In my book, Stock Investing for Students, I develop a long-term investment plan to achieve financial independence and an early retirement. The plan is initiated by using broad market index funds. This article will highlight the reasons why I favor passively-managed mutual funds to their actively-managed counterparts. First, some definitions.

Definitions

Index fund: A type of mutual fund with a portfolio constructed to track the components of a market index like the S&P 500. It provides broad market exposure at low cost.

Actively-managed mutual fund: Active managers rely on research, forecasts, and their own judgment and experience in making investment decisions on what securities to buy, hold and sell.

Statistical data resources

1- The Index Revolution

Burton G. Malkiel, Princeton

2- Common Sense on Mutual Funds

John C. Bogle, Chairman of The Vanguard Group

The case for indexing

In the long-term, it is virtually impossible for actively-managed funds to out-perform the “market” due to fees and costs. Approximately 75% of mutual funds under-perform the benchmark they are attempting to beat. To a great extent, much of this is the result of the high fees paid to fund managers and the greater rate and costs of the transactions. Index funds and index ETFs represent 30% of the market assets but only 5% of market trading.

Fees

Actively-managed funds charge fees greater than 1% while index funds average about 0.10%, more than ten times less. When computing the math regarding fees, we should calculate costs as a percentage of returns rather than total assets to get a clear picture of the damage high fees impact our net worth. Let’s assume the market returns an 8% annualized return and that actively managed funds can achieve similar results (most cannot). In doing the math, we will assume a cost of 0.10% for index funds and 1.2% for actively-managed funds. Okay, put on your seat belts:

Index funds

0.10%/ 8% = 1.25% negative impact on our returns

Actively-managed funds

1.2%/8% = 15% negative impact on our returns

Keep in mind that these stats assume the actively-managed funds can achieve broad market results which most cannot.

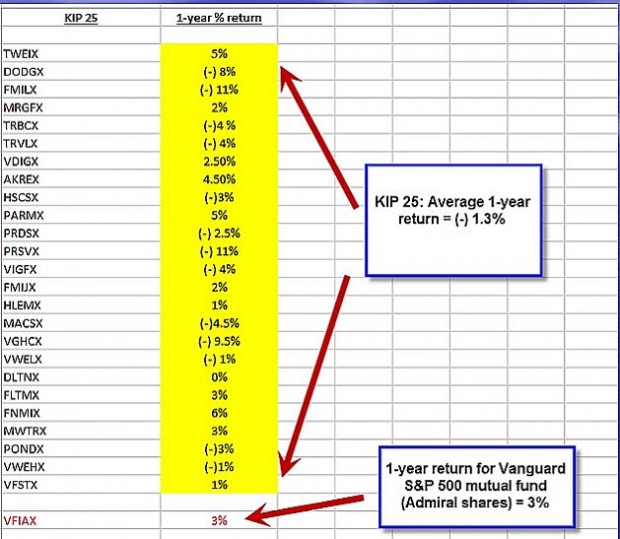

Comparing recommended actively-managed mutual funds to a Vanguard S&P 500 Index Fund

In the 4th quarter, 2016 I did a comparison of the KIP 25 (25 no-load actively-managed mutual funds recommended by Kiplinger Advisors at the end of 2015) to the Vanguard S&P 500 Index Fund. Please note that no position management was included and all positions were held for one year. Here are the results:

KIP 25 versus Vanguard S&P 500 Index Fund

The Index Fund (VFIAX) out-performed the 25 actively-managed mutual funds by 4.3% (+3% compared to (-)1.3%).

Why not choose funds that have out-performed?

It is impossible to predict future results based on past performance with one very important exception. Managers that charge lower fees tend to out-perform.

More factors

- Actively-managed funds result in higher taxes causing a loss of 4% of returns over a 25-year time frame

- Indexing dramatically reduces operational costs, including transactional costs

- Indexing reduces risk via diversification

- With indexing, there are no concerns of a fund manager leaving the fund or getting ill

Game plan

- Select a family of funds with low fees (Vanguard, Schwab, BlackRock as examples)

- Consider S&P 500 and Total Stock Market Index Funds

Select a high-grade diversified bond fund in a ratio appropriate for your risk-tolerance and age (stock funds in a greater percentage the younger you are)

Rebalance your index funds annually

Discussion

The most important factor in the long-term success of investing with mutual funds is the cost or expense ratio. This, along with other factors, give index funds a distinct advantage over actively-managed funds.

Next live event

American Association of Individual Investors

Washington DC Chapter

Saturday July 15, 2017

9 AM – 12:00 PM

“Using Stock Options to Buy Stocks at a Discount and to Bring Portfolio Returns to Higher Levels”

Co-presenter: Dr. Eric Wish, Finance Professor, University of Maryland

Northern Virginia Community College

Annandale Campus

Richard J. Ernst Community Cultural Center

8333 Little River Turnpike

Annandale, Virginia 22003

Registration link to follow

Market tone

Global stocks were flat this week, but there was significant volatility midweek as political chaos exacerbated in Washington. West Texas Intermediate crude oil rose to $50.30 a barrel from $47.50 last week amid signs OPEC and major producers such as Russia will retain output curbs through March of 2018. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), jumped as high as 15.50 at midweek before dipping back to 12.04 on Friday. The VIX began the week at 10.80. This week’s reports and international news of importance:

- President Trump embarked on his first overseas trip as president on Friday, leaving behind a litany of controversy in Washington. Trump will visit Saudi Arabia, Israel and the Vatican before a stop in Sicily for the G7 summit

- On Wednesday, the US Department of Justice appointed former FBI director Robert Mueller as special counsel to investigate Russia’s intervention in the 2016 presidential election as well as any improper contact between Russian agents and the Trump campaign

- Revelations that Trump disclosed extremely sensitive intelligence to the Russian foreign minister and ambassador during an Oval Office visit last week added to the controversy.

- UK prime minister Theresa May unveiled the Conservative Party manifesto on Thursday, setting the stage for the general election on June8th. On Brexit, the manifesto says that no deal is better than a bad one and that the United Kingdom seeks an agreement with the European Union that would take the UK out of the single market and customs union but continue close ties through a comprehensive trade and customs agreement

- The UK this week reported that its unemployment rate stands at 4.6%, its lowest level since 1975

- German chancellor Angela Merkel’s party, the Christian Democratic Union, has performed extremely well in German state elections in recent months. This potentially paves the way for Merkel to retain her post when Germany holds federal elections in late September

- Brazilian president Michel Temer, who came to office after the impeachment and removal from office of his predecessor, Dilma Rousseff, was placed under investigation by the nation’s Supreme Court this week after allegations surfaced that Temer was taped condoning the bribery of a witness in a major corruption

- After being sworn in on Sunday, French president Emmanuel Macron on Monday appointed Édouard Philippe as prime minister. Phillipe is a member of the Republicans, and his appointment is an effort to woo support from the center-right in case Macron’s En Marche! party fails to secure a majority in next month’s parliamentary elections

- Later in the week, during a meeting with European Council president Donald Tusk, Macron vowed to work for the overhaul of Europe. Tusk praised Macron, saying Europe needs his energy, imagination and courage

- Japan’s economy grew 2.2% in the first quarter of the year, its fifth straight quarter of growth, the longest string of gains in over a decade

- As of May 17th, with 458 companies in the S&P 500 Index having reported, 1st quarter earnings are expected to increase 15% from a year ago. Excluding energy, earnings are seen growing 10.7%

- Revenues growth is estimated at 7.2%, falling to 5.3% ex energy

THE WEEK AHEAD

MONDAY, May 22nd

- Chicago national activity index April

TUESDAY, MAY 23rd

- New home sales April

WEDNESDAY, MAY 24nd

- Markit manufacturing PMI May

- Markit services PMI May

- Existing home sales April

- FOMC minutes May 3

THURSDAY, MAY 25th

- Weekly jobless claims 5/20

FRIDAY, MAY 26

- Gross domestic product revision Q1

- Durable goods orders April

- Consumer sentiment May

For the week, the S&P 500 declined by 0.38% for a year-to-date return of 6.38%.

Summary

IBD: Uptrend under pressure

GMI: 3/6- Buy signal since market close of April 21, 2017

BCI: This week’s volatility and continuing political bombshells out of Washington have muted my aggressiveness moving forward. I will be taking on an equal number of in-the-money and out-of-the-money strikes for the June contracts.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a cautious outlook. In the past six months, the S&P 500 was up 8% while the VIX (12.04) moved down by 2.5%.

_____________________________________________________

Wishing you the best in investing,

Alan (alan@thebluecollarinvestor.com) and the BCI team

Hi Alan,

At the end of our “conversation” under your article posted 04/29, you told me to let you know how my NFLX/GLW trade worked out.

So I am happy to tell you it ended very well, as you predicted.

GLW closed at 29.05, and my shares were called away, leaving me with a nice 5% one month return. (NFLX aprox. 3.7% plus GLW 1.3%)

Roni – 🙂

Roni,

You put a smile on my face just like the emoji in your post.

Alan

Alan,

What are your comments, rules of the road, best practices, things to consider, when making large orders of 10, 20, 30 contracts?

Thanks,

Mario G.

Mario,

Fills will depend on the liquidity of the underlying. For example, we are much more likely to get filled when using QQQ as an underlying than a less liquid security.

I try to stay within 10 contracts or less so as to have the best chance to leverage the “Show or Fill Rule” and “negotiate” with the market-makers especially when bid-ask spreads are $0.15 or greater. This may not be a factor when spreads are tight.

Do not check the “All or None” (AON) box on the trade execution form when placing limit orders between the published bid and ask.

Alan

Jay answered my follow up question suggesting to spread out large contracts over more than one day.

In a way I am spreading out my contracts automatically since I have at two brokerage houses (Fidelity and Optionshouse (acquired by Etrade)), each with two accounts (Retirement, Non-Retirement). I make similar positions at each and trade them in parallel on each platform (with some variation depending on cash available and diversification). Trading in parallel, I get similar price fills and I avoid them going crazy as I change my spread limits to get a fill. Has worked out fine.

I also have a Joint Trust Account with Fidelity which I just opened 5 weeks ago for mainly ETF trading since they are our joint funds. I will describe my experience with that account in a separate message.

Mario G.

Thanks Mario,

But, please know I was speaking only for me expressing my opinion. I do not speak for Alan or anyone else!

Larger accounts afford the ability to construct ladders so you execute different trades at different times to leverage market direction and expiration dates on the same underlying(s).

In the past people did that with Certificates of Deposit and Bonds. Now many use SPY, QQQ and LEAPS laddering covered call expiration! – Jay

Mario,

Talk about a nice “problem” to have :)!

My add to Alan’s answer is always layer into large positions by covering them on different up days and consider spreading out strikes and expiration dates.

The odds of you covering all 3000 shares on the same day and catching the top for the next month or two are remote even if the spread is pennies. Unless it’s a monthly over write on something like SPY or QQQ, but even then I say spread it out….Jay

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 05/19/17.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry (barry@thebluecollarinvestor.com) and The BCI Team

Alan,

What is your opinion about weekly vs monthly calls? It seems that selling weekly call options during the last week or two before expiration would have the most benefit since time decay is the most severe during the last days. So why not focus on weeklys?

Regards,

Tom

Tom,

I favor Monthlys but feel success can be achieved with either time frame as long as the 3 required skills are mastered (stock selection, option selection and position management).

In my books and DVDs I detail pros and cons of Weeklys and Monthlys. Here are a few:

Weeklys: Pro: easy to maneuver around earnings report and ex-dividend dates. Con: Quadruple the number and amount of trading commissions.

Monthlys: Pro: Ideal time frame for exit strategy executions with many more securities available with monthly options. Con: Can never hold a security in our covered call portfolios for more than 2 months at a time due to earnings report rule.

Alan

Tom,

In addition to Alan’s comments, in many cases there may not be enough time to execute the various Exit Strategies that are part of the BCI methodology.

Best,

Barry

Alan,

You have the 3% rule for exiting if the stock goes below the strike – do you have an exit point if the trade is going the way you want it to go or do you usually wait and let it expire. For example, do you buy back the put you’ve sold at a specific profit…30%, 50%, 70% etc…or let it expire?

Thanks.

Regards

Dhavid

Dhavid,

Yes, we have a specific set of guidelines should share price rise substantially. I refer to these as the “20/10% guidelines” for puts. As share price rises, put value declines. We close the short put positions when value declines to 20% of initial value in the first half of the contract and 10% of original value in the latter part of the contract. This assures us of retaining 80-90% of our original premium profit and frees up the cash we used to secure the put to then secure a different put position and therefore a 2nd income stream in the same month with the same cash.

See the exit strategy sections of my put book/DVD program for more information with examples.

Alan

Alan,

With your broker is there a settlement period after selling before you can use those funds to buy? With my broker (IB) there’s a ‘T + 3’ waiting period which is extremely annoying.

Justin

Justin,

Although settlement is 3 days typically for most brokers, the cash can be used immediately to purchase new shares. Those shares cannot be sold until the 3-day settlement period has transpired. Cash, however, cannot be withdrawn until settlement. I have been doing this for decades in my cash accounts. Get clarification from your broker to make sure you have this right.

Alan

Alan,

Looks like maybe I need a different broker! Had the following exchange with IB:

May 23: “In a cash account such as this, settlement for stock trades is T+3. So for example if you sell shares today, they would settle on Friday, which would be the date you could trade on the settled funds.”

And in reply to my q. if the process could be sped up:

“No, it is not possible to speed settlement. If you don’t want to wait for funds to settle before you use them to trade with, you need a margin account.”

Justin

Alan

I recently signed up for the BCI method and have been reading your books and videos. Amazing amount of educational material.

I have kicked off some investments and am waiting with trepidation for the month to go. So far so good.

Except one of my stocks has appeared on your BCI report as having an earnings report on the 31/5. Semtech Corporation (SMTC). I realise that perhaps I should have checked on the company website before buying – but oh well – I have to deal with it.

I bought the share at 35.86. Sold the 36 Option at 1.29.

Should I buy back the Option now and sit on the share – as it has good technicals and fundamentals and is appreciating (price currently 36.62).

Or do I wait to buy back the Option to next week nearer the 31st – when the time value will have decreased BUT the share price might be flying high as people anticipate the earnings report.

I’m guessing buy back now and hope the shares appreciate.

Sorry for the long question – but I wondered whether you tackle this issue anywhere in your education so that I can take a look.

Many thanks

Glenn (UK)

Glenn,

One way to help you make your decision is the recent news about a stock. One of the best places to get this information is at:

http://www.finviz.com

This is a free site that has great information about stocks that you are interested in. It has one of the best compliations of recent news, analyst calls, and financial data available to the retail investor. When I’m doing the Weekly Premium Report, I use this site to get better insight to a stock’s behavoir if I see an unusual chart pattern as well as getting insights into negative news.

One item you can look at is the “Analyst Recommendation” data element (lower left hand box (“Recom”). The ratings are on a scale of 1 to 5 where:

1 = Strong Buy

2 = Buy

3 = Hold

4 = Sell

5 = Strong Sell

This data might be able to help you make your decision.

Best,

Barry

Glenn,

As Barry just did, he and Alan will always give you great information about the factors to consider and the resources available when making trading decisions. But because of fiduciary, legal and business practice concerns here in the States they will not give specific trade advice which is prudent on their parts.

But I am just a subscriber and blog member so I sure can :)!

Looks like you sold the June expiry call on SMTC for $1.29. It closed at $1.76 last trade today. So to buy it back would cost you 47 cents depending on how tomorrow goes. You bought the shares at $35.86 and they closed at $36.70 so you are already 84 cents up there on unrealized appreciation.

If you feel you sold the covered call in error overlooking an earnings report date and are bullish the stock buy back the option sooner than later – particularly if SMTC shows any daily weakness and you can buy back for less. If it goes up as you suspect you will be buying back increasing amounts of intrinsic value which is never any fun!

You will then be left with the decision about whether to hold your shares through earnings as you continue to follow it’s price movement and news reports. Never be afraid to do that if you like the stock, news is favorable and it’s recent earnings history is good. The less risky thing to do is take your profits before earnings but don’t kick yourself if it pops :)! Maybe sell half and keep half on the table?

Anyway, just my two cents – best of luck with it! – Jay

Glenn,

One additional comment to add to Barry’s and Jay’s great posts is that we can have a look back at market reaction to past reports. As shown in the screenshot below, the market reaction was favorable after the last 3 reports. This does not guarantee a favorable report coming up in a few days but may be a determining factor if we are considering holding a stock through a report and then writing the call post report.

Buying back the option will leave you in an approximately breakeven position. The question is whether to hold or sell the stock. Our confidence in the underlying security and personal risk-tolerance will dictate how we proceed.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates. For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Hi Alan,

I understand the advantages of indexing, but why wouldn’t I just do covered call investing instead according to your methods? Surely that would yield a greater return. What return could I reasonably aim for, using your methods, by the way?

Thanks!

Zack,

Indexing is a strategy geared to long-term investing goals…for those not near retirement. Generally, covered call writing will generate higher returns and is geared to generating monthly cash flow. Stated differently, they are different strategies with different time frames. Many of our members use indexing to build up portfolio size in order to then move to option-selling.

For those of us who have mastered the 3 required skills for option-selling, we should beat the market every year, frequently substantially.

Alan