Mastering exit strategies is the 3rd required skill for successful covered call writing and put-selling. On November 28, 2018, Nirav wrote to me regarding a series of trades he executed and wanted to know how to categorize the position management aspect of these trades. This article will highlight the differences between “hitting a double” and mid-contract unwind” exit strategies as they relate to Nirav’s trades.

Nirav’s trades with Bio Telemetry, Inc. (NASDAQ: BEAT)

- 11/12/2018: Buy 100 x BEAT at $62.25

- 11/12/2018: Sell-to-open the 12/21/2018 $60.00 call at $5.00

- 11/28/2018: BEAT trading at $68.85

- 11/28/2018: Buy-to-close the $60.00 call at $9.50

- 11/28/2018: Sell-to-open the 12/21/2018 $70.00 call at $2.50

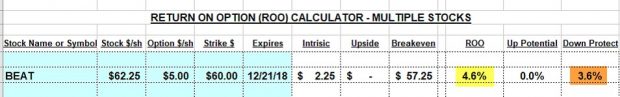

Initial calculations with the Ellman Calculator (multiple tab)

BEAT: Initial Time Value Returns with Downside Protection

The initial time value 5-week return was an impressive 4.6% (yellow cell) with 3.6% downside protection (brown cell) of that time value profit.

Position management overview

Since share value moved rapidly from $62.25 to $68.85, we look to the “mid-contract unwind” exit strategy to determine if the time value cost-to-close (CTC) is approaching zero, such that a new trade will generate more than this CTC. “Hitting a Double” would apply if the share value declined such that the option premium would approach our 20%/10% guidelines leading us to close the short call and evaluating the next step (rolling down, waiting to “hit a double” or selling the underlying stock). In these trades with BEAT, we are in “mid-contract unwind territory”. The twist here is that Nirav closed to short call at a cost of 1.08% early in the contract and then generated an additional 3.6% for a second income stream net gain of 2.5% with the same stock. We usually turn to a different underlying to avoid profit-taking after a large price movement upward.

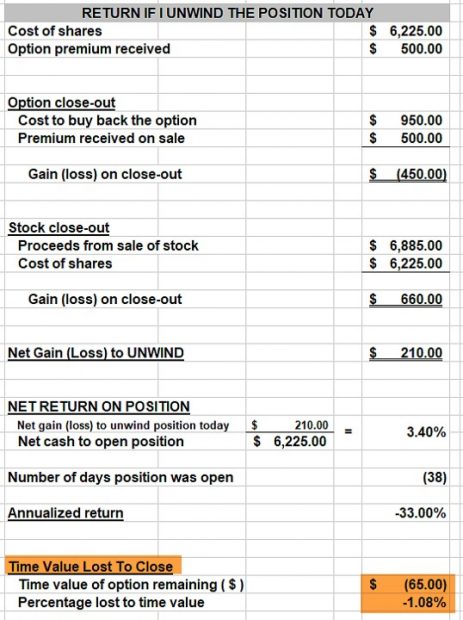

Calculating the time value cost-to-close using the “unwind now” tab of the Elite version of the Ellman Calculator

BEAT: Time Value Cost-To-Close: The brown cells highlight the time value cost-to-close (1.08%), incorporating share appreciation from the original strike price of $60.00 to current market value of $68.85.

Discussion

It is important to take advantage of situations when share prices rises significantly causing the time value component of the option premium to approach zero, especially early in a contract month. This strategy is known, in the BCI community, as the “mid-contract unwind exit strategy” and usually involves using a different stock in the second income stream but can be used, in rare circumstances, with the original stock if there is extreme confidence in continued share appreciation.

Exit strategy resources

Elite Calculator for Covered Call Writing

Honored to meet so many BCI members at my recent Las Vegas presentations

All Stars of Options at Bally’s Hotel, Las Vegas

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Hello Alan,

I just wanted to tell you that since last year when I was divorced and had to handle my own investments for the first time, I Have been trying to find someone in the industry to teach me. After trying many avenues and finding NO one who had the ability to teach, I found you.

You are the BEST. I am working my way through your videos, learning and enjoying every minute. You have given me the confidence I need to start managing and growing my investments. Thank you so much!

Mariann

Upcoming events

June 11: Plainview New York

Long Island Stock Traders Meetup

Plainview-Old Bethpage Public Library

7 PM – 9 PM

Free presentation

July 22: Chicago Traders Expo

1:30 – 2:15

Hyatt Regency McCormick Place

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports.

Alan,

Thank you for all you do for us little guys.

What happens to the shares that are called away at expiration that are only .01 over the strike? Surly someone has more than that in premiums.Why would they want them underwater? Does the OCC just bank the shares for later ?Can’ find info on internet.

Thanks again…Vince…

Vince,

When we “allow” an option to expire in-the-money by $0.01 or more (in most cases), we become share sellers. The OCC will match up buyers and sellers to complete these trades. The buyer of our shares can be another retail investor or a market-maker who is required to provide a market for the options they are responsible for. Here is a link to an article I published 5 years ago that details the process:

https://www.thebluecollarinvestor.com/options-clearing-corporation-guaranteeing-our-options-trades/

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 05/24/19.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The Blue Collar Investor Team

Premium Members,

There was an error in the charts displayed on the first page of the Weekly Report. The VIX was displayed twice instead of the SPX and VIX. This has been corrected. Please download the report dated 05/24/19-RevA. No screening results were impacted. A thank you to Tom for noticing the error.

Have a great holiday weekend.

Best,

Barry

Alan,

I was reading your article on selling puts instead of using limit orders when we buy stocks. I really like this concept but can’t see how to do it on my broker account. Any advice is appreciated.

Henry

Henry,

You will need to request approval to do option trading. There are forms our broker requires us to fill out which will determine if we receive this approval and, if so, there will be cells on our broker trade execution page which will allow for option trades.

Covered call writing is the easiest form of option trading to receive approval for and put-selling is usually one or two levels more difficult. Here is a link to an article I published several years ago on this topic:

https://www.thebluecollarinvestor.com/option-approval-levels-for-our-brokerage-accounts/

Alan

Henry,

Welcome to our group and welcome to options selling! if you are like most of us you will look back at the day you get options clearance in your accounts as a day your investing took a big step forward!

If you have an IRA with any of the major discount brokers I recommend you seek options clearance there as well as in any cash account you trade in. I am retired so my situation may be different but I trade options ONLY in my main trading IRA. I would not want to keep up with the tax implications of selling cash secured puts and covered calls in an after tax cash account.

I have heard friends say “Gosh, I did not think you could do options in IRA’s? I find them the best place for it! – Jay

Alan and Jay,

Thanks for your responses. Very helpful.

Henry

Welcome Henry,

Alan and Jay have given you advice that is priceless, in the sense that no cost was involved in the transaction. 🙂 That is the beauty of BCI and of this forum. You can get specific questions answered without having to wade enormous amounts of data or doing a lot of time consuming research. This is not to imply that these two things can’t make you a far better investor. But often the answers you get here are more surgical and are from people who had the experiences you are about to have. There are many benefits that are individually worth the membership fee.

Alan has totally immersed himself in covered call and cash secured put selling and is a true Master of the concept. There are no aspects of this that he has not mastered.

Jay’s experience in all aspects of trading is unsurpassed by any I have known in my 35+ years of trading. His sharing of his experiences is alone worth the membership fee.

Barry and the staff compile the various Watchlists with great skill that saves us many hours of painstaking research.

Jay’s advice about trading in an IRA is right on. That is the only way I trade. No bookkeeping required. I do keep a spreadsheet dairy of my trades so that I can go back and review to see exactly what happened and what I can learn from previous trades. I use E-trade. You can create your own “screen” in the portfolio tab so that the info is formatted the way you personally feel is the best for your decision making.

The concept of options trading in an IRA is very simple. Under ERISA regulations you can execute a trade in an IRA only if the potential loss is quantifiable (known) and you have the resources unencumbered to cover the potential loss.

Most brokerages, as Alan noted in his excellent article, will easily allow covered call writing as the potential result is quantifiable and you have the required shares of the underling on hand. Their software will not let you sell calls without owning the stock and will not let you sell the stock if you have a short call position on the number of shares you attempt to sell. They will not let you make an options trade above your approved level. At least this is the way it works at E-trade. I am pretty sure it’s that way at most major brokerages.

I have “walked” through several IRA investors in getting initial approvals and then getting upgraded to higher levels. As I stated earlier you will not be approved for “naked” trading of any kind in an IRA because of the unquantifiable aspect.

Additionally, buying of calls is not included in Level one because the brokerages are afraid you might not have the ability to have the calls automatically exercised if you fail to sell them before expiration and they expire $0.01 or more in the money. They usually send you a notice that you have options expiring soon and if you are fairly new at options trading they will call you on expiration Friday for instructions for them not to exercise your options that might expire ITM.

I have been too long-winded already so I will shut up now.

Best of luck in your investing and be sure to be disciplined in following the BCI methodology.

Hoyt T

Thank you Hoyt,

I am uncertain of my greater pickle: accepting your overly kind words or living up to them :)?

I hope everyone had a great Memorial Day Weekend ready to come out trading in the new week!

Pundits are all bearish (for whatever that is worth)? So if we bounce a bit tomorrow I may buy a few put spreads underneath weak stuff like XLE, XHB and CAT to give the pundits a low risk benefit of the doubt :).

To BCI’ers, please understand Hoyt is a modest gentleman of immense value in our community with a vast wealth of investing experience. But please do not believe a thing he says about me :). We have both been in this game a long time. Our hosts Alan and Barry are kind enough to provide us a forum in which we exchange thoughts and encourage others.

If there are newer options investors reading this the best advice I can offer is get good at one or two things first. Please do not try to do it all at the get go. That temptation is strong since as soon as you listen to a webinar – really “infomercial” sales pitch – which “promises” triple digit returns with options you will be on the web chain for a dozen of them and have to delete them laboriously when you log on each morning.

The best place to start with options is covered calls and cash secured puts. And there is no better place to learn them than here. When I retired my goal was to make more in the options market than I spend each month. So far so good. BCI had a lot to do with that.

A successful new week to all. – Jay

Jay and All, especially beginning options traders,

Quoting Jay:

“The best place to start with options is covered calls and cash secured puts. And there is no better place to learn them than here. When I retired my goal was to make more in the options market than I spend each month. So far so good. BCI had a lot to do with that.”

1.The first two sentences should be etched on the frames of our laptops or computers.

2. As Jay said, master these first before going deeper and you don’t have to go deeper.

3. The third sentence embodies a concept I have hammered into the DNA of my children and grandchildren. “Make more money than you spend, always.” Many of us do this even in retirement. It’s in our DNA.

Additionally, Jay hit the nail on the head and Alan has always said the BCI methodology is not “a get rich quick scheme”. I will not call names but if you watch CNBC you will see free books offering “secrets” of how to make triple digit returns. As always with this type of offer once signing up for the “free” book you are required to give your phone number, which they verify, and then you get calls from them and other options huskters for eternity.

Stay disiciplined

Hoyt,

As follow up when we opened higher this morning I did construct and buy 3 put spreads in my IRA against XLE, XHB and CAT expiring in July so that I have a small amount of bearish exposure in things that have been lagging the SPX. I also noticed VIX, TLT and UUP (US dollar) were all up with SPX. Often when I see that the SPX gets the short end of the stick so I bought two ITM puts against it which expire today.

As luck would have it I took the first one off for a double (100% gain) to eliminate trade risk and the second for a triple (200% gain) just now. Could have held until nearer the close but my target was reached. I could have just as easily been wrong on a guess like that so I had a stop of 30% in mind.

Nothing works all the time, all of us who engage in trading at any level know that. But I have found intra day alignment in VIX, TLT and SPX to be tradeable with tiny bets and managed risk. Notionally VIX (plus often TLT) and SPX should be opposed. When they are in alignment going up I buy puts against SPX and when all are aligned going down I buy calls on SPX. It has been a simple but consistent winning formula for junkies like me who have a tough time breaking away from the market on SPX expiry days! – Jay

Jay,

I was out on my tractor yesterday doing no trading. I checked the market mid morning and it was up. I thought of your comment. I checked later and the market was fading. I grinned. Checked again when I came in around 6:00. I really smiled and said to myself, “I be damned, Jay has done it again. You called it.

Well done, my friend.

Hoyt

Alan,

How do we know when we are in a bear market or when we should be out of the market entirely?

If I’m going along happily selling calls there’s got to be something that tells me to stop doing that and just to sit on the sidelines if those kind of market conditions occur.

If those situations occur are there any other strategies to use during those bearish Market times or shouldn’t I have to worry about any of that?

Thanks,

Jack

Jack,

Periodically, there will be increased market volatility and bear market environments that make trading more challenging. Currently, we are dealing with tariffs against China set by the US and then China against the US. The potential for a longer-term trade war with China has caused the market to decline over the past month despite a healthy earnings season. Each investor must decide if trading in these market conditions meets their personal risk-tolerance profile. For me, I am almost always in the market. Exceptions included the pre-Brexit vote, the 2016 US election and late in 2008 when we has a severe recession.

In our premium stock report, we publish overall market assessment of IBD, BCI and the GMI index. From there, our members can decide.

There are many tools we have to counter market volatility. These include using ITM calls, OTM puts, collars, the PCP strategy, low IV securities, ETFs instead of stocks, setting lower return goals to lower volatility exposure and much more.

Trade preparation and position management is critical…”worrying” is not productive.

Alan

Alan,

For Poor Man’s Covered Calls, you set a minimum pf .75 delta but no maximum. I see some in the.90s and a few at 1.00.

The cost of these is more than those near.75 bur appreciably cheaper than the stock Is there no or too little benefit or a disadvantage that caused you to not set a higher minimum.

Thanks Homer

Homer,

When we set up the PMCC, the long LEAPS positions should mirror the price movement of the underlying stock. This is why I set a minimum Delta of .75. The maximum Delta will be 1.0 by definition. As stated on the bottom of page 119 in our book, “Covered Call Writing Alternative Strategies”, … the deeper ITM LEAPS…will require a larger overall initial investment… We select Deltas between .75 and 1.0 based on the investment we are willing to make and the calculations determined in the first tab of the PMCC Calculator.

For members who have the book, pages 117 – 134 discusses initial trade setup parameters.

Alan

Alan,

My name is Alan also. I also live on Long Island.

I’m watching your videos on covered call trading. I have some questions:

1) What type of equities do you trade covered calls with? Do you have guidelines for what stocks to trade with?

2) If I have a large account, could I simply trade a GOOGL or AMZN covered call by buying 100 shares each and do covered calls on them? Is the leverage of premium credit beneficial to trade higher priced stocks than lower priced stocks?

3) I like the small returns compounded month after month for years with covered calls. Do you trade other strategies?

4) Do you ever invest in mutual funds or do you just solely trade options?

Thanks,

Alan

Alan,

My responses:

1. In the BCI methodology, the selection of eligible stocks for short-term option trading is based on fundamental analysis (earnings and sales growth), technical analysis and common-sense principles (like minimum trading volume)… yes, very specific guidelines.

2. Proper diversification is critical and easily achievable with large accounts. Avoid just 1 or 2 high-priced stocks only. Premium credit (% return) is based on implied volatility of the security, not on the price of the stock.

3. 90% of the stock portion of my portfolio is dedicated to option-selling.

4. I have a small percentage of my stock portfolio in broad market, low-expense ratio index funds.

PS: A few years ago I moved to south Florida although Long Island was a great place to live. Gave away the snow-blower!

Alan

Alan,

I hope all is well!

How would you handle this situation? Let’s say you purchased INTC (Intel) on May 6th, 2019 for $50.82 and you sold the 51 call on May 6th which gave you .92 cents of premium. As you know, the trade war is heating up and when President Trump made some announcements, Intel took the brunt of it. In a few short days, the price dropped and currently it’s about $44.57. I immediately bought the call back for .02 cents on May 10th but now I’m waiting for the price to appreciate to sell calls against it again. The stock is dropping as I write this today but I could consider to sell the $50 call for .69 cents in 115 days or the 52.50 for .36 cents or just hold it until the price comes back up a bit.

I’m a long time holder of Intel and do not have a problem holding Intel over the long haul. What are your thoughts?

Rob

Rob,

When there is a price gap-down on shares we plan to hold long-term, another choice would be to roll down to out-of-the-money (OTM) strikes. This will accomplish 2 goals:

1. Continue cash flow from option premium

2. Allow for price recovery from current market value to the OTM strike

I prefer to avoid selling options 4-months out because it will take us through 1 – 2 earnings reports and result in lower annualized returns (compared to shorter-term expirations).

Alan

Thank you! In this case, I would have to be careful if I rolled down because the strike price I roll down may be lower than what I paid. In that instance I would simple have to pay careful attention so I don’t risk losing money if I had to buy the call back? Is this your preference when the stock gaps down?

So to be more specific, you would sell the 47 call for .47 cents in the next 29 days? My cost basis is $49.90 so far.

Rob,

At any point in time, our investment decisions should be based on current data (in my humble opinion). Otherwise, we would be making emotional decisions. If a stock price drops from $51 to $44, we have $4400.00 per contract at this time (Not $5100.00). Where is that cash best placed? If the underlying is a long-term hold based on our system requirements, we sell OTM options if we are bullish on price recovery. If not, closing the position is always a choice assuming no negative tax consequences (none in this particular scenario). If our analysis is that our bullish assessment no longer exists, selling the stock should be considered.

Now, selling at $44.00 will not be a happy outcome but if the stock price drops to $37.00 we may wish we sold at $44.00.

To sum up, if share price drops significantly but we are bullish on price recovery, selling OTM strikes at a lower price than the original stock price is a sound approach.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Alan

How are you?

I am wondering, what would happens if you have a sales cover call option on a company XYZ and this company file bankruptcy?

What happens with your shares and contracts? and what happens when the SEC stop the trading on that particular stock?

Have a good day

Daniel

Daniel,

When a company seeks bankruptcy protection, trading in the stock is usually halted. Buyers of options now own a worthless asset. However, we are option-sellers and likely will realize the entire premium generated.

If we follow the BCI methodology for stock screening, it is highly unlikely we would hold a security that is near bankruptcy.

Alan

Alan,

I paper trade PMCC on SPDR S&P Biotech ETF (XBI) and I noticed that LEAPS bid/ask spreads varies a lot intraday and day to day. For example today Jan 20 $60 call bid/ask spread traded in $0.25-0.40 range, but some days it gets as wide as $0.90-1.00. Do you have explanation why is that?

Thank you,

Sunny

Sunny,

The width of an option’s bid-ask spread is directly related to its liquidity (open interest). In general, LEAPS have lower liquidity than Monthlys and therefore wider spreads. When retail investors place market orders, the spread will tend to get wider and when limit orders (that are placed between the bid and ask prices) are placed, the spread will become tighter.

The takeaway from your excellent question is to always leverage the “Show or Fill Rule” when the bid-ask spread is wide and if the target price is not accepted to meet the PMCC trade initiation formula, pass on that security.

For more information on leveraging the “Show or Fill Rule:

Complete Encyclopedia I (classic edition): Pages 225 – 227

Complete Encyclopedia Volume 2: Pages 122 – 124

For more information on setting up an initial PMCC trade:

Covered Call Writing Alternative Strategies: Pages 117 – 134

Alan

NEW WEBINAR:

DELTA DECISIONS: IT HAPPENS AUTOMATICALLY

How Delta is Incorporated into our Option-Selling Decisions

Blue Hour Webinar #12 is now located in the premium member and video sites

Alan and the BCI team