Whether we are using covered call writing, put-selling or any other investment strategy, investor interpretation of results is an interesting topic to analyze. Is the glass half-full or half-empty? On October 5th, 2018, Gene wrote me about two covered call positions he was holding and expressed deep concern over the status of those trades. This article will review one of the trades, discuss potential exit strategy opportunities and examine the lessons learned.

Gene’s trades with Amarin Corp. (NASQAQ: AMRN)

- 9/17/2018: Buy 11,000 x AMRN at $1.88

- 9/17/2018: Sell 60 x $5 1/19/2019 calls at $1.17

- 9/17/2018: Sell 50 x $7 1/19/2019 calls at $0.60

- 10/5/2018: AMRN trading at $20.29 (not a misprint!)

Gene’s dilemma

Since the strike is deep in-the-money, exercise is likely and is currently, according to Gene, ” losing a lot of money” The question posed to me:

- How can exercise be avoided?

- What can be done to recover these losses

The price chart and news

AMRN Price Chart on October 5, 2018

Checking the news, we conclude that the price jump was related to positive news regarding this biotech company’s fish oil product as well takeover rumors:

https://finance.yahoo.com/news/apos-why-amarin-corporation-jumped-202400588.html

Initial calculations using the Ellman Calculator

AMRN Initial Calculations

Both strikes offer huge initial returns which, if realized, would result in annualized returns of over 5000%. As of October 5th, shares would have to move below the strike prices for these amazing returns not to be realized. If closed, the returns would still end up more than 250% for the 18-day period from 9/17 to 10/5.

Why is the glass half empty?

Although the trades are currently at maximum, impressive returns, more money could have been made had the calls not been written. This means that maximum covered call success was achieved (to date) but had another strategy been employed (straight stock ownership), better results could have been achieved.

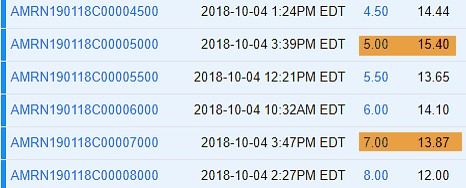

AMRN option chain on October 5th

AMRN Option Chain for January 2019 Contracts

Action choices

1. Take no action and re-evaluate as expiration approaches…still 3 months+ to go.

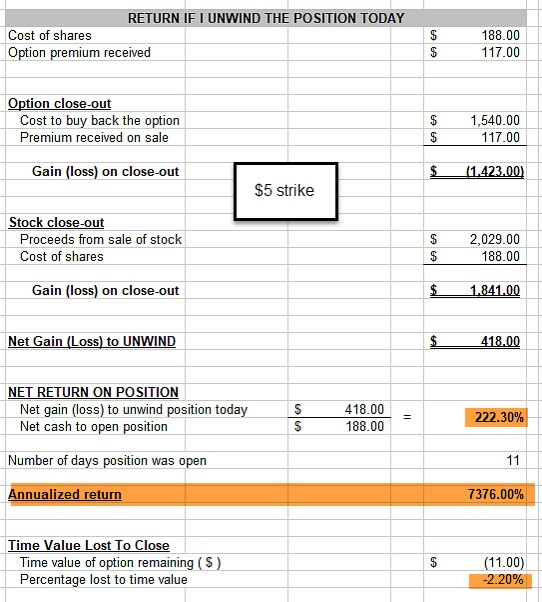

2. Unwind entire position and use cash to establish additional income streams. For this, we would need to calculate the time value cost-to-close. Using the “Unwind Now” tab of the Elite version of the Ellman Calculator, we see the cost-to-close the $5 strike is 2.2% and the $7 strike is 8.29%. We ask ourselves, can we generate more than 2.2% or 8.29% over the next 3 months in a new position with a different stock? 2.2% absolutely; 8.29% maybe not. Covered call writers would be more likely to close the $5 strike and leave the $7 strike as things stand now if unwinding is considered (Known as the mid-contract unwind exit strategy in the BCI methodology).

Cost-to-close the $5 strike

The Elite Ellman Calculator: Unwind Now Tab

Cost-to-close the $7 strike

Closing the $7 Strike

Lesson learned

The initial and current calculations reflect huge short-term returns. This is the good news. The negative concerns are inherent in using such a volatile underlying which could just as easily resulted in catastrophic results. This stock may be a decent longer-term candidate in a portfolio consisting of riskier trades funded with cash not needed for everyday consumption.

Discussion

When measuring the success of our trades, we evaluate the results based on initial goals not on potential results had a different strategy been employed. It is critical to use the most appropriate stocks and options for conservative option strategies like covered call writing and exit strategy implementation must be based on sound understanding of the calculations involved.

***For more information on the mid-contract unwind exit strategy:

The Complete Encyclopedia for Covered Call Writing- classic edition: Pages 264 – 271

The Complete Encyclopedia for Covered Call Writing- Volume 2: Pages 243 – 252

Upcoming events

-March 29th

Quinnipiac GAME Forum

International forum for college and graduate school finance majors

-May 8th

Alan will be hosting a free webinar for the Options Industry Council (OIC) on generating income from selling options. More information to follow.

-May 13th

All Stars of Options

Bally’s Hotel, Las Vegas

10 AM – 10:45 AM

How to Select the Best Options in Bull and Bear Markets

Free event

-May 14th

Las Vegas Money Show

Bally’s/ Paris Hotel

12:15 – 3:15

Master class encompassing covered call writing, put-selling and the stock repair strategy

This is a paid event hosted by The Money Show

Your generous testimonials

Over the years, the BCI community has been incredibly gracious by sending our BCI team email testimonials sharing stories as to what our educational content has meant to their families. Moving forward, we have decided to share some of these testimonials in our blog articles. We will never use a last name unless given permission:

Alan,

I’m in love with covered calls and your system. You have done an excellent job explaining and mapping out your thoughts behind your system and each step.

Anthony W.

Market tone

This week’s economic news of importance:

- Retail sales Jan. 0.2% (0.1% expected)

- NFIB small business index Feb. 101.7 (101.2 last)

- Consumer price index Feb. 0.2% (as expected)

- Durable goods orders Jan. 0.4% (-0.1% expected)

- Producer price index Feb. 0.1% (0.2% expected)

- Construction spending Jan. 1.3% (0.5% expected)

- Weekly jobless claims 3/9 229,000 (225,000 expected)

- New home sales Jan. 607,000 (616,000 expected)

- Industrial production Feb. 0.1% (0.4% expected)

- Job openings Jan. 7.6 million (7.5 million last)

- Consumer sentiment March 97.8 (95.0 expected)

THE WEEK AHEAD

Mon March 18th

- Home builders’ index March

Tue March 19th

- Housing starts Feb.

- Factory orders Jan.

Wed March 20th

- Federal Reserve announcement

Thu March 21st

- Weekly jobless claims 3/16

- Philly Fed index March

- Leading economic indicators Feb.

Fri March22nd

- Markit manufacturing PMI March

- Markit services PMI

- Existing home sales Feb.

- Wholesale inventories Jan.

- Federal budget Feb.

For the week, the S&P 500 moved up by 2.89% for a year-to-date return of 12.59%

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Bullish signal since market close of January 31, 2019

BCI: I am favoring out-of-the-money strikes 3-to-2 compared to in-the-money strikes for new positions.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to mixed market tone. In the past six months, the S&P 500 down 2% while the VIX (12.88) moved down by 1%.

Wishing you the best in investing,

Alan and the BCI team

Alan and Gene,

Been there, done that.

Once upon a time I screened for calls that had the highest time value. Most of them had earnings reports upcoming. The time value indicated a plus or minus change in the stock price after the earnings release. These indications could range from 25-50%.

As things, for me, usually work I was initially successful selling covered calls on some of these issues. Many times, especially in biotech the moves were fantastically up. I was exercised, made good money and saw the buyer of my options make tremendous profits.

As I wrote in a previous blog, one of my sons remarked that if I had not any written calls I would have made fantastic profits. My reply was that if not for the volatility I would never have been in them at all.

Well after thinking I had this down pat, my losing trades, for example, AAOI, which Alan wrote about on one of the blogs, began to cost me much more than I was making on my successful trades so I moved on.

For me, the most important take away from BCI is to avoid having any short positions during an earnings report.The absolutely most conservative approach is to have no positions during earnings report. However most of us have some long term holdings that we are willing to hold through earnings reports.

Many thanks to you, Gene, for sharing with us. Thanks to you Alan for assembling all the facts and timelines into an educational capsule from which we can all benefit.

Hoyt

I agree with you Hoyt. Avoiding earnings is one of best lessons I learned from BCI. Large premiums are tempting but the risk isn’t worth it.

Marsha

You got that right.

Hoyt

For PMCC trades is it worth holding long LEAPS position through the earnings? Maybe the better strategy is to close both legs and setup new trade after the earnings report? Any suggestions?

Sunny

Sunny,

Speaking just for myself, I haven’t had great success with PMCC. Primarily because I haven’t found many LEAPS that let me meet the criteria. I may be, and probably am, missing something with the formula. I will give it a second look.

I do use LEAPS as a stock ownership substitution play.

For example: MFST closed 3/15/19 @$115.91 +$1.32. Jan 16 ’21 $120 Call, Bid $10.85 Ask $15.80 (very wide spread, not unusual) Last trade @$12.84, down $0.56 from 3/14/19. Open Interest is 3,845. Volume 3/15/19 was 3,178. This was a little under half way between the two prices. Day’s range was $12.73-$14.75. I will not get into the reasons it ended down but you can see from the range and spread there are a lot of possible price points.

Now if a call was bought for $13.33 (midway between the spread) you would be paying 11.5% of the underlying equity. The Delta of this call is 0.5557. This means that on balance the call goes up and down $0.56 for each $1.00 change up and down in the stock.

Obviously the call did not close up $0.74 (56% of $1.32) but the range moved roughly that amount.

So basically for 11.5% of the stock price you will get 56% of the gain in the price of the equity. Now as expiration approaches, assuming by then you are ITM, Delta will begin to approach 1.0. At that point you begin to get close to $1.00 for every $1.00 increase in price.

On the other hand if the stock goes down the same thing occurs in the other direction.

In the early and mid stages of a bull market with a growing stock this can be a very good approach. It has worked well for me in the past. However my experience with FB in July of 2017 was a super disaster. I lost $30,000 of profit 30 minutes after the market closed when an earrings report was released.

Now I am not recommending either this approach or MFST. I have made money off MSFT with this approach in the past.

Sorry to be so long winded.

As to your original question about selling during earnings reports when using LEAPS to sell covered calls, my answer would be, “Yes”.

A more complete answer would probably depend on the relative strength of the equity to the S&P 500 for the last 3 months. This measurement tends to hold for the next few weeks but not always.

Hoyt

Hoyt T,

My primary PMCC trade is on QQQ. I don’t buy very far expirations LEAPS, I think 6-12 months is enough. Short leg is 1 month.

Actually PMCC are good on blue chips stocks and some ETF’s. Not all of them meet initial trade setup criteria, but most of them do.

I don’t have much experience with PMCC, I made my first PMCC trade in February this year only, but results are good so far. I tend to close both positions prior earnings reports too, as holding long LEAPS creates leverage and if earnings comes negative the loss can be too big.

Sunny

Sunny,

Every strategy has its pros and cons. Long-term commitment to a security and exposure to multiple earnings reports is one of the understood disadvantages of PMCC when deciding on this strategy. Certainly there are advantages. See pages 105 – 109 of our book, “Covered Call Writing Alternative Strategies, authored by me and Barry, for a comprehensive list of pros and cons of the PMCC.

Given that we have agreed to the exposure to multiple earnings reports when deciding on this strategy, it is the short call that we do not want in place at the time of these reports. In the past several years, there are many more positive reports than disappointing ones as companies tend to mute guidance so capping the upside is generally not to our advantage. Securities like QQQ have weekly options available so the short (monthly) call can be written after the report (if early in the contract) or Weekly calls can be used that month, by-passing the one week of the report.

The PMCC Calculator will be quite useful in setting up and managing these trades:

https://thebluecollarinvestor.com/minimembership/poor-mans-covered-call-calculator/

Alan

Alan,

MSFT, AAPL and AMZN are roughly 30% of QQQ. From your response I didn’t understood clearly if you recommend not having short call (on QQQ) in place when largest holdings of QQQ reports earnings? As ETF QQQ itself doesn’t have earnings reports, but most of it’s holdings reports around the same time (late April-early May).

Sunny

Sunny,

I was responding in general terms regarding securities that do report earnings. That does not apply to ETFs I used QQQ as an example of a security that has Weekly options associated with the underlying. So no ER concerns with QQQ or other ETFs.

Alan

Hi Hoyt,

I tried to learn the PMCC method a couple of years ago.

I had some very nice results, and some awful results, and finally I decided to stick with the monthly CC trades, and avoid ERs like the pest.

I now believe that if I cannot afford to buy 100 shares of a stock, I’m better off buying one less expensive.

Roni

Hi Roni,

I tried it some time back too. My memory fails me sometimes so I don’t remember exactly what my issue was. I had experience with diagonal spreads so I think I tried PMCC with the wrong stocks.

I am going to read Alan and Barry’s new book and I am thinking about giving it another shot.

While I expect this year to be bullish, almost all third years of a first term president are, I do expect major headwinds in 2020 and/or 2021.

What are you expecting down in Brazil, or is it Brasil, now that you have your Trump like President?

Hoyt

Hi Hoyt,

Brazil in English and Brasil in portuguese (Brazilian) both are correct..

We had a very bad recession since 2015, now recovering slowly.

The former government (since 2003) was leftist and enourmousely corrupt. Now most of them are in prison (more than 200 including former president Lula).

The new president is trying to clean up the mess, and our hopes are high.

Roni

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor premium member site and is available for download in the “Reports” section. Look for the report dated 03/15/19.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and The Blue Collar Investor Team

[email protected]

Alan,

Just watched 2nd video of CC course( live talk you gave) Selling monthly’s and turning portfolio 20 -80 % how much time do you actually put in a week ?

How many holdings are you typically holding my impression was around 50, maybe less a month.

Thanks a lot. I like your presentation style.

Bryan

Bryan,

I currently spend 3 – 5 hours per month managing 50 -100 contracts (15 – 25 positions) in my portfolio and a few in my mother’s account. Most of that time is spent early and late in the contract although a few position management executions occur in between.

I’m pleased you are enjoying the DVD Program. I suggest you use it in conjunction with the Encyclopedia.

Alan

I have a question about exit strategies in covered call option trading. Since you give the buyer of your covered call the right to use your stock for a month aren’t you breaking your agreement with that trader? What happens to their trade?

Thanks,

MT

MT,

When we sell an option, we are not selling it to a specific person. Buy and sell orders go into a pool of buy/sell orders and these are matched up by the Options Clearing Corporation. Both buyers and sellers have the right to close long and short positions at any time prior to contract expiration. As trades continue during the contract, the OCC continues to match these trades.

When managing our trades, the only factors that should be considered are those that impact our position and there is no need to spend even a second on those taking the other side of our trades.

Alan

so if the buyer decides to exercise the option even though the seller has bought back the covered call option trade the OCC will fill the buyers order with stock from their stock supply???

MT,

The OCC will match the order with a different option seller or share seller or perhaps a market-maker.

Alan

Alan,

Question regarding PMCCs. If the short call gets assigned, and the person doesn’t have enough money in their account to sell 100 shares of the underlying, what happens? Margin call? Reason I ask is because I presume most people using the PMCC strategy probably do not have the money to buy 100 shares of stock in their account to begin with.

Joanna

Hi Joanna;

If the short call were assigned you would need to sell the long Leaps to unwind the position. This would avoid the margin call.

Best;

Terry

Joanna,

In addition to Terry’s excellent response, I would add that it is critical to set up the trade, such that, if closed (exercised), it will be done so at a profit. There is a formula we must adhere to when entering a PMCC trade that will ensure a profitable close if both legs of the trade are closed as share price moves above the short call strike.

See pages 117 – 134 of our book, “Covered Call Writing Alternative Strategies” for rules and guidelines on initial structuring of PMCC trades. The BCI PMCC Calculator will also be quite useful.

Bottom line: When these trades are entered properly, the long and short calls will cancel out at a profit and the shares will not have to be purchased in the scenario you have depicted.

Alan

So, are you saying (sorry I’m not able to grasp this) that if I get assigned, I will get notified by my broker of this fact, and then I can just simply buy back the LEAPS and the person won’t be able to exercise the short option and acquire the 100 shares?

Wait….I think I get it now. When the short call gets assigned, I will then be “short selling” 100 shares of the underlying. Then all I would have to do is exercise the LEAP, which would automatically buy back those 100 shares, right? So, long as the trade is set up from the beginning to ensure profit (or minor loss) then risk will be mitigated as far as assignment risk is concerned.

Joanna,

Yes, as long as the trade is set up at a profit, when both legs are exercised, a profit will be realized. The long call provides the shares for the short call obligation.

Alan

Consider writing your call on only part of the position.

Alan,

Just thought id reach out and see if i can get involved with US options, i mainly trade AUS but there limited and premiums are low, what do you suggest for me have you any short courses already seen your online material??

Many thanks Chris

Alan,

Do you now or have you ever considered listing the IV for the at or nearest to money strike for each individual stock on the Running List? Or possibly a simple average composite of the at/near and nearest in and out strikes for each stock?

The differentiation is helpful in terms of stocks that passed all screens, stocks with ERs during the next contract etc.

However, the member may be presented with 50-60 stocks to narrow down. After and within industry diversification, the member still must narrow a large list down.

If the IV was listed, a member could narrow down the list commensurate with his or her risk tolerance and stance on the market or individual stock strength.

I realize the IV is a dynamic figure and ranges across strikes with the IV smile. However, listing the at or nearest or a composite average of the 3 nearest to strike would give the best approximation of the IV at the time of report issue.

If I have a larger risk tolerance and am bullish, I would go to the stocks with the highest IV on the near strike within each industry— If I have a low risk tolerance and am bearish, I would look first for stocks with the lowest IV within each industry.

This is not to say I just want to IV fish for returns. I understand and agree with the golden rule of not writing a call on a stock you do not wish to own. But, if you have a list of the best stocks in the best industries as determined by the extensive screening process, the IV could give the member a quicker clue on which stocks he or she may wish to consider first out of the 50 that may be presented.

Thank you for your consideration and for all the work you do to help retail investors.

Michael

Michael,

We do give IV stats in our ETF reports because many beginners assume all ETFs have low IV which is correct in general, but not in all cases.

Regarding individual stocks, it is not necessary to look up specific IVs because those stats are “baked into” the premium returns. Instead, we can set up an initial time value return goal range that reflects the personal risk-tolerance and market assessment you alluded to in your question. In my case, it is 2% – 4% per month for near-the-money strikes and up to 6% in strong bull markets. (It is 1% – 2% in my mother’s portfolio). I will reduce that range to 2-3% in bear and volatile market environments and favor in-the-money strikes.

We use the multiple tab of the Ellman (covered call) Calculator to determine if our initial time value return goals (and therefore, our IV goals) are met.

Alan

Chris,

Glad to help and welcome to our BCI community..

Best online courses:

https://thebluecollarinvestor.com/minimembership/complete-dvd-bundle-package/

Best books:

https://www.thebluecollarinvestor.com/alan-ellmans-complete-encyclopedia-for-covered-call-writing-scover/

https://www.thebluecollarinvestor.com/alan-ellmans-selling-cash-secured-puts/

Most online discount brokers allow international investors to trade on US exchanges. See the online discount broker file in the “Free Resources” link on the top black bar of these web pages.

Alan

Alan,

I have a question regarding ETF exit strategies… You previously mentioned closing the long stock position if it underperforms S&P 500 and declines by 8-10%. But how about ETF’s? Does the same guidelines applies to ETF’s as well? Our expectations for ETF monthly CC returns are lower, 1-2% per month compared with 2-4% for individual stocks. Do you have any guidelines when underperforming ETF position needs to be sold?

Sunny

Sunny,

The same exit strategy guidelines apply. If share price declines, we use our 20%/10% guidelines to close the short call. From there, we can wait to “hit a double”, roll down or sell the underlying if it is substantially under-performing the overall market. This means that if an ETF is declining in price even if we don’t sell the security, some action will be taken to mitigate losses.

Alan

FYI….I just bought your book “Covered Call Writing Alternative Strategies” like you suggested, and it’s really clarifying things. For some reason, all the other sources of education I have sought out on this journey end up confusing me more than explaining things in plain language. Thanks for all your help!

Joanna,

Much appreciated. Our goal here at BCI is to provide as much information as possible to elevate returns to the highest possible levels as we learn from each other.

Alan

Ciao from Italy dear Alan!

I’d like to ask you if you ever tried your screening process to purely buy-and-hold stocks for a while.

I’m in the third month simulating with 30k dollars, chosing stocks from your premium reports. It’s amazing!

It’s a bullish bully bul market, sure, but I managed to make 18.5% in three months and that’s pretty amazing!

That’s it, I just wanted to share this with you. It’s simulation, but it’s serious simulation, still going…

Wagner

Wagner,

Congratulations on your recent (paper trade) success and for taking the time to practice before “going live”

Yes, many of our members use our screened stocks and ETFs for purely buying and selling securities without the option component. Our screening process is rigorous from fundamental, technical and common sense perspectives and the “surviving” securities represent the best of the best.

Keep up the good work.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Alan,

I hope all is well. I’ve been using the CC strategy for a few months now and had a question about something Im not understanding.

Today I entered a CC trade on TTD. Bought 2oo @ 205.97 and sold the April 200’s for 12.60. When does my account reflect the profit for the options, at expiration? My account balance did not go up after this was executed today.

Hope that was clear.

Mark

Mark,

The cash from the sale of the option will be reflected in your cash account. The actual account position will appear in brackets as a “negative” because it represents an obligation. This is a standard brokerage accounting method. Once the option is closed, exercised or expires worthless, the brackets will disappear and your account will reflect the profit (loss).

Alan

Hey Friends,

I am an old buzzard in this community who has been around a while.Yet between a late Mardi Gras and then St. Pat’s down here in New Orleans I have had a wonderful flow of house guests. Now, I warn you, I may get back to commenting :)!

It really is great to read all the new voices here. But everyone please remember: this is not just the “Quiz Alan Hour” :). Please share your experiences and recommendations also!

Hoyt, since December I have opened up half a dozen or so LEAP positions out into early 2020. Nothing too nuts. I invested a few thousand bucks each into a diversified handful of large caps just as a stock replacement strategy experiment in an IRA. I have not made them PMCC’s yet since I would like to get some appreciation in them first if the market allows.The best of the bunch has been CSCO. I bought 6 contracts initially at the .50 delta strike for Jan 2020. They tripled. I sold 2 to make the trade risk free and the delta has gone up quite a bit so the LEAP now performs like the stock – for good and bad – and I will hold the balance at least into August when the crummy seasonality often sets in and the time decay curve begins it’s descent.

My worst performer has been BAC. I am down about a third on that one but I still like the banks and have some XLF uncovered in the account. I just added a LEAP on BA since I think the current weakness shall pass and the fundamental story is too good to ignore.

Hope everyone is having a great week! – Jay

Hi jay,

Well I guess old buzzards flock together too.

Congratulations on CSCO LEAPS. As I said earlier BAC has been a core holding since I started buying it during the great recession. Also as I said when you first went into BAC I have experienced around $30 being a ceiling. Having said that I bought today some BAC Apr 18 ’19 $28,50 Calls. I am expecting BAC to be the best big bank stock going forward. Some technicians are predicting a major breakout if it breaks $32.

I opened two PMCC positions yesterday on CSCO and INTC. I have 2 Long contracts on each, CSCO Jan 17 ’20 $30 Call purchased 04/30/18 and INTC Jan 17 ’20 $35 Call purchased 03/30/18. Sold the Apr 18 ’19 $55 and $56 respectively. I used yesterday’s price on the LEAPS to plug into the Ellman & Bergman PMCC calculator. CSCO ROO 1.16%, Upside 7.64%,

Total Annual 110.74%; INTC ROO 2.50%, Upside 10.05%, Total Annual 157.97%.

Many days like today and I will have to visit the What Now tab on the Elite Calculator.:)

Seriously, the new Ellman & Bergman PMCC calculator is awesome. Beats the hell out of the old spreadsheet I created a few years ago. I rename and save the PMCC calculator on the positions I open so I can go back and look at the criteria I used in making the decision.

I copied and pasted the PMCC two times so I could analyze three short strikes on one screen. Works great so far. Still have the original in case my revised one crashes.:)

I think your call on BA is right on. Probably more downside until the whole story is out. Afterwards, no matter how bad, it will go back up. If it is real bad someone will be thrown under the bus and all will be forgiven. I actually bought BA Apr 18 ’19 $390 Calls in the morning on 3/11/10 while BA was down about $50 and sold in the afternoon when it was still down about $25 but up where I bought for a $1,078.00 profit. This rarely happens. But one(AMZN) of the positions I opened this morning have had that kind of returns.:)

Finally, I felt the Fed would not raise rates at this meeting and bought 20 contracts on XLK May 17 ’19 $74 Calls on 3/15 up 76% to date.

After yesterday’s Fed statement I am even more in on tech. Low rates are really the sweet spot for tech. So this morning I opened long call positions in QQQ, AMZN and, weirdly, NFLX.

Buckle up and hang on.

Hoyt

Thanks Hoyt,

Always a pleasure to share notes with you and I appreciate the kind prompt reply! My LEAP on BAC is the $30 strike Jan 2020 so I am not worried and it is a tiny position. I am Tech Heavy like you at the moment. Buying calls on a few marquee names and the QQQ has paid my bills for many months while taking very small risk with tight stops that never got hit. So I just kept moving the stops up. I do sell half of my my bought option positions when they double to eliminate risk and another quarter when they go up further to lock down a gain. Then let the rest run. I use a 50% stop loss on options buys and sometimes that gets hit but I never put more than 1% of any particular account into any given trade and end up covering retirement bills every month when I combine that with my cc overwrites on core holdings never touching principal. What a fun hobby :). – Jay