Every investment strategy, including covered call writing and selling cash-secured puts, has advantages and disadvantages. When we decide to implement a plan, it is with the understanding that we accept and embrace these pros and cons. It is not productive to look back and say we could have made more money using a different approach. Recently, Scott sent me a series of hypothetical trades comparing covered call writing and traditional stock ownership. His premise was that if a stock was in an uptrend, it would be preferable not to write the call and allow for full price appreciation.

Scott’s hypothetical trades

Buy-and-hold the stock: Scenario I

- Buy XYZ at $100.00 per share

- Price rises to $104.00 in 2 weeks

- Sell stock at $104.00

- Net profit = $4.00 per share

Buy stock, sell covered call and close short call to avoid assignment: Scenario II

- Buy stock at $100.00 per share

- Sell 1-month $102.00 (4-week) covered call for $1.00 per share

- Price rises to $104.00 in 2 weeks

- Buy-to-close the $102.00 call for $2.50

- Sell stock for $104.00

- Net profit = $2.50 (a gain of $4.00 on the share side and a loss of $1.50 on the option side)

Buy stock, sell covered call and allow assignment: Scenario III

- Buy stock at $100.00 per share

- Sell 1-month $102.00 (4-week) covered call for $1.00 per share

- Price rises to $104.00 in 2 weeks

- Stock is assigned at the $102.00 strike price

- Net profit = $3.00 per share (a gain of $2.00 on the stock side and $1.00 on the option side)

What can happen to share price of a carefully screened stock?

Anything! There are too many factors influencing share price to be 100% certain that a stock that has been screened from fundamental, technical and common-sense perspectives will automatically only appreciate in value. That, also, does not mean that stock screening is an exercise in futility because we are dramatically throwing the odds of a successful trade in our favor. Let’s view the possibilities of share price movement and how that result will impact our covered call writing results:

- Share price moves up a lot: we win generating option premium + share appreciation to the strike for out-of-the-money strikes

- Share price moves up a little: we win generating option premium and modest share appreciation if out-of-the-money strikes are sold

- Share price remains the same: we win generating option premium

- Share price moves down a little (less than option premium): we win generating a net credit return

- Share price moves down a lot: we lose and use our position management skills to mitigate these losses

Evaluating Scenario I

Pure stock ownership, looking back, will produce the best results because the maximum covered call writing profit is $3.00 per share ($1.00 option premium + $2.00 share appreciation). Since the stock moved up $4.00, this turns out to be the best approach under this specific circumstance.

Evaluating Scenario II

The short call was closed at a time value cost of $0.50 ($2.50 – $2.00). This represents 50% of the original $1.00 premium. This is not the proper management approach in this situation. If share price continues to move up causing the time value component of the option premium to approach zero, we may consider the mid-contract unwind exit strategy. Scenario II is not a valid consideration.

Evaluating Scenario III

This trade has been maxed with a $1.00 realized option profit and a $2.00 realized share profit resulting in a $3.00 total profit or a 1-month 3% return, 36% annualized.

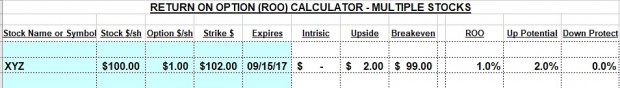

Scenario III: Calculations with the Multiple Tab of the Ellman Calculator

Discussion and perspective

Every strategy has pros and cons and we must understand and accept these parameters before deciding to utilize that approach. If we have a 1-month return goal of 3% and then successfully meet that objective, it is not productive to look back and feel that if we used a different strategy, a better result would have been achieved. In the above series of trades, covered call writing would have achieved better results than pure stock ownership if share price remained under $103.00. Covered call writing also would have produced a profit when share price moved between $99.01 and $99.99 while pure stock ownership would have resulted in a loss. The math speaks for itself.

Next live event

AAII National Conference

November 3rd – 5th: Loews Royal Pacific Resort Orlando Florida:

Exhibit Hall # 303

Alan’s Workshop presentation Saturday 10:30 – 11:45 AM

Market tone

Global continued their gains this week supporting signs of global economic expansion. Oil prices held steady, with a barrel of West Texas Intermediate crude oil closing at $51.70. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX) was also unchanged, at 9.80. This week’s economic and international news of importance:

- Investor sentiment readings continued to improve this week as 60% of Wall Street newsletter writers were bullish on the market, up from 47% in early September, while the American Association of Individual Investors sentiment survey showed that 40% of retail investors were bullish on stocks over the next six months, an above-average reading

- The Merrill Lynch fund manager’s survey reported that cash is moving off the sidelines and into stocks, bringing average cash balances down to 4.7%, the lowest level since May 2015

- Negotiators from the United States, Canada and Mexico extended the talks into the first quarter of 2018. Officials from the three nations made clear they are at an impasse and have called for a nearly month-long break in order to regroup. US trade representative Robert Lighthizer said he had seen no indication that the trading partners were willing to make any changes that will result in a reduction in trade deficits

- The US Federal Reserve’s Beige Book stated that the US economy continues to grow at a moderate pace despite some disruptions from a series of hurricanes

- Markets expect one more rate hike from the FOMC before the end of the year, probably in December

- The US Senate passed a fiscal year 2018 budget resolution late Thursday evening, helping pave the way for a tax reform bill later this year

- The Spanish government is said to have reached agreement with socialist opposition parties to hold regional elections in Catalonia in January

THE WEEK AHEAD

Sun Oct 22nd

- Japan: General election

Mon Oct 23th

- None

Tue Oct 24th

- Global: Purchasing managers indices for October

Wed Oct 25th

- UK: Q3 gross domestic product

- US: Durable goods orders and new home sales

- Canada: Interest rate decision

Thu Oct 26th

- Eurozone: European Central Bank rates decision

Fri Oct 27th

- US: Q3 gross domestic product

For the week, the S&P 500 rose by 0.76% for a year-to-date return of 14.90%

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Buy signal since market close of August 31, 2017

BCI: My portfolio makeup reflects neutral market assessment with an equal number of in-the-money and out-of-the-money strikes

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a slightly bullish outlook. In the past six months, the S&P 500 was up 10% while the VIX (9.80) moved down by 10%.

Much success to all,

Alan and the BCI team

Alan,

I was “playing” with the free version of the calculator and notice that Roll out and Down cells in the WHATNOW are not blue and sort of not live. Is that an error in the version i downloaded or am I missing something (please excuse my ignorance as I am brand new to options).

Regards

Manjit

Manjit,

Rolling out-and-down is not one of the position management strategies inherent in the BCI methodology. There is a note on the right side of the spreadsheet to that effect.

Rolling down implies a declining stock price so we may roll down in the same contract month but to roll down and out implies the strike is still in-the-money so rolling out alone will suffice. If we have concerns that share price will continue to decline, we can allow assignment and select an underlying that we have more confidence in.

Alan

I’ve read your books, and I’m curious. With volatility down at or near all time lows, are you still able to choose 5 stocks per month that would yield 2-3%?

thanks, Doug

Doug,

Yes, despite the low market volatility, these securities do exist. In the screenshot below, I selected 3 stocks that meet these thresholds and do not report earnings in the November contracts. These are based on our 10-13-17 premium stock report so I would wait for this weekend’s report to make selections for next week. There also may be some selections from our ETF report.

Since we are in earnings season, populating our portfolios this contract month is a bit more challenging but still manageable.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Alan,

in my opinion, using scenario III and following the BCI covered call methodology has more advantages then the other scenarios.

Lower risk, consistent gains, and easy decisions to make.

Doug,

if you embrace the BCI methodology, low volatility will be your best friend.

Roni

Most of my options were exercised on expiration Friday for a good profit, but I had two that expired OTM. I don’t plan to keep the two stocks going forward as they both report earnings in the next couple of weeks. My question is as follows: is it suggested to enter a sell order against these two stocks first thing Monday morning, or is there ever a case where you would BTC the option on Friday (for a few pennies) and sell the stock on Friday? My concern is always the possibility of the stock moving down substantially on Monday before I can execute my trade order. thanks, Ed.

If you think that a stock has upward potential next week, close the short calls for pennies and hold the stock. If you have determined that you don’t want to hold the stock, use a Buy/Write order to close everything at once, prior to expiration.

The B/W order has several advantages. You can split the B/A, often obtaining a better exit price. If the call is ITM, the single B/W order insures a good fill. And legging out should only be done by those with some trading experience.

Ed,

Our underlying stocks are generally sold prior to earnings releases. The advantage of closing on Friday of the current contract month or early the following week (1st week of next contract month) is that the cash from the stock sale can be put to work immediately in the form of another covered call position with a different stock or ETF.

Closing on Friday provides the advantage of avoiding the risk of negative news coming out over the weekend. The advantage of waiting until Monday after the OTM option expires worthless is that we are incurring one less trading commission or a lower trading cost. I generally wait until Monday to close positions I no longer want to retain in my option-selling portfolios. Nothing wrong with closing on Friday if it helps sleep better over the weekend!

Alan

October cycle expiry weekend report :

My total account value increased by a healthy 2.9%. 🙂

Total of 9 positions.

7 were excercised/assigned

1 expired worthless, but has accumulated gain from mid contract exit strategie.

1 expired worthles slightly above break even.

I am now 80% in cash, waiting for Barry’s stock screen for the November option cycle.

Roni

Hey Roni.

Wouldn’t life be a “box of chocolates” as Forrest Gump said if we made 3% true gain every month :)? Well done! – Jay

N1 Roni! Personally I made a gain of 1.95% (see pic) but feel like I got hit by a truck, since with only seven trading days to go I was looking at a quite possible gain of around 5%. Two stocks did most of the damage, OMER and FMSA, while CTRL didn’t help, deciding to jump off a cliff with only two days left. Anyhoo I’m now showing a gain of 9.8% after four months of serious cc trading so can’t complain too much 🙂

(Calcs: I closed three positions early and used those funds to invest in GLOB, FMSA and TTD, so a total of about $230k invested after subtracting premiums rec’d, and a profit of $4479.)

Justin,

Thanks.

I understand your frustration. This kind of situation happened to me several times in the past, and will probably happen again in the future, but 1.95% is actually not bad at all. A gain is a gain.

Cheer up – Roni

No probs Roni, if I can maintain that average I’ll be happy 🙂

You’re starting a lot faster than me, I’m opening positions gradually as usual. Just got into YY 90.50’s with a ROO of 2.7% and DP of 4.3%, and SINA 105’s with a ROO of 2.7% and DP 5.4% – that’ll do me for today I think.

Hey Justin,

Please keep a watchful eye on SINA. It is a Chinese stock and they cook the books. I have owned it and made money on it but I finally just punted when it comes to China and own PGJ uncovered. -Jay

Hey Jay,

I don’t trust Chinese companies myself but I figure if it’s been trending up for years, any big downwards move is most likely to happen after an E.R. so I figure it’s worth taking that chance for the good premium on offer.

Justin

Thanks Jay,

if I get 2% consistently I am happy. The rest is extra to save for a rainy season.

Roni

Good morning Roni,

When I read your results post it got me interested in how the S&P (SPY) did during the October expiry period. it was up 2.9%, ironically the same as you were.

One could ask “Well, why bother with all the account churn and options selling? Just hold the index.”

The reason, to me, is you booked those gains, went back to 80% cash and they added to your cash war chest which you have likely redeployed by now to further compound it. For the buy and hold index investor who never heard of options those paper gains are here today and gone tomorrow. – Jay

Jay,

you are right.

I started to enter new trades yesterday, but I’m still 50% in cash, and hope to be fully invested again by the end of this week.

Also you must remember that we are in this game to have fun too.

As you get older, you have to give up most of the things that used to be fun. In my case, sports, sun, booze, food, young girls, older girls, etc. etc. and the TV is mostly trash.

🙂 Roni

Decades ago when I ran on the beach with my shirt off I would get cat calls from women having a good time at the beach bars I passed. If I did that today they would probably call 911 or at least tell me to put my shirt back on :).

There are myriad reasons we are all in the market. I agree fun should be one of them! I enjoy taking a tiny % of assets and playing hunches with options buys always ITM and usually with vertical spreads in either direction so I am not just buying time. Then I see how I do. I pay retirement expenses selling options as others here have discussed. Options speculation gets that new TV or grill I wanted :).

We live once. I do not hang out in the sun like I used to (I am almost 60 and have had basil cell). But, Roni, please don’t give up on the rest of your list until they bury you 🙂 – Jay

OK Jay,

I’ll do my best.

Cheerio – Roni 🙂

Roni – I didn’t see “breathing” on the list of things you’ve given up due to age 😛 Based on that list I’d calculate you’re about 117 years old, am I close? 🙂

Justin

Justin,

you are a bit far, but let’s talk about it in 10 years again, when you young fellows are closer to my present age, ha, ha,ha …… 🙂

Roni

That dates you a bit if you’re calling Jay a “young fellow” Roni 🙂

I’m feeling a bit more conservative today with the market taking a dive, just bought into SCSS with a 2% ROO and 4.9% DP. It has the added bonus of being a mattress company so useful in the event of any hard landings 🙂

I love the landing on the matress, LOL

Entered PYPL today, and have 6 more positions: NFLX, PANW, VEEV, WGO, ULTA, and LRCX.

Will look at SCSS when I get home.

Must go now – Roni

Hi Guys,

I did a little shopping myself on the dip today and added to index positions in DIA, QQQ and IWM. I’ll wait for an up day to cover them. There is hardly any premium out there without getting into higher beta stuff and certainly scant in the index ETF’s. But if I over write on bounce days and ladder the expiries much like you would with CD’s or Bonds it meets my needs.

Our CC and CSP strategies are more flexible than many people realize! – Jay

I can see you’ve both been busy! – personally my plan is to continue to slowly move into positions into next week as more coy’s complete their E.R’s. I like NFLX and WGO Roni (both have been on my watch list) but would avoid ULTA myself since it’s in a downtrend. I actually broke that rule with FMSA last month since there were only a few days left in the contract and was severely punished. I broke another rule with OMER (avoid smaller biotech/medical stocks) and was given a severe spanking there too. So if I break those rules again please let me know 🙂 – Justin

Justin,

Isn’t there an old saying that “Rules were meant to be broken” :)?

I admire you, Roni, Alan, Barry and all our other friends here who are stock pickers married not to their tickers but to the cash value of their portfolios and the goal to grow it one month at a time.

I used to do the same thing. But we all fish this river differently as time flows on. I grew weary of the constant turnover in my portfolio and the roller coaster of individual stocks.

Today I keep an income portfolio of DIA, SPY, QQQ, IWM, GLD and TLT I over write OTM for 1% or less each month. If I get exercised, that is fine, I buy back next dip and over write next bounce. I stagger expiries to lock down a cash flow schedule. It pays the bills.

I also hold a growth basket of ETF’s I like but don’t over write because that would defeat the growth purpose :).

Anyway, you guys do not need my blather, I wanted to tell you, as I did Alan off line, why I don’t join you much on the individual stock discussions. I just don’t trade them anymore except for very brief option buy speculation. – Jay

Jay – I find some rules work a lot better than others, particularly the one about avoiding downtrends. And biotechs are probably particularly bad for cc writing given their penchant for sudden large moves. Re indexes and ETF’s I’m still hopeful that I can maintain an average of at least around 2.5% a month with cc’s, so I’m not considering them at this stage myself. Do you post on other forums? I’ve posted on EliteTrader from time to time when discussing other trading strategies so you might get some discussion there – certainly I prefer the forum format to the ‘comments’ format, much easier to navigate and find posts. – Justin

Hey Justin,

You caught me just before hitting the sack at about 11 PM New Orleans time!

No, I am not on other blog sites because I like this one and have yet to read anything from someone here who was not kind of heart and good intent. Plus I am an old buzzard who has been here a long time :)..

I wish you every success in your goal of 2.5% or better each month. My only suggestion is make certain you are looking at total portfolio return. You know as well as I do that I ROO of 3% on a stock that goes down 4% is a 1% loss. And a ROO of 3% on a stock that goes up 10% probably means either a costly buy back or money left on the table.

That is why when I was trading the stocks you and Roni talk about I always tried to buy at least 200 shares so I could write one contract and let the other half run like a wild pony 🙂

Good night from New Orleans but good morning in Australia! Jay

Hey Jay,

Those screenshots I’ve been posting each month ARE my total cc portfolio return – I’ve been posting them along with my trades so that I can’t be accused of fudging my figures if I complete a year with a 5% (!) monthly return =:-O Let’s face it, anyone can claim they made a great return, but as we all know the net is full of liars (apart from BCC obviously 🙂 ) so without solid proof nobody’s going to believe it.

Re “ROO of 3% on a stock that goes down 4% is a 1% loss” that only applies to ATM trades – I’m trading mostly ITM so I’m regularly making trades where my DP is 6-7%; that’s one reason I managed to make a profit of nearly 2% last month even though I had two nightmare stocks that fell nearly 20% each.

” And a ROO of 3% on a stock that goes up 10% probably means either a costly buy back or money left on the table.”

To me that means a good chance to do an MCU and put the cash to work in another stock – I did that three times last month for instance, so bring ’em on 🙂

11pm in New Orleans = 3pm (Thursday) here in Melbourne – you’re living in the past over there Jay, Good afternoon 🙂

Justin

Hi Jay,

as Alan always say’s, each one must find the method that suits him best, and makes you feel most comfortable.

Me personally, I’m still trying to make less mistakes with my CC only trades, before I move on to more sofisticated stuff.

I read all the posts each week, and take note of all the suggestions, to use them in the future.

Roni

Hi Justin,

I have bought 700 SCSS shares this morning @ 34.04, and sold 7 SCSS 11/17/2017 34.00 C for 1.24.

Now we can watch the matress business together. 🙂

During each montly cycle, I love to see the money left on the table, cause it makes me feel protected.

The more there is, the better I feel, and sometimes I can execute an MCU and shift the cash to a new trade as you said.

If you live in Melbourne, good evening.

Roni

Hi Guys,

I hope others find our “Thread within a thread” entertaining :)?Thank you for all the posts!

Justin, your points were well made and and I applaud your success! Sorry my clock is off a bit and I am living in the past :). Jethro Tull had a song about that or am I dating myself? Maybe that is why Aussies always seem so smart – you are a day ahead of the rest of us 🙂

Best of luck with all your stock trades this expiry. Writing some calls ITM makes a ton of sense even though it may seem counter intuitive to some. – Jay

Justin,

I forgot to comment about ULTA.

I agree, it has been down trending for quite some time.

ULTA is one of my favorite stocks. I traded it successfully from Feb 2015 @ 157.00, through May 2016 @ 231.00, 5 times, and I stopped because it became too expensive, above my limit.

I was really lucky, as it took a big dive after it went above 300.00.

I still like this stock, and this is my first trade since.

Last Tuesday I bought 100 ULTA shares @ 203.11, and sold 1 ULTA 11/17/2017 200.00 C.

And watching it all the time very carefully.

Roni

Roni,

Another of my investing friends uses ULTA as one of his go to stocks with favorable experience like yours. I never traded it but I like it’s business, I have listened to an interview with the CEO on Cramer and she has a lot on the ball. But they all do and none get into those positions without skill, poise and marketing acumen. So I hope your trade works once again.

I’ll ask my significant other what she thinks of ULTA products and if she uses them. That may be the better indicator :)? -Jay

Roni – ‘ULTA Beauty’ was a beauty of a chart for quite a few years; now it’s turned into an ugly wildebeest. Sorry, but I wouldn’t touch it with a ten foot pole (or a five foot Yugoslav). 😛 If I had to give one piece of advice after 32 years of analyzing and trading from charts I’d say “Remember, the trend is your friend!”

Re SCSS, you can now have the fun of telling people that “I’ve invested in a mattress biz – I’m hoping for a quick bounce!” 🙂 I see you sold the ATM option – one reason I prefer the ITM’s is not only the solid DP but also the much greater chance to do an MCU and at a good price if the price jumps. The ATM still looks good value though at about a 3.5% ROO.

Jay – yes this thread is getting a bit unwieldy now with all the posts! Thanks for the applause but as we both know it’s only early days with four months data (though my previous four months of paper trades had fairly similar results – no proof of that though.) Re ITM’s as I’ve mentioned you miss out on the upside compared to OTM’s but I think in most cases the DP as well as a much higher chance for a well-timed MCU more than compensates. I do throw in the occasional OTM though if I find a good-looking candidate.

Justin

Jay and Justin,

this is my last post this week.

On ULTA, I’m ready to pull the triger.

My other positions are carefully divided 50/50 ITM and OTM, generally ATM or NTM.

I always try to stay with Alan.

Have a nice weekend – Roni

Hey Justin,

Happy Friday – but it may already be Saturday down under :)?

Yes, we three knuckleheads will likely want to take up less space on future blogs lest Alan put our tiny fraternity on “Double Secret Probation” :)! (A joke from the old movie Animal House).

I understand your use of ITM CC strikes and suspect only the more knowledgeable call writers use them. I rarely do except when very bearish because I am a portfolio over writer with little interest in having my core positions called away.

I do second guess that occasionally and wonder if my allegiance would be better placed not in my portfolio but in my account value and go back to using stocks as monthly vehicles with which to advance it. Or maybe do a little of both?

Anyway, have a great weekend and we shall chat again soon unless Dean Ellman kicks the three of us off campus 🙂 – Jay

As a matter of interest Jay how much DP do you get on those positions of yours? I tend to average about 5-6% or so on the positions I take. I’m constantly trying to improve my strategies as well – I’ve just discovered the EarningsWhispers Calendar page for instance, and have downloaded all the data for the rest of the contract period to help me come up with a ‘scanning list’ to run against all stocks with a market cap > $800MM. They include the time of day the report is expected, so I include all stocks from the previous day which have reported before the opening bell in my scan – the more candidates the better during these earnings months. Have a happy Sunday,

Justin

Hi Justin,

It’s likely a mater of perspective but I don’t get anything like the DP you shoot for. I am interested in keeping the positions, for the most part,so I look to over write OTM to give things a little running room and get extra yield of maybe 1% in a month.

If it goes down that is not much DP. But if I have had the position for a while and over written it a few times I’ll have a true DP of quite a bit more than than. – Jay

Oops I was thinking of my breakeven point I think with the 5-6% – my DP average would be closer to 3-5% (see current holdings below.) Though looking at recent breakeven %’s that average is probably more like 6-8%. I’m also looking to invest primarily in uptrending stocks which don’t tend to move too violently, hence my scans of all stocks >$800MM market cap since there aren’t as many as I’d like of those (esp. during earnings months.) Obviously it wouldn’t be possible if I was only doing manual searches.

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 10/20/17.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are at the beginning of Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

[email protected]

Alan,

I have started reading your book “Covered calls Encyclopedia volume 1”.I have a question on options, was hoping you could clarify. If I buy a call option worth 2.45$ with 245$ ,and its expiration date is next week. How can make money with that call option ?

Basically how can you make money with buying naked call option buying if I don’t have any intention of buying shares?

With selling call options you get the premium ,and your obligated to deliver the shares.

Thanks,

Harini

Harini,

When buying call options (we sell options in the BCI community) investors are expecting the underlying stock or ETF to appreciate in value thereby causing the corresponding call option to also appreciate in value. This is known as Delta. Now, option value will decline over time (Theta) all other factors remaining the same much like a car depreciates in value once we pull it out of the dealer’s parking lot. So for option buyers to make money, Delta must exceed Theta assuming the volatility of the underlying remains the same.

In our BCI community, we prefer to be on the sell side of options. This is a more conservative approach to option trading with the disadvantage of capping upside compared to buying call options.

Alan

Harini,

If there was only one way and one club with which to hit a golf ball I would not carry 14 clubs around the course :).

By that I mean selling options is the way most of us play this game. But buying them is not blasphemy. I do it all the time.

My suggestion to friends who buy them is please do enough homework to choose tactics consistent with your market view and risk tolerance then be accountable for better or worse. I, of course, wish you only the better! – Jay

Alan,

There is one area I feel completely lost. I did not see a chapter on definitions of the terms “sell to open …sell to close… buy to open…etc”. When you give the instructions in the book you use different terminology. Can you lead me to another book you have written that goes into detail on what to click to start an option?

Thx Scott

Scott,

The terms on our trade execution forms:

Sell-to-open (STO) when our options are first sold.

Buy-to-close (BTC) if we decide to buy back that option.

The best book to understand details on trade executions is The Complete Encyclopedia- Classic edition pages 215 – 245:

https://www.thebluecollarinvestor.com/alan-ellmans-complete-encyclopedia-for-covered-call-writing-scover/

Alan

Alan,

I have tried to tell a few close friends about your methodology and they either thought I was trying to sell them something or said options sounded too risky, even after I attempted to explain that the system is actually safer than only owning equities, because the position is hedged. Maybe I was too enthusiastic, but it is hard not to be.

I learned about the BCI system in Feb 2016 when I had the flu and was out of work for a week. I stumbled upon your youtube videos. That one week period is the most valuable experience I have ever had (from a financial standpoint). You don’t know how much I appreciate you and your team – it is difficult to put into words. After making a few rookie mistakes and not following the system, the past year has been so rewarding and fun. The only station I listen to in my car now is CNBC (with maybe a little Margaritaville radio mixed in occasionally).

Anyway, thanks and “take care” 🙂

Dan

Dan,

You made my day and my team and I can’t thank you enough. We’re glad to have played some small role in your success.

Don’t become discouraged as you spread the word regarding option-selling. Some may not take the time to evaluate the strategies and others may do their due-diligence and find that it’s just not right for their trading style. If you reach one person who benefits from these strategies, it will be quite fulfilling.

Keep up the good work.

Alan

Your article this week, ‘Pros and Cons of Covered Call Writing: Calculation Perspective’, resonated with me. I think investors need to clearly define their goals when writing covered calls and selling cash-secured puts. Too often when investing, the ‘greed factor’ tends to creep in. When selling options, we set our monthly ROO goals at 2 to 4 percent (sometimes a bit less). If we stick to this goal, we can generate a very attractive annual return on our portfolio. I’ve been writing covered calls for years, and many times I’ve had stocks ramp up far above my strike price. Most of the time I let the option exercise because the numbers often do not pencil out – to justify buying back the option contract and then selling the stock. If I let it go, it’s a win (as you say) since I accomplish my goal for that month. I’ve done this over and over through the years…always keeping focus on the monthly goal (i.e., to generate that 2 to 4% return), and it has worked well. I am now entering my retirement years with a handsome portfolio, and I’m continuing to follow the process to generate monthly income. I enjoy the fact that I can manage my own portfolio, and generate adequate income each month to live my desired lifestyle. No need to chase the big winners…that’s for speculators. Thank you, Alan, for all the fine guidance you have provided over the years.

Byron,

So well stated. Great summary of non-emotional investing leading to a structured plan that will help us become CEOs of our own money and ultimately financial independence.

Thanks for sharing and for your kind words.

Alan

Byron,

I agree with every word in your post.

I am using exactly the same successful method, and I hope to be able to replicate it like you did for years.

Roni

Alan,

I pretty sure I watched one of your videos regarding poor man’s covered calls, though for the life of me i cannot find it on YouTube today.

Have you considered creating a spreadsheet (similar to your basic calculator or your elite calculator) for these poor man’s covered calls.

Thanks, Doug

Doug,

The video is available to premium members only and located on the member site as shown in the screenshot below.

The PMCC is one of 3 strategies detailed in my upcoming book (co-authored with Barry Bergman), “Covered Call Writing Alternative Strategies” In addition, to the PMCC, Portfolio Overwriting and the Collar Strategy will be discussed.

We are developing new calculators for all 3 strategies and we expect the book and calculators to be available within the next few months.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Alan,

Will these new calculators contain tabs for exit strategies like your others? Looking forward to your new book.

Marsha

Marsha,

Yes, as currently constituted, there are 3 tabs (pages):

1. Initial trade calculations

2. Trade management- Price Up

3. Trade management- Price down

Alan

Doug,

A Poor Man’s Covered Call is a diagonal spread. You can find a variety of option strategy calculators for this strategy as well as others at:

http://www.optionsprofitcalculator.com/calculator/call-spread.html

If you do some searching, you might find a more advanced one that permits you to vary the implied volatility. While this may be more than you want/need, this feature enables you to model various scenarios, in particular, what the position might look like as implied volatility increases into an earnings announcement.

Earnings Whispers has MBUU ER Nov 7. Latest report lists as Dec 7.

Premium members:

The Blue Chip Report of top-performing Dow 30 stocks for November 2017 has been uploaded to your member site. Login and scroll down in the “resources/downloads” section as shown in the screenshot below.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Last month I managed a 3.8% return. However this month I can’t find many stocks that meet my requirements and for those that I do find, the premiums are not quite as good as last month.

Blair,

Earnings season is always a bit more challenging. Be sure to check the ETF and Blue Chip reports as well.

Congrats on a super month!

Alan

Hello Alan,

A lot of the stocks on this past Sunday’s report that passed the ALL screens (BOLD) was highlighted as do not trade due to upcoming earnings reports.

Some of those earning reports have already published today and yesterday. So can we no treat them as regular BOLD report stocks and write covered calls/trade on them the next day for November Expiring Option Month? Or is there a recommended waiting period after an earnings report to start trading the stocks?

Andy

(New BCI Member)

Andy,

Yes, once the report passes, it becomes an eligible security. If there is any post-report volatility, I wait for the price movement to subside (1-2 days if at all) and then treat as all other eligible stocks or ETFs.

Alan

While you are watching a particular stock and waiting for the ER to pass, do you often find that the premium shrinks after ER?

Thanks,

Terry

Terry,

Good observation. Once a report passes, the implied volatility of the stock will decrease as speculation regarding the outcome of the report is no longer a factor. So, yes, option premium will decrease in value nearly 100% of the time after the report passes.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates. For your convenience, Here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

On the wishingwealthblog the following was posted:

“The put/call ratio is suggesting extreme bearishness among option traders. A reading larger than 1.1 generally leads to a bottom or at least a bounce.”

Does this mean that premiums -in general- will rise?

Blair,

The put/call ratio is generally considered a “contrarian indicator” If investors are trading bearishly (p/c above 1) then we can expect a bounce a stated on the Wishingwealthblog site. I would never hang my hat on any one indicator but for those who use this indicator and anticipate an uptick in market performance our option premiums will still hinge more on market and stock volatility. Currently the VIX (CBOE Volatility Index) is historically low and this is reflected in lower option premiums. This is actually a positive for us because the VIX is usually inversely related to the performance of the S&P 500 as shown in the screenshot below. When markets are uptrending, we can generate 2 income streams by favoring out-of-the-money strikes.

Bottom line: For those who use the p/c ratio as a market indicator and also subscribe to the premise that it is a contrarian indicator, it may nudge a covered call writer to favor out-of-the-money strikes assuming all other factors and criteria support that conclusion.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Trading Experiences through 10/20.17 Expiration Friday.

Was a crazy week last thought just before Expiration Friday. Several to be assigned options on Wednesday suddenly changed to worthless by Friday, then I sold out on Monday because of Earnings reports. Ended with 4 stocks assigned, 3 Worthless, 2 Roll Outs. Strangely I ended up mostly in Cash by Tuesday. I have found you can find good stocks for covered calls to trade late in Week 1 and early days of Week 2 to end up 90% invested. Will use ETFs as well, if needed.

Attached is my YTD chart for my own 4 accounts I’ve presented before. I improved it (Chart Columns F and G) to see the YTD gain and Month to Month gain clearly. I also added my Week 5 of 5 trading detail in the comments which includes my 5th Joint Trust Account. The notes show my planned trading for Expiration +1 Monday to start the next cycle.

The chart shows my Month to Month gain for 10/20 Expiration was 1.02% (was 5.58% last month) and my YTD performance was 21.1% or 25.0% annualized (YTD last year was 17%). Satisfies my 18-24% goal for the year.

Autohome (ATHM) hurt my performance after 2 of the top management President and CF0) left the company. Was great looking until it dropped suddenly without any public news, which did not appear till 2 days later. Earlier this year I had a similar story with MGM which I held for several months and then suddenly took a turn down after a typhoon or tornado hit Macau, Hong Kong, a casino city, which was not a positive for MGM.

Our Joint Trust Account, in which trade ETFs is at 10.71% YTD annualized.. Unfortunately, 4 months ago, I violated my rules and emotionally traded stocks I though were “safe” (MGM, for example) which hurt the performance. The last 3 months, though, with ETFs only again, I had month to month gains or 2%, 1.5%, and 1.35%. So it is recovering well. Beats the 1.25% CD that we decided to try trading with covered calls.

Trading:

Byron is right in a separate blog post about trying to avoid the Greed Factor affecting your trading decisions. If you follow the recommended “conservative” trading rules of diversifying, selecting good stocks, and reviewing and taking action with exit strategies to control or increase your potential gain, you are more likely to end up with a satisfactory performance on the average. This even allows for some mistakes to be tolerated, which do happen.

Mario