Selling cash-secured puts is a strategy similar to, but not precisely the same, as covered call writing. In February 2020, Chevy wrote to me asking for an article or video addressing weekly cash-secured puts, a strategy he was using and looking to enhance.

The 3-required skills

Whether we are selling calls or puts and whether they are Weeklys, Monthlys or other time-frames, we must master the 3-required skills:

- Stock selection

- Option selection

- Position management

Given this uncompromising rule, we must then develop a strategy that uses this skill set specifically for puts with weekly expirations.

Determine our goals

When writing covered calls or selling cash-secured puts in normal market conditions, my initial time-value return goal range is 2% – 4% for my monthly option positions. Let’s take that range and convert to weekly positions. Our weekly initial time-value goals range becomes 0.5% – 1%. These stats can be crafted to meet the goals of each investor depending on several factors including personal risk-tolerance… one size does not fit all.

Real-life example with Square, Inc. (NYSE: SQ)

On February 10, 2020, SQ was an eligible stock on our premium stock watch list and trading at $80.28. This means it met the fundamental, technical and common-sense requirements of the BCI methodology.

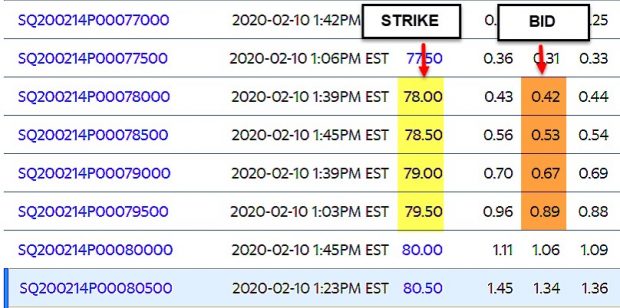

Put option chain for SQ 1-week expirations on 2/10/2020

With SQ trading at $80.28, we will look to OTM puts (our focus in the BCI methodology) that return 0.5% – 1.0%. The yellow column shows the strikes to be evaluated and the brown column highlights the bid prices. Let’s take this information and enter these stats into the BCI Put Calculator.

SQ put calculations

The red arrow shows 1-week returns ranging from 0.54% ($78.00 strike) to 1.13% ($79.50 strike). If we are bearish on the overall market, we are more likely to use the additional downside protection of the $78.00 strike. If we lean bullish, we are likely to favor the $79.50 which offers a greater initial time-value return (ROO). All 4 strikes do meet (or are very close) our initial time-value return goal range.

Discussion

As with all forms of option-selling, selling weekly cash-secured puts requires mastering the 3-required skills. Generally, we favor OTM puts and must first establish our initial time-value return goal range. Once our trades are entered, we move immediately to position management mode.

More information on selling cash-secured puts

Investment club program board members

If you would like to schedule a private webinar with Alan and Barry, send an email to:

Include:

- Contact email

- Contact phone #

- Club website URL

- Put “private webinar” in the header

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

I loved your BCI Zoom presentation last evening! You did a very nice job. Thanks.

I am working with a guy from Forbes on option picks. I told him that I know you. He replied “Alan is the smartest guy in the business” Nice compliment!

Best to you,

John

Upcoming event

1: Private webinar (California investment club)

Covered Call Writing with 4 Practical Applications

Saturday September 17th

9 AM – 12PM PT

2: Money Show Virtual Event

Master Class (2-hour)

Creating a Covered Call Writing Portfolio Start to Finish

I am invited speaker for this event. The Money Show charges a fee to attend ($139)

September 16, 2020

3:45 – 5:45 ET

3: Free webinar for entire BCI community

The feedback from our August 13th webinar was so positive, the BCI team decided to schedule another in the fall. I have written over 50 webinars over the years and will select one or write another based on your feedback regarding the topics you are most interested in. Send your ideas to: [email protected]. We will publish the topic, date and time in the near future.

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 1 of our mid-week ETF reports.

****************************************************************************************************************

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 08/28/20.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

On the front page of the Weekly Stock Report, we now display the Top 10 ETFs, the Top 3 SPDR Sector Funds, and the 4 single Inverse Index Funds. They are sorted using the 1-month performances from the Wednesday night ETF report and the prices from the weekend close.

Best,

Barry and The Blue Collar Investor Team

[email protected]

Hi Alan,

Starting to have good success with the PMCC approach and looking for a clarification plz.

After I’ve set up the initial trade (buy a LEAP and sell a Call) and confirmed it will be profitable if I have to close the entire position (Initial Trade Profit Calculation), should future short calls sold against the LEAP, and short call Rolls, also have to meet this requirement?

I’m assuming “yes” because we want every future trade to be profitable like the initial trade but needed to confirm with you to be sure.

Thank you sir….

Dan

Dan,

Kudos to you for doing your due-diligence learning all the “moving parts” related to the PMCC strategy. There is so much more to this strategy than “covered call writing but cheaper”

The initial structuring formula applies to the very first trade we make for the PMCC strategy. It assures that if share price moves up substantially, requiring us to close both legs of the trade, they are closed at a profit.

Traditionally, when we use the PMCC strategy, we are making a long-term commitment. Certainly, we always have the right to close both legs if our bullish assumption has dramatically changed.

Once the trade is entered, we move to position-management mode. I suggest studying pages 149 – 164 in our book, “Covered Call Writing Alternative Strategies” Also, review Appendix VII pages 191 – 201 for a review of the exit strategy tabs on the BCI PMCC Calculator. If you have access to our online DVD PMCC program, there is a large section on position management.

We must master management of:

Short call-current month

Short call- next month

Rolling LEAPS

Closing early

To sum up:

Use the initial structuring formula to enter the trade and then management of trades if and when indicated.

Alan

Alan,

I hope this e-mail finds you well. I have two questions about cash secured puts.

In the second half of the contract period if your 10% guideline is met and you are able to profitably close out your position how do you decide whether to roll into the next monthly contract period (with an different security) as opposed to using the same cash to secure a different put in the same/current monthly contract period. In my case I had 4 days left in the monthly contract period and It was difficult to find an attractive (decent premium) put in the same contract period with so little time left till expiration.

In your book (selling cash secured puts) you outline the 3% guideline (Underline security price falls below the strike sold by more than 3%). If your very bullish on a stock and you allow yourself to sell a put paying a 6% monthly premium, do you then adjust your downside protection guideline to match the 6% premium that you brought in or do you maintain the downside at 3% despite the increased upside. Should the down side always mirror the upside? 3, 4, 5, or 6%?

I have to tell you that I have a deep respect and appreciation for what you do. I have never experienced anyone who can explain options in such an effective and comprehensive manner. Although I have been aware of option selling for quite some time I never had any lasting success, but now that I have found your program I can see glimmers of consistency in my profits and it is giving me hope for the future.

Thank you for your time,

Tony

Tony,

Thank you for your generous remarks.

My responses:

1. Before executing the 20%/10% guidelines for cash-secured puts (different from the 20%/10% guidelines for covered call writing), we check to make sure that after closing, we can enter a new trade (and 2nd income stream in the same contract month) that will generate about 1% more than the cost-to-close. If not, we allow the put to expire worthless.

2. In my book and DVD program, I use the 3% guideline to align with the 2% – 4% initial time-value return goal range. So yes, the guideline can be adjusted based on strategy goals and personal risk-tolerance.

Alan

Hi Alan,

This is Chintan. Hope you and Barry are doing well in this difficult time.

My question is regarding when to execute call option.

I bought 4 XDA call options ($1.88) at $68 strike price, expiry Sep 18, 20.

Currently, XDA call option trading at $4.58.

Could you please advise how and what should I do on expiration day? How to secure profit that I am making with this trade?

Kind regards,

Chintan

Chintan,

Here, in the BCI community, we are on the “sell-side” of options but most of the option basics apply to your trade. Once your profit goal has been reached after buying an option, you can sell it at any time. You don’t have to wait for expiration Friday. Look for “sell-to-close” on the broker trading form.

Alan

Hi Alan,

A lot of people with knowledge and experience are now saying more and more of the overbought conditions in the stock index and predicting a correction (NASDAQ, S&P especially).

1.What are your views? Is the time ripe for a correction…..??

2.If this can be a probable option then what do you think of selling OTM Puts and buying a protection (Diagonal Put Spread) with an Expiry further than the short Puts.So that if the stocks go down the protective Puts increases in value plus we buy a good stock at a good discount.

Regards

Hey Andrey,

You will get a better reply from Alan or Barry but your post made me think so I thought I would chime in!

Sounds like you are bearish at the moment given all you have heard and read from knowledgeable people? If so this may not be the time to be selling underneath puts. Though as Alan’s article above suggests they can be done successfully week by week with small chance of really going against you like the monthlies can now that commissions are zilch. I have a pile of OTM csps open for Friday on tickers I want to own at the strike I picked.

But let’s say you are bearish a ticker from now to the election? A way to play a bearish diagonal could be to buy the ATM put for Oct 30th (last expiry before election day) as your lead trade. Then sell further underneath it puts each week to reduce your cost and time decay. It’s like a cc or pmcc in reverse on a shorter time horizon!

The trade you described could end up as a bullish put credit spread. It did not sound like you intended that? – Jay

Jay,

Thanks for your introspection! You reading my thoughts:). That’s exactly what I am doing at present also. Sort of PMCPs (poor man’s covered PUTS). My gut feeling says some sort of a correction somewhere around (or before) elections very very likely. Besides, God forbid,if something unusual happens at or after the elections then the market can become highly volatile and crazy! Hence I am buying Puts for the year end.

Thank you Andrey – I am not often accused of being a mind reader :). When bearish the easy answer is add unleveraged short ETF’s like SH and drop your covered calls closer to or ITM.

Buying options is more tricky since you will always be in an uphill battle with time decay. If you get them right you hit it out of the park :)!

But if you are adding bought puts for year end I suggest you also sell some puts underneath those to make it a spread and help reduce time decay and cost even though it will negate your Grand Slam Homer potential. :)!

Another thought is look at the things that go up when stocks go down like TLT and GLD. Maybe buy some call spreads on those or sell bull put spreads underneath them to offset the cost of your put trade against the stocks? – Jay

Thanks again Jay for your kind thoughts and wise advice!

Let’s hope and wish that this party doesn’t fall apart too soon.

Regards

Hello Jay,

nice to see you are well.

The bearish sentiment seems to be around lately. Alan is only 50% invested despite the IBD “confirmed uptrend” and 22.96 VIX.

But of course, COVID and its fallout plus upcoming elections are worrisome events.

On the other hand, there are no alternatives to the stock market for investors.

I am 100% invested in my monthly CC trades.

Also, I am trying to learn the daily iron condor trade with the help of our dear friend Hoyt. (today I disturbed him a lot with my mistakes). 🙁

Take care – Roni

Thanks Roni,

Always a pleasure to hear from you. Hoyt knows his stuff on options and had shared with me off blog you are experimenting with same day iron Condors.

One thing I hope Alan and Barry feel good about is how many friendships they have created. If you want to chat directly off blog just tell Hoyt and he will send me your e-mail. We talk every day!

I absolutely agree with you that the market is the only game in town. I have made the mistake in years past of holding too much cash awaiting the next crash leaving a lot of money on the table.

That said I see the VIX going up on a calm market day and the election uncertainty looms so I will be cautious buying new things. – Jay

Sure, Jay, I will ask Hoyt to send it to you.

As for friendships created through this blog, these are very special friends because of the common interest we share.

Me, for example, down here in Brasil, I cannot find a single person, online or offline, that trades US stocks to exchange ideas with.

One or two trade in the Brazilian stock market, but it is different, and therefore I would be alone if I did not have the BCI members.

Cheers – Roni

Jay,

People’s darling NASDAQ down today at this time 2.85%,ouch!

This was what I meant about my gut feeling that I wrote above and why I was buying Puts.

I hope this is not another one of those downtrends.

Take care

Thanks Andrey,

Hat’s off to you buying the puts, Well done -enjoy those profits and please take them while you have them!

Call me Don Quixote but I actually sold a few further under the market puts today on APPL, QQQ and XLK that expire next Friday. I wouldn’t mind buying at the strikes I sold and time decay is rapid now.

Have a restful long weekend. – Jay

Jay,

I was in the same situation with ROKU and WYNN.I had sold deep out of the money cash sec.puts. Their premiums were really fantastic.Never thought they can fall sooo much in such a short time…..And I began to roll them every week for a few times,so as to remain on the dance floor. It all ended up raking me some very good profits!

Good luck to you!

Alan,

What is a reasonable number of stocks [or ETF’s] with calls [and or puts] to have open at a time?

Thanks,

Dellmen

Dellimen,

As I always write… one size does not fit all. The number of open positions depends on the amount of cash available and the comfort level of the investor in terms of managing a certain number of trades.

We want to diversify as much as possible but also want to set ourselves up for success. When I started more than 2 decades ago, I allocated about $25k in cash available for 5 positions (stocks were much less costly back in the day). Today, I sell 50 -100 contracts per month which translates into 15 – 25 positions plus a handful of trades I manage in my mother’s portfolio.

A sound game plan would be to start small and conservatively and then add more positions until there is clarity as to the number of positions right for you.

Alan

Hi Alan,

Apologies in advance but my brain has turned to jelly after wrestling with this all weekend…

Can I please ask you about mid contract unwinds?

Just trying to understand the concepts…

Am I right with this statement?

“The time-value of the 2nd position must be greater than the time-value to close the first position to justify the mid-contract unwind”???

In your Encyclopaedia;

You said that due to the stock price darting to the moon, we can view this as having made a “significant profit”.

But how can the profit be ‘significant’?

The profit is determined & limited by the chosen strike price, so even if the shares go to the moon we will only be paid what the strike price is- which in this case will be much less than the stock price as it’s deep I-T-M.

The only other profit is the initial option premium, which even for an I-T-M strike does not represent a significant profit…right?

Indeed the only scenario where we can make a significant profit is if it’s an O-T-M call & then the stock price darts to the moon, because then we profit from both option premium & share appreciation…right?

You also said that we could either allow assignment or choose to unwind the position mid-contract…

I just can’t see how allowing assignment of a deep I-T-M call would be any more beneficial than allowing assignment of a just I-T-M call, in both cases, again, we only get paid the predetermined strike price and stock value accelerations to the moon- or not- don’t affect what we end up being paid for the stock- which is just the strike price.

In other words ( forgive me for repeating myself )…if we allow assignment then the shares are sold at the I-T-M strike price, so it’s irrelevant to what value the share price has risen, our profit is limited to the pre-determined strike price.

If the call was originally O-T-M then we would have made some extra profit in share appreciation

If the call was originally I-T-M then we would only make the premium as profit & nothing extra

Either way, the share price reaching the moon has not increased our profits- unless we buy back the option & sell the stock…only then has the increased ‘moon price’ of the stock actually increased our profits…right?

Yaz

Yaz,

My responses:

1. Yes, as a guideline >1% greater.

2. Significant = maximum return. In most cases a very high annualized return.

3. Is 3% – 8% per month significant? If closed early… less than 1 month.

4. When a strike ends deep ITM, it may have started OTM. In either case, our maximum returns are about to be realized.

5. Closing may not make financial sense. I use a guideline of >1% greater than the time-value cost-to-close. Therefore, either close or allow assignment.

6. You are falling into the trap of comparing covered call writing to other strategies… I made this mistake when I first started trading options. Let’s say we structure our trade for an initial time-value 1-month profit of 2.5% with an additional 2.5% of upside potential. Now shares prices heads to the moon. If our 5% 1-month (or shorter) return is realized, who cares what the ultimate stock price is… we have a significant 1-month return of 5%. This calls for celebration, not a box of Kleenex. As I said, I can relate to your excellent questions, because I asked myself the very same ones as I was learning these strategies.

I just want our members to enjoy success.

Alan

Hi Alan. I agree. I set up my Covered Calls with the hope that they will called away. Getting assigned is what I want.

Making 5-10+% on my position in 15-30 days is fine by me.

Managing down stocks and knowing when to sell them, or wait for a recovery is a little harder.

Hi Joe,

getting assigned is my goal too.

I believe that 5-10%+ in 15-30 days, consistently, is not impossible, but you will probably take on too much risk.

Beware – Roni

Hi Alan,

I would like to thank you and share one of my trade based on what I learned from you and also I like to emphasise:

We must master the 3-required skills:

• Stock selection

• Option selection

• Position management

On Aug 5, 2020, GDXJ was on our ETF watch list and trading around $64.

I started to use our Cash-Secured Puts strategy for this ETF instead of Cover Call as I thought price is too high:

1- Aug 5,2020: Sold weekly the $60 Put for $0.60 (Expired) –> Profit $60 (1%)

2- Aug 11,2020: Sold weekly the $59 Put for $0.58 –> Profit $58 (0.9%)

3- Aug 14,2020: Roll over & down for next week, the $58.5 Put for ($2.15 – $1.48) –> Profit $67 (1.15%)

4- Aug 21,2020: Roll over & down for next week, the $58 Put for ($1.94 – $1.17) –> Profit $77 (1.3%)

5- Aug 27,2020: Roll over & down for next week, the $57.5 Put for ($1.89 – $1.18) –> Profit $71 (1.23%)

Since my first trade the GDXJ price was moving down but it has moved up again on last Friday and current price is $59.72.

First Trade date: Aug 5,2020

Last trade expiry: Sep 4,2020

Total duration: One Month

Total Profit for one month: $60 + $58 + $67 + $77 + $71 = $333

Total Commission: $8.77

Net Profit: $333 – $8.77 = $324.23

Monthly return by last strike ($57.5): 5.6%

I made 5.6% without even buying any Stock/ETF.

Regards,

Amir

Amir,

You made my day.

Thanks for sharing and keep up the great work.

Alan

Hello Alan,

I joined the BCI membership community very recently. I have two of your books and have devoured your YouTube videos. I have a few questions:

1. I am working my way through the “Ask Alan” videos and am up to #45. I have repeatedly heard you say it is rare for an option to be assigned early. I’ve also heard you say not to sell a covered call if there is an upcoming ex-div date. However, I’m not clear on what defines “upcoming”. Does that mean if there is an ex-div date 1 week from expiration date? Two weeks? Next 30 days? I ask this because last week I was assigned 1 week before expiration although I understand why… there was a dividend involved that was greater than the time value remaining. However, today, my Dad was assigned FIVE MONTHS early (15Jan2021 expiry), ironically, on the same stock that I was assigned early last week (UPS). Other than his shares being deep ITM, there was no ex-div or even earnings report involved. Between these two experiences, I am a bit “gun shy” to pull the trigger on covered calls with dividends until I can get clarification.

2. How often have you experienced (or heard about) having a covered call be ITM and it *not* being called away? This has happened to my Dad twice in the past year. All the things I have says this is basically unheard of. Even the info on the CBOE site says it will get called away.

3. The video I watched last night had the Elite Plus calculator. Is that included with membership? If not, is the cost the same to members & non-members?

4. I watched an older video of your’s a few nights ago saying you were “rarely in cash” but I see on the BCI watchlist that you are now in 50% cash. I assume this is due to the extraordinary times we are in. My question is what guidelines are you using to put this cash back in the market? Have you done a video on that or is it somewhere accessible to BCI members?

Thanks so much for the response, Alan. Have a safe and super weekend.

Alex

Alex,

1.”Upcoming” means prior to contract expiration. ITM options expiring close to contract expiration and the time value < the dividend are more likely to be exercised early, but still quite rare. Keep in mind that this is a factor only if share retention is critical to your strategy approach. For me, I could care less. It means I've maximized my trade and have the cash back early to initiate a 2nd income stream in the same contract month with the same cash investment. For those trading in non-sheltered accounts, there may be negative tax consequences related to early exercise so I include this information in our material. Early exercise is rare but these are American style options that can be exercised at any time... sometimes a result of investor error. Don't be discouraged by events that will take place on a very limited basis. _______________________________________________________________________________________________________________________________ 2. Market-makers have about 90 minutes after market closes to decide on exercise. rarely, ITM strikes are not exercised and this is usually due to information that comes out during that 90-minute time-frame. We trade as if all ITM strikes will be exercised on Saturday and not on the basis of occasional aberrations. ____________________________________________________________________________________________________________ 3. Premium members receive a member discount. _______________________________________________________________________________________________________ 4. Yes, I am currently in 50% cash and will probably remain this way until after the election (I may move to 100% cash prior to the election). I am almost always 100% invested in more than 2 decades of selling options. I can't wait to be fully invested once again. I will continue to publish what I'm doing, IBD market assessment and Dr. Eric Wish's GMI in our weekly ETF and stock reports. _________________________________________________________________________________________________________ Alan

Premium members:

This week’s 4-page report of top-performing ETFs and analysis of the top-3 performing Select Sector SPDRs has been uploaded to your premium site. One and three-month analysis are included in the report. Weekly option and implied volatility stats are also incorporated.

The mid-week market tone is located on page 1 of the report.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Dear Alan;

Does the 10/20% rule apply in this case:?

On August 21 I bought to close the Aug 21 QQQ 245 strike and sold to open the Sept 18 280 strike at a debit cost of $1.33. The QQQ was trading at 281.48.

Now the QQQ is trading at 285.20 and the cost to close the Sept 18 280 call is a debit 1.38.

So how does the 10/20 rule apply in in the money or does it?

Do you have any lessons on what to do when there is a sudden dramatic pull back in the market? Maybe that would be a topic for discussion.

Thank you.

Donna, premium member

Donna,

When we roll an option, we immediately place a BTC limit order on the most recent option sold. Neither the original option sale nor the cost-to-close that first option is factored into the amount of the BTC limit order on the new option. For example, if we closed the near month option for $2.00 and sold the next month 1-month call for $4.00, we place a BTC limit order at $0.80 and change to $0.40 mid-contract.

When the market gaps down:

1. Do not panic and allow emotion to dictate our decisions.

2. Follow the BCI exit strategy rules and guidelines. It covers all scenarios.

3. These rules and guidelines are summarized in the Emergency Management Report located in the “Resources/Downloads” section of the premium site (right side). Scroll down to “E” They are detailed, with examples, in both versions of the “Complete Encyclopedia” and in our online streaming DVD Program in the “exit strategy” sections.

Alan