In the BCI methodology, we never sell a covered call or cash-secured put on a stock with a projected earnings report date prior to contract expiration. When selling our traditional monthly options this means we are only able to use a particular stock for eight months of the year because most companies report earnings on a quarterly basis. This is rarely a problem because we have so many elite companies to choose from, our watch lists should have between forty and sixty eligible candidates each month in addition to exchange-trade fund candidates. As options have gained in popularity over the past several years more and more products have been made available including weekly options. Weeklys options are options that are listed to provide expiration opportunities every week. Weeklys are typically listed on Thursdays and expire on Fridays, provided that such expirations were not previously listed (i.e, Weeklys are not listed if they would expire on a third Friday). Many Weeklys are listed several weeks prior to expiration. Short-term option-sellers can take advantage of Weeklys to use a favored stock forty eight weeks out of a calendar year, avoiding that security only the four weeks of the year when earnings are projected to report.

How to use the BCI Premium Watch List to Locate Stocks with Weeklys

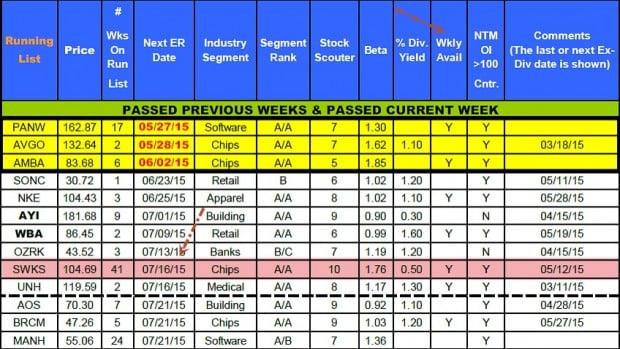

Weekly Options from the BCI Premium Watch List

Note the following:

- The red arrow at the top of the chart shows the column that identifies stocks with weekly options showing a “Y” for “yes”

- The three rows at the top in “gold” color show the stocks that have passed all our screens but have projected earnings report due out in the current contract (not calendar) month

- PANW and AMBA both have Weeklys associated with them and therefore can be used in three of the four weeks of the current contract period

- The red arrow in the middle of the screenshot shows the July 16th projected earnings report date for SWKS, a stock on our Premium Watch List for forty one weeks at the time I created this screenshot

Viewing an Options Chain for Weeklys

Weekly options for SWKS

Note the following:

- The June contracts expire on June 19th

- The July contracts expire on July 17th, the day after SWKS is projected to report earnings

- The screenshot shows the availability of some lower strike Weekly June 26th options for SWKS. These expire on June 26th.

- Other choices that will be available are the July 3rd and July 10th Weeklys

- We will avoid the July 17th monthly option and continue (after the earnings report passes) with Monthlys until the next earnings report date approaches

Discussion

A significant percentage of stocks that are eligible for short-term option-selling have weekly options associated with them. We can then use these expiration dates to leverage the underlying securities up to forty eight weeks per year using our option-selling strategies.

Shipping of The Complete Encyclopedia for Covered Call Writing has begun

Complete Encyclopedia for Covered call Writing Volume 2

All pre-orders placed prior to September 4th have been shipped. The remaining pre-orders will be sent by the end of this upcoming week. All subsequent orders will be shipped within two business days. Your amazing response to this new book was a very pleasant surprise to me and my team. Thanks for your support.

September live appearances

1- St. Louis, Missouri

September 15, 2015

6:30 PM – 9 PM

2- All Stars of Option Trading

September 16, 2015

Discussion panel

New York Stock Exchange

4:10 PM – 5:00PM

Market tone

Global equity markets remained volatile but actually were up for the week despite nervousness about China’s slowing economy and the much-anticipated US Federal Reserve policy meeting next week. The VIX index traded in a fairly tight range of 23–27, indicating less market volatility than in the past few weeks. This week’s reports:

- Non-farm job openings rose more than expected to 5.75 million in July, the highest number since December 2000. However, the number of hires in July fell to 4.98 million from 5.18 million

- The University of Michigan consumer sentiment index dropped to 85.7 in September from 91.9 in August. This was the lowest level in a year and well below expectations for 90.3

- US consumer debt rose at a 6.7% annual rate in July, slightly below expectations but extending the run of modest monthly increases in overall consumer credit to almost four years. Recent gains in credit card debt could be a sign of growing confidence amid lower gasoline prices and a healthier job market.

- The National Federation of Independent Business index of small business optimism rose slightly in August, suggesting that the month’s financial market turmoil had little impact on US small businesses

- The US producer price index was unchanged in August and fell 0.8% year over year, the seventh straight 12-month decrease. Lower crude oil prices and the strong US dollar have held down producer price increases

- Initial jobless claims decreased 6,000 to 275,000 for the week ended 5 September Claims have been below 300,000 for 27 straight weeks, the longest streak in more than 40 years

- Continuing claims rose 1,000 to 2.26 million for the week ending August 29th

For the week, the S&P 500 rose 0.36% for a year to date return of (-) 2.93%.

Summary

IBD: Uptrend under pressure

GMI: 0/6- Sell signal since market close of August 24, 2015

BCI: This site remains bullish on the US economy and encouraged by declining volatility but still cognizant of events in China as well as the Fed watch. At this time, I am retaining all shares currently in my portfolios and planning to start selling options again for the upcoming October contracts.

Wishing you the best in investing,

Alan,

I have been trading stocks for 15 years but relatively new to options. Do options trade during the same hours as stocks?

Thanks for all the information your provide.

Jennifer

Jennifer,

Generally, yes, between 9:30 AM and 4:00 PM ET. However, options on some broad-based ETFs and index options may trade up to 4:15 PM ET. For those check with your broker or the products specifications at the exchange where a particular product trades. For a major majority of the options we are dealing with 4 PM ET is the magic number.

Alan

Premium Members,

The Weekly Report for 09/11/15 has been uploaded to the Premium Member website and is available for download.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the BCI YouTube Channel link is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The Blue Collar Investor Team

Alan,

Thanks as always for another timely and insightful blog article!

Like you, I have always preferred monthly covered calls. But I now supplement with weeklies to steer around a variety of events: earnings reports as you describe, ex-div dates to avoid exercise for dividend capture, Fed Meetings like next week (I had all my options expire yesterday since this could be a pivotal meeting) and even the end of this month budget stand-off. I will not enter new credit spreads or cover current stocks for greater than weekly duration after Fed next week so as to be out before month end deadline until that mess is resolved….

So the great thing about the weeklies is if you see an event particular to one of your stocks or market sensitive overall you want to avoid being call obligated during you do not have to sit out that entire monthly cycle. Just use a one, two or three week expiration short of the event, hop scotch it uncovered then go back to the usual monthlies. – Jay

Jay,

An outstanding way to utilize one of the advantages of Weeklys…thanks for sharing.

MEMBERS: See our file of the Pros & Cons of Weeklys in the “Resources/downloads” section of the Premium site…scroll down to “W”

Alan

Alan,

Thanks for your kind follow up.

You and I are old enough to remember the original “Lost in Space” episodes :). Their robot would warn “Danger, danger”!

I feel that way about the market. As I always do in the third quarter into October where so many mishaps have occurred even in good years.

Having been with you a while I enjoy the growth of this comment board. Many new voices sharing their experiences in pursuit of our common goal: get wise and wealthy together in a warm and respectful forum! – Jay

You may have something there Jay. Technically the market is a textbook bearflag suggesting another leg down. High volume drop followed by uptrending consolidation with declining volume. Then possible drop with increased volume. But who knows, I feel a big move coming soon one way or another.

Nate,

Thanks for your always kind words. Not so sure I called this one correctly….

I had no idea where Janet might take the market today. So I bought a straddle at SPX 2000 at lunch time.

That’s an option strategy that makes money only if the market moves dramatically. Which it did not after her announcement. I was slightly “encouraged” by the dive into the close and for the purpose of this trade would be cheered by volatility tomorrow.

It is not an “income trade” by our definition. But if I can close it for a gain it will seem that way in my account.

Thank you for your astute description of the Technical picture. I have an ongoing debate with myself about whether the news or the Technicals drive the market? I think the news – at least for today :)! – Jay

Agreed, the market was relying on the the news. Hopefully that 1.6 % decline on Friday put some money in your account. The volume did spike above average on that down day so we may have some follow through down on Monday.

I am currently invested in a portfolio of 19 stocks/etfs. I would like to sell covered calls on these but am wondering what the best strategy is. Am I right in figuring I need to wait until the current share price is “close” to what I paid? And what is considered “close”?

I don’t mean to take up your time on this. If you can just point me to one of your blogs or videos that would be great.

Cheers,

Bernie

Bernie,

First thing is we must identify our goals. If its leveraging these 19 securities to generate income, there’s no time like right now. The one caveat is the volatile market conditions we’ve experienced lately, but seemingly calming now. I, personally, am waiting to write calls for the October contracts as long as volatility doesn’t turn for the worse this week.

Secondly, we must decide if we care if shares are sold. If trading in non-sheltered accounts with stocks that have a low cost basis, there may be tax considerations and that will favor writing out-of-the-money calls.

Dividends may be another factor. I know I’m throwing a lot of info out there but it is important for all of us to understand all aspects of this strategy as well as put-selling before risking even one penny of our hard-earned money.

I can give you one simple answer regarding when to enter a trade as per the original cost basis. Shares in our portfolio are worth what they are valued at today, not some price we paid for them in the past. If we have decided that cc writing is the strategy that we will use to generate monthly cash flow (as I have) the time to get started is now. We can achieve both cash flow and share appreciation by favoring out-of-the-money strikes.

All this information is detailed in my books and DVDs with examples, charts and graphs.

Alan

Alan,

what do you think about the idea of BETA weighting this (or any) portfolio of stocks and then selling OTM SPY calls against the entire beta weighted amount?

It’d be much easier selling calls on the one position per month and you would not worry about earnings? I know the vol of the ETF’s are not as much as individual stocks but it would be a lot easier.

Jim,

I love when our members think outside the box. I would hesitate to give a definitive opinion on this strategy without having tested or back-tested it over a significant time frame. I spent years doing that with our BCI methodology.You certainly have identified potential advantages to the proposed strategy.

I would want to explore the trade-off of easier trading for lower returns. Also, most beta-weighting stats I’ve seen are based on 5 years of historical data and that time frame would be of concern when trading 1-month options.

Another approach to a less- time-consuming approach to option-selling is to use ETFs as I do in my mother’s portfolio. We can even use the best-performing SelectSector SPDRs and write calls on those and not limit to OTM strikes in bear market conditions. This would simplify even more because of the lower number of securities in our portfolio.

Your idea needs to be explored in the practical world of trading (not from a computer model) and then compared to conventional cc writing before any meaningful conclusions can be determined.

If you decide to paper-trade this approach I hope you share it with our BCI community.

Alan

I noticed there tends to be a correlation between the health of the market and the number of stocks on the Running List. Have you found the list to be some sort of market indicator? E.g. above 30 mildly bullish; over 50 wildly bullish.

Of course on earnings months it will automatically be lower.

Nate,

Your observation is an absolute home run. I have noticed this for years and one of the items on my “to-do” list (incredibly long based on ideas from the BCI community) is to quantify these stats and create a market indicator.

I’m sure your comment was partially motivated by the fact that last week we had 10 eligible securities and this week we’re up to 29.

More on this in the future.

Great point.

Alan

Alan, I first want to thank you for the recent answers you gave me, and also to Barry for generously giving me all those resources to see. I have already the knowledge of interpreting Oscillators in a S/ways channel, and have always known that the position of ‘Moving averages’ don’t matter.

I want to go over 2 answers if you can please first confirm, followed by 2 questions.

– So to buy or rollout any stock in a S/ways channel the 20d EMA should be above the 100dEMA, but the price can be anywhere in this channel – either above or below, as it just doesn’t matter where? (if this be right, then I probably could have done a rollout for some of my past papertrades)?

– Confirming too answer to Q.5,- if I am understanding it then I can use a stock with no R/R rating, yet just see that the ATM return is not too high first, this is what you say isn’t it? But by high do you still mean anything over 6%?, can’t high premiums/high I.V be good if the market is bullish?(I’m sure you’ve told me this?)

1. Something else about the technicals position I am trying to get my head over is why it is alright to Roll-out a stock when both the MACD & Slow Stochastics are down (a rather ‘mixed view’ you state), yet it’s not alright to actually buy the stock, – as it’s advised we need either one of these 2 indicators to first be going up?

2. Also even though we may avoid ER’s for a stock, what about larger stocks that are in the same industry as the one I may use, but not only are more popular and influential on the price of smaller stocks but also report an ER; – won’t this have an impact on the price of my smaller sized stock during a month I use it(with no ER present for it)?

Enjoy your seminars and hope it attracts a big crowd too!

Thanks

Adrian,

1- In my view, moving averages that are consolidating are less reliable and I turn to the other technical parameters for guidance. Generally, unless we are in a strong bull market, I favor ITM strikes with a sideways moving average.

2- I will go higher than 6% in a strong bull market, but not much higher. Each investor must make a decision based on personal risk tolerance.

3- We are rolling when share price is above the strike. It is unlikely that technical are breaking down as you describe. If so, simply allow assignment.

4- This may be a minor peripheral factor but if we avoided all stocks in an industry if one of the industry components disappointed, there would be no watch list. I understand and respect the inquiry which attests to the meticulous nature of your investment approach.

Alan

Alan,

I used some weeklyes to roll out while avoiding earnings, but I observed that most of the time, weeklyes have low open interest, large spreads (above the 30 cents recomended in your book), and unfavorable risk/reward situations.

As you say, there are so many eligible candidates each month with far better possibilities for the covered call method.

P.S. – I think of you, Jay, Ken, and all the other Airforce guys each evening as I read “Catch 22”. I just bought the new 50th anniversary edition (Kindle).

Correction : I mean weeklys

Roni,

Yes, you have identified one of the disadvantages of some Weeklys…lower liquidity and therefore wider spreads. I was at an options panel discussion yesterday at the NY Stock Exchange and two of the participants couldn’t believe that weeklys for these securities have lower liquidity. Experts…go figure! Try to negotiate leveraging the “Show or Fill Rule” whenever possible. For the complete file of the pros and cons of Weeklys, check out the “resources/downloads” section of the member site.

For full disclosure: Captain, US Army (as a dentist).

Alan

Alan,

thanks again.

Will do as you recommend.

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

I’ll be catching up an emails and blog commentary over the next several days.

Alan and the BCI team

Alan

I am looking at buying KBE, the banking ETF, and selling a covered call option against it. According to the Ellman calculator, for the 3 options I am evaluating, I would receive a greater annualized return, if I sell the 10/16 call (108.4%) per the calculations below:

Stock name >> Banking ETF

Stock symbol >> KBE

Stock share price >> $33.74

2) ENTER THE SYMBOL, STRIKE PRICE, EXPIRATION DATE AND OPTION PRICE PER SHARE

Symbol Strike Price Exp Date Price / share

Option choice #1 >> A 37.00 10/16/15 0.05

Option choice #2 >> B 37.00 12/18/15 0.15

Option choice #3 >> C 37.00 03/18/16 0.55

Ellman Calculator Results

Option profit $5.00 $15.00 $55.00

Upside profit $326.00 $326.00 $326.00

Total profit $331.00 $341.00 $381.00

Cost of shares $3,374.00 $3,374.00 $3,374.00

Return On Option (ROO) 0.1% 0.4% 1.6%

Return on Upside 9.7% 9.7% 9.7%

Total return 9.8% 10.1% 11.3%

Annualized return 108.4% 38.4% 22.1%

Vince

Vince,

You have identified one of the main reasons I like Monthlys over longer-term options…higher annualized returns. The ability to avoid earnings reports is another.

Alan

Alan,

I have been a customer of yours in the past but gave it up because of time limitations. Now that I am retired this seems like an excellent way of creating an ongoing income.

I have made mistakes in the past by going for the high premiums instead of a quality stock. Your method identifies the quality stocks. I am coming back home again.

Now my question. Has the Ellman calculator been adjusted for weekly options? I changed the date in the example but nothing seems to happen. In the past I would take days or weeks off and not watch my stocks. Weeklys keep you in the game all the time.

Mike

Mike,

Congratulations on your retirement. many of our members are using option-selling to generate additional retirement income.

Our calculators can be used for any time frames, including Weeklys. However, as currently constituted, only our put calculators will annualize those returns.

We are also in the process of developing additional tools like a ”

“Trade Planner” and a PCP Calculator where we can calculate returns when using both covered call writing and put-selling as one multi-tiered option-selling strategy.

Enjoy retirement!

Alan