Covered call writing and put-selling can be used in most market conditions including bear markets. In my books and DVDs, I detail the use of in-the-money call options (strikes lower than current market value), out-of-the-money put options (also lower than current market value) and securities with low-implied volatility like exchange-traded funds (ETFs). In this article we will use all three of these criteria and demonstrate the process of establishing our defensive positions using a popular ETF, QQQ.

What is QQQ?

This is the ticker symbol for the Nasdaq 100 Trust, an ETF that offers exposure to the 100 largest non-financial stocks that trade on the Nasdaq exchange. It is a popular ETF with more-than-adequate trading volume and option liquidity.

How do we establish our defensive positions with QQQ or other ETFs?

First and foremost, we must establish our initial time value return goals (we do not include intrinsic value in our return calculations). If our goal for individual stocks is 2% – 4% per month, let’s use 2% for this ETF with the understanding that this target can be adjusted based on our personal risk tolerance. ETFs, in general, generate lower option returns than individual stocks. Next, we view the options chain and select strikes that meet our 2% criteria and also offer downside protection of our call and put positions…in-the-money calls and out-of-the-money puts. We will be using the multiple tab of the Ellman Calculator for call calculations and the BCI Put Calculator for put computations.

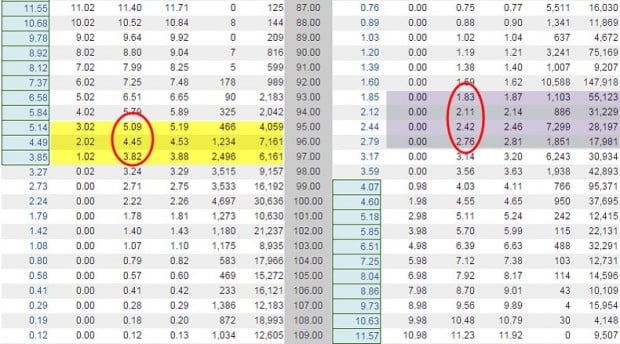

QQQ (trading at $98.02) options chain for 1-month March 18, 2016 expirations

QQQ: Options Chain for March 18, 2016 1-Month Expirations

Highlighted in the yellow field on the left side of the screenshot are call strikes we will evaluate and in the purple field on the right are put strikes to be evaluated.

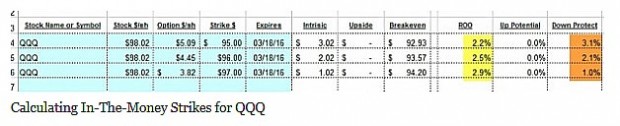

Covered call writing calculations using the multiple tab of the Ellman Calculator

All three in-the-money call strikes meet our 2% criteria. The higher the time value returns (ROO), the lower the downside protection (profit protection, not breakeven). The column to the left of ROO shows the breakeven points. All three choices represent reasonable defensive positions to consider.

Put-selling calculations using the BCI Put Calculator

Put Calculations for March 18, 2016 1-Month Expirations

All four out-of-the-money put strikes meet our initial (unexercised) return goals as highlighted by the red arrows. The row adjacent to the blue arrow calculates the percent a stock must decline to reach the breakeven point. As an example, the $93.00 out-of-the-money put strike guarantees a 1-month return of 2.01% as long as share value does not decline by more than 6.99% by expiration. All four strikes offer reasonable defensive put-selling positions to establish in a bear market environment.

Discussion

Option-selling can be crafted to most market conditions. In bear markets we take defensive positions by selling in-the-money call options and out-of-the-money put options. Consideration should also be given to exchange-traded funds which generally (there are exceptions) have lower implied volatility than individual stocks.

Next live event- Workshop

July 16, 2016

American Association of Individual Investors

Washington DC Chapter

Northern Virginia Community College

9 AM – 12:30 PM

Seminar information and registration link

Market toneGlobal declined this week after an initial boost on dovish commentary from US Federal Reserve Chair Janet Yellen. Crude oil prices rose to $49.31 from $48.11 last week, and global Brent crude prices dipped to $49.62 from $49.72 a week ago. The Chicago Board Options Exchange Volatility Index (VIX) rose to 17.03 from 14.48 last week. This week’s reports and international news of interest:

- Concerns about the economic outlook have been raised by recent labor data, Fed chair Yellen said in a speech on Monday, just days after a disappointing employment report. Markets give a June rate hike extremely low odds, and a July hike is now also seen as unlikely

- Record low 10-year bond yields were recorded this week in Germany, Japan and the United Kingdom as the Fed backed away from an expected summer rate hike

- The average yield on European investment-grade corporate bonds is now below 1% while some issues trade with negative yields

- Switzerland held a referendum on a universal basic income last weekend. The notion of sending each adult 2,500 Swiss francs a month and each child 625 — with no strings attached — was soundly defeated at the polls

- The World Bank downgraded its global GDP forecast which now sees a 2016 growth rate of just 2.4%, down from its 2.9% January forecast. Its 2017 growth outlook was trimmed to 2.8% from 3.1%

- Economic growth in the eurozone was revised higher in the first quarter, coming in at 0.6%, up from the prior 0.5% reading. On an annualized basis, growth grew by 1.7%. That’s the fastest rate in 12 months. Inflation, however, remains far below the ECB’s target of near 2%

THE WEEK AHEAD

- China reports direct foreign investment, retail sales and industrial production figures on Monday, June 13th

- The eurozone reports industrial production data on Tuesday, June 14th

- The United States reports retail sales data on Tuesday, June 14th

- The Swiss National Bank holds a quarterly monetary policy meeting on Thursday, June 16th

- Eurogroup finance ministers meet on Thursday, June 16th

- The Philadelphia Fed’s manufacturing index is released on Thursday, June 16th

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Buy signal since market close of May 25th

BCI: Cautiously bullish favoring out-of-the-money strikes 3-to-2

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

Alan ([email protected])

Raleigh North Carolina seminar:

I just returned to the hotel. Thanks for your gracious hospitality, for packing the room and for your generous feedback. I especially want to acknowledge BCI members who I got to meet in person. So great to put a face to the name.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Premium Members:

This week’s Weekly Stock Screen and Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 06/10/16.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Best,

Barry and the BCI Team

Hi Alan,

I would love to attend one of your seminars and meet you, but my last trip to the US was in 2011, and I do not know when my next one will be.

Maybe you can come to Brazil in the future? If you do, please let me know. 🙂

Meanwhile, I will send you a picture by e.mail, so you can see who you are talking to.

Cheers…..

Roni,

Thanks for your membership and participation in our blog. I am extremely fortunate to receive speaking invitations from so many venues but so far none have landed me in Brazil…but you never know!

We are planning to add webinars to our arsenal for our premium members starting July 28th. I hope you find them beneficial.

Alan

I will try to participate in the webinars Alan, thank you.

Alan,

Hope all is well. I am a new “very green” investor and have been attempting to learn as much as I can and found your website and watched a few videos and YouTube events you have done and find them very informational. I also just joined BCI and gradually understanding the concepts, but can’t get my head wrapped around few things. I have a Scottrade account that was empty for years and I recently fired it back up and wanted to do some “covered calls”. I thought maybe you could answer a few questions if you have the time. Like I said, I am new and very green, so you can expect maybe some silly questions. Anyway here they are.

Let’s say I purchased 100 shares of XYZ company. Then I wrote a covered call at a strike price of 102(higher than market) and set the expired date in the future. Then, a few days go by, and the price of XYZ goes to 110, wouldn’t someone exercise an option and purchase my shares at 102 and sell at 110? If they did, wouldn’t I see my shares in my account automaticity be sold and disappear from my account before expiration date?

Next question, same 100 shares, but this time instead of strike price of 102 I set it at 98. (lower than market) I can’t understand why my shares wouldn’t t instantly sell to someone and then they turn around and sell at 100? If they can buy at 98 and sell at 100. Wouldn’t my shares instantly go away from my account?

Next, those options chains that are on Yahoo, or wherever, they are already there. Is it possible, that I just create a brand new one myself? Why work with ones already there?

Last question, can people belong to several brokers and how does covered calls work with day trading and rules and regulations?

Thanks in advance if you answer my questions or even just one and thanks for the information that you already have provided,

Sincerely,

Neil

Neil,

In our BCI community there is no such thing as a silly question. Every question I receive is one that I asked myself as well when I started teaching myself option selling strategies in the 1990s.

When a strike is in-the-money (lower than current market value) whether when initially sold or after a price movement up the option is almost never exercised early. The reason is that option premiums consist of time value + intrinsic value. By exercising early, we capture intrinsic value but leave time value on the table. Let’s take your example of the stock that moved to $110 after selling the $102 strike. The premium will consist of $8 of intrinsic value ($110 – $102) + some time value, let’s say $0.50. If the option buyer exercised early, shares are purchased at $102 and sold for $110,a credit of $8. BUT, the option can be sold for a credit of $8.50.

Option chains: These are price lists determined by the markets in much the same way that the price of the stocks are dictated by the markets. We have no influence over option chains.

Covered call writing is in no way shape or form related to day trading. It is a conservative form of investing that our government permits in self-directed IRA accounts, unlike day-trading which is quite risky and should be considered only by sophisticated investors with high risk-tolerance. That said, we are dealing with American Style options which can be bought or sold at any time.

Take your time to educate yourself and then paper-trade (practice with a hypothetical account) for a few months and then you will have years and decades to benefit from this great strategy.

Alan

Thank you for responses. I guess they make sense, but if there is profit to be made at any time, it would seem someone would buy those lower priced shares and sell them at the higher price and know they made a profit, right? What am I missing here?

thanks,

Neil

Neil,

Absolutely, exercise will result in an $8 profit. BUT…selling the option results in an $8.50 profit…let’s go with the latter!

Alan

Alan…

I find your videos and website so helpful, and was wondering if you ever run workshops in Canada…

I live in Montreal, so Montreal or Toronto would be the ideal locations for me.

Thank you!

Catherine

Catherine,

Thanks for your generous feedback. As I mentioned to Roni in a comment above, my speaking engagements are based on invitations I receive. I would definitely be open to an opportunity to speak in Montreal or Toronto should I receive such an invitation. I wish I could say that all those years of taking French in high school and college would be an asset for such a presentation but speaking a foreign language is not riding a bicycle…out of sight, out of mind.

Alan

Premium Members,

The Weekly Report has had a minor revision…there was a typo in number of weeks that ITC has been on the Running List. It has been changed from 3 to 4. This should not impact on any trading decisions. Thank you Mario.

Best,

Barry

Alan-

I attended your sessions in Vegas at The Money Show last month. As a result, I just signed up for the Blue Collar Investor. I have traded options in the past plus I listened to all of your videos on Covered Calls and on Puts. I have a couple of questions related to your service:

1) Is there a way to download the current stock list into excel? I would like the option of sorting it in other ways, as well as adding my own columns. I see where you list just the ticker symbols for spreadsheet loading, but I want to start from your base of data. I don’t want to have to enter it all again.

2) Is there any significance to the stock list sort? Appears to be sorted by the Next ER Date

Thanks

Jeff

Jeff,

Great to have you as a premium member.

Pages 5 and 6 of the 8-page report are designed to allow members to copy and paste the current eligible stocks to their own spreadsheets and build from there. The ticker symbols in bold have the strongest technical charts but all are eligible assuming adequate option liquidity .

We sort stocks based on our extremely important rule to avoid selling options when there is an upcoming earnings report prior to contract expiration. Those stocks that report in the current contract month are highlighted in the gold cells and are eligible after the report passes (dates are shown as well) but we also show when the other candidates report so we can look into our future positions as well.

Alan

Alan,

I was at your talk on Saturday in Raleigh. Thanks for coming to town. I watched the beginners videos this weekend and have started reading your 3rd book.

I know the rule is to avoid starting a position when the next month has earnings. Let’s say you purchased 100 shares this Friday 6/17 and sold one OTM call and the earnings report is due on 8/3/16. So we avoided the earnings report. Well now let’s say that the option expired worthless and I still own the stock. Do I sell another option on 7/15/16 on this underlying even though the earnings report comes before the expiration on 8/16. If not what do we do with the stock, just wait until the day after the earnings report?

I’m planning on subscribing, however I wanted to wait until I read your book and got some questions answered 1st.

Again, thanks for coming to Raleigh and sharing your knowledge.

Thanks,

Nelson

Nelson,

If we hold a stock in our portfolio which has an upcoming earnings report the next contract month, there are 3 possible actions we can take:

1- Sell the stock and consider re-purchasing after evaluating the response to the report.

2- Hold the stock through the report and then sell the call option after price volatility subsides.

3- Sell Weeklys (if the stock has Weeklys) up to the week of the report and then starting again after the report.

Alan

I suspect many here are “market junkies” like me who enjoy following the financial media :). If so, you know all about the “Brexit” vote next Thursday. If not, please Google the term.

Opinion polls and discussions of impact vary widely. Which is why I consider it the equivalent of an “earnings report” for the market. Meaning I will not be in new covered call positions for next week or month after this Friday’s June expiry until Monday the 27th. I am skipping the Brexit vote, thank you very much :).

There has been a rush of new voter registration in Britain and pundits see that as helpful for the status quo. If you look at Predictit.org “no” shares still cost more than “yes” shares. This could be an already priced in non event – a yawner.

But we are patient investors who evaluate percentages. The chances of market volatility next week are elevated compared to an ordinary new monthly expiry first week.

Knowing that I can wait a week to sell new calls….- Jay

It will be interesting to get the Fed’s take on “Brexit” May hear something about that today…Alan

Alan, I will be listening for Yellen’s comments as well. This tidbit from my morning reading:

A new UK survey showed 55% of prospective voters favored leaving the EU while only 45% wanted to stay. This is the biggest percentage spread in favor of leaving and the tide is turning in their favor. The vote on June 23rd is a flashing warning signal on investor calendars, but I suspect most really do not have any idea what will happen after the vote.

The vote itself is nonbinding. However, it will express the will of the people and the lawmakers will begin the process to leave the EU if that is how the vote plays out. The UK will have to file an “Article 50” request to exit the EU. That starts a two-year countdown clock that will give officials both in the UK and the other EU countries time to begin making plans for how they will handle business with the UK after their exit.

The UK leaving the EU is not the biggest problem. The problem will be other countries also planning their exits. France and Italy have already expressed a desire to go back to an independent status. Italy is suffering from the EU rules and wants to go back to its own currency (Lira) and abandon the Euro. Wage and cost inequality between all the Eurozone countries makes it difficult for some countries to compete, while others have become trade powerhouses.

Alan,

I feel ridiculous double posting. But I feel strongly Monday is not the time to buy replacement positions, new positions or sell new optons for July expiry. We can give it a rest for a week :). – Jay

Hello Jay,

Great posts. I agree 100%.

Nobody knows what will happen to the stock market after June 23rd.

So it´s time to be prudent.

Would like to add:

I am today 57% in cash, and probably will be 72% in cash after tomorrow’s expiration.

So much for BREXIT referendum. 🙂

Thanks for the kind words Roni.

Barry will publish a list of great stocks this weekend. Something tells me you can get them on sale if you wait a week:)! – Jay

Yes Jay, it may be so.

I prefer to hear that Britain will stay in the EU, because we don’t need a new turmoil in the stock market.

Either way, I prefer to get back in after this event is over.

It is, like you said, equal to ernings reports high risk situation.

Good luck to you – Roni

And best of luck to you as well Roni!

My hunch is you will be happy you are 72% cash a week from now. But a hunch is all it is. I have no idea where the market will be.

If anyone says they know I suspect they have the same love affair with their mirror Trump has :). Happy weekend! – Jay

Alan,

I have a question I own 300 shares of FIVE at 40.26 and hold a 38 Option for which I received $434 premium total for 3 contracts expiring 6/16. Trading at $44, I wonder if I am better off being assigned, or roll out to next month’s $44 for a premium of $540 total. I am bullish on the stock.

Can you help ???

Thanks,

John

John,

Before I respond to the rolling aspect of your question, the original premium received looks incorrect unless you sold the option after share value declined from $40.26. The $38 strike is $2.26 in-the-money which would generate $678 in premium for 3 contracts alone without any time value…check that out.

Now, to determine if rolling out and up to the $44 strike makes sense we use the “What Now” tab of the Ellman Calculator. The screenshot below shows a 1-month initial and maximum return of 2.61%. If this meets your goal then rolling makes sense especially since you are bullish on the stock.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Alan,

CMCM is reporting earnings on 16/8/2016. Is it possible for me to sell the options for August, but exit prior to earnings (eg on Friday, 12/8/16)? The August option expires on 19/8/16.

Alex,

The short answer is yes, that can be done but there are a couple of considerations we must factor in. First, the August contracts will not be available until the June contracts expire so we can’t even do calculations at this point in time.

Most importantly, is the fact that just prior to the report, the implied volatility of most stocks is quite high as the “Street” anticipates a favorable or unfavorable report. When IV is high the cost to close will be high as well and this may result in an overall option debit. If the stock had Weeklys, we can circumvent the earnings issue by avoiding that one week but CMCM does not. However, the July contracts are in play if you like this equity.

Alan

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Hello Alan,

First of all I would like to say how much I enjoy to read your books, especially the one related to covered calls.

I do have a question regarding to the options strategy management: Why Do we need to bother and manage the written call? For example if XYZ stock price is 60, we bought a PUT in strike 90 expiring in 6 months, now we can write a cash secured put for 58, if assigned sell covered call and if assigned, don’t really mind as we can repeat the process, Am I mistaken?

Emmanuel,

Let’s look at this trade from a mathematical perspective to see our realistic expectations. The $90.00 put is $30.00 in-the-money and will cost us $30.00 + a time value amount, let’s say $32.00 or $3200.00 per contract. To breakeven, we must generate $533.33 per month for 6 months. On a $60.00 underlying security, this computes to an 8.9% monthly return just to breakeven. This is an unrealistic expectation.

The initial position is spread trading with a bearish perspective. For most retail investors starting out with options, covered call writing (with the possible addition of protective puts) and/or selling cash-secured puts are most appropriate. Once mastered, spread trading can be considered.

Alan

Hello,

2 short questions please: the first one is related to the buy put strike isn’t the $30.00 guaranteed? therefore actually have to cover more or less $200.00?

The second is related to the position, sorry for being miss understood, I didn’t mean spread trading but rather intending to write a covered call: first step sell cash secured put if assigned as I now own the stock write a covered call, the related question is why do i mind if the covered call is assigned? I can always sell a cash secured put and again if assigned write a covered call?

Emmanuel,

1- The value of the $90.00 put 6 months down-the-road with no position management (as implied in your question) is unknown at this point in time. It’s value at expiration will be the amount the put is in-the-money at expiration. If the stock value is $85.00 at expiration, the put value will be about $5.00. If share value moves above the $90.00 strike leaving the put out-of-the-money, the put will expire worthless. This is precisely why position management is critical for all option strategies. If we notice share price acceleration after buying a put, we may want to sell the option to mitigate losses.

2- The strategy you describe, I refer to as the “PCP Strategy” in my books and DVDs. Here’s a link to an article I published on this topic:

https://www.thebluecollarinvestor.com/using-put-selling-to-enter-a-covered-call-trade-at-a-discount/

We’re on the same page with this one.

Alan