Strike selection is the second required skill when writing covered call options or selling cash-secured puts. Over the years I have been asked to suggest a specific Delta for strike selection implying that this statistic would be the sole criterion to determine strike determination. This article will make a case why Delta, although important, should not be the exclusive benchmark we use for strike price selection.

Delta defined

Delta, one of the 5 option Greeks, can actually be defined from 3 perspectives;

- Delta is the amount an option price will change for every $1.00 change in share price

- Delta is the equivalent number of shares represented by the options position

- Delta is the percentage likelihood that, upon expiration, the option will expire in-the-money or with intrinsic value

Option buyers may be most interested in how much their long positions will appreciate as share value moves up. Portfolio managers frequently seek to achieve Delta-neutral portfolios making them less susceptible to market risk. Option-sellers, like us, may want to evaluate the percent chance of the option expiring in-the-money making us vulnerable to assignment. We must develop a plan to integrate Delta into our selection process without over-emphasizing this option Greek.

Delta as it relates to the “moneyness” of our call strikes

Delta and the “Moneyness” of Strikes

Delta runs from 0 to 1 (or 0 t0 100 for a contract). The chart demonstrates:

- The deeper out-of-the-money the strike, the lower the Delta

- The deeper in-the-money the strike, the higher the Delta

With this information, we can make the following conclusions:

- Low-Delta options are less likely to be assigned and offer the greatest opportunity for additional share appreciation in addition to the option premium

- High-Delta options have the highest exposure to assignment (of course, we have our exit strategies to mitigate) and offer additional downside protection because of the intrinsic-value component of the option premium. They offer little or no opportunity for additional share appreciation.

Where can we locate Delta statistics?

Most brokerages incorporate this information into their option chains. There are also many free sites we can access like www.cboe.com:

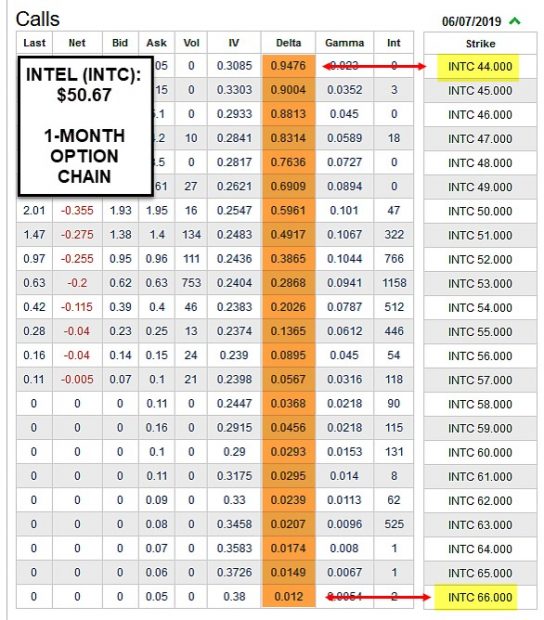

INTC Option Chain with Delta Stats

The deep in-the-money $44.00 strike has a Delta of 0.9476 while the deep out-of-the-money $66.00 strike has a low Delta of 0.012. Option-sellers must understand the relationship between Delta and the “moneyness of strikes” before incorporating Delta into our covered call writing decisions.

Delta and strike selection: A viable plan

Every investment strategy should have an intended goal. I prefer a goal-range. In my case, I seek to achieve a 2% – 4% 1-month initial time-value return when initiating my positions. I use 1% – 2% in my mother’s more conservative account. Once that has been decided, we next decide on our overall market assessment and personal risk-tolerance. If we are bullish, we favor out-of-the-money call options. If bearish or have a low personal risk-tolerance, we favor in-the-money strikes. It doesn’t matter on the “moneyness direction” we choose, our intended goal range must be satisfied. Using the “multiple tab” of the Ellman Calculator is a great way to complete these calculations. Delta will come automatically. Let’s say we seek a 2% initial time value return and are currently bullish on the market. We check the option chain for strikes that are out-of-the-money and generate that 2% initial time-value requirement. In the option chain above, we may select the $52.00 strike (bid price of $0.95) which shows a Delta of 0.3865. In a different market environment, we may have used an in-the-money strike with a much higher Delta. Perhaps our goals will differ from the 2% hypothetical. One size does not fit all investors or circumstances.

Discussion

The option Greeks, including Delta, are important to understand but shouldn’t be over-emphasized. Our investment plan should include a goal-range, market assessment and a defined personal risk-tolerance. Once those decisions have been determined, Delta will come automatically having the emphasis placed on the most important investment criteria.

BCI in Germany

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

I have benefitted greatly from your training. I have been steadily increasing my efforts and knowledge in this approach since 2015, and it is truly a viable long-term retirement strategy. I will continue to be your student!

Clyde B., MD

Upcoming event

October 25th – 27th American Association of Individual Investors National Conference @ The Orlando Omni Resort @ ChampionsGate

BOOTH 314

Saturday October 26th workshop presentation: Covered Call Writing & the Stock Repair Strategies: 10:30 -11:45 AM

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports.

***********************************************************************************************************************

Hi Alan,

I hope all is well. I have a question about how often in your experience earnings dates change. I entered TEAM last month @ 125.35 and sold the Oct 18th 120’s for 9.40.

When I entered earnings was Oct24th, I never would have entered with a earnings date before contract expiration. It then changed maybe 2 weeks ago to Oct 17th.

What can I do in these situations? How often does this happen?

—

-Mark

Mark,

Corporations can change the date of earnings release. That’s why we ask our members to re-check ER dates prior to entering positions (see screenshot below from our stock reports). Now, this is rare but will come up from time-to-time.

In the case of TEAM, once we learned of the change, we should close the entire position or at least the short call if we wanted to risk a disappointing report in hopes of a positive one (not part of the BCI methodology). In most cases, closing the entire position would result in a net gain.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Hello Mark,

You were much luckier than me because I have also entered a trade on TEAM, and ended with a loss of 6%, despite all my mitigating efforts.

My loss would have been much worse if I had not liquidated the position before the bell October 17.

I have noted that early ERs are quite frequent. PYPL did exactly the same this month, and I lost “only” 1.26%.

We must check ER dates of all our positions each and every day to avoid these surprises.

Roni

Mark & Roni — you are both luckier than me, I bought at 139 on 9/23 and sold 140 OTM weekly. The weekly option made it harder to execute exit strategy, so I had to hold on to the stock during the ER (which was held earlier than expected).

The really weird part, was that although the ER was positive (and afterhours trading went up), the stock dropped like a rock the day after along with other cloud stocks. Now I’m down 15%.

Similar thing happened to PAGS (bought 47.27 9/26, sold 47.5) — the secondary offering does not dilute per the announcement, but for some reason the stock dropped significantly in one day, now I’m down 17.8%.

Alan — what would you have done on these two scenarios? If I sell them now at these huge loses, they will wipe out all the gains for the month. Not sure if I should wait for them to get back up, roll down, or move on and throw away all the gains from other stocks.

Ken,

If we find out about an earnings date change earlier than originally anticipated, we close our entire position to avoid the potential risk.

If we unexpectedly get exposed to a disappointing report share decline, we analyze the reasons for that market reaction (www.finviz.com is an excellent resource).

Once we have this information we ask ourselves this question: “Would I buy this stock today at this price?” If the answer is “yes”, we write out-of-the-money strikes. If the answer is “no”, we take a deep breath, sell the shares at a loss, and move the cash into a better-performer… if a stock goes from $50 to $40, we cringe. If it then moves from $40 to 30… $40 looks pretty good.

Alan

Hi Ken,

sorry to hear about your situation.

I hope that your other positions are offsetting these significant paper losses.

Maybe tomorrow brings you an opportunity to get out at better prices.

After the British parliament voted for delay for Brexit, the market will react (one way or the other) who knows?

But the best decision is always to get out of Dodge as soon as possible, because the odds at this point are against us.

When a stock drops sharply, it normally keeps on dropping , or comes back very slowly, and our remaining cash is better placed on another, more promising ticker.

A strong rebound is quite rare, so better not count on it.

Roni

Hi Roni,

I find your comments to be right on.

My experience has been overwhelmingly exactly what you said.

My biggest mistakes have been in two areas.

1. Not “getting out of Dodge as quickly as possible”.

2. Since I hold a lot of LEAPS, and write PMCCs, on high growth stocks sometimes I have very large paper profits. An example of this was a situation I shared in July of 2018. On July 25, 2018, at market close, I had over $30,000.00 in paper profits on a LEAPS position I had in FB. Following an after market close earnings report I had, the next morning, lost all of that paper profit. I held on to the LEAPS “hoping” for some kind of rebound. When I finally closed the position I had a realized loss of $7.000.00.

While at first glance this appears to fall under mistake number 1, and it does, it also illustrates what problem number 2 is. That is holding large paper profits on LEAPS positions through earnings reports. Sad to say, I have had the same results on WDAY and SQ.

The solution. Close the LEAPS position ahead of ER. Buy weekly calls covering the ER, most ERs, in a bull market, are positive. Reenter LEAPS position, maybe even further out, after the ER.

I believe this has a higher probability of profit than holding the LEAPS position and buying weekly puts which is a plan some funds employ by holding the stock and buying weekly puts at ER. Insurance they say.

Thanks again for your comments.

Wishing you and everyone “The best of Good Buys”.*

Hoyt

* Thanks to Paul Kangas. May he rest in peace.

Thanks Hoyt,

I must learn much more before trading LEAPS.

I tried a few in the past, and got into some trouble. Therfore I decided to stay away from them until I have more time to study these trades more carefully.

Roni

Alan,

Let’s say we sell covered call on stock from BCI report. During the month it is up and down, but 20/10 exit rule is not met. And it closes slightly below the purchase price on expiration Friday with option expiring worthless. At expiration stock is no longer on BCI report (removed from the list).

What do you usually do in such situations? Is it better to sell another covered call on this stock, or just sell the stock with a loss and move to another security that passes all screens from the most recent BCI report?

Thanks,

Sunny

Sunny,

In the scenario you are describing, the report is telling us that there are better candidates at this point in time.

Let’s take Teradyne Inc. as an example and leave the 10/22 earning report out of the equation for purposes of my response.

The stock was on last week’s eligible list but removed this week. The chart below shows why. The moving average, MACD histogram and stochastic oscillator indicators all turned negative (3 red arrows). Since you describe a winning trade for the near month, so far, so good. The best choice is to move on to a better-performing stock. Plan B would be to sell an ITM strike for additional downside protection.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Alan,

I’ve been told to sell calls with deltas closest to 40. That would be the 52 strike in your chart above. This article clarifies why this may or may not be the best choice and gives us so much more flexibility when we set up our trades. Thanks for another wonderful article.

Marsha

Marsha,

Our approach to option-selling where one size does NOT fit all, is just one of the reasons members of the BCI community are positioned to achieve the highest returns for covered call writing and selling cash-secured puts. I’m happy to provide this information in a forum where we learn from each other.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 10/18/19.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The Blue Collar Investor Team

[email protected]

The word is “criterion”, not “criteria”.

Richard,

You are correct. “Criteria” is the plural. I changed the spelling in the article and appreciate the feedback

Alan

Hi Everyone,

Sometimes we get lucky.

On 10/11/19 I overwrote 1,000 shares of SGEN(10 contracts).

SGEN, which I have owned for years and discussed before here, was selling at $83.40. The 10/18/19(1 week) expiration $90 strike premium was $0.48. On 10/18/19, around 2:00pm, the price was around $86.60. I was considering buying back the calls and selling the 11/15/19/ $95 calls. I actually offered $0.05. No one took the offer. That was weird. Did anyone expect that within the next two hours the stock would go past $90?

So I decided to let the options expire and sell the $95 strike on Monday morning. SGEN closed at $87.40 and the options expired.

This morning at 6:45am SGEN announced very positive results on a major test. Pre-market trading opened up over $7 and climbed to up $12 by market open.

As I write this SGEN is at $100.70, up $13.30.

If the announcement had been five hours later I would have already sold the $95 strike.

Biotechs can warm your heart and can break your heart.

Obviously, there is a much larger story of my relationship with SGEN beginning 02/01/07 when I acquired my first shares on a story by Elaine Garzarelli on the Nightly Business Report hosted at that time by Paul Kangas. She also had a great story on MDVN which has been one of my all time winners(bought out by PFE in 2016). But that’s a story for another time. We all have them but sometimes they don’t any interest for anyone but us.:)

Yes sometimes we get lucky.

Hoyt

Hi Hoyt,

Although not on the topic at all…when I was a sales manager at Sun Microsystems selling to the big investment banks, she was one of my customers. Back then Sun and Cisco (I was a regional manager there as well) were the “hot stocks”.

Barry

Hi Barry,

Boy, us older guys can really come up with some names, both humans and companies, out of the past. Sometimes I think I am the only one left that remembers the likes of Sun, Dec, Compaq,

Osborne, Kaypro, Wang and many more.

As best I can remember Sun was light years ahead of most folks. Wasn’t their system called Apache? What ever happened to Scott McNealy?

BTW, the first “computerization” of my company was by five Kaypro IIs, not linked but sharing 5 1/2 floppies:), that was followed by a Wang system with one sever and a dozen or more “dumb” terminals. Then finally a LAN system with Dell microcomputers which, it seems, were upgraded continuously.

Thanks for responding. It really brings back the memories.

Oh, how was it to work with Garzarelli? I once heard that she was difficult although her on air personality was great.

Her brother, can’t remember his name. started a produce warehouse business, can’t remember it’s name, here in Atlanta that went bankrupt. His intention was to have a national chain.

Hoyt

Hey Hoyt and other friends,

Great blog this week!

I am bullish this month so I limit my call selling. I cover half of my worst positions NTM for protection. I let my ponies run unsaddled:)!

Yet these are actually great times to be selling cc’s on up days since a pullback is hard to bet against at these levels soon.

I just would not be buying anything new now. Over write the stuff you have. And whatever one does please do not sell CSP’s now. Wait for lower. My two cents. – Jay

Hi Jay,

Good to see you back here.

I agree, I too am bullish for this month and maybe next month. That is I am bullish for the averages. Rotation can keep the averages up but can really tear up positions on the stocks being rotated away from. Right now that seems to be growth stocks except for possibly AAPL. BA is absolutely unfathomable right now.

There are opportunities I just don’t have the foresight to know where they exist. The gunslinger in me wants to buy LEAPs on BA. For the next ten years or so BA is in a duopoly industry. Most airlines will have no choice but to continue to buy from them. To me we are in a meadow filled with landmines trying to make it across to a higher plateau before the flood arrives.:)

I sold my entire position in SGEN Monday a few minutes before the close. I had owned SGEN since 2007. I agonized on whether or not to hold it for a buyout. It was difficult to pull the trigger but once I did there was a real sense of relief. It’s funny how it works that way. We must attempt to discern whether our reluctance to sell is based attachment or potential future return vs another stock. We don’t want to let familiarity hinder our making the best decision. We don’t want to fall in love with our stocks. A mentor I had long ago, now dead, told me that deciding to sell would be a lot more difficult than deciding to buy. Boy, was he ever so right. You only become a Jedi in this business when you reach the point where you have no emotional attachment to your positions.

Thanks again for your insights.

Hoyt

Interesting article in today’s Wall Street Journal that lays out the case that we could be in a stealth bear market that already started in January 2018. Rut small cap index down approx 14% from highs.

Best;

Terry

Hoyt and Jay,

when I see you commenting about BA, I remember my wife telling me, right after the accident, that their stock will certaimly drop sharply.

I said, you are probably right, but the market is a strnge beast, and we should not confuse the company itself with the stock price.

Boeing will certainly overcome the momentary problems, but the stock price depends mostly on investor’s expectations.

So, nobody can tell.

I suggest you move your remaining cash to other, more promising tickers.

Remember Kodak? or Xerox? or even IBM?

Also, never forget October 2008.

Roni

Terry,

thanks for your timely comment.

My portfolio would be showing a similar drop in this period if I were not using the exit strategies and mitigating moves from the BCI methodology.

Roni

Thanks Hoyt,

Great job on your bio stock! I got a bit spooked about bio with it being in the political crosshairs so I don’t have much. What I do have I over write. Same with XLV.

I appreciate your comments on BA. That is my crowning “Sh–t the bed trade” for 2019. After the tragedies I bought a long LEAP figuring it would come back. Then the Max got grounded and I held anyway thinking that would not last long. Boy, I got that one wrong! Alan and Barry talk all the time about how if a fundamental reason for a trade changes get out! Not stubborn old me :). But a lesson learned the hard way. – Jay

Hello Alen,

I bought Non-Standard options (EGO) by mistake. The stock has doubled but the options did not move.

Once I learned about it I looked into what they are. My NS options are for 20 shares of stock. $4 calls and the stock is now $8.

They are Jan 2020 $4 calls. I have time but are they ever going to grow in value? What to do?

Joe

Joe,

Whenever a non-standard contract is available, some sort of corporate event triggered the need for these contracts. In the case of Eldorado Gold (EGO), it was a 1-for-5 stock split making the share price higher but decreasing the number of shares owned by the same factor (see the screenshot below). So, if we owned 100 shares at $2.00, a 1-for-5 split would result in owning 20 shares at $10.00. The total $200.00 value does not change.

In the case of EGO, the $4.00 strike is DEEP out-of-the-money and that it why it has no value at this time. Stock price would have to move up to $20.00 to become at-the-money. If we don’t want to deal with NS contracts like this one, it can be closed for pennies.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

WOW…Thanks…Joe

If you discourage trading just before earnings, why are your recommended weekly stock list having earnings soon? The ones in yellow? I do not understand this?

Cliff

Cliff,

We want to provide our members with the most relevant information to create the best opportunities for successful trades. The stocks in the yellow cells have passed the rigorous BCI screening process but report during the November contracts. Most will become eligible once the report passes.

As an example, EDU reported yesterday and can be used this week if it meets our personal risk-tolerance and investment goals. 7 of the stocks in the most recent report have earnings due out this week and may become eligible with lots of time left in the November contracts.

Another advantage of including this information is that if we already own the stock, we may want to hold it through the report and then write the call. The report let’s us know if the stock will still meet our system requirements.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team