Portfolio overwriting is a covered call writing alternative strategy. Our goals include increasing our returns by a modest amount while still retaining ownership of the shares. Deep out-of-the-money strikes are sold with specific annualized returns in mind, let’s say 6% for purposes of this article.

Apple Computer is a widely held stock by many of our members who look to leverage these securities to generate additional income. In January 2020, AAPL had been on a bullish tear with share price rising exponentially:

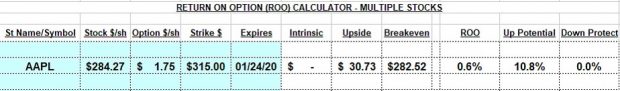

Portfolio overwriting trade entered 12/24/2019 (1-month return)

- Buy AAPL at $284.27

- Sell $315.00 1/24/2020 call at $1.75

- Goal is an annualized 6% or 0.5% per month return

A 0.6% 1-month time-value return approximates our 0.5% goal with a huge 10.8% upside potential (130% annualized). Selling deep out-of-the-money calls similar to this $315.00 strike will normally have Deltas of <.15, meaning less than a 15% chance of expiring in-the-money. However, as we can see from the chart above, AAPL out-paced even this strike and was trading at $318.60 on expiration Friday (1/24/2020).

Trade status 3 PM ET on expiration Friday (1/24/2020)

With AAPL trading at $318.30, the cost-to-close the $315.00 call was $3.50, double the amount we generated from the initial option sale. If we buy-to-close the short call, are we losing money? Heck no!

Final trade overview

We maximized our trade as it was initially established with a 0.6% time-value option profit + a 10.8% upside potential for a total 1-month profit of 11.4%. That’s not losing money. Now, if we close, of the $3.50 we pay, $3.30 is intrinsic-value driving the value of our AAPL shares from the $315.00 contract obligation to current market value of $318.30. The actual time-value cost-to-close is $0.20 or 0.06%. We can now write another deep OTM call with a target 0.5% 1-month initial time-value return. On Thursday, AAPL had a favorable earnings release. A critical BCI rule is never to have an option in place that expires after an earnings report. This matter can be circumvented by using Weekly options the month of the report. Avoid the week of the report and then return to Monthlys. If our annualized goal is 6%, our weekly target would be approximately .1%. If AAPL is trading at $400.00, our weekly time-value return goal would be about $0.40.

Discussion

Portfolio overwriting is a covered call writing alternative strategy geared to increasing returns on long-term buy-and hold stocks. Deep out-of-the-money strikes are used with a set target annualized return in mind. Should a strike end up in-the-money as expiration approaches, we can buy-to-close with a miniscule time-value debit.

For more information on Portfolio Overwriting

BCI Portfolio Overwriting Calculator

Free webinar

I have cancelled all my in-person presentations through the end of the year due to the coronavirus crisis. To keep in touch with our members, we have decided to provide our BCI community with a free webinar in August. Feel free to send in topic ideas and suggestions. Send to: [email protected].

FREE WEBINAR JUST ADDED Thursday August 13th

LOGIN INFORMATION

Alan Ellman is inviting you to a scheduled Zoom meeting.

Topic: FREE WEBINAR Hosted by The Blue Collar Investor

Time: Aug 13, 2020 08:00 PM Eastern Time (US and Canada)

Join Zoom Meeting

Meeting ID: 933 8656 0621

One tap mobile

+16468769923,,93386560621# US (New York)

+13017158592,,93386560621# US (Germantown)

Dial by your location

+1 646 876 9923 US (New York)

+1 301 715 8592 US (Germantown)

+1 312 626 6799 US (Chicago)

+1 669 900 6833 US (San Jose)

+1 253 215 8782 US (Tacoma)

+1 346 248 7799 US (Houston)

Meeting ID: 933 8656 0621

Find your local number: https://zoom.us/u/ad6BluRQRH

Investment club program board members

If you would like to schedule a private webinar with Alan and Barry, send an email to:

Include:

- Contact email

- Contact phone #

- Club website URL

- Put “private webinar” in the header

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan and Barry,

Thank you very much for your webinar today. It was a great presentation and exceeded my expectations. Everyone was very pleased. It clearly had some appeal for everyone. As I was hoping, you have set the bar for future speakers.

Regards,

Tyler (Program Chairman)

Upcoming event

Private webinar (California investment club)

Covered Call Writing with 4 Practical Applications

Saturday September 17th

9 AM – 12PM PT

***********************************************************************************************************************

Market tone data is now located on page 1 of our premium member stock reports and page 8 of our mid-week ETF reports.

****************************************************************************************************************

Alan,

With the uncertainty of the current market, I am thinking of adding protective puts to my covered call trades. What is the best way to select the strikes for the call and put options?

Thank you for any help.

Dennis

Dennis,

The way I do it is to select 1 strike higher than current price for the call and 2 strikes lower for the put. I’m looking forward to Alan’s response.

Good luck,

Marsha

Dennis,

Marsha offers a reasonable formula… calls strikes and put strikes are generally out-of-the-money for collar trades.

I use strategy goals to craft our strike selections. Let’s say our initial time-value return goal for traditional covered call writing is 2% – 4%. When we add protective puts, that range must be lowered due to the cost of the put, let’s say to 1% – 2%.

Here’s a hypothetical;:

With BCI trading at $58.00, the $60.00 call generates $1.50 and the $55.00 put costs $0.75This creates a net option credit of $0.,75, on a cost basis of $58.00, or a 1.3% 1-month return. This meets our hypothetical initial time-value return goal range of 1% – 2%.

The screenshot below shows the calculations using the BCI Collar Calculator Note that if share price moves up to the $60.,00 strike, there will be a max 1-month return of 4.74%. The max loss is 3.88%

For more information on the collar strategy:

https://thebluecollarinvestor.com/minimembership/covered-call-writing-alernative-strategies/

https://thebluecollarinvestor.com/minimembership/collar-calculator/

https://thebluecollarinvestor.com/minimembership/video-the-collar-strategy/

Alan

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 07/31/20.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are starting Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

The BCI team has added additional information, improved the format of our weekly ETF Reports, enhancing the quality of these reports, and making them more user-friendly and time-efficient. Here is a link to a video overview of these new upgrades:

https://youtu.be/-wgqoyjP5bQ

On the front page of the Weekly Stock Report, we now display the Top 10 ETFs, the Top 3 SPDR Sector Funds, and the 4 single Inverse Index Funds. They are sorted using the 1-month performances from the Wednesday night ETF report and the prices from the weekend close.

Best,

Barry and The Blue Collar Investor Team

[email protected]

Alan,

If we are avoiding earnings weeks and ex dividend weeks, shouldn’t our are aim should be for higher than 1/2% per month to get to 6% annual? Hope I’m not getting too picky.

Thanks,

Tim?

Tim,

You are not being too picky at all. If the ex-dates and earnings dates are in different contract months, there will be 8 weeks per year when we are not selling options. This will move our monthly target from 0.5% per month to 0.6% per month or 0.14% per week..

Alan

Hello Alan,

I just watched the BCI podcast 15. Very informative. I’d like to incorporate puts to buy stocks at discount.

How can I use that in conjunction with your BCI weekly reports? Just wondering how your timing works with your reports/ expiration date and writing a put to utilize the PCP approach?

Thanks in advance and have a great week!

Regards,

Steve H

Steve,

The same stocks that have passed our rigorous screens that are appropriate for covered call writing are precisely the same securities we use for selling cash-secured puts.

In our PCP strategy, we sell out-of-the-money cash-secured puts and then follow our exit strategy guidelines. If we allow assignment and accept the shares at a discount, we then write our covered calls in the next contract month., I usually keep all my expiration dates the same unless I turn to Weeklys to circumnavigate earnings dates.

Alan

What a time to write an article about Apple. They just announced their 4 for 1 stock split.

I have been busy buying back Deep In The Money Covered Calls and selling the shares. Taking the profit early and selling the shares.

Then buying shares in a new company and selling Covered Calls for more premium.

I like the idea of being a more long term holder of quality companies. So I am now selling premium out a lot further. 4-6 months. With an eye on making money with the share price increase as well the Covered Call premium.

The S&P 500 and Nasdaq have seen an almost full recovery, Do you think we are due for another sell off? Or can it climb higher?

I have also been looking for Deep In The Money Covered Calls I can sell that can still generate 3-5% monthly income, but with a lot more downside protection.

I do think we are looking at a sell off of some kind in the next few months and would rather make less in premium and have more downside protection.

Hey Joe,

If you are new here, welcome, this is a great place to discuss investing ideas!

I may be similar to you in that I have always found it helpful to have an intermediate market target in mind before deciding specific options strikes and expirations. I think all of your ideas have merit for the months ahead.

A simple one that used to escape me when I was a bit bearish is to consider building cash reserves when indexes or stocks hit nice high points. Just sell stuff taking profits assuming you are doing all trading in an options cleared IRA and there are no tax issues?

Then you have the ability to sell cash secured puts against the money if you are right, the market declines some and you can generate a new cash flow even further OTM below price to maybe start adding back again lower after taking profits higher?

These tools are limited only by our creativity :)! – Jay

Dennis and Marsha,

as Alan shows in the hypothetical collar trade example above, there is a nice max. gain possibility of 4.7%, and a limited loss possibility of 3.9%.

This is probably true for most such trades.

It is obvious that a safety net is very comforting

My concern is that these “collars” add an extra factor to the multitude of elements we must consider, before and during, each options cycle.

The BCI CC methodology is a very straightforward approach to low-risk consistent gains for retail investors, such as myself, and by the time we master the required skills, we do not need anything else, except maybe a little bit of luck.

Roni

Hi Alan,

Love your covered call information and processes. I have read your books and followed your emails. The only decision analysis you suggest that I have problems accepting relates to the calculation of returns (and thus decisions)in potential Roll-Out Roll-Up situations. I have struggled with this for some time and have created a couple of spreadsheets to compare my thinking with yours.

My biggest objection is to using UNREALIZED asset gain in the calculation of returns. That gain can, and often does, disappear and is never realized. Yet very often it is the factor that drives the potential return calculation positive or acceptably high.

A second concern is that you don’t account for gain left on the table if you roll out. Very often I would have a positive, realized gain if the option exercises, and I give that up if I roll out. For me it comes down to taking any and all realized gains when they are available.

Would love to hear your thoughts and comments.

Stay healthy,

Charles

Charles,

I’m happy to share with you the rationale behind the BCI formulas.

1. When we buy back an ITM strike at expiration, we are paying mostly intrinsic-value + a little time-value. If we are calculating that intrinsic-value as a debit, we cannot ignore the associated benefit of increasing the value of our shares, realized or unrealized. Now, if we allowed assignment or we were not in this position at all, on Monday, if we liked the stock, we would buy it at the appreciated value. It is, after all, a stock that is most likely performing well.

2. Rolling our options is not automatic. It is a choice available to us. If the stock meets our system criteria and there is no upcoming earnings report and the calculations meet our initial time-value return goal range, rolling is frequently a beneficial choice. If we would not want to own the stock at the current price, allowing assignment would be a better path. We should always opt for the path that offers us the best chance to succeed.

Alan

Alan,

I really like how you explained this. Would I buy the stock on Monday at the current appreciated price if I never owned it before?

If the answer is yes, than rolling an option is a good choice. It makes sense. I get it.

Thanks,

Marsha

Premium members:

This week’s 4-page report of top-performing ETFs and analysis of the top-3 performing Select Sector SPDRs has been uploaded to your premium site. One and three-month analysis are included in the report. Weekly option and implied volatility stats are also incorporated.

The mid-week market tone is located on page 1 of the report.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Hi Alan,

Hope you are doing well.

I am one of your premium member and I like to thank you for all knowledge you are teaching us.

I have a question about one of my trades.

Based on your ETF report, I have bought one contract of ASHR (Xtrackers Harvest CSI 300 China A-Shares ETF) on 21 Jul and sold 3 times weekly call with following detail.

ASHR is not on your recent ETF list also based on news, tension is rising between US and China, what is your suggestion for this ETF as I am making profit from this ETF? If it is not Exercised this Friday, should I sell the ETF at market price or keep seeling cover call?

1- 21 Jul 2020: bought 1 contract of ASHR @ $33.99

2- 21 Jul 2020: Sold weekly the $34 call for $0.54 (Expired) –> Profit $54

3- 28 Jul 2020: Sold weekly the $34 call for $0.10 (Expired) –> Profit $10

4- 3 Aug 2020: Sold weekly the $35 call for $0.40 (Expired) –> Profit $40

Total profit for 3 weeks: $54 + $10 + $40 = $104

Breakeven: $33.99 – $1.04 = $32.95

Current Price: $34.82

If Exercised:

Stock $35.00 – $33.99 = $101

Option $54 + $10 + $40 = $104

Total Profit = $205

3 weeks ROI = %6

If Expired and sell the ETF:

Stock $38.82 – $33.99 = $ 93

Option $54 + $10 + $40 = $104

Total Profit = $197

3 weeks ROI = %5.8

Regards,

AMIR

Amir,

Congratulations on a successful series of trades.

At this point in time, ASHR is not a poor-performer but not an elite-performer as the other eligible ETFs that did appear in this week’s report.

I cannot give specific financial advice in this venue but I can share with you why we “bumped” this security from the recent ETF Report:

Over the past 3-months, ASHR is outperforming the S&P 500, but in the past 1-month, it has underperformed the benchmark as shown in the screenshot below.

Keep up the good work.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Alan,

I’m a fan of BCI, and enjoyed meeting you at one of the last trade shows before the pandemic. I recently discovered that Fidelity displays incorrect Intrinsic Value and Time Value amounts for most of their Options on their Active Trader Pro platform. Their Tech Support acknowledges the problem, and supposedly it will be fixed in the next release. The lesson I learned: don’t assume that trading platforms always calculate correctly.

Dan,

Thanks for sharing. Only an educated investor would pick that up.

Alan