Strike price selection is one of the 3 required skills for covered call writing and put-selling. When we sell in-the-money call options we are protecting our positions to the downside while still generating the time value initial profits we have established in our strategy goals. In return, we are relinquishing any opportunity to generate additional profit from share appreciation. Another way to state this approach is that intrinsic value protects time value.

When to consider in-the-money call options

- Bear markets

- Volatile markets

- Pre-event (Brexit, elections, Fed watch etc.)

- Satisfies personal risk-tolerance

Methodology to select in-the-money call strikes

After establishing a watch list of eligible securities, we must select our target initial time value returns whether they are for in-the-money, at-the-money or out-of-the-money strikes. In my case, I target monthly 2% – 4% time-value in most market conditions and up to 6% returns in bull markets. For in-the-money strikes, the time value is calculated as follows:

Total option premium – Intrinsic value = Time value

Real-life example with Control4Corp (NASDAQ: CTRL)

With CTRL, a stock on our Premium Watch List at the time of this writing, trading at $32.78 on 11/8/2017, we will view the option chain for the 5-week expiration (11/15/2017):

CTRL: 5-Week Options Chain

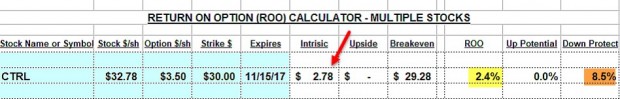

The $30.00 in-the-money strikes shows a bid price of $3.50. We cannot count this entire premium as initial profit because we can lose $2.78 on the sale of the stock. The Ellman Calculator will deduct this intrinsic value component to yield a time value initial profit. The $2.78, however, does represent protection of the time value. Consider the intrinsic value as an insurance policy paid for by the option buyer, not by us, the option-sellers. Let’s feed this information into the multiple tab of the Ellman Calculator.

The Ellman Calculator

CTRL: Calculations with the Ellman Calculator

Once the blue cells are filled with the options chain information, the white cells will become populated. The red arrow shows the intrinsic value component of the $3.50 premium and this amount will be deducted to calculate the 2.4% initial 5-week return (yellow field). The downside protection (brown field) reflects the protection of this time value, not the breakeven (shown as $29.28). In this case the downside protection is 8.5%. This means that we are guaranteed a 5-week 2.4% return as long as share value does not decline by more than 8.5% by contract expiration. Stated differently, we are guaranteed a 2.4% return as long as share value does not decline from $32.78 to below $30.00 by contract expiration. It is important to remember that the trade-off is that should share value appreciate, we will not participate in those gains.

Discussion

Selling in-the-money call strikes offers downside protection of the initial time value profits but will not allow for additional income from share appreciation. The approach can be summarized as intrinsic value protects time value.

Upcoming event

American Association of Individual Investors: Charlotte NC Chapter

Saturday June 9th 9 AM – 12 PM

“How to Generate Monthly Cash Flow and Buy a Stock at a Discount Using Two Low-Risk Option Strategies”

All Stars of Options event at The Las Vegas Money Show at the Bally’s Hotel

Thanks to all our BCI members who attended and filling the room:

Market tone

This week’s economic news of importance:

- Retail sales April 0.3% (expected)

- Home builders index May 70 (last 68)

- Business inventories March 0.0% (last 0.6%)

- Housing starts April 1.287 million (1.290 million expected)

- Building permits April 1.352 million (1.377 million last)

- Industrial production April 0.7% (0.6% expected)

- Weekly jobless claims week ending 5/12 222,000 (215,000 expected)

- Leading economic indicators April 0.4% (last 0.4%)

THE WEEK AHEAD

Mon May 21st

- Chicago national activity index April

Tue May 22nd

- None scheduled

Wed May 23rd

- Markit manufacturing PMI May

- Markit services PMI May

- New home sales April

Thu May 24th

- Weekly jobless claims through 5/19

- Existing home sales April

Fri May 25th

- Durable goods orders April

- Consumer sentiment index May

For the week, the S&P 500 moved down by 0.54% for a year-to-date return of 1.47%

Summary

IBD: Confirmed uptrend

GMI: 6/6- Buy signal since market close of April 18, 2018

BCI: Selling an equal number of in-the-money and out-of-the-money for new positions.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a neutral to slightly bullish tone. In the past six months, the S&P 500 was up 4% while the VIX (13.41) moved up by 22%.

Wishing you much success,

Alan and the BCI team

Alan,

I have a question on 20/10 guideline (to buy back the options). I have noticed that as we are approaching the expiration the OTM calls do depreciate to low values needed in the 20/10 guidelines. However, the ITM or deep ITM calls never drop that low because of their intrinsic value. In fact they could go up as the stock’s value goes up because of the high delta that they have.

Am I correct to conclude that we close the ITM or deep ITM calls as soon as their time value drops to 0? (if indeed makes sense to close them). If that is the case then we could close them mid-cycle (unwind strategy) as you have very clearly demonstrated in your material. If you could shed some light on my thinking here, I would greatly appreciate it.

Thank you!

Kaveh

Kaveh,

You’re on the right track here…nice going.

Deep ITM calls will depreciate in time value quicker than OTM strikes because of their higher Delta. Mid-contract, we close both legs of the trade (short call and long stock) when the time value approaches zero. The guideline we use is that if we can generate more than 1% over the cost-to-close in a new position, we execute the “mid-contract unwind exit strategy” (MCU exit strategy)

Let’s take the same scenario as expiration Friday approaches where time value is approaching zero. At this point, there is no time value to generate in a new position for the same contract month so we decide whether “rolling” is an exit strategy consideration. In this case, it is important to check the earnings report date for the upcoming contract consideration.

For more information on the MCU exit strategy:

Complete Encyclopedia- Classic edition: pages 264 – 271

Complete Encyclopedia- Volume 2: pages 243 – 252

Alan

Alan:

Great! I am delighted to hear from you that I am on the right track! I think it is coming together for me. I am a somewhat conservative investor and the ITM calls ( when it makes sense to use them) appeal to me because of their high premiums and their protection. But I had a problem with their intrinsic values….Because I could see that buying them back would create a net debit in my cash account because of their typically high intrinsic values. Now I can see that (if the situation is right) we can close them and get our ‘buy downs’ back. Moreover, selling the underlying rising stock (almost at the same time) makes the ‘buy downs’ a realized return whereas they were unrealized before. Then by buying a new stock and a new option in the same cycle we create more income in the same cycle…..thus a debit in the cash account ( as a result of the high buy back cost) can be eliminated using the MCU strategy. This looks like a great strategy and a very intelligent approach…. Especially since we are doing it relatively early and quickly in the cycle. Again please let me know if I am off…. but I think I’ve got it with respect to the management of the ITM situations.

On a different note, I am planning to buy your book (Encyclopedia) which I’m sure is going to be a great resource, but which one do you recommend? the classic edition or volume-2 edition?

Thanks,

Kaveh

Kaveh,

You’re still on the right track. ITM strikes lower cost basis more than ATM and OTM strikes because of the additional intrinsic value component of the option premium. If we decide to close the ITM short call, the intrinsic value cost-to-close is “offset” by the now additional share value created by removing the ITM strike restriction. The disadvantage of ITM strikes relate to the fact that we will not be able to participate in any share appreciation after the trade is entered. The MCU strategy should always be considered if share price continues to rise.

The “Complete Encyclopedia…”: classic edition should be read before Volume 2

Alan

Hi, Alan & what a great resource your website is !

I have a long-term core holding of 2kg gold in my SIPP (UK equivalent of IRA), so $75k or so – the point being that I am not too concerned if it has periods of decline – so I thought to add a simple sell cash covered puts>if/when assigned, sell covered calls>if/when called restart cycle method using GLD. Probably one strike OTM for both puts & calls on a monthly / 6 week cycle.

I have read McMillan on Options and also Leroy Gross'”Conservative Guide to Options”, what of your service is most relevant to my endeavour, please ?

Thanks & greetings from the unusually sunny Netherlands, where I presently live.

Best regards, Jeremy.

Jeremey,

The strategy you reference, I call the PCP (put-call-put) strategy. It is a solid strategy for those who have mastered the 3-required skills (stock selection, option selection and position management) for both put-selling and covered call writing.

I prefer Monthly options but GLD has strong option liquidity so both Monthly and 6-week time frames will work. Aside from mastering those required skills (including knowing when to close the short calls or puts), we must also be sure the option returns meet our return goals. In the case of GLD, initial time value returns based on this model would be less than 1% per month.

One final thought: In bear or volatile markets, consideration should be given to in-the-money covered calls for additional protection to the downside.

Thanks to Jay for his excellent response.

Alan

Good morning Jeremy (It’s still morning in the States)

I have never visited the Netherlands but understand it is beautiful. Alan will get back to you but I am a long time holder of GLD in my US IRA and usually over write at least part of it near the money on the high side every month. More so lately since it has been behaving somewhat bearishly but it is an investment for portfolio balance and not a trade.

Should it wander ITM every now and then I usually buy the option back and roll it out and up. But even it assigned I then sell a near the money underneath cash secured put on a down day and resume the premium flow that way until I re-establish the position.Gold is not exactly a speeding train or biotech stock you need to chase :)! If SIPP works like US IRA’s none of that is a taxable event until ultimate withdrawal of funds.

Have a great weekend! – Jay

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 05/18/18.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are near the end of Earnings Season, be sure to read Alan’s article,”Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

[email protected]

Alan,

About Exit strategies:

– Do you sell the shares if the price has declined 8-10% regardless of the reason for the fall? I understand that if the reason for the fall is company specific, say for example, corporate fraud then we need to buy back the option at any cost and sell the shares immediately.

– What if the 8-10% fall is due to a non-company specific event such as panic selling? Do you still sell the shares as per 20/10% guideline?

I also noticed that in some of the examples given in your book on Exit Strategies, you have rolled down, as opposed to selling the shares, even when the price had fallen by more than 8-10%. These shares had also recovered later or enabled to reduce losses thereby justifying your decision to stay with the stock.

Thanks,

Duminda

Duminda,

The guideline I use is that if the stock performance is significantly under-performing that of the overall market (S&P 500), I will sell the underlyings after closing the short call. If the price decline was related to overall market downturn, I will lean to waiting to ‘hit a double” (after closing the short call) if early in the contract or rolling down in the latter half of a contract.

“Exit Strategies for Covered Call Writing” was published in 2009 so many of the stocks had gone down in value due to the recession and overall severe market weakening.

Alan

To all HQY Healthequity investors…

I am posting on my cellthe first time so let’s see how this works…

Just checked 5/18 premium report. Last weeks ER was 6/18. On the new report it is 6/4 and I verified this on earningswhisper web site.. So I must unwind before ER date.

I rolled out and up 2 contracts HQY at 73.51 strike 70 to Strike 75 on 2 accounts with 4.6% static net gain and 6.5% if evercised with expiration Friday 6/15. No more.

The old gain at strike 70 was 1.4% if assigned. I paid 3.59 for the BTC and 2.25 for the sell to open for the roll out up. In order to salvage the 1.4% I need to make up the time value of the BTC (.02/share) and 2 commissions (0.10 /share) = 0.12 . That is almost 0.2% (.12/70).

Current position delta is 1 (Stock) – .4626 (delta of short call at .current strike 75) = 0.5374. So my profit would increase 0.54 if HQY rises $1. I only need 0.12 which is about 1/4 or 0.25 in underlying price. I need to unwind 73.51+ 0.25 = 73.76 or better.

Closing Current price on 5/18 of HQY is 73.72. Almost there. If HQY keeps rising to higher levels I may do better than 1.4%.

Mario

Correction. The time value of the BTC to strike 70 is 0.08, not 0.02. (3.59 (premium) – (73.51 -70 intrinsic)) = 0.08. Adding the commission factor of 0.10, the needed rise in the profit or gain = 0.18. That’s 0.3% loss (.18 / 70). That’s significant.

With a position delta of 0.5374, the 0.18 increase is a change of 0.34 in the underlying price (0.18 / .0.5374).

So needed rise in HQY price is to 73.85 (73.51 + 0.34) to guarantee my original 1.4% ITM profit and nullify the roll out and up.

Mario

I have started to use a late collar strategy (I call it mid-contract profit lock-in) as an alternative to the mid-contract unwind in certain cases where the bid-ask spread on the in-the-money option becomes too wide to create a favorable exit.

I have noticed that the bid-ask spread on the put at the same strike price as a way in-the-money call will often be much less wide than the bid-ask spread on the in-the-money call. This offers an alternate way to lock-in profits by purchasing the put in cases where the mid-contract unwind cannot be accomplished at a favorable price.

It is best used for the following circumstances:

1. The stock has earnings next month so you are looking to have it called away and will not be able to use a roll out or roll out and up at expiration anyways.

2. The stock has increased sharply but is still at risk to reverse back down ( high beta stocks ).

3. You want to completely eliminate risk in the position ( say you are on vacation and won’t be able to effectively monitor and manage any position adjustments ).

4. The stock is problematic for legging out of the position, and a combined stock-option order will not execute at a favorable price.

I have noticed a few situations recently where this strategy could be effectively used to lock in profits and prevent losses ( example I had ENTG 35 call strike in the April expiration cycle ).

Hey Mike,

Thanks for the idea, I will look into that further! Please remember to sell any puts that you buy that go ITM at or before expiration or your broker will assign you the shares at the strike above market.

Just sitting here on a hot New Orleans Sunday afternoon doing my usual thinking and planning for a new expiry. It really is an interesting time in the market. The major stock indexes are all above their 50 day MA’s while TLT and GLD are below theirs

Isn’t this supposed to be “Sell in May and Go Away” season :)? Perhaps as with global warming market seasonality is shifting? It now seems the rough patches are later given no other factors. But it is more difficult to rhyme things with August and September I suppose :)?

My two cents, likely worth barely a penny, is I am bullish the new expiry, will let more things run than not and will sell a few CSP’s on down days. There is not much premium out there at these VIX levels anyway so it is likely a good time to just let fast horses run…- Jay

Hey Jay;

Agree with “…a good time to let fast horses run…”

Just like JUSTIFY yesterday in the Preakness!

Best;

Terry

Thanks Terry,

I am over weight Defense, Tech and Health Care at the moment and likely will not do much over writing for June. The premium just is not there versus the upside in my view.

Since my earlier post I came up with a rhyme: “Try to remember to buy in September” ( a rip on the old songl ).

We shall see if that catches on :)? – Jay

What about the tax implications of selling an in-the-money covered call? It is my understanding that if you are more than one strike in-the-money the IRS considers that you are “fully hedged” and they change the holding period which could mean you lose any Long-Term capital gain holding period potential tax treatment when/if you sell the underlying. Do you cover this in your materials?

Fred

Fred,

I stay away from tax questions because I am not a tax expert and tax laws are constantly changing. That said, in the BCI methodology, when selling covered calls against shares in a long-term buy-and-hold portfolio (portfolio overwriting), we only use out-of-the-money strikes so diminishing or “frozen” holding periods would not apply. Any feedback from CPAs/tax advisors in our BCI community is welcome.

Alan

Alan,

I have a question regarding the bid-ask spread. Sometimes even though the open interest is very high, the spread is still wide. I have attached an image of the option link for the company Viper Energy, VNOM for an easier explanation. If you would please note that for the 30 ITM call, the open interest is pretty high about 6437. Yet the spread is 1.25. So If I were to hypothetically close this call and use the midpoint rule, then I would use 1.67. Do you think 1.67 would have been acceptable? and what is your perspective on ask-spreads of this magnitude even when the open interest is well above 100? VNOM is trading at $31.78.

Again thank you very much in advance for your help!

Best

Kaveh

Kaveh,

It is unusual for an option with such high open interest to have a large bid-ask spread. I’m curious if the screenshot was taken before market opened for the new monthly contracts? That could account for the wide spread.

Below is a screenshot I created today showing a much more reasonable bid-ask spread of $0.35 for the $30.00 ITM call.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG.

Alan

Alan:

Thank you so much for the email. Yes I assumed the same thing because I took the screenshot on Sunday so I figured that things hadn’t settled down yet. But even on Monday a call that I was interested in (to sell on another stock, Etrade) had 0 open interest and yet its ask-bid spread was terrific! nevertheless, I didn’t dare to violate the open interest rules. So thinking that things would settle down Tuesday, I decided to wait till today to sell most of my contracts (even though I had bought all the 5 stocks on Monday).

That presents me with a question regarding the cost basis for the option calculations in the Ellman calculator. Because I sold the contracts on a different day than when I bought the stocks. I don’t know if that is a problem in your mind? My broker, Vanguard doesn’t have the option of buy-write for us or at least I haven’t seen it.

In any event I entered my positions today and I am very hopeful that I can be successful in this. Your BCI methodology is so intelligent and scientific (I hope you don’t mind me saying this) and it gives us the blue collar investors the tools to succeed. I realize that nobody can predict the stock market but with your methodology we have the science to make intelligent decisions. I look forward to reading your book the classic edition of the Encyclopedia.

Thank you again for your responses, I certainly appreciate the correspondence.

Best

Kaveh

Kaveh,

Unless you are writing calls on an existing buy-and-hold portfolio, shares should be purchased and calls sold at the same time, whether “legging-in” or using a buy/write combination form. This will allow us to achieve our initial time value return goals with consistency.

Please check to make sure you are paying industry-standard trading commissions.

Thank you for your very generous remarks.

Alan

Alan – I will paper-trade my way through a one month trial : what is the first date after 1 June that a monthly sequence starts, please (both ETF and stocks) – or does it not really matter, ie. there is a weekly cycle?

Secondly, are you aware of any UK or EU investors hedging their US dollar exposure with your screens ?

Thanks, Jeremy.

Jeremy,

Options contracts begin the first Monday after the 3rd Friday of the calendar month. The July contracts begin on June 18th. Option contract availability is based on the “cycle” associated with the underlying stock or ETF. All underlyings with options have the current and next month option contracts available. Here is a link to an article I published on this topic:

https://www.thebluecollarinvestor.com/stock-option-expiration-cycles-beware-of-expiration-dates/

Many of the stocks in our reports do have weekly expirations (clearly indicated in our reports) although I, personally, prefer Monthlys…nothing wrong with Weeklys as long as pros and cons are understood.

We do have a large contingent of members from the UK and EU who use our BCI screens. I believe generation of cash flow is the main motivation.

Keep in touch and let us know how you’re progressing.

Alan

Jeremy,

Search for “OIC options expiration calendar” (include the quotes) to view a 2018 calendar for the whole year at the Occ web site.

Its always the 3rd friday of the month. So some cycles have 4 weeks and some have 5 weeks.

If you are a member, you can download that same document in the member downloads area.

Mario

Alan, when you indicate an equal-number of ITM and OTM strikes in the weekly report, do you split those on the same security, or balance between securities, for example, covered calls on four stocks – two stocks have strikes all OTM, and two stocks have strikes all ITM?

Thank you!

Phil

Phil,

I do both. Since I sell between 50 – 100 contracts per month, I have the flexibility to use ITM and OTM between and within each underlying position. The stocks in bold (strongest technical signals) in our reports are the ones I am more likely to favor OTM (call) strikes.

As an example, let’s say I am selling 5 contracts for each of 2 underlyings within my portfolio (with many more positions). My overall market assessment in this hypothetical is neutral. Let’s further assume that stock A is in bold and stock B is not (mixed technicals). A typical approach would be to sell 3 OTM and 2 ITM for stock A and 2 OTM and 3 ITM for stock B. Overall, I am selling an equal number of ITM and OTM but enhancing my opportunity for greatest returns by favoring the stock that is technically stronger when I entered the trade.

If I were only selling 1 contract for each underlying, stock A would favor the OTM strike and stock B the ITM strike.

Alan

Alan,

In your book “Complete Encyclopaedia for covered call writing (Volume 1)” you have clearly stated in chapter 9 the case against protective puts. However, the markets can gap down over the week end and share prices can fall more than 8-10% when the market reopens on Monday morning.

– If the reason for such a huge fall across all markets is a catastrophic global event (I understand that these events occur very rarely) even if you had selected the best covered call writing candidates, it can leave a huge dent in your trading account because a numbers of stocks in your well diversified portfolio can get adversely affected by this, can’t it?

– Have you ever experience that?

– How long on average it will take to recoup such losses?

– Have your ever used the collar strategy to avoid such huge losses?

Thank you.

Duminda

Trading Experiences 2018 through May Expiration cycle 5/18/18:

Jay, Roni, Duminda,

Performance for Expiration Friday 5/18/18 cycle: Up 3.35%

YTD performance 1/1/18 to 5/18/18 cycle: Down 0.9%.

YTD performance – If I add back the taxes to IRS I took out and the portion of the IRA RMD’s I used to meet our budget, then I am exactly even for the year.

So I am relatively in fine shape at this point and looking for better results the rest of the year. This compares to the performance I had of 24% last year (2017) and 16% in 2016.

ETFs:

Those Oil, Gas, Services, Equipment ETF’s have been terrible this year.. When I buy, they fall and when I sell the go up. I bought XES and OIH in Jan when they peaked and then they shot down. Rolled them down. Looks like they are repeating the same story here in late May near today’s closing bell . You can add XOP to the group. I am not invested in any of these right now.

This last cycle I did recover OIH with a 1.5% after a roll down loss, yet if I had not rolled down, I would have ended up with a gain, since it started rising after roll down to strike 27.5.

I did not do as well with XES.

It is correct to say that these losses can wipe out a lot of good gains from other efforts. Consider that an 2% monthly gain on $10,000 is $200 while an 8% loss from the investment is $800.

To help mitigate the problems I have had this first part of the year I am going to keep a certain percentage of cash free for good buying opportunities when the market takes a gap down (I was 92% invested all of 2017 in the rising market). I was able to do that last cycle with CAT, HQY and GOOS. RHT however, has not done as well and hopefully it will turn for the better later. FIVE was also rewarding.

I will look at protective puts as well to protect a covered call or rising long position.

Mario

Joint Trust ETF Portfolio:

Opened in May 2017, 12 months have passed. My goal with this account was to beat my 1.5% CD rate that we had for this. On 5/18 the performance for 12 months was 3.13%, despite the price swings and some violations of my trading plan (ETFs only). To guarantee better performance in this unpredictable market, I considering selecting safer strikes for a 6-12% goal (0.5% per month to 1% per month).

Mario

Hi Mario, thanks as always for the update. And you are indeed doing fine, great May expiry!

I suspect many investors/traders are finding it a challenge to make money this year. If one is a traditionally diversified buy and hold investor with 60 % SPY, 30% TLT and 10 % GLD as a simple example SPY is only up 2% YTD while the other two are down 7% and 2% respectively.

Using tech and small caps in the mix would help as QQQ leads the way up 8% and IWM is up 5%.

We could discuss individual stocks all day. They will always be all over the map depending on many factors which can help or hinder stock option sellers. The %’s above just paint a little picture of the market YTD to measure against.

I think for cc’s or csp to cc to csp to work best one needs to use stocks off the premium list with short/monthly time horizons or higher beta ETF’s than the one’s I mentioned. Maybe QQQ/IWM?. Rarely much there on DIA/SPY/TLT/GLD.

Anyway, … have a great June expiry! – Jay

I like how you bring big picture thinking information here and tickle others minds. We all look at things differently since there are so many pieces in this pie.

I am glad I added margin level to my two individual accounts at Etrade and Fidelity. That gave me the capability to do regular vertical spreads and PMCC diagonal positions (Poor man’s CC), which are diagonal calendar spreads. Interesting how Options Action cable program uses a version of PMCC now and then and I then proceed to analyze their profit chart.

I am not using the margin at all so there are no charges and I learn new things about trading. From Fidelity I get false positives for a margin call when your short call positions are assigned and then you go long the next day on new positions. Was explained to me that my long purchase also take two days to settle so you really do not have a real margin call since the assigned calls already would have settled.

Mario

Hi Jay;

Have you had success overwriting on QQQ and IWM? How much premium do you target? When do you go uncovered? Thanks for sharing.

Best;

Terry

Good morning Mario and Terry!

Mario, I don’t know how “big picture” I am but thank you for your always kind words! I do a lot of vertical spreads and they are a logical extension of our options trading once we feel comfortable with cc’s and csp’s as a baseline. They likely require Level 2 option clearance in IRA’s but that’s an automatic request once they see you have been selling/rolling the others.

Terry, I have a large QQQ position and a smaller IWM position I acquired through the csp process for the most part. I use a 1% monthly target on index ETF’s in both the cc and csp direction.

So, for example, if I was interested in buying the next dip since the Qs are down today I could go all the way down to the July 160 put and sell it for just over 1% and Q’s would need to drop 5% for me to be assigned. But that is cash intensive and not everyone would be interested in tying up the money for that return/opportunity in that period of time.

On the cc side I don’t have anything covered at the moment except GLD which I am bearish on. I use a loose rule of thumb that if the VIX is below 15 and the indexes are above their 50 day moving averages I buy option spreads since premium is low and there is usually a general up trend in place in those conditions. I don’t over write then for the same reasons. I struggle with blocking upside more than most do but that is my issue :)! As VIX and premium rises I switch more to the sell side in options transactions.

Just one hobbyist’s trading style among countless others, for what it’s worth. Thank you for asking! – Jay

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates.

New members check out the video user guide located above the recent reports.

For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

What are your comments on the following option trading method?

1. Sell OTM puts on an individual stock, and then using part of the premium money received, 2. Purchase OTM puts on the Index where the stock can be found for protection against the down side risk of a market drop.

Thanks,

Robert

Robert,

Using protective puts (whether on an index or the stock itself) certainly has its place in a covered call writers arsenal especially for those with a low-risk tolerance. it will protect against a catastrophic gap-down. There are pros and cons using protective puts (additional protective to the downside versus the additional cost of the puts). We will be providing a lot more information on this topic in our soon-to-be-published book, “Covered Call Writing Alternative Strategies” (currently at the publisher making final edits).

Alan

Alan,

What do you think about selling deep OTM leap PUT options?

I know this breaks your rule of holding during earning call…

I want to sell a deep OTM 1 year+ leap in NFLX or FB to get the bigger cash early and pay less taxes.

Thoughts?

Alp,

When using puts, I do prefer OTM strikes unless I am selling these options to “buy a stock at a discount” and want to own the stock in the near-term.

I prefer shorter-term options to assist in circumnavigating around earnings reports as well as achieving higher annualized returns.

I prefer not to make investment decisions based on tax issues although I do understand your idea of extending the holding period to more than 1 year and 1 day.

Alan

Premium Members,

OLLI has just confirmed their next ER date. It is scheduled for 06/05/18. The Weekly Report for 05/25/18 will reflect this change.

Best,

Barry and The Blue Collar Investor Team

Hello Mario and friends.

Thank you for sharing your expiration results.

I had similar results this month (3.5%) with my purely stock/CC trades.

10 out of 11 were assigned, leaving me almost fully in cash on Monday.

I am having a difficult time placing new trades, and I am still 50% in cash today.

I now have ALGN, SCHW, ILMN, and NVDA, in the 06/15 cycle, plus CRM (rolled out from last cycle) and expiring tomorrow.

Roni

Roni,

The 3.5% is a good number for May the cycle. Congratulations.

Funny, how the volatility this year after the market’s peaceful rise in 2017, has brought new challenges in our monthly trading. It’s affected how I now select some stocks to reduce my risk exposure. I now want to wait with some cash for better price opportunities. That’s in today’s market. Doing the same last year I would have missed upside gains.

I am 75% invested now. Hold positions in BOFI (CC), KWEB (Long) NSP (Long) RHT (Long) VNOM (CC) CVX (Long) KBE (CC) XHB (Long).

Good luck,

Mario

Thanks Mario,

yes, it is a difficult year.

May was good to me, but the previous 3 months set me back quite a bit.

Yesterday I added PYPL, QCOM, NFLX, and GRUB when the 06/15 ATM calls were above 2% ROO.

So now I am fully invested again.

My belief is that I need to have as many positions as possible in each monthly options cycle, because some will probably go against me, and I need several others to cover the losses and hopefully make some profit.

Roni

Roni,

PYPL and GRUB are good picks. I looked at the numbers and chart. I also calculate the BEP and see how it relates to support levels on the down side and margin to breakeven. I don’t like to see a lot of price swings which I feel reduces my chances of having a good end of cycle outcome.

I picked up ZBRA CC today at 2.0%/2.34% OTM strike 155 and sold RHT (long) since it was under performing.

Mario

Mario,

you are totally right about being careful during volatility, and staying in cash partially until the market calms down.

I know the risk of being fully invested, but I say to myself :

“there is always something happening, plus there are 4 earnings seasons to worry about too”.

Therefore, I only stay in cash when some really big event is on the horizon, such as Brexit for example.

See you on next week’s thread.

Roni