Nov 3, 2018 | Investment Basics, Option Trading Basics, Stock Investing

One of the BCI guidelines for selling covered call and cash-secured put options is that we require a bid-ask spread of $0.30 or less and/or an open interest of 100 contracts or more. Typically, options with large open interest will also be associated with smaller...

Aug 27, 2016 | Fundamental Analysis, Investment Basics, Option Trading Basics, Stock Option Strategies

When selling call and put options, the liquidity of these securities must be evaluated to determine their eligibility. There are two measures of investor interest in options, Vol(ume) and Open Interest (OI). Vol represents the number of times a particular contract is...

Jan 9, 2016 | Investment Basics, Option Trading Basics, Options Calculations, Options Trade Execution, Stock Option Strategies

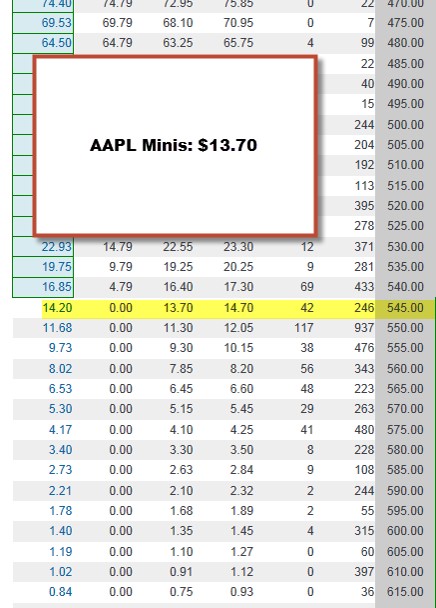

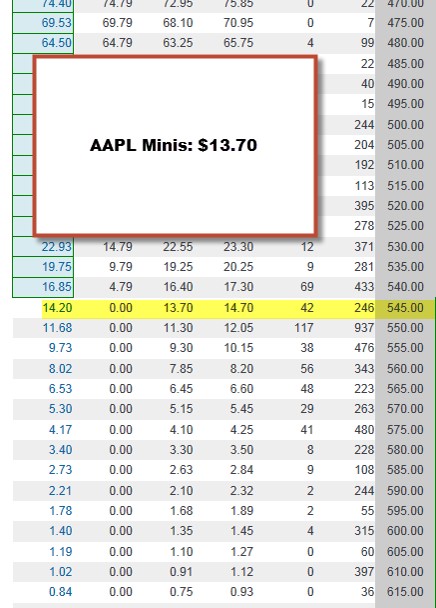

Corporate events can impact our covered call writing and put-selling positions in many ways. In today’s article we will focus on spin-offs and how to read an options chain after the event and calculate to moneyness of our options based on the specifics of that...

May 23, 2015 | Investment Basics, Option Trading Basics, Stock Option Strategies

Check the options chain before selling a covered call or cash-secured put. In addition to determining the premiums and returns we will generate we also need to make sure the interest or liquidity in these options will be adequate enough for favorable trade executions....

Feb 22, 2014 | Investment Basics, Option Trading Basics, Options Calculations, Stock Option Strategies

Our stock options strategies have a new product to consider: mini options. These options have a deliverable 10 shares of underlying security instead of the traditional 100 shares. The options symbol for these minis begin with the security ticker followed by the number...