When we sell in-the-money call options, we are generating initial time-value profit that meets our stated goals plus creating downside protective of that time-value profit in the form of intrinsic -value. The disadvantage of these options is that we do not benefit from share appreciation because of our contract obligation to sell at the lower strike price. In June 2019, Kurt wrote to me about a covered call trade he executed with TriNet Group, Inc. (NYSE: TNET). The in-the-money (ITM) strike he sold was moving deeper ITM as share price accelerated mid-contract. He was deciding between rolling out-and-up versus allowing assignment at expiration. This article will review and analyze management considerations.

Kurt trade

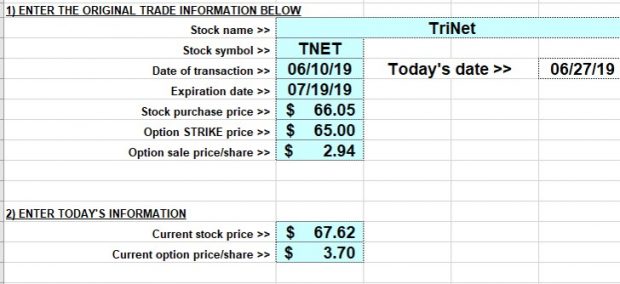

- 6/10/2019: Buy 100 x TNET at $66.05

- 6/10/2019: Sell 1 x $65.00 ITM call at $2.94

- 6/27/2019: TNET trading at $67.62

- 6/27/2019″ $65.00 call priced at $3.70

Structuring the trade with the BCI Trade Planner

TNET Calculations with the BCI Trade Planner

The red arrows highlight that Kurt received an initial 5-week time-value return of 2.90% with 1.60% downside protection of that time-value return.

Rolling-out mid-contract considerations

Rolling out (or out-and-up) generally should be considered for ITM strikes as expiration is approaching. Here, Kurt is contemplating rolling out and up mid-contract. The first step would be to close the current short call and we must analyze the time-value cost-to-close. We can accomplish this using the “Unwind Now” tab of the Elite version of the Ellman Calculator.

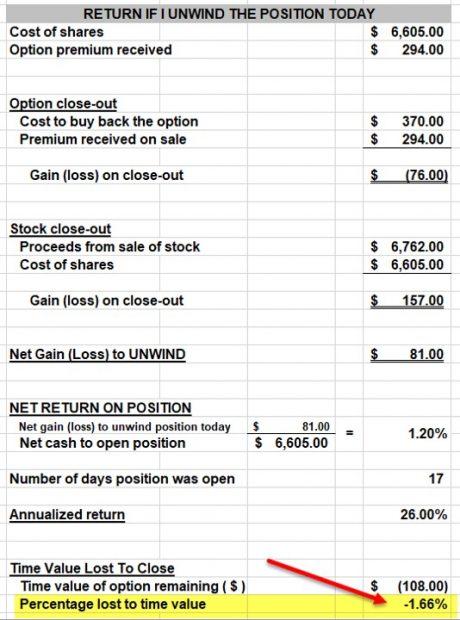

The Elite Calculator Unwind tab data entry

Elite Version of Ellman Calculator: Data Entry

The Elite Calculator Unwind tab calculation results

TNET Calculation Results of Unwinding Mid-Contract

The time-value cost-to-close calculates to 1.66%. In order to consider this approach, we would want to generate at least 1% more or 2.66% with 3-weeks remaining until contract expiration. Is that possible? Yes, but not guaranteed so why take the chance on what is currently a very successful trade. As share price moves up, the downside protection of the 2.9%, 5-week return becomes even greater.

What about rolling out-and-up?

I prefer to reserve rolling out strategies to the day(s) near or on expiration Friday. If share price moves up such that the time-value cost-to-close approaches zero, then we look to the mid-contract unwind exit strategy.

Discussion

After selling ITM calls and share price accelerates, rolling options out should be reserved for expiration Friday or the days just prior to it. We may close the near-month short call if the time-value cost-to-close approaches zero, using the mid-contract unwind exit strategy.

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Hi Alan,

Thank you for all your help.

I’ve already learned so much in this short time.

Thank you.

Andrew H.

Upcoming events

1.Michigan AAII Chapter webinar

Trading in a Low Interest-Rate Environment

Creating a 3-income stream strategy

Wednesday June 24th

7 PM

Login information to be sent to registered members (club and premium members)

2.Sacremento Options Traders webinar

Covered Call Writing with 4 Practical Applications

Sunday July 19th

12:30 – 4 PM

Login information to be sent to registered members (club and premium members)

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 8 of our mid-week ETF reports.

*********************************************************************************************************************

Alan,

Thanks for another enlightening article. Do you ever use ITM strikes when you don’t want your shares sold to avoid paying capital gains tax? Even in bear markets?

Thanks,

Marsha

Marsha,

In our BCI methodology, if avoiding sale of our shares is critical to strategy goals, we favor OTM strikes that meet our initial time-value return goal range.

For example, if we are seeking to generate an additional 6% per year over and above the portfolio appreciation and dividends we are currently receiving, we use OTM strikes that generate 1/2% per month.

Check out the “portfolio Overwriting” sections of my books and DVDs and our Portfolio Overwriting Calculator for more information on this approach to covered call writing.

https://thebluecollarinvestor.com/minimembership/covered-call-writing-alernative-strategies/

https://thebluecollarinvestor.com/minimembership/video-portfolio-overwriting/

https://thebluecollarinvestor.com/minimembership/portfolio-overwriting-calculator/

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 06/19/20.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The Blue Collar Investor Team

[email protected]

Hoyt, Roni,

My friends,

Meant to send you a message last week. Happy Birthday this and next month. My birthday turns 78 (1942) on June 28 so we are all in the same years with I am sure a varied background of experiences. We have experienced a rapid changing computer revolution – the Transistor was invented in 1947 by Bell Labs.

Best,

Mario

Mario and Roni,

Thanks and Happy Birthday to you.

Yes, we have experienced and seen rapid changes in most all aspects of life. It has been a challenging, exciting and rewarding time. I am reminded of the Farmer’s Mutual ads on TV. “We know a few things because we have seen a few things.” Very true.

I am, however, convinced that more changes are coming and at a more accelerated pace. Hold on to your hats.

Take care my friends,

Hoyt

Thank you Mario, and same to you.

Today I just returned to trading CCs. The premiums are very tempting.

The market is down again today but as Alan says, the long term trend is bullish.

I bought/sold PYPL and SSYS for the July 17 options cycle.

Regarding amazing revolutionary changes, Stratasys is the leader in the cutting edge technology of 3D printing, and if my wife would allow me, I would start a new company, and buy their machines to compete providing this service

The market has abandoned this exciting business for a long while, but I believe that after the sanitary crisis is over, and the economies start recovering, 3D will become the ultimate solution for unlimited applications.

Roni

Hey Roni,

There is a small ETF available through ARK Innovation Funds ticker symbol PRNT that gets to your idea up here on the US Exchange. None of the ARK funds are optionable since they are likely too small but they have been top performers for me.

But please believe me, I am just a BCI friend and have no association with whoever runs those funds :)!

I tried something different today. Alan talks about ITM covered calls frequently when he is bearish. I am bullish for July so I sold a couple ITM cash secured puts today on the dip..No one is going to exercise me early, there is too much time value in them.

And I sold them on stuff I would like to own anyway as investments. The premium was handsome and if we get back in melt up mode through the Holiday they will work fine.

I know you have been out of the market for a while and may still be skittish. Selling cash secured puts OTM to be paid to wait for a lower price may be ideal. I sold some ITM today only because I think this market will be higher by July expiry and today was an aberration. But I could just as easily be wrong. – Jay

Hi Jay,

you hit the spot.

Would you be willing to disclose the tickers of your OTM puts that you have sold for the July options cycle?

Roni

Oh, absolutely Roni! I apologize for not being more fully disclosed earlier. I think biotech will benefit from virus research so I sold some ITM puts on XBI. Maybe I am just as dumb as every other person on the street but I have a hard time betting against big tech. So I sold some ITM puts on XLK and QQQ.

The market is rarely linear. So if you want to get back in by selling OTM cash secured puts I think any of those would be good and please do it on a down day when put prices go up.

Of course SPY is hard to beat. When you read about sector rotation unless people are leaving equities for TLT and GLD having SPY will do the sector rotation for you. And overwriting it for about half a % a month would be a 6% yield on a rising asset base and be a very pleasant way to spend retirement if you don’t want to watch the tape all day:)! – Jay

Thamk you Jay,

As I sold my copany, I have more time to watch my trades, and I have placed already half of my trading cash back in CC trades, plus one OTM CSP on SSYS, following your tip.

I’m not yet ready for ETFs. That will be my next study.

Roni

Alan,

In your recent news letter where you state, “I’m not adding new cash to current positions. My plan for the July contracts is to remain 50% in cash and favor OTM calls 2-to-1 for the best-performing stocks and ETFs.”

Is this because you anticipating a pull back in the near term?

Thanks in advance.

Joe

Joe,

I am not 100% convinced that we are enjoying a V-shaped recovery from the coronavirus crisis. I am bullish from the perspective that interest rates are so low that the stock market is essentially the only venue investors can generate significant returns. On the other hand, the Fed has infused trillions of dollars into the global financial markets and recently started buying corporate bonds. There’s even talk the Fed may start buying stocks. This unprecedented support of the stock market cannot go on forever and ultimately the stock market will have to move forward based on good old sales and earnings growth. It is unclear to this investor when that will take place as we are in unparalleled economic times resulting from the coronavirus crisis.

Every investor must make a personal decision, based on goals and personal risk-tolerance how much of our hard-earned money we are willing to invest in the stock market and, for me, it’s 50% of the cash I have allocated to stock and stock option investing. I will adjust that amount up or down as more clarity is gleaned moving forward.

This is one man’s opinion. I never tell others what to do but I’m happy to share my view and how I’m crafting my portfolios.

Alan

Thanks Alan for quick and detailed response. I always appreciate your insight, your willingness to share your experience and your candor about what you are doing with your own money and portfolio. You continue to teach me so much.

Thank you.

Joe

On the same subject, I’ve been thinking I should really learn more about gauging the longer term health of the market since it has such an effect on our portfolios. Does anyone have any book recommendations on this subject? So far all I’ve come up with is books with “economic indicators” in the title, am I on the right track or do you have any favorites I didn’t see? Thanks!

-Other Steve

Steve,

I read the weekly economic reports and summarize them in our weekly premium member stock reports. I also follow Fed announcements on the current status of US and Global economies:

https://www.federalreserve.gov/newsevents.htm

Alan

Alan

I was looking through your past premium reports and noticed you were selling ITM more than OTM.

How much ITM and how do we gauge the strike price to choose.

Lots of useful flow chart etc

Thanks,

Chandrika

Chandrika,

I re-evaluate the mix of my positions each week and publish that information in our member reports. My plan for the July contracts is to favor OTM strikes 2-to-1 as I enter my positions later today.

First, decide on our initial time-value return goal range (2% – 4%, for me on my monthly positions). Then we view the option-chain and check strikes, ITM or OTM that meet our goal range. Use the “multiple tab” of the Ellman Calculator to generate the time-value return (ROO) as well as upside potential and downside protection.

We can also ladder strikes depending on how bearish/bullish we are. As I said, 2-to-1 for my current positions favoring OTM strikes.

Whichever strikes we select, we immediately enter buy-to-close limit orders to protect against share decline and take advantage of option price decline. Check the exit strategy sections of my books./DVDs.

Alan

6/20/20

Alan,

Strange thing happened Expiration Friday. My Covered call for SOXX closed in-the-money (Strike 265, Last Price 267.28). I expected to lose the shares of stock. However, the call was not assigned and instead showed up in the history log as expired.

See attached graphic of Fidelity’s history log.

The 100 shares of stock are still in my portfolio with the same cost basis. Fidelity explained to me this does happen, but not often.

I checked and this ETF was last listed on the ETF run list of 2/19/20 with a volatility of 24.29%. The market took a downturn mid-March and I overwrote a short call on 6/3 when the price was at 263.63 and I realized I could at least break even. I checked my notes on 6/3 and I recorded a Bid/Ask of 6.00 and 6.40 which gave me ROO of 2.3%. All near BCI guidelines.

I decided then to search the internet for some comments on in the money call not being exercised and surprisingly up showed up a Money Show article date 2/1/2013 by Alan Ellman. Congratulations! That covered a situation with a high volatility stock which was expecting bad news and profession traders – holders stopped the automatic exercise after closing at 4 pm because they are allowed an extra 90 minutes of trading (till 5:30 pm).

Here is the article:

https://www.moneyshow.com/articles/optionsidea-30240/

This equity however is an ETF which as far as I could tell is not expecting bad news. (I will monitor on Monday, first day after expiration.)

Any comments as to what circumstances may have occurred for this ETF?

Mario

Mario,

Very rare, indeed. It’s happened to me 2 or 3 times in over 20 years of selling options. OCC error? Unlikely. It appears that market-makers made the call that semiconductor stocks would open lower today. I could find no news items to justify this decision and SOXX is up slightly in pre-market trading.

Thanks for sharing the link to that article as our members may find this information of interest.

Please keep us updated.

Alan

Guys,

Today, SMH was up $1.38, almost 1% .

Best,

Barry

Barry,

My luck. I held long positions in SMH and then overwrote a short call when it rose above my purchase price. The next day, to my astonishment, 6/3 it shot up past my strike sharply. On Expiration 6/19 – I let them be assigned with ROO of 3%. Seems like it happens a lot in my trading. The market makes decisions after I make a limiting move.

Mario

Hey Alan,

Can you look at this trade.

Below are the trades I made on MGM.

I think the first mistake was buying MGM. The second was selling the OTM option and the third was not monitoring the purchase closely enough.

I bought 100 shares of MGM on 6/08/20 For $23.18

I sold the $26.00 OTM 17 July 20 call for $1.54 on 6/08 /20.

I bought that option back on 6/12/20 for $.54.

Then I sold the 17 July 20 $19.00 call for $2.38.

Thank you for any advice you might have for me.

Best,

Clark

Hi Clark,

I will defer to Alan’s expertise to break down your trade for you and coach you from here.

The observation I will share is you made a bullish bet in the gaming and casino biz – one of the most ravaged by COVID. It’s right there with airlines, cruise ships and car rentals. That could be a fantastic bet on recovery and the economy reopening since those stocks all took such major hits!

But in my opinion it’s better as a speculative long – maybe even with bought call spreads out in time – than it is as a covered call stock. For those I have had best success using blue chip plow horse type stocks that aren’t going to gallop away from me or go down the drain unless something really big happens :).

Your $19 strike July is safe now. Should you keep the 100 shares I would hold on to them uncovered. The gamblers will be back and that stock could break out :)! – Jay

Clark,

Let me add this to Jay’s important points:

I want to first commend you for taking action to manage your trade. The position management skill is one of the traits that make BCIers elite option-sellers. Let’s break down these trades:

1. The initial trade structuring resulted in an initial time-value return of 6.6% with an additional 12.2% upside potential, a possible 18.8% 5-week return. This reflects a tempting but highly risky trade as Jay implied in his response. We should only enter trades that align with our personal risk-tolerance. My initial time-value return goal range is 2% – 4% which usually results in a similar upside potential for OTM strikes. No right or wrong here but we must define our goals and risk prior to entering our trades.

2. The BTC price point was at 35% of the original premium. In our BCI methodology, we prefer closer to 20% in the first half of a monthly contract. Yesterday, the $26.00 call could have been closed at $0.10.

3. The STO of the $19.00 call locked in a trade loss of $80.00 per contract if MGM closes at or above $19.00. We are still early in the contract, so after closing the short call, we can wait another week to see if share price recovers and perhaps create an opportunity to “hit a double”.

4. At this point, we set a BTC limit order at $0.45 for the $19.00 short call and manage moving forward.

There are 2 positives here, as I see it:

1. You are focused on managing your trades which gives you a huge advantage over those who do not.

2. You have experienced a trade that is instructive on many levels and the lessons learned will put cash in your pocket in the future. This is precisely how I learned more than 20 years ago.

Alan

— Hey Alan and Jay,

I don’t see much hope for MGM. It is now down $666.00. To buy back the option is about .60.

Should I continue to wait and try to buy the option back at about .25 and sell another ITM at about 14.5?

Any advice will be greatly appreciated.

Best,

Clark

Clark,

We must keep in mind that we are still in the first week of a 4-week contract. Since the last option sold was for $2.38, a BTC limit order should be set in the $0.45 – $$0.50 range. We are close to that threshold now.

Should the current short call be closed, and we are aligned with the position management approach in our BCI methodology, we have 2 choices:

1. Sell the stock if we have changed our bullish assumption. This can be done even if the 20% threshold has not been met.

2. If we still have confidence in MGM, and since we are very early in the contract, we can wait up to a week to see if share price recovers and then re-sell the same strike ($19.00 or higher).

We generally reserve rolling-down to the latter half of a contract.

We must also decide if the stock we select aligns with our personal risk-tolerance. MGM has an implied volatility of 94.27, nearly quadruple that of the S&P 500 (26.90). No right or wrong here as long as we have a thorough understanding of the risk a trade presents.

Alan

Hey Clark,

It is fantastic we have Alan to both provide this blog and break down our trades with us! I can’t add a penny to the advice he has given you.

I do think you need to decide whether you want to keep MGM or not regardless of how the covered call trades work out. The risk is never in the options we sell it is in the underlying stock/ETF we choose. I like MGM for the future. I am playing it less specifically by selling a further OTM cash secured put or two on it’s sector XLY on down days. If there is such a thing as “The post-COVID era” my hunch is XLY will do great in it. And I am a reasonably patient dude. So best to build a position when it is down if you have future faith.

Wishing you and all friends here a pleasant weekend. – Jay

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

Also included is the mid-week market tone at the end of the report.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Hey Alan

when rolling out or up , how to calculate the 20%, 10% rule?

Is it from the current price of the option or the current price less the cost to close the option from the previous contract?

Thank you very much.

Garoda

Garoda,

The 20%/10% guidelines are based on the option premium generated from the sale of the next-month option.

For example, if we are rolling a $50.00 call option on a stock trading at $51.00 at expiration, we may see the following scenario:

1. Cost-to-close the near month $50.00 call is $1.10

2. STO the next month $50.00 call for $3.00

3. Set a 20% guideline BTC limit order at $0.60 and change to $0.30 mid-contract

Now, the cost-basis of our stock position is now $50.00, the value of our shares at the time the rolling strategy was executed and the amount we would have received had we “allowed” assignment.

Alan