Covered call writing can be used in a variety of ways. Most covered call writers use this strategy to generate monthly cash flow. It can also be adapted to enhance the returns of a long-term buy-and-hold portfolio where some of our securities may have been purchased at a significantly lower price than current market value and sale of these stocks would create adverse tax consequences. This latter strategy is known as portfolio overwriting.

Differences between portfolio overwriting and conventional covered call writing

With portfolio overwriting our intention is to hold on to the stocks in our portfolio and avoid exercise of the options. We structure the strategy in a way that allows for continued share appreciation with additional profits earned from sale of the call options. To accomplish this we use only out-of-the-money strikes and move the strike price as far away from current market value to minimize the risk of exercise while at the same time achieving our option-writing goals. For traditional covered call writing we may use in-the-money strikes in bearish market environments and perhaps also use strikes not as far out-of-the-money if bullish. Option return goals are generally lower for portfolio overwriting than for traditional covered call writing.

Structuring a portfolio overwriting trade

Let’s say our long-term buy-and-hold portfolio has been generating an average annualized return of 8% and we want to enhance those returns by 6%. That means we are looking for returns of 1/2 1% per month or 1% for a 2-month return. Now we normally stay with 1-month options for the traditional strategy but when we are concerned about early assignment, ex-dividend dates must be accounted for. As a result, we may need to employ 2-month options for portfolio overwriting and I will explain.

Ex-dividend dates and portfolio overwriting

99% of the time, if options are exercised it will occur the day after expiration Friday (4 PM ET on the 3rd Friday of the month). To avoid this, we simply buy back the near-month option and sell the next month’s option. This is known as rolling the option…problem solved. However, there are times when an option will be exercised early and when that occurs it is usually associated with an ex-dividend date. This is the date shares must be owned in order to capture an upcoming dividend. The option holder (buyer) has the right to exercise the option any time before expiration to capture that dividend. When this occurs, it is usually the day before the ex-date.

How to avoid early exercise related to ex-dates

There are two ways to dramatically reduce the chance of early exercise related to ex-dividend dates:

- Write the 1-month call the day after the ex-date

- Write a 2-month call moving the contract expiration date much further away from the dividend ex-date

How to decide between 1-month and 2-month expirations: Real life example with AXP

With American Express trading at $52.96 (late January, 2016) and a goal of 6% per year on the option side, let’s have a look at a real-life 1-month options chain:

American Express (AXP): 1-Month options Chain

A goal of 1/2 of 1% would calculate to approximately $0.27. Let’s select the out-of-the-money $56.50 strike that earns a 1-month return of 0.60% and allows for an additional share appreciation profit of 6.7% (up to the $56.50 strike). This would make a great trade unless there was an ex-dividend date issue. Let’s check:

www.dividendinvestor.com

AXP: Ex-Dividend Date

We see that the ex-dividend date passed in early January and so the 1-month option will work just fine.

What if the ex-date was due mid-contract?

If the ex-date is due the first week of a contract, we simply write the call option the day after that date. Had it been later in that contract month, we could have viewed the 2-month expiration. Let’s have a look:

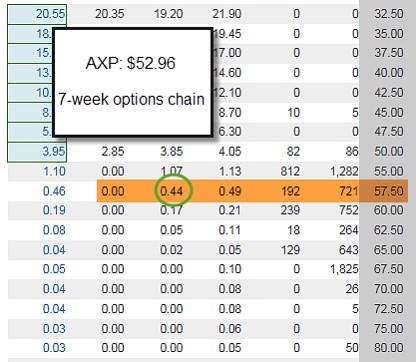

AXP: 2-Month Options Chain

This is actually a 7-week return and the $57.50 strike produces a $0.44 return which annualizes to 6.17% to meet our goal of 6%. It also allows for share appreciation to the $57.50 strike or an additional 7-week return of 8.6%.

Discussion

With portfolio overwriting we use covered call writing to enhance portfolio annualized returns while structuring the strategy to avoid exercise and sale of our shares. This involves selling out-of-the-money call options that meet our return goals and factoring in ex-dividend dates. We favor 1-month options if there is no ex-date that contract month or if it occurs in the first week of a contract. If there is an ex-date that contract month that is projected after the first week, we use a 2-month expiration so that the contract expires well after the ex-date making early exercise much less likely.

Next live event

June 11, 2016

American Association of Individual Investors

Research Triangle Chapter

Raleigh/Durham, North Carolina

10 AM – 12 PM

Registration link to follow

- US retail sales rebounded in April, rising 1.3%, their biggest increase in a year

- March sales figures were revised higher to -0.3% from -0.4%

- The sales gains were broad based, though strong auto sales were a standout

- Retail sales bounce supports faster US growth in Q2 after a weak 0.5% growth rate in Q1.

- Germany, Europe’s largest economy, grew 0.7% in Q1, more than twice Q4’s 0.3% pace

- Eurozone growth was slightly less robust on a quarterly basis, growing 0.5% but on an annualized basis, the eurozone grew 1.5%

- Eurogroup finance ministers met this week to discuss debt relief for Greece. With the United Kingdom’s Brexit vote looming, ministers are widely expected to work out a deal for Greece so as to avoid a crisis that could provide ammunition to Britain’s “Leave” camp

- Brazilian president Dilma Rousseff has been suspended from office for up to six months while she is being tried in the Senate for violating fiscal laws to cover budget deficits

- Both the Bank of England (BOE) and the International Monetary Fund (IMF) warned this week that the UK economy will grow more slowly if Britain votes to leave the European Union

- In a letter to a US congressman, US Federal Reserve Chair Janet Yellen said negative interest rates cannot be ruled out as a possible policy tool in an adverse economic scenario but the Fed would use other tools at its disposal before resorting to negative interest rates

- Loan growth in China dropped 60% in April as Chinese authorities warned that the government intends to rein in debt-fueled stimulus. Local government bond issuance has been surging in recent months

THE WEEK AHEAD

- China reports retail sales, industrial production and investment data on Saturday, May 14th

- The eurozone consumer price index is released on Wednesday, May 18th

- The minutes of the April FOMC meeting are released on Wednesday, May 18th

- An account of the April ECB meeting will be released on Thursday, May 19th

- The UK releases April retail sales data on Thursday, May 19th

- The minutes of the April BOJ Monetary Policy Committee meeting are released on Friday, May 20th

Summary

IBD: Uptrend under pressure

GMI: 3/6- Sell signal since market close of May 4th

BCI: Neutral selling an equal number of in-the-money and out-of-the-money strikes.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

Alan ([email protected])

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member website and is available for download in the “Reports” section. Look for the report dated 05/13/16.

Be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar Investor YouTube Channel. For your convenience, the link to The Blue Collar Investor YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in “Earnings Season”, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings season/

Best,

Barry and The Blue Collar Investor Team

Thanks Alan for another very interesting article.

I have been recently doing Portfolio Overwriting in my IRA account and like the idea of generating some modest additional income on a annualized basis.

After reading your article I am wondering if you could comment on overwriting in tax differed accounts, such as IRA’s. since being assigned has not tax implication for the account, even with potentially large capital gains on long term holds. I’m wondering if picking lower strike prices out of the money makes sense.

I have been re-establishing a position for those I want to continue to hold after the assignments.

thanks again for your great series of informative articles,

Alex

Alex,

If there are no tax or dividend issues that any strike can be used and we can be more aggressive in our trading style. Here we can select closer to-the-money strikes, even in-the-money strikes in a bearish environment. It really becomes traditional covered call writing. Thanks for the question allowing me to clarify.

Alan

I found your recent discussion of Portfolio Overwriting to be of great interest, as also I have Chapter 14 in your Encyclopedia as well. My interest stems from the fact that I have a significant collection of holdings that I essentially treat as a “buy-and-hold” Portfolio, mainly to help maintain pre-determined asset allocation objectives, while adding a bit of extra return in the process. Tax concerns are not a factor, as these holdings are kept in an IRA account.

In your discussion, you generally suggest using out-of-the-money strikes to reduce the risk of unwanted or unexpected exercise. But, I note that in Chapter 14 you allude to alternatively using at or in-the-money strikes, which is much closer to what I do. To protect these holdings from assignment, I regularly & religiously monitor the time value remaining in the Option, as well as anticipated Dividend dates & payments. And of course, I keep ample time between the current date & the expiration date.

At times, as a result of rolling some of these holdings out and/or up, the current option value includes some significant Intrinsic Value, which I can control by including a “buy up” component with some of the rolls.

Your current comments on this subject, however, prompt me to ask 2 questions on this subject I have meant to ask for some time:

Aside from the need to carefully maintain monitoring of such in-the-money call positions, as mentioned above, do you see any downside or potential problems with the approach outlined?

When the current value of an option for a stock one wishes to keep includes substantial intrinsic value, would it be better to “buy it up” to close to the current value?

Regards,

Paul

Paul,

You have an outstanding grasp as to how this strategy works and as long as you are comfortable trading intrinsic value for share “buy-up” when you want to retain a stock, this approach makes 100% sense. This, I believe, answers question 2 as well. Since you are trading in a sheltered account you, of course, have more flexibility in letting a stock go if you choose to.

Alan

Paul,

Thanks for your informative post. Like you, I use covered calls on core holdings to enhance yield. Speaking only for me, I have not gotten the hang of using them with growth stocks :).

Also like you, I only sell options in my IRA. Too much tax fuss in a cash account!

My approach to portfolio over writing is embarrassingly simple: I use monthly expiry and sell OTM to yield 1% ROO. Since they are core holdings earnings reports don’t bother me. I just don’t want to be covered if they are good and I don’t want to be covered for an opportunistic options buyer to exercise me for a dividend. So I steer around those dates using weeklies.

If I can enhance the yield on MCD, XOM, PFE, T, PG, LLY, etc.. by 1% a month why not?

If my position get’s over run it’s a toss up what to do next. Often I allow exercise then sell a cash secured put to start the circle over. Sometimes I buy back and roll. The beauty of doing all this in IRA’s is taking tax issues off the table.

After Alan’s great replies my favorite part of our blog is reading how others use this great strategy. Thanks for sharing how you do it! – Jay

Alan,

First off thanks for the service. I have read the books and watched the DVD’s and practiced now for 4 months. I am going to be starting official trading next week. The strategy is great and I really like the way you take it to another level. I have a question though on expiration Friday.

If you know a stock is not going to be sold, the strike price is higher than the market price, when would you sell the stock? This assumes you aren’t using another exit strategy. This happened to me during practice. I had a stock that that I bought for $51.32 and sold the $55.00 strike. The stock was at $53.50 towards close on expiration Friday. I thought about locking in those profits from the stock going up but also didn’t want to subject myself to a sudden price hike and have the option called. Do you have any guidance on when to sell the stock that you are not planning on selling an option on the following month, and the current option won’t get exercised?

Thanks!

Dustin

Dustin,

You’re in the driver’s seat in the scenario you describe. You have generated two income streams…one from option premium and the other unrealized share gain (stock hasn’t been sold yet).

Now, a sudden price hike is actually a positive because you will generate even more share appreciation up to the $55 strike and then your stock will be sold after contract expiration which you are considering anyway…the best situation.

Assuming no further share appreciation, closing the short call will cost a bit of time value plus 2 trading commissions. You can wait until the contract expires worthless and sell the stock on Monday after expiration and incur no time value loss and only 1 trading commission. The only disadvantage of this latter approach is if the stock value declines over the weekend…unlikely but possible.

Keep up the good work.

Alan

Hi Alan,

I am currently reading your book “Selling Cash-Secured Puts” I purchased at the AAII Conference in Las Vegas Last November. I also purchased and read your “Complete Encyclopedia for Covered Call Writing”.

My question is on page 109 of your “Selling Cash Secured Puts” you mentioned a “just developed “BCI Cash Secured Put Selling Calculator”. Is this calculator available to me?

Please let me know.

PS

I already have your basic calculator for covered calls. The covered call calculator and your encyclopedia has helped me out a lot in making covered call option trades.

Bob

Bob,

Yes, the single-column version of the BCI Put Calculator can be downloaded for free by clicking on the “Free Resources” link on the top black bar of our web pages and entering your email address. There are many more free resources there as well. Glad to help.

Alan

Alan,

I really appreciate your approach to teaching about options. I have a question as I have attempted to use my first premium report:

Is there an easy way (easier than by hand) to populate the Ellman calculator with options of the companies listed in the report?

Thanks,

Jim

Jim,

Yes…pages 5 and 6 of the stock reports are designed specifically to be copied and pasted onto the multiple tab of the Ellman calculator.

Alan

Alan,

Can you comment about using naked calls instead of covered calls – it seems to me that this would eliminate the risk of stock movement (and the possibility of stock gain) but, assuming the underlying is a suitable stock, would enable full benefit to be derived from the call in a down market without concern about stock losses and rules in an up market would still apply. Does this make sense.

Thanks

Peter

Peter,

Let me respond with a hypothetical example:

COVERED CALL WRITING

BCI trading at $28

We buy 100 shares = $2800

We sell the $30 call at $1

BCI moves to $40 and option is exercised at $30

We generate $1 + $2 (share appreciation) = 11%

NAKED CALL SELLING

Sell $30 call at $1 when BCI is at $28

BCI moves to $40

We are obligated to sell at $30 *(shares we must now buy at market)

Buy 100 shares per contract at $40 to sell at $30

The loss is $900 per contract

With this (admittedly exaggerated) example, we make $300/contract with covered call writing and lose $900/contract with naked options selling. The risk in naked call option selling is when share value rises above the strike. It is a risky strategy and appropriate only for those with high risk tolerance.

There is no one strategy right for every investor. Conservative investors should favor strategies like covered call writing over naked options trading in my humble opinion.

Alan

Alan,

As a newbie, I just ran across your cover call (10 mistakes) You Tube video.

As a retiree, concerned about risk, should a covered call writer buy a protective (married) put on stocks used for covered calls. ?

In my research, I was thinking about buying ATM leap puts (Jan 2018) which (with Theta)would average down monthly insurance cost. Perhaps holding the insurance for a couple of months to confirm stock direction, and then sell back the leap put. which would give me cheaper insurance coverage per month vs buying front month.I

I appreciate your thoughts please, pros and cons… Is this a strategy you would endorse in your service ??

Thanks

Cecil

Hi Cecil,

Protective puts are a reasonable way to avoid catastrophic losses. The main disadvantage is the cost and the impact on covered call returns. LEAPS imply a long-term commitment to the underlying, something I do not subscribe to. I re-evaluate all positions on a monthly basis. But certainly my way isn’t the only way so LEAPS may have application in certain investment approaches. Here is a link to an article I published on this topic:

https://www.thebluecollarinvestor.com/covered-call-writing-with-protective-puts-a-proposed-strategy/

Alan

Cecil,

You are obviously not a newbie to options or investing and as a fellow retiree it is nice to have you here! We have a great comment group.

I consider covered calls, cash secured puts and portfolio overwriting essential tools for any retiree who manages their own money, No better resources than the material on this site and Alan’s books if you are not familiar with those tools.

And there are times, maybe now, given today’s news about a probable rate hike, the often crummy summer seasonality and the uncertainty of a bizarre election year that buying protection makes sense.

Not position by position. But blanket future dated SPY puts funded by call/put premiums and dividends. Then, as you say, sell them when you think the coast is clear before theta decay gets severe. My two cents, – Jay

Alan, Jay,

Thanks so much for sharing your perspectives. I’ve been learning so much on this site. I may try protective puts on a few of my positions.

Arlene

Arlene,

Thank you for your kind words. This a great place to share and learn with like minded investors!

But I often think we rely too much on Good ‘ol Alan :). When I read the questions our friends ask here they suggest a wealth of underlying knowledge and experience like icebergs below the water line.

Meaning I would love to see this site become a place where people share their experiences as much as they pose questions of Alan.

It’s late in this post cycle, Arlene. So if you read me making this suggestion under future blogs thank you for inspiring the idea :)! – Jay

With all the chatter about market weakness and concern that it will only get worse, how should we approach covered call writing?

Thanks

Ron,

If your market outlook is bearish or volatile consider in-the-money call options and out-of-the-money put options:

https://www.thebluecollarinvestor.com/using-out-of-the-money-puts-and-in-the-money-calls-to-manage-bear-markets/

Also, using low-beta stocks and ETFs (with low to moderate implied volatility) will also create a more defensive portfolio. Finally, protective puts are in play if we don’t mind spending the money (I don’t use protective puts but there’s nothing wrong with it if it helps us sleep better at night).

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

Note the unusual number of ETFs priced under $50.00 this week.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

The article is very interesting for people with tax residence in (socialist) europe (like italy) where capital gain is (heavly) taxated.

Hi Mark and all, and thanks again Alan for your great blog!

Mark, I found your comment really interesting so I looked into its assumption that we pay less than socialist countries of Europe. What I found doesn’t support your thesis. Do you have any references to this topic.

Here is one report I found based on a study by Ernst and Young and Deloitte Tax Foundation Calculations: It shows the USA is pretty high up the list at number 6 actually ahead of Italy mentioned in your note that is at number 11.

here is a link: http://taxfoundation.org/blog/us-taxpayers-face-6th-highest-top-marginal-capital-gains-tax-rate-oecd

Alex