One of our covered call writing exit strategies when the strike is in-the-money on expiration Friday is rolling out-and-up. This is when we buy back the near-month call (buy-to-close) and sell the next month’s higher strike. There are times when share appreciation has dramatically increased above the near-month strike price such that buying back the current call option can be expensive relative to the premium originally generated. The question we ask ourselves is whether the cost-to-close is justified? On June 15, 2018 (expiration Friday), Karl wrote me about such a scenario he was considering with Five Below, Inc (NASDAQ: FIVE).

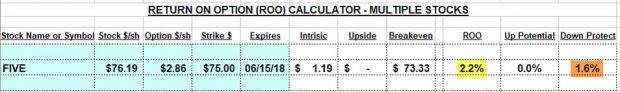

Karl’s initial trade with Five Below, Inc. (NASDAQ: FIVE)

- 5/17/2018: Buy 100 FIVE at $76.19

- 5/17/2018: Sell 1 x June $75.00 call at $2.86

Initial trade calculations using the multiple tab of the Ellman Calculator

Initial Calculations with FIVE for the June Contract

- Yellow field: Time value return on option is 2.2%

- Brown field: Downside protection of the initial time value profit is 1.6%

Expiration Friday statistics

- FIVE trading at $102.09

- Cost-to-close the June $75.00 contract is $27.50 ($27.09 of intrinsic value and $0.41 of time value)

- Premium generated when selling the July $105.00 contract (rolling out-and-up) is $2.80

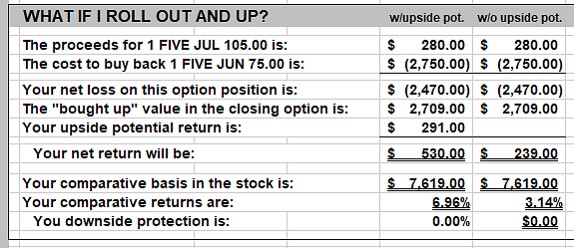

Rolling out-and-up calculations using the “What Now” tab of the Ellman Calculator

Rolling Out-And-Up with FIVE

- The intrinsic value component of the $27.50 cost-to-close ($27.09) is neutralized by the increase in share value from the $75.00 contract sale obligation to the current share value of $102.09

- The initial return on option (ROO) from rolling out-and-up is 3.14% (without upside potential)

- The potential total return (if share value moves to the new $105.00 strike) is 6.96%

Approaching the trade when there is a bullish assessment

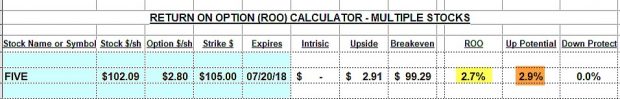

In my books and DVDs, I define rolling out-and-up as a bullish exit strategy where we still like the underlying security and overall market environment. That said, how would this trade look if we were never in a trade with FIVE for the June contract and were considering this stock for the July contract:

FIVE Calculations for the July Contract

- Initial 1-month ROO is 2.7% (yellow field)

- Upside potential is 2.9% (brown field)

- Total 1-month potential return is 5.6%

Discussion

Rolling out-and-up is a bullish covered call writing exit strategy. We employ this position management technique when the stock continues to meet our system criteria and our overall market assessment is neutral to bullish. When evaluating the cost-to-close, we must factor in the increase in share value created by the intrinsic value component of the buy-to-close option premium.

**********************************************************************************************************************************************

HOLIDAY DISCOUNT CODE

Give the gift of education this holiday season and use this discount promo code to get a 10% discount at checkout on all items in the BCI store:

HOLIDAY10

Click here to enter the store the BCI store

**********************************************************************************************************************************************

Upcoming event

February 7th – 10th, 2019

Orlando Money Show

Omni Orlando Resort @ Champions Gate

February 7th – 10th 2019

Speaking schedule:

1. Getting Started with Stock Options: Creating Monthly Cash Flow with Covered Call Writing

February 8, 2019, 3:10 pm – 3:40 pm

2. Getting Started with Stock Options: How to Select the Best Options in Bull and Bear markets

February 9, 2019, 2:00 pm – 2:45 pm

Market tone

This week’s economic news of importance:

- Markit manufacturing PMI Nov. 55.3 (55.4 last)

- ISM manufacturing index Nov. 59.3% (58.0% expected)

- Construction spending Oct. -0.1% (0.3% expected)

- ADP employment Nov. 179,000 (225,000 last)

- Weekly jobless claims 12/1 231,000 (224,000 expected)

- Trade deficit Oct. (-)55.5 billion [(-) 55.1 billion expected)]

- Productivity Q3 2.3% (2.2% expected)

- Markit services PMI Nov. 54.7 (55.4 last)

- ISM non-manufacturing index Nov. 60.7% (59.1% expected)

- Factory orders Oct. (-)2.1% [(-) 2.0% expected]

- Nonfarm payrolls Nov. 155,000 (190,000 expected)

- Unemployment rate Nov. 3.7% (as expected)

- Average hourly earnings Nov. 0.2% (0.3% expected)

- Consumer sentiment index Nov. 97.5 (97.3 expected)

THE WEEK AHEAD

Mon Dec. 10th

- Job openings Oct.

Tue Dec. 11th

- Producer price index Nov.

Wed Dec. 12th

- Consumer price index Nov.

- Core CPI Nov.

- Federal budget Nov.

Thu December 13th

- Weekly jobless claims 12/8

- Import price index Nov.

Fri December 14h

- Retail sales Nov.

- Industrial production Nov.

- Business inventories Oct.

For the week, the S&P 500 moved down 4.60%% for a year-to-date return of -1.52%

Summary

IBD: Market uptrend under pressure

GMI: 2/6- Bearish signal since market close of November 13th, 2018 as of Friday morning

BCI: Selling an equal number of out-of-the-money and in-the-money strikes. Will hold with this ratio until the Fed announcement.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a bearish tone. In the past six months, the S&P 500 down 5% while the VIX (23.34) moved up by 93%.

Wishing you much success,

Alan and the BCI team

Hi,

Maybe someone could help me with STOCK REPAIR strategy. I’m having trouble understanding it.

The original article is here:

https://www.thebluecollarinvestor.com/stock-repair-strategy-using-stock-options-to-reduce-losses-when-stock-price-declines/

I purchased FDX at 235. As of 12/07/2018 stock trades at $201.39

If I’ll initiate the stock repair at prices below:

Exp. 01/11/2019

Buy 1x 200 CALL $10.90

Sell 2x 210 CALL $5.45

Let’s say on 01/11/2019 FDX closes at $225, what will be my breakeven price?

Call will be worth $25, calls sold -$15 x2 = -$30 and the stock -$10? I don’t understand how to calculate breakveven and how this trade could help me to reduce my cost basis.

Thanks!

Sunny,

The way this stock repair trade is structured, a loss is locked in but is dramatically reduced if share price moves to $210.00 or higher by expiration. When the trade was entered (before stock repair), the loss on the stock value was $33.61

When we sell the two $210.00 calls, our original shares plus the potential shares if the long call is exercised, can be worth no more than $210.00, our contract obligation. Let’s break down the value of these two positions at expiration given the share price closes at $210.00 or higher (given no additional position management trades):

1- The original shares are sold for a loss of $25.00 (buy at $235.00 and sell at $210.00)

2- The $200.00 long call is worth $10.00, reducing the net loss to $15.00

3- The net cost of the option trades was $0.00 (less commissions)

4- Shares loss was reduced from $33.61 (14.3% loss) to $15.00 (6.38% loss) by executing the stock repair strategy

I’ve attached a screenshot of the (soon-to-be-released) BCI Stock Repair Calculator reflecting these calculations.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Thanks Alan for such detail explanation. It is clear now.

Sunny

Alan,

Instead of using call options to average down with this stock repair strategy, can we use puts?

Thanks for all your education,

Margie

Margie,

Yes, we can sell out-of-the-money puts which, if exercised, will allow us to average down our cost basis. The difference is that we will need to provide additional cash to the position when (if) the option is exercised. With the stock repair strategy, little or no additional cash is required. If the put is not exercised, the put premium will assist in mitigating losses.

Alan

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 12/07/18.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The BCI Team

[email protected]

Premium Members,

This week’s Weekly Stock Screen And Watch List has been revised and uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 12/07/18-RevA. There was a typo. The IBD section in the “Weekly Summary” should read “Uptrend under pressure”.

Best,

Barry and The BCI Team

[email protected]

Alan,

In a volatile market like this one is it better to use calls or puts. I think you once said that puts are better.

Thank you.

Marsha

Marsha,

In bear and volatile markets, it is to our advantage to favor in-the-money calls and out-of-the-money puts. Both will enhance our downside protection.

A combination of both types is called the “PCP (Put-call-put) strategy in the BCI books and DVDs and is quite effective in these challenging market environments. (Deep) out-of-the-money puts are sold and, if exercised, (deep) in-the-money calls are sold. In many cases, no money will be lost when share price declines in value up to 10% – 15%.

Alan

Hey Friends,

Is everyone enjoying the roller coaster? Are you throwing your hands in the air screaming in joyful defiance as it takes it’s terrifying drops then gathering yourself on it’s slow clackety clack uphill moves :)?

Dec. expiry is going to be fun to manage for me and I suspect others. I was bullish so I wrote a pile of OTM puts on things I would like to have at prices I picked but really did not think I would have to buy any of them. I just figured I would beat bank rates by a million % on the cash for the month :)!

Now about half are ITM so it will be calculator and scratch pad time at expiry for me! Hope everyone has a great week. – Jay

Hi Jay,

Started out to be a super day. But markets watched the s***show at the White House.

Hope it moves back positive today or tomorrow or we will break the tradition Dec 7-15 being the best week of the year.

Hoyt

Hey Hoyt,

I watched that too. I think Trump’s wall is a ridiculous idea. He could not deliver on his campaign promise to have Mexico pay for it so just give up that ghost.

I have been day trading puts on SPX and SPY making money that way shorting at resistance and selling support. I had a great trade with that today after the opening highs which I figured had no chance of holding up.

But my positions are getting hit hard, these are frustrating times and I don’t see it getting better any time soon. Santa can just skip this year and lounge on the beach somewhere warm :). – jay

Jay,==

I agree

Hindsight is 20/20 vision, or at least it ought to be. What I should have done was to close all my equity positions on 01/26/18 and day/week trade calls and puts until we have a recession to clear the decks.

No way this is going to turn out good in the next two years. The sooner we have the wash out the quicker we start another bull market.

I admire your energy, guts and intelligence to take advantage of this schizophrenic market. Those days of day trading for me are gone. Can’t do it anymore. To quote Chief Joseph, “I will day trade no more, forever.”:)

I will live vicariously through you so take care and keep us posted as to what you are doing. We are learning a lot from you.

Hoyt

Hello Jay,

I wish I had the time and the energy to follow your examples of trading during such a chalenging market environment. Fascinating.

Meanwhile, I am almost 100% in cash, except for my original December VEEV trade, where I bought back the calls last week when they were at 20% of the premium received, and rolled down this week to mitigate my paper loss.

So right now I am looking at a 5% loss. But the jury is still out on it.

Anyway I believe my trading activity for 2018 is pretty much over.

I am too old for pedaling up-hill, so I will be waiting for the bull to come back for good, before starting to trade again.

Roni

Thanks Roni,

Since the market is in my blood, I understand the risk and I have at least a clue about what I am doing I find day trading options related to the S&P, which I specialize in after much study, to be a rewarding and fun hobby in my retirement.

I don’t blame you for being 100% in cash. I have a good friend who is a very sharp investor and he goes to cash anytime the S&P goes below it’s 200 day moving average, which it is now. His reasoning is sound: no one ever went broke above the 200 day MA :)!

There was even a “Death Cross” recently, as the chartists would say, where the SPY 50 day MA went below the 200 day. A very bearish signal to those who follow charts.

I am 50% cash across my retirement accounts and make money these days day trading. But, again, that is because I have studied it, have a handle on what I am doing, take limited risk, always think risk first and enjoy it as a hobby. If anyone here is thinking about trying it please make sure you can say those things about yourself first.

My hunch is somewhat contrarian: with so many people in high cash positions despite anything Trump does or gets convicted of I can’t see a crash coming. More downside? Of course. Bear market 20% off highs? Probably. Half of the S&P is there already.

But crashes happen when people are exuberant about the market all in. And I don’t know anyone who is :)! – Jay

Jay,

thanks for detailed response and recomendations.

Good luck – Roni

Jay,

Don’t know what the == was all about.

Reminds me of one of my favorite rock bands, Three Eggnog Night.:)

Hoyt

Hoyt,

It’s only my opinion but I think Six Eggnog Night was actually the better band at Holiday parties :)?

Thank you for the kind words about my trading. I made a triple today on a put and three different doubles yesterday on puts. It’s bittersweet because any blind monkey can buy puts and make money these days if you spot a good resistance point or catch a news event (I caught Brexit, Macron and today Trump’s temper tantrum all at the right time) but it is a shame we have to trade this way….- Jay

Alan,

I am new to options and hope this isn’t too basic a question but I’m unsure of the difference between a covered call and a cash covered call? Learning a lot from you. Thank you.

Herb

Herb,

Welcome to our BCI community.

There is never a question “too basic” for this site…all are equally important.

The difference between traditional covered call writing and cash covered calls is the motivation and goals of the investor. For the former, its generating cash flow by leveraging stock already owned. For the latter, it’s setting a maximum price for a stock we are interested in purchasing and allowing for the opportunity to change our mind.

For members not familiar with cash covered calls, it involves buying call options and then setting aside the cash (usually in an interest-bearing account) to purchase the shares at a future date. The shares can then be purchased at the lower of the current market value or the call strike price.

Alan

Not sure why, but my brain is on a milk carton today, and seems to be missing. Do you have a video or other reading material on cash covered calls? I might consider this strategy if I can back test it properly.