Technical analysis is an integral part of mastering covered call writing. This week’s article is a follow-up to an article posted on October 19th. In this week’s column I will […]

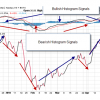

MACD: A Lagging and Momentum Technical Indicator: Part I

Technical analysis is as much an art as it is a science. No one parameter, by itself, will allow us to make our buy/sell decisions. However, when all the indicators […]

Technical Analysis: How to Use Volume in our Covered Call Decisions

When learning how to trade options volume must always be factored in. Volume is the number of shares or contracts that trade over a specific period of time, usually one […]

BLUE COLLAR INVESTOR Q&A- Your Questions Answered

This past Thursday and Saturday I conducted a webinar series attended by investors throughout the United States and Canada. I am humbled by the response and supportive emails that you […]

Recent Comments