Whether I am selling call or put options I prefer to use a cash account. That’s where we invest and utilize only our own cash to purchase stock and secure put trades. More aggressive investors may want to magnify their returns by leveraging margin accounts. This entails borrowing money from the broker based on rules and regulations set forth by both FINRA (Financial Industry Regulatory Authority) and the specific brokerage. Using this leverage can magnify both gains and losses. In this article, we will compare the differences between selling puts in a cash account (cash-secured) and in a margin account.

Put-selling in a cash account

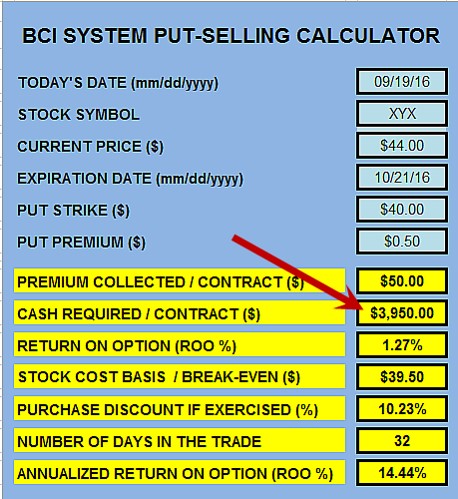

When we sell a cash-secured put we are obligated to buy the stock at the strike price if exercised. If stock XYZ is trading at $44.00 and we sell the out-of-the-money $40.00 put for $0.50, we must set aside $4000.00 in our cash account to be available to purchase the shares. Since we are allowed to apply the put premium ($50.00 per contract) to the required amount, our total cash investment is $3950.00 as shown in the screenshot below:

Put-Selling in a Cash Account

If we sold 10 contracts, the required cash to secure the trade would be $39,500.00.

Put-selling in a margin account

Different brokers may have slightly different margin requirements so consider these general formulas and check with your specific broker regarding your margin account obligations. The amount of margin required is the greater of:

1- 25% of the underlying stock price – the out of the money amount (if there is any) + option premium x number of contracts x 100. In the example shown for the cash account the formula in a margin account is:

[(.25 x $44.00) – $4.00 + $0.50] x 10 x 100 = $7500.00 OR

2- 15% of the strike price + option premium x number of contracts x 100. The formula in scenario #2 is:

[.15 x $40.00) + $0.50] x 10 x 100 = $6500.00

Since the greater of these two equations calculates to $7500.00, this is our initial margin requirement.

Other factors to consider in margin accounts

Maintenance margin during the life of the contract, margin call and interest that must be paid for borrowing from our brokers are factors that must be managed and considered when using margin accounts. We must always check with our brokers to fully understand our trading obligations and costs.

Discussion

Put-selling in margin accounts offers the potential to magnify gains by borrowing from our brokers. There is also higher risk since losses can also be elevated. Each broker will offer formulas which determine the amount of margin we are required to provide initially and for maintenance and these formulas will vary from broker-to-broker but must also meet FINRA and SEC regulations.

Upcoming live events

1- March 21st and 22nd, 2017

Two live Florida events (Fort Lauderdale -22nd and Delray Beach- 21st)

2- April 12, 2017

Income Generation Webinar for The Options Industry Council

Market tone

Global flat for the week. Rising US crude oil inventories sent prices down this week. West Texas Intermediate crude fell to $49.25 per barrel from $53 a week ago, while global Brent crude slumped to $52.10 from $55.50. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), was little changed (11.66). This week’s reports and international news of importance:

- Nonfarm payrolls rose 235,000 in February, more than economists anticipated. The strong data, along with upward revisions to prior months, have prompted Fed watchers to begin to forecast a faster pace of tightening by the US Federal Reserve.

- The unemployment rate dipped to 4.7%, while the labor participation rate rose to 63%

- European Central Bank president Mario Draghi said this week that deflation risks in the eurozone have “largely disappeared,” as ECB inflation forecasts were raised to 1.7% from 1.3% for 2017 and 1.6% from 1.5% in 2018

- At its annual meeting of the National People’s Congress, China announced it had reduced its official economic growth target to 6.5% for 2017 from a range of 6.5%–7% in 2016. Actual growth in 2016 was 6.7%.

- Scottish first minister Nicola Sturgeon says late 2018 could be the best time for a second referendum on independence from the United Kingdom. Brexit has set off fresh calls for independence

- German factories started the year negatively as new orders fell 7.4% in January, the largest drop since the depths of the financial crisis in 2009

- The United States reported its largest monthly trade deficit in nearly five years this week. January’s deficit rose 9.6% from December, to $48.5 billion. US Commerce Secretary Wilbur Ross, calling for free and fair trade, said the latest data show that there is much work to be done on trade agreements

- South Korea’s president, Park Geun-hye, was forced from office as the country’s Constitutional Court unanimously upheld the National Assembly’s vote to impeach her after she became embroiled in a corruption scandal. Presidential elections must be held within 60 days, with acting president Hwang Kyo-ahn heading the government in the interim

THE WEEK AHEAD

MONDAY, March 13th

- None scheduled

TUESDAY, March 14th

- Producer price index Feb.

WEDNESDAY, March 15th

- Consumer price index Feb.

- Retail sales Feb.

- Home builders’ index

- Business inventories Jan.

- FOMC announcement

THURSDAY, March 16th

- Weekly jobless claims 3/11

- Housing starts Feb.

- Building permits Feb.

FRIDAY, March 17th

- Industrial production Feb.

- Consumer sentiment index March

- Leading economic indicators Feb.

For the week, the S&P 500 moved down by 0.43% for a year-to-date return of 5.98%.

Summary

IBD: Market in confirmed uptrend

GMI: 4/6- Buy signal since market close of November 10, 2016

BCI: I am currently fully invested and have an equal number of in-the-money and out-of-the-money strikes. A 25-basis point March interest rate hike appears already factored into market pricing.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a slightly bullish outlook. In the past six months, the S&P 500 was up 10% while the VIX (11.66) declined by 22%.

_____________________________________________________

Wishing you the best in investing,

Alan ([email protected]) and the BCI team

Alan,

Here is my trade:

2/21 BOT 1 EBAY @ $34.12

2/21 STO 1 Call strike $34.50 @ .67

3/10 BTC 1 Call @ .12 (20%/10% Rule)

3/10 STO 1 Call strike $34 @ .21

.67 + .09 (.21-.12) / ?

What is the new denominator?

Thanks,

Serre

Serre,

Assuming the $34 strike was sold in the same March contract month, the exit strategy (rolling down) is an extension of the initial investment of $34.12. This remains our denominator.

If EBAY closes below the $34 strike, there is a realized net profit on the option side of $76 per contract and an unrealized loss on the stock side of $34.12 – current market value.

If the shares are sold at the new $34 strike, there is a realized option credit of $76 and a realized stock loss of $12 for a net profit of $64 per contract. This represents a 1-month return of 1.9%.

Alan

Alan,

For an income generation investor like me, margin account is additional risk plus extra calculation factor every time I make a trading decision.

In the end the whole thing becomes too complicated to oversee.

What with diversification, earnigs dates, comissions, 20/10 rule, OI, spreads,market events, etc,etc, Wow.

Roni

Hey Roni,

Well, as we all know our trading and investing can be as complicated as we want to make it :). To my ongoing chagrin I find the simpler I make it the better I do!

I have fewer positions than I used to, do less with them and try to go for longer stretches without rocking the boat. My options selling is progressively further out of the money to not have to relinquish things on the high side or buy things on the low side.

I must be getting old :)? – Jay

Hi Jay,

wellcome to the club of “simpler is better”.

As I say above, one “silmple” monthly covered call trade needs a large number of considerations and calculations, plus several hard decisions every day.

If you have $200,000.00 of your hard earned money in play, you will probably have 10-15 different tickers to oversee each month, and it will take many hours of work each day.

I do love this “work”, but it takes up a lot of energy, so I must make it as simple as possible.

I am probably older than you, but when I was younger, I had no money to invest, and was otherwise busy with my job and my outdoor activities, and taking care of my family.

Cheers – Roni

Happy Sunday Roni,

Hope you have a successful week ahead!

Depending on what Janet does and what The Donald “Tweets” the market could do anything :). I find these whimsical rudderless Trump times unsettling. But the market loves them so far.

For me simplicity means I first think about the likely market direction then use only a few tickers to play it.

Some people love this stuff so much they think the more positions the better! I understand them whole heartedly because that used to be me 🙂

Today I would feel no compulsion to divide a $200K chunk of retirement money into 10-15 individual stock positions when SPY and QQQ will do just fine. LEAPS on the two can work even better. It becomes a question of your personal return target, time for the hobby and comfort level.

Roni, they say age is a state of mind! I am 59. I retired 4 years ago to hopefully pay my bills trading options. Some months are better than others but it is doable :). – Jay

I can go you one better there Jay – I’m 53 and retired 16 years ago to play the stock market and online poker. Sadly the great bull years of online poker are long gone, though I managed to pull down seven figures in the great bull years of Party Poker in ’05 to ’07, so since then I’ve focused full time on the markets. Re the SPY and QQQ – are you writing cc’s or something else such as spreads?

Justin,

I hope it is OK to say “balls” here because you certainly need a wheel barrow to haul yours around in making that kind of money in online poker :). My hat is off to you. Well done!

Congrats on being financially independent at such a young age.

I do everything under the sun using SPY and QQQ because I feel I know them like family members. The liquidity is instant and the spreads are pennies.

I am net long through June though I hold June dated VIX calls at the $11 strike as a hedge.

How are you playing it ? Thanks, – Jay

Thanks Jay, but no big cojones needed since back then so long as you played a good tight game you couldn’t help make the big bucks so long as you’d mastered the game. I also avoided the really big games and stuck to the $1000 NL tables. Playing the stock market is very similar – learn as much as you possibly can, play conservatively and look for situations where the odds are in your favor, or as the song goes “know when to hold ’em and know when to fold ’em.” Right now with options I’m studying everything and doing lots of paper trading with a view to commencing trading soon and gradually increasing my trades as things (hopefully) go my way.

Thanks Justin,

If I had it all to do over again I would take much smaller positions than I thought I was ready for at first until I saw how it worked real time and became OK with it. – Jay

Jay,

your comments are a great help for me to build my trading skills. Thank you again and again.

You guys are so young, that I will not state my age, but I will give you a hint : elexexwhywhy ho,ho,ho,ho . :o)

On the other hand, I am NOT retired. You never retire when you have a small company to run (50/50 with my partner).

Anyway, I’m much younger than Warren Buffet, and he is still going strong.

Justin,

congrats on your very sound betting principles.

Many years ago I read a book written by a poker champion who stated the same basic rules.

He sayed : “I never bet when the odds are not in my favor”, and he was a master in calculating the odds at all times.

Roni

Roni,

Thank you for your always kind words.

Congratulations on being a business owner. I think it is helpful to view managing one’s own investing and trading (and Poker playing for Justin!) from the same point of view as owning a business.

There are costs and risks that need to be controlled. There is cash flow, taxes and insurance to be considered. You need to be ever aware of your competitive position. In this analogy how you are doing against SPY.

I divide my “business” of being retired into two divisions: Investing and Trading. Investing is 90% plus of it and trading is the rest. Investing is where the index funds, blue chips, covered calls, cash secured puts and money market funds reside. Simplicity and a longer term view helps there.

Trading is where the whacky stuff like betting on Fed meetings, jobs reports and elections buying and selling puts, calls, spreads, straddles and condors resides. Some months Trading pays all the bills and more, which is the goal! I sweep any extra over into the Investing side of the business. Other months not so lucky so I keep my speculative positions small taking profits when I have them and saving for a rainy day. Just as one might do in any other business. – Jay

Jay,

your investing and trading methods sound very solid.

It must be a full time job to oversee, but it is so much fun, it sounds more like a hobby.

My work at the company used to be fun too, until 2015 when the recession hit the Brazilian economy.

But hopefully we are going to have a recovery starting very soon.

Thanks Roni,

I am one of those odd people for whom investing and trading is hobby, livelihood, mistress, tormentor and solace at the same time! I would not wish that on anyone :).

I wish only the best for Brazil and your business. – Jay

Got it Jay

cheers

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 03/10/17.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The BCI Team

Alan,

I noticed in a previous blog that you said you had “50-100 contracts open on 15-25 stocks at a time.” Would this possibly include having ITM and OTM contracts open at the same time on a single stock?

Justin

Justin,

Absolutely. I will frequently “ladder” my strikes. For example, if I sell 5 contracts on a particular stock that has a mixed technical chart in an uncertain market environment, I may favor ITM strikes and go with 2 contracts OTM and 3 contracts ITM. In a strong bull market with strong chart technicals, I may sell all 5 contracts OTM. I am currently selling an equal number of ITM and OTM. This is another way to hedge our positions and tailor our investments to current market conditions and data.

Alan

Thanks Alan, just re-discovered laddering from page 111 of your first ‘pedia – seems you deploy it regularly but your correspondents here only ever seem to quote examples of trades which use either an ITM or OTM but not both simultaneously. Could this mean they’re not adhering rigidly to the BCI methodology? 🙂

Justin,

The fact that our members are addressing the “moneyness” of options on a regular basis shows how the BCI community is a cut above. Laddering strikes is a guideline incorporated into the BCI methodology and based on years of member feedback I can say that there is a high percentage of the BCI community that has decided to take advantage of this approach in their option trades and portfolio mix.

Alan

Alan,

Enjoy your videos on Covered Call strategies. Have you ever done one or would you consider doing one on whether it is ever a good idea to use an ITM or ATM Covered Call and if so when.

Thanks,

Bill P

Bill,

Yes, strike price selection is one of the 3 required skills in the BCI methodology (stock selection and position management are the other 2). I have included this information in my books and DVD Programs as well as blog articles and Ask Alan videos. Here is a link to an article I published on this topic a few years ago:

https://www.thebluecollarinvestor.com/selecting-a-specific-strike-price-for-our-covered-call-positions/

Alan

Hi Alan, I have a next round of questions for you, and bringing to your attention this first one I think is important:-

1. A common situation I have found myself in almost every time is when the market has risen up quite a lot over the whole of the contract – yet I can’t seem to outperform it, compared to when the market has ended the contract down(where I can), and for here just wonder if this is quite normal? (perhaps because CC’s cap the profits at the strike).

Do you experience these same situations when comparing your return to the market at contract end?

2. If deciding between 2 stocks to use where one stock is trending up with all positive technical indicators with say a 1.50% return, compared to another stock that has mixed technical indicators and in a S/ways channel but also a greater 2% return, then in this comparison are you most likely going to choose the 2nd stock because of the greater return?(if using the same type of strikes too depending on the market?)

3. When just starting out live-trading then wouldn’t it be best to use ETF’s and the Blue-chip stocks, than the IBD50 list stocks,- as these are less volatile and risky to use – but then when more experienced at trading go and use the IBD50 later on?

4. Your running list stocks, are these all growth stocks?, but if not then how do we tell the difference between the growth and income stocks?

5. And can I just confirm again that you don’t look to see if there are any support levels around your breakeven points, for any new trades you are just about to put on?

Just a confirmation for No.5 needed, it’s just that when I backtested some of your P/L spreadsheet trades(backoffice) almost all the winners seemed to have some area of support around the B/even.

I thought I better let you know that in case you hadn’t previously.

Thank you.

Adrian,

With Alan moving to Florida, I’ll take a shot at some of your questions…

Question 1:

This is a characteristic of covered call trading. You have to change your mind set to income generation instrad of price growth. The goal of the BCI methodology is to generate 2% to 4% per month in normal markets. You can increase that return…but…you will have to acceept the increased risk and volatility.

Question 2:

It depends! No perfect answer to this. It depends on your risk tolerance and trading style. Both work.

Question 3:

My personal opinion…starting off with ETFs eliminates single stock risk as well as concern over earnings reports. The returns will be lower, but it gives you the opportunity to grow your skill set.

Question 4:

The stocks on the Weekly Premium Report Running List are stocks with momentum. They are a combination of large cap, small cap, growth etc. From my personal experience, whether a stock is a growth stock or income stock is in the eyes of the writer or analyst. For an academic answer, check out “Investopedia” on the web.

Question 5:

Not sure what youy mean with this question.

Best,

Barry

Barry,

When you next talk with Alan please give him our best on his move to Florida!

It reminds me of a Jerry Seinfeld joke where he talked about his parents moving from Long Island to Florida when they turned age 65 and retired: “They did not want to move to Florida but they are 65 and that’s the law.” 🙂

I have no idea how old Alan is and I suspect he will not retire from BCI any time soon :). I just liked the Seinfeld joke!

My suggestion for Adrian on Q5 is break even points are determined based on the trade one is in. Support levels are Technical chart points apart from any particular trade. Look at the two indepent of each other. – Jay

Hi Adrian,

Just re (3) I can’t help noticing you’ve been posting a large number of questions for three years now, and yet you say you’re “just starting out live-trading.” Have you only been paper trading all that time? (Not that there’s necessarily anything wrong with that, but WOW that’s a long time to just paper trade…)

Justin

Hey Justin,

As a poker player what is in Janet’s hand for Wednesday :)?

And how do we play it before that?

In fairness I can not ask you that without showing my cards. I held TLT and GLD puts running up to this event and am layering out taking profits. Will buy XLF calls on any weakness tomorrow or Wednesday morning. Still holding VIX calls as a hedge.

Am interested in your thoughts. Thanks, – Jay

I reckon it’s a psychic you want Jay, not a poker pro 🙂

I’m not familiar with the trades you’re making – are you doing those at random or is there some scientific/mathematical reasoning which makes you think they’re high probability trades?

That’s a good one Justin, thanks! Oh, to only be a psychic when it comes to the markets :)? I have watched for patterns around probable interest rate hikes and things that are sensitive to rates have tended to go lower and the things that benefit from higher rates such as banks (XLF) have tended to move higher. No more science to it than that and nothing works all the time! – Jay

Yes you don’t need something that works all the time, just more often than not. The major reason I’ve been drawn to cc’s – the BCI stock picks should rise more often than they fall, and using cc’s you can buy them at a discount. The trouble with most ‘investors’ (gamblers is more accurate) is they try to make too much money too fast.

Justin

Justin,

now I understand why you posted a picture of a squirrel.

I love it.

Roni

Premium Members:

1- This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site and is available in the “ETF Reports” section. Look for the report dated 3-8-2017.

2- Members who live in southeast Florida, I hope to see you at one of my live seminars:

http://www.aaii.com/localchapters/pdfs/SOUTHEAST_FLORIDA_170321.pdf

3- This week’s ETF report has been published a day early as we are moving our main office from NY to Florida next week. All articles, reports and shipments will be sent in a timely manner.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

Alan and the BCI team

That’s no squirrel Roni – try again 🙂 (I was experimenting trying to add a pic next to my name – apparently you can’t.)

Is it a Koala bear :)?! – Jay

Try again – here’s another one:

Well, I have every certainty on the left of this picture resides an attractive woman! The animal has me stumped :). – Jay

I am very interested in wildlife, and I thought I knew all the animals on the planet, so I was very surprised with “Quokka”. Good to know. Thanks.

My wife thought it was a baby Panda.

‘Tis the famous quokka of Western Australia 🙂

Oh well, my guess was in the ball park :)!

Barry, Thanks for those replies(and Jay/Justin too), they are good for now.

For that Qu.5 what I was still trying to decide, was before going through with any trade order, is there any point for me to check that there is some areas of support where the trade B/even price would be?

For instance for a stock bought at say $50 with a $1 premium, then with a B/even at $49, wouldn’t this trade more likely become successful if there also support around $49 too?

That’s just my thought on possibly making a trade more profitable!

Hope you can get back to me on what you think. Thanks

Only if you believe support works Adrian 🙂

Adrain,

The answer is…”it depends”. It depends on:

– What your goals are, i.e.: get assigned or continue to write calls on your stock for ongoing income

– The trend of the market, sector, and the stock itself

– Recent news

– etc.

The way I trade, I ALWAYS draw support and resistance lines to better understand where the stock might go based on its’ trading history. Additionally, I draw support and resistance lines at recent swing highs and lows…for the same reason…to understaand the stocks’ behavoir.

So, it is up to your trading style as to whether you write the calls at support (I assume you want to be assigned) or at resistance (to get possible additional upside movement).

Best,

Barry

Adrian, thank you for your kind mention in your reply to Barry.

In my opinion it is easy to over think this stuff and I suspect many do. If, for example, one thinks the market will be higher a year from now one could buy SPY, go to sleep under a tree and wake up richer than many people who trade every day if correct. If you can’t sleep that long write OTM calls for 1% yield each month. You might be richer still!

We here will never make it that easy, this stuff is in our blood :). My point is if it ever feels like work, becomes too time consuming or if what you are doing is not keeping up with SPY it is time to take a step back and simplify instead of trading more. – Jay

AMGN – ouch! =:-O And on expiry day too…

Hey Justin,

Happy weekend and happy St. Pats Day!

I see AMGN got clobbered today. But that is not the end of the world. It’s a great stock. Keep a longer view. If you had a covered call on it good for you – loss protection. I’ll bet 99% of AMGN owners did not have that and wish they were you today! – Jay

Happy St Pats Day Jay!

Though it’s been the 18th here in Oz for the last 13 hours, so that’s now history 🙂 I’m still only paper trading options and AMGN was one of them. What do you (or Alan) think the strategy would be now? Close the whole position or roll to the next month?

Justin

Justin,

I never pretend to speak for Alan or Barry. The stuff I post is completely my opinion, for better or worse! I am the only one guilty of my crimes :).

The options we sell are never the problem. It is the underlying stock or ETF. Since you are still paper trading the discussion is academic. My best advice is think about your risk tolerance before your security selection.

Did it rattle you when AMGN went down over 6% today? If so I suggest you trade SPY and QQQ instead of stocks.

I do not care how good a stock picker anyone thinks he/she is. Many stocks go down for no good reason every day, like AMGN. You have to ask yourself if you are ready for falls? If not stick with ETF’s.

It’s tough to do but when you get your risk mix right you sleep better at night :)! – Jay

Thanks Jay, it’s only cc’s I’m new to, I’ve been trading using t.a. and f.a. since 1985 so I’ve seen everything that stocks could possibly do many times over. In retrospect that trade had a big red flag in that it was a weekly with five days to expiry yet had a ROO of 1.6%. That plus being a biotech which had also had a recent big run would probably make it an “avoid” in normal circumstances,

Justin

Thanks Justin,

I did not mean to lecture and you can kick my butt if I did :).

Alan will post a new thread in the morning. I appreciate all your conversation on this one!

Good night man! – Jay

No problem Jay, you can’t know how much or little I know unless I tell you since I’m new here 🙂 You on the other hand obviously have a lot of experience with various forms of option trading based on what I’ve been reading in the blogs so I definitely value your feedback on cc alternatives (not that cc’s aren’t great as well.)

See ya in the next thread!