reports since ETFs are baskets of stocks with some having positive and others negative results.

Discussion

Inverse ETFs are securities available to us when selling options. They are most appropriate in extreme bear market environments as they will allow us to generate both option profit and share appreciate as markets decline. We must be prepared with our exit strategy arsenal and have the flexibility to change to more conventional securities when markets turn positive. Historically, markets go up.

Option Greeks: New product now available (for $0.99)

In the BCI store:

Amazon kindle:

http://www.amazon.com/dp/B01AZG08UU

***Free to PremiumMembers

Upcoming live appearance

New York Stock Traders Expo

February 21st – 23rd

Marriott Marquis Hotel, NYC

http://www.newyorktradersexpo.com/expert-details.asp?speakerID=891071A

JUST ADDED: I was recently interviewed by the Options Industry Council (OIC) Radio Network and will be provided with a free link to share with our members. Keep an eye on this site for that link. I will also be part of an OIC Panel Discussion on Tuesday January 26, 2016 and will get you that link as well once I receive it from the OIC.

Market tone

Global markets rebounded towards the end of the week as comments from European Central Bank President Mario Draghi suggested further action to boost inflation toward the ECB’s target rate. Comments from Chinese and Japanese policymakers also hinted at further action. Market volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX) declined to 23.5 after a spike above 32 earlier in the week. Crude oil prices were also elevated slightly at the end of the week. This week’s reports:

- Oil recovered late in the week on hopes of additional monetary and fiscal stimulus from Europe, Japan and China and less aggressive Fed tightening

- New applications for unemployment benefits rose to 293,000 in the week ending January 16th

- The US Consumer Price Index fell 0.1% in December

- For all of 2015, prices rose 0.7%, according to the US Department of Labor

- Sluggish inflation measures call into question the need for additional Fed rate hikes.

For the week, the S&P 500 rose by 1.41% for a year-to-date return of – 6.70%.

Summary

IBD: Market in correction

GMI: 0/6- Sell signal since market close of December 10, 2015

BCI: 1/3 of my stock investment portfolio remains in cash short-term. Favoring only deep out-of-the-money puts and in-the-money calls on active positions. Although an up week is welcome news, one week does not confirm a bottom so caution remains a focus in my current investment portfolio. With earnings season heating up, I expect a more positive market short-term. Plan to get more aggressive when markets calm.

Best regards,

Alan ([email protected])

Alan,

I am always impressed by the timeliness of your posts. I had been thinking about using the inverse ETF’s if we are indeed in a bear market. Or even just in an off year less than the 20% decline that triggers the bear label..

So I dipped my toe into this tactic at the close yesterday buying a small QID position (2X Nasdaq short) and selling a couple call contracts against half of it for February for the usual reasons: income/loss protection/incremental gain.

My over night second thoughts are that I bought the position on a dip instead of strength (we need to turn our thinking caps around with the inverse ETF’s – big up days are “dips”). What is to say Tech earnings coming out next week, a Fed statement and a possible continuation of the oil rally will not make this a pretty ending to an ugly month?

So I likely should have waited for this week to play out. If we do get more down side next week, as I suspect, and QID takes off I will buy back the contracts at a small loss to let QID run. If the bull breaks through the next levels of resistance I will unwind the position at a bigger loss loss but keep the premium as consolation prize! A fun game as always…. Jay

Hi Jay,

Oil rally seems very unlikely to me, but the market is always a “little box of surprises”, so…….

Regards – Roni

Hey Roni,

I am writing with no idea how today’s games turn out. I would love a Broncos – Carolina Super Bowl where Peyton Manning wins and rides off into the sunset!

In my market reading this weekend I plotted oil (USO) against the S&P to better see their correlation. All asset classes crashed in harmony during the ’08/09 collapse. In retrospect cash was the only place to hide.

Thereafter oil found a comfortable level, the Fed stepped in and the bull was born. Oil started falling last summer as did the S&P. The Fed had ended QE on the threshold of a rate hike. This year the correlation is joined at the hip.

How do we trade it? I wish I knew. The easy supposition is the market will not find an investment worthy bottom until oil stabilizes. OK, Einstein, at what price? Again I wish I knew. Fourty seems reasonable. Fifty would be better. I fear a default contagion if we do not get higher than the present.

So the simple tactics now suggest sell up days to build cash. Buy Treasuries and inverse ETF’s. Sell ITM calls on core holdings. The usual bear market prescription.

I look for recovery of 50 day moving averages before I will feel comfortable buying new long stock positions.

Anyway, thanks for listening, Roni. Go Broncos! – Jay

Hello Jay,

sorry for delay, I was away a few days.

You got your wish with the Broncos win. Congrats and cheers. 🙂

Your market appraisal is wonderful.

Your expertise is far beyond my present trading knowledge, therefore it is very valuable to me.

Please remember that I live in Brazil, where almost nobody trades in the American market, and I have nobody to help me.

My friends and aquaintances don’t know anything about the subject, and I cannot even have a conversation with them about this.

Best of luck – Roni

OOPS, double type of “loss” in last sentence

Thanks Kansas City:

For filling room beyond our greatest expectations…great meeting you.

Click on image to enlarge and use back arrow to return to blog

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 01/22/16.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article,

“Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

Our flight back to NY was cancelled due to the snow storm. We expect to return later Monday. All books and DVDs ordered over the weekend will be shipped first thing Tuesday morning and I will catch up with emails during the week. Kansas City is a nice place to spend an extra day!

Alan

That’s an interesting play. I think it would be a strange animal as I don’t think anyone would want to short the market for too terribly long. I’ve personally played volatility (on both sides depending on the day) using ETFs this year, and have generally assumed a defensive posture on my longs since late in the year seeing many bad signals in October. However, most of those positions I don’t want to hold overnight because the risk is too great (for my tastes). And, knowing that volatility doesn’t go up indefinitely but tends to trend backwards doesn’t make me stay long in that, either.

Geoff,

Poignant comment as always.

I feel like a thief in the night making money short. It is tough to do. Corrections are swift. I usually get the timing wrong.

But at the risk of using the tattered expression “This time is different” it may be. QE is over. Interest rates have been raised. The world is a dangerous place. Sarah Palin got her “Drill, baby, drill” wish. The market is paying for all of that.

We could be in for a tough year. In that case the tactics in Alan’s note above will work.

Don’t buy anything until you hear market friends say “I went to cash”. Then you will know the bottom is in :)! – Jay

TUESDAY 1/26/2016 4:30 PM ET-

Panel discussion with experts from the Options Industry Council + Alan: To register:

https://event.on24.com/eventRegistration/EventLobbyServlet?target=reg20.jsp&referrer=&eventid=1117640&sessionid=1&key=00D55526FF16A93303F01C1272CBBBE4®Tag=&sourcepage=register

Hi Alan,

I am a new member and learning. Nearly done with your first book and bought two more that are on the way to me. I am excited!

Question: from the weekly report 1/15 I bought 100 shrs of CHUY at 34.40 and sold the 35C for 1.35. I see CHUY failed current weekly report criteria and was removed from the Running List. I am unclear as to what to do with a previously passed stock that is removed from the running list. Have you covered this in one of the Ask Alan’s (#)? Do I just monitor the stock price and unwind everything if the net trade goes negative?

Thanks for any guidance you can share,

Bob

Hi Bob,

Once a position is entered, it is managed as detailed in my books and DVDs NOT based on getting “bumped” from the current report. Stocks do whipsaw and perhaps this one may re-appear in the next weekly report.

Alan

Alan,

First Class job on the panel discussion today! Thanks for alerting me to it. – Jay

Thanks Jay. I enjoyed working with the experts from the OIC and CBOE. The feedback from our members was positive for both the webinar itself and the notification.

Alan

Alan, I was still waiting for your replies to last questions I had.

First for your answer to my Qu.1, you say:- “I use a comparison chart of the stock and the S&P 500 (3-month) and sell if the stock is significantly under-performing.”

But on a previous article titled “When do we sell our covered call writing stocks”(24/1/15), you are using a 1-month chart for 4 stocks. So why use a 3-month chart?, I am talking about during the month so is this different compared to end of month price performance comparisons?(1-month actually seemed better.)

2. I ask again, those stocks that have larger strike price gaps(like $5), will they have less liquidity than another stock with a smaller price gap(like $1)?

3. On ‘Earningswhisper.com’ there is a predicted short, medium,

and long-term trend for each stock. I am wondering what you think of this prediction, and is this something we should use, so to be made aware of the stocks likely trend,- or maybe for not even buying a stock at all,- if short-term trend was forecast to be down?

4. If using weekly options up to an ER date, then is it still not a good idea to rollout and down the option each week?

5. Finally for the stocks I see on recent report that reported ER’s that are not in the 1st contract week, then if they don’t have weeklies then I don’t understand why these are even listed?

No need now for me to ask you about ‘waiting for market volatility to go’ as for now I found some Etf’s to try out. Hope these workout.

Thanks again for your time.

Adrian,

1- A 3-month chart does include the latest month…gives a bit more perspective as to what transpired prior to the current month but the most recent month is of utmost importance. The information we need is in both…your choice.

2- Generally, options with $1 increments are more heavily traded and more popular so I would say it’s fair to assume the liquidity is greater for these options than those with $5 increments only. There are exceptions to this rule. For example, ETFs have $1 increments and if you look below at the options chain for EWL, a Swiss ETF, you will see almost no liquidity.

3- I do not use this resource. I use exponential moving averages, MACD Histogram, Stochastic oscillator and volume. I encourage our members to use whichever technical parameters they are comfortable with. My way isn’t the only way.

Will get back to you on 4 and 5.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Adrian,

4- Rolling out-and-down with Weeklies in the same contract month is the same thing as rolling down with Monthlys in the same contract month so I would consider it. The question we must evaluate is the security initially selected as an option-selling candidate still our best choice for investing the cash currently in that stock or ETF. Also, if the share price is declining and is below the strike, rolling may not be necessary as expiration approaches. Just allow the option to expire worthless and write another call the following week.

5- There are two primary reasons we display great-performers even though they have ERs in the current month and do not have Weeklys associated withy them: First, we have many members who use our reports to buy and sell stock in accounts not related to options and second members may decide to hold stock already in their option portfolios and write calls after the report passes and want to evaluate whether these shares still meet our rigorous system criteria.

Alan

Alan,

I missed yesterday’s webinar with the oic as I was at work. Is it available online?

Hope so.

Ruth

Ruth,

Yes, the options industry Council did archive the presentation on its site and will be available on its Youtube channel as well. here’s the link:

http://event.on24.com/wcc/r/1117640/00D55526FF16A93303F01C1272CBBBE4

Alan

Members,

I returned very late on Monday from a seminar presentation in Kansas City. Our airline flight was cancelled on Sunday and delayed on Monday. Yesterday I participated in a panel discussion with educators from the OIC and CBOE. I should be all caught up responding to emails by the weekend.

All books and DVDs ordered have been shipped and the Premium ETF Report will be published to the member site this evening.

Alan

So I have a subscription to eIBD for 3 weeks now. Been making my watch list…there are a couple that show some promise. QUESTION: At what point is “watching” turned into “trading”… actually pulling the trigger and making the trade? What’s the tipping point ?

Billy

Billy,

Here’s the plan:

1- We must educate ourselves in all 3 required skills for option-selling. These are stock selection, option selection and position management.

2- Paper-trading (practicing with a hypothetical account similar in size to what you envision when starting for real).

3- Years and decades to generate cash selling options.

Step 3 should be initiated conservatively and with a lower cash amount than you ultimately foresee. As your skill level increases so will your confidence and then there will be no stopping you!

Alan

Hey Billy,

I love eIBD and find it a great resource. One thing I caution you on is do not take their market flag indicators very seriously in your trading. They change frequently, have time lag and I have found them wrong at least as often as right. Use them as a data point along with others. – Jay

Alan,

We are still pretty snowed in, so there is enough time to study your weekly and run a few tests.

First of all, the calculator is really helpful and a great tool! I just love it.

In the current weekly you mention that you are focusing on deep–in-the-money covered calls. I did plug in the new stocks into the calculator and I am not sure if I am doing something wrong.

Let me give you an example: ITC:

All in the money CCs have a negative return. This is even worse using the deep-in-the-money strike prices.

Am I doing something wrong here? Is this normal? What am I doing wrong here?

Thank you so much for your help & support.

Regards

Rainer

Rainer,

You’re doing nothing wrong. As a matter of fact, you’re doing great the way you are approaching this. With 3 weeks and 2 trading days left to expiration, Theta is eroding the time value of our premiums. The deeper ITM we go, the lower the time value. When we see the intrinsic value (amount strike is ITM) near the total premium amount, we know that strike will not work so we must continue to explore. CHUY was on our premium list last week…let’s have a look as of this post:

CHUY trading at $36.03

The February 19, 2016 $35 ITM call generates a bid of $1.85

ROO = 2.3%

Protection of profit = 2.9%

Breakeven = $34.18

This is not necessarily a recommendation but it is an example of an ITM strike generating acceptable and significant returns.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Premium members:

This week’s 7-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

If you missed my appearance with experts from the Options Industry Council, here is the free link (signup and you’re in):

http://event.on24.com/wcc/r/1117640/00D55526FF16A93303F01C1272CBBBE4

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

I have just one question I don’t see answered

How far forward should I go on covered call selling

We are 3 weeks from expiration

3 weeks 7 weeks or 12 weeks

I seems to me 7 would be the best What do you recommend

GC,

There is no one right answer to this question but I can tell you that my personal preference is to stay with the confines of the current contract, currently the February Monthlys. If I were entering a position today, I would check for returns from my watch list for the February 19th expiration. I don’t like to take a longer-term obligation into the next contract month. If I can generate an initial return of 1 1/2 – 2% for 3 weeks, I’m happy. If we do go into the March contracts, it is important to check for earnings report dates.

I am frequently asked about entering the next month contract in the final week of the near-month contract. Because time value erosion (Theta) is logarithmic in nature (starts off slowly and picks up steam as expiration approaches), I prefer to wait until the near-month contract expires in that we will lose very little time value and incur less risk.

Alan

Hi I know you have discussed this in your book but I been trying to go back to your books and I cant seem to find it again. Some stocks have a high profit than other stocks. For example NFLX if its a 10% in the money covered call I can still earn around 2% profit while some stocks a 10% in the money can only let you earn 0.2%. Whats factor causes that? is it IV%? beta? Can you help me out so that I can quickly identify which stocks I should avoid or becareful off thanks.

Kind Regards,

John

John,

This is such an important concept to master as covered call writers or put-sellers. The time value component of our premiums is impacted by time to expiration and the implied volatility of the underlying security. Assuming we are comparing options with similar expiration dates, it’s all about the volatility. In essence, we are selling volatility.

The takeaway: The higher the time value, the greater the premium but also the higher the risk.

Alan

Alan,

On confirming your 2nd answer, the options with higher strike price gaps such as $5 so these would be riskier to hold, because if price goes down then the liquidity may reduce so much that I may not be able to rolldown or close-out a position.

Wasn’t this what you meant by once saying to constantly check about closing a position? (maybe it’s best for me to include a scan of stocks with strike gaps no greater than $2.50, what do you even think of that?, noticeably most of my papertrade losses have been from those stocks with $5 strike gaps too.)

– I had Qu’s 4 and 5 whenever you want to reply? Thanks

Adrian,

$5 strike increments have always been the “norm” However, because of the huge popularity of options, additional products like Weeklys, Quarterlys, Minis and smaller strike increments have been added and continue to be added. Our guideline remains open interest (OI) of 100 contracts or more and/or a bid-ask spread of $0.30 or less. Also, be sure to leverage the “Show or Fill Rule” to negotiate the best prices with market makers (see pages 225 227 of the Complete Encyclopedia classic and pages 122-124 of the Complete Encyclopedia Volume 2).

Alan