Technical analysis is a critical part of our covered call writing success. We use it for both stock selection, exit strategy execution and timing of our trades. We screen stocks fundamentally and technically via the IBD 50, SmartSelect Scan and MSN Scouter. We make sure we have industry diversification and cash allocation equality. Earnings reports and same-store-monthly retail sales reports are avoided as are companies that trade in low daily volume amounts. Ultimately, we create a watch list of the greatest performing stocks in the greatest performing industries.

In our Blue Collar System, we use moving averages, MACD, the Stochastic Oscillator and Volume to ascertain the technical health of our equity. For me the moving average is king of these parameters with the others playing confirming roles. Each indicator by itself will not suffice, but as a whole they paint a very important picture relating to our buy-sell decisions. First, some key terminology.

Definitions:

- Moving Average (MA)– the average value of a security’s price over a set period of time. They are used to measure momentum and define areas of possible support and resistance.

- Simple Moving Average (SMA) – a moving average that gives equal weight to each day’s price data.

- Exponential Moving Average (EMA)- similar to a SMA except more weight is given to the most recent data.

- Support– the price level which a stock has had difficulty falling below. It is a point where a lot of buyers tend to enter the stock.

- Resistance– the price level which a stock has had difficulty rising above. It is a point where sellers tend to outnumber buyers.

- Uptrend– the price movement of a stock is in an upward direction. The stock price forms a series of higher highs and higher lows.

- Downtrend– the price movement of a stock is in a downward direction. The security forms a series of lower highs and lower lows.

- Sideways Trend (consolidation)- the horizontal price movement of an equity where the forces of supply and demand are equal. The stock simply cannot establish an uptrend or a downtrend.

Simple vs. Exponential Moving Averages:

When selling 1-month options, I prefer the ema to the sma because it provides a quicker response to a change in the stock price. It also avoids false positives where a stock may jump above the sma but not above the ema. In the chart of AAPL below (taken from www.stockcharts.com), the red line represents the ema and the blue line depicts the sma. Note how the ema starts moving up faster as the stock price appreciates and how the ema would have avoided the false positive in February where the price momentarily breaks through the sma but then drops dramatically:

When to use moving averages-practical application:

Moving averages have little value when the stock price is in a period of consolidation. In these instances, we turn to our confirming indicators or exclude the stock from consideration. When the stock is downtrending, we opt for another equity. If the security is trending upwards, the price bars are at or above the 20-d ema and the short term ema is above the longer term ema, this is a strong buy signal. The signal is even stronger if confirmed by MACD, Stochastics and volume. Most winning stocks never make a serious breach of the 20-d ema which is now considered support for the share price. This is indicative of institutional support for that equity. On the other hand, when a stock drops sharply below support on high volume, these major players (mutual funds, banks, insurance companies, pension funds etc.) are starting to move out of this stock and so should we.

Moving Averages and the Premium Report:

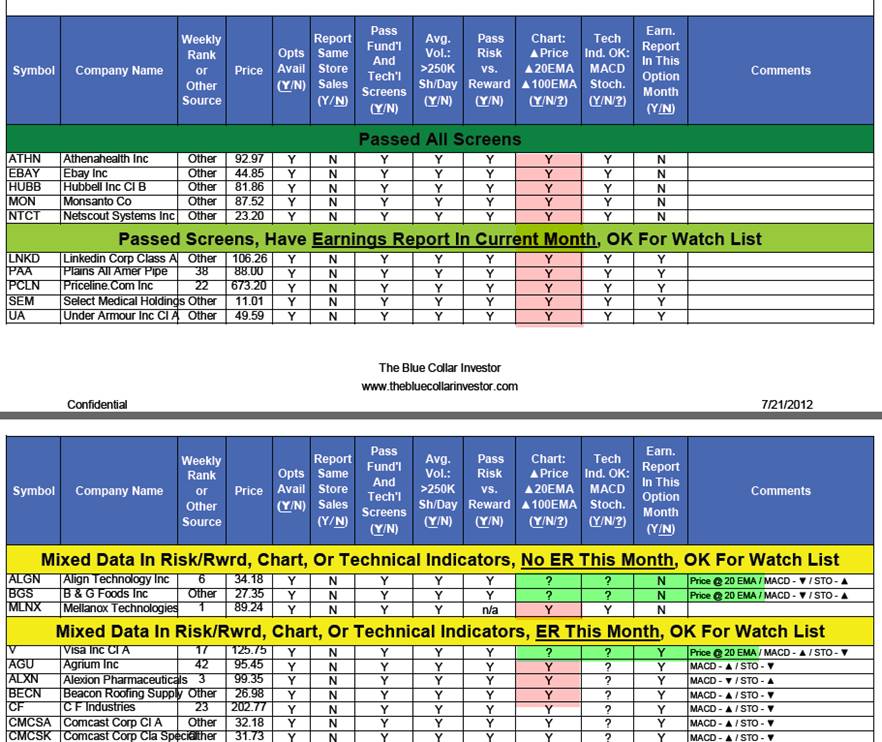

Moving average information is an inherent part of our weekly premium reports. In the column headed by the term “chart”, a “Y” ranking means the following:

- Uptrending pattern

- 20-d ema above the 100-d ema

- Price bars at or above the 20-d ema

I have highlighted in the chart below equities that meet this criteria as of 4PM EST on the last trading day of the week (Pink columns).

If a stock is trading right at the 20-d ema but not above it, the cell is filled with a “?” and a comment is left stating “Price @ 20 EMA”. I have highlighted this in the “green” rows below:

Conclusions:

Moving averages are effective tools for identifying and confirming trends as well as support and resistance. This facilitates our trading system as it assists in making our buy-sell decisions. Since it is a lagging indicator, it is not predictive of change as let’s say the MACD is. But as they say on Wall Street, “the trend is your friend” and we want as many friends as possible when investing our hard-earned money. As with all technical tools, moving averages should not be used alone, but rather in conjunction with our other technical indicators.

More information on technical analysis and the confirming indicators are found in Chapter 8 of Cashing in on Covered Calls and Chapter 4 of Alan Ellman’s Encyclopedia for Covered Call Writing.

Market tone:

This week’s economic reports were highlighted by a positive jobs report on Friday which propelled the market into positive territory for the week:

- Employers added 163,000 jobs in July well ahead of the 100,000 expected based on a survey of businesses

- Unemployment rate ticked up to 8.3% based on the household survey which is a smaller sample size

- The ISM Manufacturing Index showed weakness @ 49.8, lower than the 50.1 anticipated

- Orders for manufactured goods dropped by 0.5% in June lower than the + 0.5% expected

- Auto sales are projecting to an annual rate of 14.1 million, the best since 2007

- On Wednesday, the FOMC declined from making any changes to monetary policy and re-affirmed its commitment to keep the target interest rate between 0% and 0.25% through the end of 2014

- The Conference Board’s Index of Consumer Confidence (a gauge of consumers’ attitudes about the present economic situation as well as their expectations regarding future conditions. Consumer confidence tends to have a strong correlation with consumer spending patterns) rose by 3.2 points to 65.9 in July more than the 61.5 anticipated

- Personal income rose by 0.5% in June while the savings rate rose to 4.4%, the highest level in a year

- The Census Bureau’s report on construction spending was also a positive with an increase of 0.4% in June from the prior month an of 7.0% from the prior year

For the week, the S&P 500 rose by 0.4%, for a year-to-date return of 12%, including dividends.

Summary:

IBD: Confirmed uptrend

BCI: Cautiously bullish on the economy and the stock market using an equal amount of in-the-money and out-of-the-money strikes. This week many investors re-visited the flash-crash memories of May, 2010 when trading in six equities was halted after an electronic trading system run by Knight Capital malfunctioned. Regulatory agencies are reviewing this matter. This appears to be an isolated incident and does not alter this site’s market assessment.

Much success to all,

Alan ([email protected])

Alan,

Excellent article, thanks. Would you use sma for long-term investing?

Irene

Irene,

Although I, personally, do very little long-term investing since I started with cc writing you are 100% correct that the use of SMAs is more appropriate. Many investors will use a 50-d and 200-d sma. As seen in the chart below for ALXN, a stock on our recently-published watch list, sma (left chart) will not give us the quick breakdown in support that is critical for cc writing and our exit strategy executions. Click on image to enlarge and use the back arrow to return to this blog.

Alan

MY BROTHER SAYS CALCULATION FOR THE TARGET PRICE FOR AAPL IS FORWARD PE 11.57 X EPS 44.16=510.93

BUT YAHOO FINANCE SAYS PRICE TARGET IS 716.69

HOW DOES YAHOO FINANCE CALCULATE THIS????????

THANK YOU

Dana,

When using fundamentals (PE ratios specifically), the formula for calculating target (future) price is:

Current price x (trailing PE)/ (forward PE)

Using the stats for AAPLshown in the chart below from finance yahoo:

$615.70 x 14.47/11.72 = $760.17

CLICK ON IMAGE TO ENLARGE

Alan

Premium Members,

The Weekly Report for 08-03-12 has been uploaded to the Premium Member website and is available for download.

Best,

Barry and The BCI Team

Alan,

I just got an teaser about a options research service that uses the Japanese candlestick charts to select good option candidates.

They state “Candlestick charts are a superior way to depict price movement because they provide more timelyand valuable information thant ypical bar charts. For example, candlestick charts more accurately reflect where a stock is trading compared with today’s open… rather than relying on yesterday’s close.”

Can you explain what this is?

Thanks very much.

Jack

Jack,

Both candlesticks and OHLC bars are excellent technical tools. Both offer major advantages over the line chart but little SIGNIFICANT advantage over each other in my view. I prefer the bar chart but that is my personal preference and have no issue with those who use candlesticks. Here are the similarities and differences:

Common Features:

•Display high, low, open and close prices

•Neither chart reflects the sequence of events between the open and close

•Provide much more information than the line chart

How they differ:

•In candlestick charts, the relationship between open and close is depicted by the color of the body, whereas with bar charts that relationship is shown by horizontal lines projecting from the vertical.

•The bar chart places greater emphasis on the closing price of the stock in relation to the PRIOR periods close. The candlestick version places the highest importance of the close as it relates to the open of the SAME day. This is the main reason I prefer the bar chart but the difference is negligible.

Alan

Jack,

Adding to Alan’s comments…

– One advantage of candlesticks is that they tend to give an understanding of trader sentiment.something that bar charts don’t do. It is important to understand that it takes a lot of training to understand and use candlesticks.

– Since bar charts (and candlesticks for that matter) focus closing price, bar charts fit nicely into our system and are easier to learn.

– The other technical analysis tools that we use…MACD and Slow Stochastics…use the closing price for their calculations as well.

– If you look at the behavior if the MACD and candlestick reversal patterns, you’ll find that that the timing is relatively close when predicting a trend reversal. For the most part, the timing differences would be of more value to a day trader vs. a covered call trader.

– With the BCI system, we use a combination of tools and screens to determine our “Running List”, so specific tool differences tend to be less important than what the confluence of inputs of our tool set tells us.

– In either case, you would want to see the trend reversal confirmed, usually by volume or other indicator.

Since the focus of the BCI methodology is on ease of use and a short learning curve, Alan selected the bar chart as the BCI price tool. As it turns out, Alan prefers to use bar charts while I tend to use candlesticks.

I hope this helps.

Best,

Barry

[email protected]

Alan, I know this is a really nit-picky comment but it may lead to a tiny bit more clarity in your weekly table.

For the Chart column, you wrote that the three components are:

Uptrending pattern

20-d ema above the 100-d ema

Price bars at or above the 20-d ema

In the table itself, you have these abbreviations:

^Price

^20EMA

^100EMA

Which words correspond with which table abbreviations? I think your word order is different than your table abbreviations order.

Assuming your words are in the “right” order, to make it a little more intuitively obvious what the abbreviations mean, I might think the abbreviations in the table and their order would be something like this:

Uptrending pattern: ^Price

20-d ema above the 100-d ema: 20>100

Price bars at or above the 20-d ema: ^20EMA

No big deal. Just food for thought.

Steve

Steve,

The meaning of the column heading is:

Price bar above the 20 EMA

20 EMA above the 100 EMA

Ideally, they should be stacked in the above order to receive a “Y”. Per Alan’s rules:

– If any part of the price bar touches the 20 EMA, then the entry is a

“?”.

– If the price bar is below the 20 EMA, the entry is an “N” and the

stock fails that particular screen.

– If the 20 EMA is below the 100 EMA, the entry is an “N” and the

stock fails that particular screen.

The notation was selected to minimize the report/screen real estate in order to get all of the information in while still using a readable font size.

Best,

Barry

Radio interview re-broadcast:

http://www.TheBusinessAuthorsShow.com

LTD: Offsite Q&A:

Alan,

Thanks for the member website and the books. Really enjoying learning more about all this and making money.

I do have a quick question if you dont mind about a stock and covered call I wrote before I found out about you. Hoping you could point me in the right direction.

Back about 6 months ago (or maybe longer) I bought LTD at $40.00 a share. I then wrote three covered calls with a strike of $44.00 expiring this month and collected $368.77

Now the stock is sitting at just above $50 and the premium is sitting at around $1900

If this was your stock (which I know it wouldn’t be now because of the earnings report coming up) would you just let it expire and move on or would you play this any other way?

At this point I really don’t know what to do but was wondering if there are any other way to play it that I haven’t thought of.

Thanks!

My response:

Hi ,

I hope you understand that I can’t give financial advice in this venue. However, I can make a few points that you should find useful:

Owning the stock through the earnings report could wipe out all your gains on the downside (or worse) and will give you no additional profit on the upside

Deep in-the-money strikes like this one usually have little time value ($0.20 in this case- see screenshot below)

This means that you can close your position at very little cost to you

Your shares are worth $44 due to your option obligation

By buying back the option, your shares are worth $50.60 (+ $6.60)

With a debit of $6.80 to close, that’s a net debit of $20 per contract to guarantee a nice profit and not risk and earnings report disappointment

As an aside, LTD is a “banned” stock because it report same store sales on a monthly basis. This is like a monthly earnings report.

Much success,

Alan

***CLICK ON IMAGE TO ENLARGE; USE BACK ARROW TO RETURN TO BLOG

Alan,

Do you use trailing stops when buying and selling stock outside your covered call accounts?

Thanks for your insight.

Irene

Irene,

I do very little pure stock buying and selling in my portfolio since I mastered covered call writing. However, the use of trailing stops makes good sense in that it protects on the downside and allows for share appreciation on the upside. The trailing feature kicks in if the price rises but does change if the price decreases. Most investors will using trailing stops in the 7-10% range.

Alan

Irene, most people who use trailing stops tend to use them for relatively short term trades (days to weeks). People who are buying stocks to hold for a longer time frame (weeks to months) tend to use stops below key points of support. In the end, it’s really a matter of risk tolerance. How much potential gain are you willing to give up by getting stopped out by a normal pull back in order to prevent any loss beyond that amount. It’s definitely a trade-off. Steve

Alan and Steve,

Thanks for sharing your knowledge and experience. It’s so helpful to newbies like me.

Irene

Premium members:

This week’s 6-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team