When studying covered call and put-selling option prices we learn that the market will correct any potential arbitrage opportunities. Arbitrage is the simultaneous purchase and sale of an option in order to profit from a difference in the price. It exploits price differences of similar financial instruments. This would not be fair and rarely exists and when it does, the market immediately corrects. In theory, the time value for calls and puts at the same strike and expiration (when at-the-money) should be the same to avoid these arbitrage opportunities. Frequently, however, we see put premiums at a lower price than the corresponding call premium. Why?

To understand this apparent aberration we must view a trade through the eyes of the market-maker, the specialist executing all buy/sell orders. If a market-maker writes (sells) a one-year $50.00 call option, the holder has the right to buy shares for that strike price within the next year. This means that the funds for the stock purchase must be borrowed at the current interest rate to buy stock making the cost of delivery greater than $50.00 and making the $50.00 call option now in–the-money, not at-the-money. Alleviating this situation would be any dividend distributions, if any, during the one-year time frame. Let’s say the cost to carry interest rate is 6% and the dividend is 2%, leaving an additional 4% cost to deliver. $50.00 becomes $52.00. The formula for future delivery of a stock is as follows:

Stock price + Interest Rate – Dividend distribution

From the perspective of a $52.00 stock, a $50.00 call strike is in-the-money and a $50.00 put strike is out-of-the-money and this explains why put premiums frequently appear lower than call premiums for at-the-money strikes. In theory, if a $52.00 strike price existed, the call and put premiums would be precisely the same.

What if the put premium was greater than the call premium for an at-the-money strike with the same expiration?

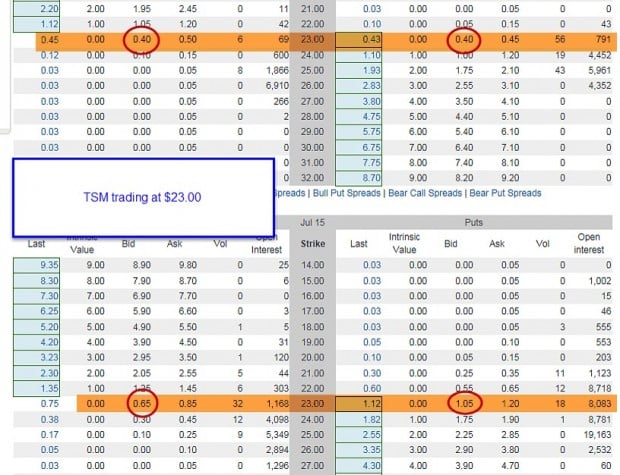

This would create an unfair arbitrage opportunity for the market-maker who would sell the put and buy the call (equal to a long stock position) and collect a net option credit. The stock can be sold and the option credit banked for a risk-free profit. However, we may see the put premium higher if the ex-dividend date of a dividend-paying stock was prior to contract expiration. Let’s have a look at an options chain for TSM, trading exactly at $23.00 at the time I created this screenshot:

TSM Options Chain on 6-4-15

Note on the top of the chart that the bid prices for the at-the-money call and put options were both $0.40 for the June contracts. However, the ex-dividend date ($0.40 was last dividend distribution) is listed as July 14th, prior to expiration of the July contracts. This makes the July call options less valuable and the put options more valuable because of put-call parity. Hence, we see a July call premium for the $23.00 strike at $0.65 and the corresponding put premium at $1.05.

Discussion

Arbitrage opportunities are rare and are almost never available to retail investors. Markets will quickly self-correct when they do exist. When we see a discrepancy in put and call premiums for at-the-money strikes with the same expiration, they are often the result of interest rate and dividend distribution factors rather than true arbitrage opportunities.

Next live seminar (recently added)

Market tone

Negotiations over Greece’s debt deal and European Central Bank President Mario Draghi’s statement after inflation picked up that the Eurozone should get used to volatility resulted in global market downturns. This week’s reports:

- The US economy added 280,000 jobs in May, the most in any month since December

- March’s job gains were revised up to 119,000, while April’s total was reduced slightly to 221,000

- The unemployment rate rose to 5.5% from a seven-year low of 5.4%

- US labor force participation moved up to 62.9%

- Average hourly earnings rose by 0.3% to $24.96 in May, 2.3% higher than a year earlier.

- The US trade gap shrank by 19.2%, the sharpest drop in more than six years, to a seasonally adjusted $40.9 billion in April, reversing the trade deficit’s sudden growth in March

- US consumers bought more cars and light trucks in May than in any month since 2005

- US non-farm productivity declined at a 3.1% annual rate

- US consumer spending was unchanged in April following a 0.5% increase in March, according to the US Department of Commerce

- Initial jobless claims decreased by 8,000 to 274,000 for the week ended 30 May

- Continuing claims fell 30,000 to 2.2 million for the week ended 23 May, the fewest since November 2000

For the week, the S&P 500 fell by 0.7% for a year-to-date return of 1.65%.

Summary

IBD: Confirmed uptrend

GMI: 4/6- Buy signal since market close of May 11, 2015

BCI: Cautiously bullish favoring out-of-the money strikes 3-to-2

Wishing you the best in investing,

Alan ([email protected])

I have heard all your talks. They are very knowledgeable and informative. Thank you for that.

I have a question: when you sell a covered call on any stock and the value of that stock goes down drastically over a period of say, one to two weeks, how can you protect the value of that stock? Thank you

Sohinder,

Your question highlights one of the most important aspects of the BCI methodology and that is to be prepared with a position management arsenal to deal with this situation along with all others that may arise during the contract.

First, it is critical to follow the 20%/10% guidelines I detail in my books/DVDs in the exit strategy sections. Once the option is bought back, we can roll down, sell the stock or wait for a share price rebound. The details with examples are found in our position management chapters.

Another approach would be to buy protective puts (collar strategy) which will prevent catastrophic loss but will also decrease profits.

Again, we must master all three of the required skills (stock selection, option selection and position management) before risking even one penny of our hard-earned money.

Alan

Premium Members:

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 06/05/15.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and the BCI Team

Hello Alan,

First, I would like to let you know how much I appreciate your blog and the premium membership. I had sold several covered calls and plan on doing more.

I have a couple of questions:

1.) The underlying stock is so important in covered calls. Is there a weeding out process or would you suggest continuing to use the same stocks for selling covered calls until the market tells us otherwise, i.e., when the stock falls hard and we apply exit strategies.

2.) Using both covered call writing and selling cash-secured puts – I have just started reading your put writing book and wonder how I would use both or if I should primarily stick to covered call writing and use put writing on certain rare occasions such as buying gap ups at a discount. Acquiring a discounted stock is not a sure thing. There is a time lag (30-day option) and a lot could happen to the stock in the meantime. If I were to use the discounted stocks to write covered calls, the logistics would need to be aligned but it is not within our control. So, I am leaning towards concluding that the best approach is to choose one predominant strategy (for me, it would be covered call writing) and just be aware of the other for when the opportunity arises. Please give me your take on this. In your experience with using both, do you have a preference for one versus the other?

Thank you in advance for your response.

Faye

Faye,

Thanks for your positive feedback regarding our premium membership and blog. My responses:

1- There is absolutely a screening process which is critical to option-selling. The good news is that process is precisely the same for both covered call writing and put-selling. You will see how that process is executed as you delve further into the book. It is also in my other covered call writing books and DVDs.

2- Both strategies are outstanding low-risk option-selling approaches to generating monthly cash flow. My personal preference is covered call writing because of the success I’ve enjoyed using this strategy over the past 2+ decades. I will implement put-selling to enter covered call trades in bear market environments. Put-selling is also a fantastic approach to buying a stock at a discount in lieu of setting limit orders. My suggestion is to master both strategies and then determine which meets your trading style best. For most retail investors, starting with covered call writing will make the learning process easier as it is more intuitive for retail investors and it is more accepted for use in self-directed IRA accounts. Also, most brokerages require a lower level of trading approval for covered call writing. That said, learning both strategies will definitely make us all better traders in the long run.

Alan

alan,

good morning – hope all is well with you wherever the day finds you.

I was watching the CD’s that I purchased when you where last visiting southern California (you presented on a saturday morning to our AAII chapter).

My question – when we set up our screens – do I choose the ‘slow stochastic’ or the ‘fast stochastic’?

What is the distinction?

I was surprised to find that I even had a choice in this regard.

Look forward to your thoughts when you have a moment.

thank you Alan, travel safely,

craig

Hi Craig,

I prefer the slow stochastic oscillator. The fast stochastic oscillator has an inherent number of false breaks, whipsaws and crossovers making it more difficult to interpret. The slow stochastic oscillator represents a 3-day simple moving average of the fast oscillator making it easier to read and interpret. For more detailed information on this topic, see pages 63 – 67 of the “Complete Encyclopedia….”

Alan

Hi Alan, it’s been a while since my last post and hope your not too busy at moment to help me out. I want to ask about using put options, so here are my first lot of questions:-

1. If I were to buy put options on some positions then where would you say is the best place for these? I thought my ideal area would be just below a support level,- but 2 other places I thought could be at a certain percent below the buy price, or maybe even at a place below buy price that ensures I get at least a 0.50 – 1% return with them in?

2. If I have rolled out a stock into the next contract period, and then for this next contract I want to buy a put option with my stock, then is this roll-out return still to be at least 1-2%?

3. If as I have read that the IBD50 stocks are more volatile than others, then I would have thought that buying put options in the bearish market conditions would be a very good idea to do?(maybe even sell ITM options too?)

4. Would a good investing strategy for just starting out be to buy put options with the covered calls I sell, and then maybe after a few months of building up enough money to withstand a large stock loss(eg. 10%), to then try the normal way without put protection? (thought it would be a lot safer even if the returns are less initially?)

5. Also just out of interest what would you say is a safer to do, to sell options on a stock and buy a put option under the price, or to sell options on an ETF without a put option in place?

I’m sort of thinking that a good plan for when(and if) I start real trades would be to use the put options only at times when I have concern just on the market tone and S&P500 charts, rather than the stock itself where ITM options are what I would use out of concern again – that’s just my idea at the moment.

Thanks for your help.

Adrian,

I’ll get to a few of these today and the rest later in the week:

1- You’re on the right track here. We are in the business of generating cash in a low-risk manner. Protective puts prevent catastrophic loss and will decrease monthly returns. I suggest setting a monthly return goal. Then calculate your call credit and put debit and use the combination that meets your goal. For example, if your goal is 1-2% per month and the call option generates 3%, select a put that costs 1-2%. Generally, protective puts will cut your call returns in half. Keep in mind that we are protecting against catastrophic loss, not loss in general.

2- If your return goal is 2-4% per month (like mine) without puts, then a 1-2% per month goal with puts is reasonable.

3- The IBD 50 stocks are generally growth stocks with favorable chart patterns. I’ve had huge success with this screen over many years. They do have higher implied volatility than typical blue chip companies. Protective puts have pros and cons as stated above. It’s an individual decision. It would be a mistake to sell only ITM strikes and not take advantage of bull market environments with stocks that have bullish chart patterns.

I’ll get back with 4 and 5…

Alan

Adrian,

Here are responses 4 and 5:

4- The use of protective puts is based on personal risk tolerance assuming we have mastered all aspects of position management. We are buying an insurance policy that we pay for. A good way to answer a dilemma like this would be to paper trade both ways and then decide which is most appropriate for you. When in doubt, favor the more conservative approach…protective puts. As confidence builds you may ultimately decide to move to traditional covered call writing.

5- This is a tough one to answer because some ETFs are associated with very low implied volatilities whereby protective puts make no sense and will lead to miniscule profits if any at all. Others can be more volatile than a typical growth security. BE SURE TO READ THIS WEEK’S BLOG…IT WILL ADDRESS THIS VERY ISSUE.

I would start by setting a minimum monthly goal and see which stock/put combos meet your goal. Then view ETFs that have lower IV than the S&P 500 and see which meet your goal. You can also start with half and half and see which direction you prefer. As I always say “one size does not fit all”

Alan

Running list stocks in the news: AMBA:

Jim Cramer was promoting this stock as a play on “drones”:

http://www.thestreet.com/story/13178559/1/jim-cramer–drones-will-drive-ambarellas-growth-not-gopro.html?puc=yahoo&cm_ven=YAHOO

Premium Members,

The Weekly Report has been revised and uploaded to the Premium Member website. There was a typo with the stock KMX. The first section of the report showed that there was no ER in this option month. KMX does, in fact, have a confirmed ER date of 06/19/15. KMX was shown correctly on the “Running List”.

Please look for the report “Weekly Stock Screen And Watch List 06/05/15-REVA.

Best,

Barry and The BCI Team