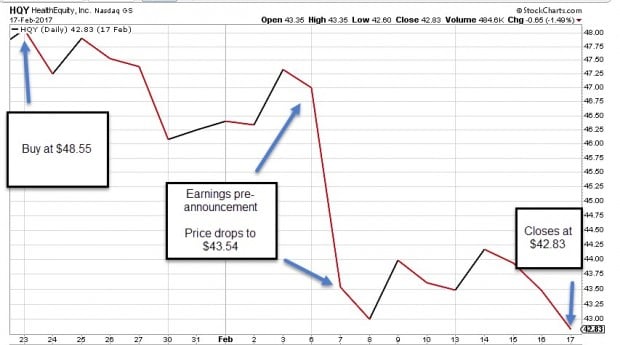

A critical BCI rule for covered call writing is never to sell an option if there is an upcoming earnings report prior to contract expiration. Earnings reports are risky events we want to avoid. From time-to-time a company will pre-announce earnings especially if there will be a negative story to tell its shareholders when the report is due out. Unlike the report itself, we cannot know the date of this disclosure and may experience significant share decline depending on the market reaction. In February, 2017, Ritchie sent me an email of a paper-trade he executed that reflected such a scenario.

Ritchie’s trade

- 1/23/2017: Buy HQY at $48.55

- 1/23/2017: Sell the February, 2017 $50.00 call for $1.45

- 2/7/2017: HQY gaps down to $43.54 as a result of an earnings pre-announcement

- 2/17/2017: HQY closes at $42.83 at contract expiration

Here is a chart showing the price movement of HQY from start to finish of the February, 2017 contract:

HQY Price Chart for February Option Contracts

Once the unexpected gap-down occurs, we can check various sites like finviz.com to research the reason for the price decline.

Ritchie’s initial returns using the multiple tab of the Ellman Calculator

HQY Calculations with The Ellman Calculator

Ritchie took a bullish position with this trade generating an initial 1-month time value return of 3% with an opportunity of an additional 3% of upside potential. There was a possibility of a 6% 1-month return.

Exit strategy opportunity

Using the 20/10% guidelines we buy back the option and look to either roll down or sell the stock. Let’s look at a roll down to the $43.00 strike:

- 2/7/2017: BTC (buy-to-close) the $50.00 call at $0.05

- 2/7/2017: STO (sell-to-open) the $40 call at $4.40

- 2/17/2017: Allow assignment and shares are sold for $40.00

Share loss if options were not sold

Shares were purchased at $48.55 and price declined to $42.83 at contract expiration. This represents an unrealized loss of $572.00 per contract…ouch!

Mitigating losses with options

Shares were sold at $40.00 representing s loss of $855.00 per contract…double ouch!! HOWEVER, we have options credits so let’s calculate:

$145.00 (-) $5.00 +$440.00 = $580.00. This represents a net realized trade loss of $275.00 per contract. Now, losing $275.00 per contract is no reason to break out the champagne but it is a lot more palatable than a loss of twice that amount had we not written options and used our management skills to mitigate this loss.

Discussion

Blue Hour webinar #7: Selecting the Best Strike Prices for Covered Call Writing in Bull and Bear Markets

Premium members can now access the latest Blue Hour webinar located on the left side of the member site:

Location of Blue Hour Webinar #7

Coming soon

1 .New book: Covered Call Writing Alternative Strategies

- Portfolio Overwriting (covered call writing with our existing portfolios)

- The Collar Strategy (covered call writing with protective puts)

- The Poor Man’s Covered Call (using LEAPS options instead of buying stock)

2. Three new calculators for each of the strategies in our new book

3. Video membership (premium members already receive these benefits)

- Entire library of “Ask Alan” videos (currently 140)

- All Blue Hour webinars

- Additional videos

- Beginner’s Corner tutorials also located on this site for your convenience

- All video content from premium site (no reports or other files)

- At least one new video added per month

4. DVD Programs will soon be available in streaming format with downloadable workbooks

New seminars added this week

May 8, 2018: Plainview New York

August 18, 2018: Denver Colorado

Market tone

Global stocks moved to all-time highs midweek before backing off slightly ahead of the weekend. Oil gained ground amid uncertainty surrounding Saudi Arabia and Venezuela, climbing to $57.20 per barrel from $54.60 last week. Volatility, as measured by the Chicago Board Options Exchange Volatility Index (VIX), rose to 11.21 from 9.5 last week. This week’s economic and international news of importance:

- The US House Ways and Means Committee, the tax-writing arm of the lower house, amended the tax reform proposal it put forth last week. The Senate Finance Committee unveiled its plan for the first time on Thursday. Among the key differences is the effective date of the proposed corporate tax cut from 35% to 20%

- According to the White House, $250 billion in trade deals were agreed during Donald Trump’s visit to Beijing. Skeptics noted many of the announced deals were not contractual obligations and some may have been agreed previously

- The US Federal Reserve will have all-new leadership as Janet Yellen’s term as chair expires in February. President Trump has nominated Fed governor Jerome Powell to succeed Yellen as chair

- Peoples Bank of China governor Zhou Xiaochuan warned again this week that his country’s financial system is becoming significantly more vulnerable because of high leverage

- Bullish sentiment is at its most elevated level in three decades. According to Investors Intelligence, 64% of newsletter writers were bullish this week, versus just 14% who were bearish. The spread between bulls and bears has been at an elevated level for six straight weeks

- Another sign of market confidence is a record level of margin debt, according to the Wall Street Journal. Margin loans grew 14% from the end of 2016 through the end of Q3

- With 90% of the members of the S&P 500 Index having reported for the third quarter, blended earnings grew 6% versus the same quarter a year ago. Stripping out insurance companies, which were hit by hurricane claims, earnings rose 8.3%

- Revenues rose 5.8% year over year

THE WEEK AHEAD

Mon Nov 13th

- None

Tue Nov 14th

- China: Retail sales and industrial production

- UK: Consumer price index

- Eurozone: Q3 gross domestic product

Wed Nov 15th

- UK: Unemployment rate

- US: Retail sales, consumer price index

Thu Nov 16th

- UK: Retail sales

- Eurozone: Consumer price index

- US: Industrial production

Fri Nov 17th

- US: Housing starts, building permits

- Canada: Retail sales, consumer price index

For the week, the S&P 500 dipped by 0.21% for a year-to-date return of 15.34%

Summary

IBD: Market in confirmed uptrend

GMI: 5/6- Buy signal since market close of August 31, 2017

BCI: My portfolio makeup reflects a slightly bullish bias, selling 3 out-of-the-money calls for every 2 in-the-money calls.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a neutral outlook. In the past six months, the S&P 500 was up 8% while the VIX (11.21) moved up by 8%.

Much success to all,

Alan and the BCI team

Premium Members,

This week’s Weekly Stock Screen And Watch List has been uploaded to The Blue Collar Investor Premium Member site and is available for download in the “Reports” section. Look for the report dated 11/10/17.

Also, be sure to check out the latest BCI Training Videos and “Ask Alan” segments. You can view them at The Blue Collar YouTube Channel. For your convenience, the link to the BCI YouTube Channel is:

http://www.youtube.com/user/BlueCollarInvestor

Since we are in Earnings Season, be sure to read Alan’s article, “Constructing Your Covered Call Portfolio During Earnings Season”. You can access it at:

https://www.thebluecollarinvestor.com/constructing-your-covered-call-portfolio-during-earnings-season/

Best,

Barry and The BCI Team

[email protected]

Alan,

On pages 26-27 of your first Encyclopedia you discuss PE and PEG ratios. Do you have a preference or is one more important than the other?

Thanks,

Daniel

Daniel,

Since many of the stocks in our Premium Stock Report our growth companies, the PE ratios would be skewed to the upside unless we factored in growth and so PEG ratios are more significant for these companies. This was a basic principle in William O’Neil’s, (founder of Investor Business Daily) screening process.

Keep in mind that PE and PEG ratios are one element of our fundamental screening which is one third of our total screening process.

Alan

Alan;

I just reviewed your video “Exchange-Traded Funds for Covered Call Writing ” and my confusion is reaffirmed.

You stated that OTM strikes are more bullish while ITM strikes will be a bearish position.

As I’ve followed your work, I believe I heard you say that an ITM strike price is a more conservative position than OTM strikes?

From my novice trading career, I feel that by using an ITM strike I have less margin of error(?) and less opportunities to end a CC trade profitably.

Please show me I am wrong! I can’t locate any information in your CC Encyclopedia showing how this ITM call will be more profitable.

I always enjoy your new articles and the Ask Alan segments and find value here.

Thank you

Jim

Jim,

OTM strikes are more bullish than ITM strikes because we have an opportunity to generate 2 income streams from both option premium and share appreciation up to the strike price. With ITM strikes our maximum profit is the time value component of the premium.

ITM strikes offer additional downside protection because of the intrinsic value component of the premium which OTM strikes do not have.

This means that OTM strikes work best in bull market environments (neutral to bullish) and ITM strikes work best in bearish and volatile markets.

In the screenshot below I created a hypothetical spreadsheet with your newly-created company Jim Corp. Note how the initial time value return on options (ROO) is similar for both but the OTM strike offers upside of 7.1% (yellow field) for a possible total 9.8% return. The ITM strike offers a 10.7% (brown field) downside protection of the 3.0% initial time value profit but no upside.

Note also the breakeven column (circled in green). The breakeven is much lower for the ITM strike ($24.25 compared to $27.25).

For more information on strike selection:

Complete Encyclopedia Classic: Pages 108 – 124

Complete Encyclopedia-Volume2: 119 – 122

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Hi Jim,

I hope this will be interesting background color to Alan’s fine reply: once upon a time there was no on-line trading. Commissions were oppressive. You had to talk to someone over the phone to execute a trade :).

That was the market I knew when I spent a brief stint as a broker in the mid 80’s. I did not have a PC. I had a Quotron with the keyboard arranged alphabetically. I could get quotes. But trades were still written out on a form with carbon copy and sent up a vacume tube to the trading floor.

That was 35 years ago. I can only wonder what it will look like 35 years from now :)?

The point of this nostalgic ramble is to comment on how things change. I was taught at Merrill Lynch any sale of a call is bearish. Any sale of a put is bullish. Few retail investors did either back then. The commissions were outrageous and you had to call me to do it!

Now we enjoy the ability to employ our strategies fluidly at our discretion. That will only get easier in the future… – Jay

Alan,

Can you explain why MKSI is no longer on our stock list. I’ve been doing really well with this stock for most of the year.

Thanks,

Ron

Ron,

The most common reason for a stock getting “bumped” from our eligible list is a technical breakdown. We all know that stock prices whipsaw and that is what gives value to our options so a recovery is definitely possible. That is why we leave stocks in our reports for 3 weeks (in the purple cells) after getting bumped before removing entirely, giving them a chance to recover and move back into the white cell section.

The chart below shows that the price of MKSI has moved down to the 20-day exponential moving average (#1) and the momentum indicators, MACD histogram (#2) and the stochastic oscillator (#3) have turned bearish.

BTW: I’ve also had this equity for a good part of this year. When a stock gets moved from white to purple cells we do NOT automatically sell it but rather manage our positions based on the exit strategy arsenal in our BCI toolbox.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

It looks like MKSI offers good returns for both itm and otm options for December contracts. I’ve had it for the past few months and plan to stay with it.

YY took me on a wild ride this contract cycle. I had to BTC early due to their earnings date change. I learned a lesson not to buy stocks with earnings date so close to the end of the cycle. Still managed to make a profit on the trade and hit a double. Always nice to learn a lesson and make a profit!

Held on to YY myself – I looked at closing early before but found the BTC price too expensive. I think too now that it’s best to avoid stocks in the week after the contract end unless they have a ‘confirmed’ tick at EarningsWhispers.

@Justin – good call holding YY. Wish I had done the same 🙂

Alan,

For the first time in 3 + years trading CCs, my call was exercised 4 days before expiration.

I am perfectly satisfied with this, as I am making my expected 2% gain.

10/23/17

Buy/write 500 WGO shares @46.93, and sold 5 WGO 11/17/2017 45.00 C for 2.83.

Today’s peak for WGO was 48.35, and is now @ 48.05 and the call is 2.30/3.60..

I wonder about the reasons for the holder to exercise ???

Your opinion please.

Roni

Roni,

Glad to learn of your successful trade.

The most likely reason for the early exercise is the ex-dividend date…see the screenshot below.

See pages 260 – 262 of the Complete Encyclopedia-Volume 2 for more information of ex-dividend dates.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Alan,

thanks for prompt response.

Of course, I should have watched the ex Div.

There are so many items to watch when trading several monthly positions, even with my focus on CC only trades I sometimes forget one item.

Usually I have 9 or 10 positions, and I tend to feel overonfident with the ITM positions.

There is always more to learn.

Roni

Hi Roni,

The primary reason for early assignment of a call is Discount Arbitrage which is an arb opportunity available when the call trades below parity (strike price plus bid < intrinsic value). This occurs when the call is reasonably ITM and expiration is nearing.

If the owner of the call sells the call at this inferior price, the market maker will simultaneously short the stock and exercise the call to book the difference. The call owner can also do this to avoid the haircut, assuming the size of the haircut is less than the commissions involved.

A pending dividend contributes to this possibility. As ex-div nears, put premium expands and call premium contracts in anticipation of the mark down. Because owners of ITM calls do not receive the dividend, they tend to sell before the ex-div date since share price will be reduced by the amount of the dividend. If that selling drives the call's premium below parity, it presents this Discount Arbitrage opportunity. It may sound like splitting hairs but the dividend doesn't directly cause the exercise/assignment. The arb arises if the selling of ITM calls prior to the drives the call's premium below parity

As an example, suppose I own the XYZ Nov $35 call and with the stock at $40, the call is trading at $4.75 x $5.20. The intrinsic value of the call is 5 points. I could place an order to sell at a better price but no one is likely to give me $5. If no one gives me a better fill, to avoid taking the 25 cent haircut, I'll exercise the call to buy XYZ at $35 and simultaneously sell 100 shares per at $40, grossing the $5 intrinsic value That night, the OCC will randomly assign someone with a short call position. Why give the MM the opportunity to do this when you can do it yourself?

For a real life example, AMGN goes ex-div by $1.15 tomorrow morning. You'll note that many of the ITM calls expiring in 3 days are trading below parity.

Spin,

thank you for the detailed explanation. It is a great lesson, and I will be wstching my ITM positions more carefully from now on.

It is very difficult for me to keep up with the everyday watch, and I just lost a nice opportunity to increase my gain with my WGO trade.

I hate to make mistakes.

Roni

Alan,

Sorry to bug, but I have a question on entering trades using your system and could not find the answer in the books or website.

1: Do you use candle patterns to time entry into a cc or only use the MACD / Stochastics?

2: When is it recommended to close the entire trade, when if breaks support or break even as an example?

3: Do you recommend the use of Delta rules when choosing strikes

Or am I over complicating the system ;-).

Thanks

Karl

Karl,

1. Although I encourage members to use the technical parameters that meet their trading style, the 4 parameters used in the BCI methodology are:

20-d and 100-d exponential moving averages

MACD histogram

Stochastic Oscillator

Volume

2. Call options are bought back using the 20/10% guidelines. A stock is sold if it is under-performing the overall market (S&P 500) otherwise other strategies should be considered (“hitting a double”, rolling down).

3. Strike selection is accomplished as follows:

Decide on the “moneyness” of the option…in-the-money (high Delta) if market assessment is bearish or volatile and chart technical mixed) and out-of-the-money calls (low Delta) if bullish and chart technical are bullish and confirming. Once the “moneyness” is established, we decide on our initial time value return goals and then look to the options chain to decide which strikes meet that criteria.

For a comparison of the “moneyness” of call and put options, see pages 20 – 23 in Volume 2 of The Complete Encyclopedia.

Alan

Karl,

Be aware that an MACD buy signal below zero may be a false signal (the shorter EMA has crossed the longer EMA but price is not appreciating). The same holds true for an MACD sell signal above the zero line.

IOW, after a sustained down move in the underlying, if the underlying trades flat, the MA’s converge (and cross) and the indicator will reverse direction and head towards zero.

You need a reference in the price domain to verify the signal’s validity. A turn upward above zero must be a legitimate signal because it can only happen when there is price appreciation.

Premium members:

This week’s 8-page report of top-performing ETFs and analysis of ALL Select Sector Components has been uploaded to your premium site. The report also lists Top-performing ETFs with Weekly options as well as the implied volatility of all eligible candidates. For your convenience, here is the link to login to the premium site:

https://www.thebluecollarinvestor.com/member/login.php

NOT A PREMIUM MEMBER? Check out this link:

https://www.thebluecollarinvestor.com/membership.shtml

Alan and the BCI team

Alan,

My name’s Kyle Ashcraft, and I am in my first month of membership with The Blue Collar Investor. I read your encyclopedia for covered call writing this month, and I watched your DVD series. In 2013 I graduated with my Finance degree and have not done much with it, so I am happy to be immersing myself in the world of investments with a systematic approach like yours.

Tomorrow marks my first month of trading covered calls in my paper money account, and I have a few questions…

1) If I know I want to roll out and up and am still one week from expiration, do I wait until I am closer to expiration Friday, or go ahead and execute? I initially bought the GrubHub November call, and once it was several dollars ITM, I bought it back to roll out to the December call. I did this one week before November’s expiration Friday.

2) When you roll down, do you sell an ITM, ATM, or OTM option? From my understanding, the roll down exit strategy is a loss mitigation strategy, so to me, it makes the most sense to get an ITM call to prevent further losses.

3) If you’re trading the day before Expiration Friday, and your stock is OTM by several dollars, can I put it in a limit sell for the underlying stock? I already know I want to get rid of the stock, so this way, I could limit my loss by $0.20-0.30 if the stock temporarily jumps up. I know then I am running the risk of a naked call, but in this example, ADBE is at $180.83 and I have the $185, so it is far OTM.

Thank you for your help!

Kyle

Hey Kyle,

I only wish I was as savvy as you at your age! I am an old buzzard so please take my comments with a grain of salt.

If you trade the important thing is get the direction right. If you don’t you will lose. Gee, you can quote me on that :)!

I am long these days. I sell CSP’s on down days and cover some of my stocks on up days. I have a market view and I stick to it. I could be very wrong between now and December expiry but I will take responsibility and own it!

My two cents as you get your trading career going is first take a step back, think about where you believe the market will be a couple months from now and place trades accordingly – Jay

” I am an old buzzard so please take my comments with a grain of salt. ”

Jay, Are you sill holding on to your vast 8-track tape collection ???

:-0

Spin,

No 8 track tapes but I do have a pile of old cassettes and vinyl record albums without the functioning equipment to play them anymore :). – Jay

Jay,

I think that in our age group, it’s quite common not to have functioning equipment anymore ;->)

Spin

Hang about Jay – aren’t you basically saying that you need to be able to correctly forecast the market direction to make a profit – something that in my experience nobody can do correctly over an extended period of time? That’s why I focus mostly on ITM cc’s – the market can move against me and I can still make a profit, so long as it’s not a BIG move (which will obviously happen occasionally, but hopefully not often enough to hurt my long term results too severely.) Or am I wrong, and you’re routinely correctly forecasting the market direction? 🙂

Justin

Justin,

I think that you have the right idea (selling ITM calls) for generating a more consistent income with a lower standard deviation. And if you avoid ownership earnings announcements, the likelihood of large adverse moves in the underlying is much lower.

Spin

Thanks Spin – how about yourself, do you believe it’s possible to predict short term market movements successfully over the long term? Re avoiding large moves, I’ve also determined I should be avoiding biotechs, airlines, stocks reporting in the week after the contract ends, and stocks linked to commodity prices such as CSTM (big mistake, didn’t do my DD properly there.) And of course, only invest in uptrending stocks.

Justin

Justin,

You can identify the trend and hope that it continues but I do not believe that anyone can successfully predict short term market movements. IOW, you can get on for the ride but how long the ride will last is a question mark.

The same holds true for overbought and oversold – you can identify it but there’s no way to know if it’s a top or bottom versus the underlying (or market) getting a lot more overbought or oversold.

Spin

What follow up action to take with an ITM covered call depends on your objectives and your risk tolerance. Here are some of mine.

1) IMHO, I would let the assignment occur and achieve the expected maximum return. Once the call is several dollars ITM, the amount of time premium available for a roll out is reduced. Always evaluate the return available for each potential write as well as the downside protection and choose the one that offers you the R/R ratio that you are most comfortable with.

As for rolling an ITM CC up and out, AFAIC, booking losses by rolling up in order to carry paper gains can be a recipe for disaster since the market has a perverse way of making you pay for that. If I choose to defend, I’ll almost always opt to book gains and carry paper losses, hoping for a reversal in my favor.

2) Rolling down is a defensive strategy to reduce losses. It will not prevent them. If you sell OTM, you get less downside protection. ATM provides more, ITM provides the most but you must then be wary of selling a CC that locks in a loss. AFAIC, if you’re bearish, take the loss and move on.

Look at the delta of the call. That number represents how much the call will deteriorate for the 1st dollar of underlying loss. Since delta declines as share price drops, the more the stock drops, the larger and larger your loss will be.

3) If your stock is OTM by several dollars on expiration day, don’t monkey around with a naked call position worth pennies. One Black Swan event could take a lot of money out of your pocket. If you want out, close both positions.

Old Buzzard #2

Spin,

this is pure gold.

Each expiration week including this last week, I was tempted to roll my winners.

At the end, I almost always decided to be assigned, and book my gains, but I was not sure that this was the best tactic.

Now, after reading your post, I feel assured, and will follow your great advice.

Thanks again – Roni

Roni,

YW. There’s no one size fits all answer. You have to evolve a set of rules that you feel comfortable with that also maximizes your chance to profit. If one is selling mildly ITM CCs and the underlying finishes mildly ITM, there’s no reason no to roll the option out if one still believes in the underlying and the next month’s return is similar to the previous month’s.

If you’re a big time roller like Jay (g) who times the market for entry, it’s a different story. But if you’re utilizing CCs as a Total Return income strategy, take the maximum amount of gain (assignment) in the shortest possible time and move on to greener pastures. Don’t marry positions because they worked out last month.

Spin

Spin,

yes, I am the low risk Totsl Return income believer.

My biggest risk is staying fully invested most of the time.

Roni

Kyle,

Congratulations on paper-trading…great way to learn before risking your hard-earned money. My responses:

1. Unless the time value component of the option premium is approaching “0”, waiting closer to expiration will be to our advantage. Time value erosion is logarithmic in nature so the near-term option time value will decline faster than the next month call option when considering rolling.

2. If rolling down in the same month, ITM calls are more conservative and afford greater protection. However, OTM calls offer the opportunity for share recovery. I will generally roll down to an OTM strike or sell the stock if extremely bearish if negative news added a new wrinkle on my previously bullish assessment.

3. No, I do not recommend this approach. If a strike is deep OTM as expiration is approaching, the time value cost-to-close will be near “0”…let’s say a few pennies. Closing the short call and then setting the limit order is a safer approach. Finally, most brokers will not approve many retail investors for naked option trading (having a short call in place without owning the underlying).

Keep up the good work.

Alan

These answers are very helpful and clearly explained. Thank you!

Kyle

Alan,

I just subscribed to your service. I’m looking for collared trade ideas: buying a high dividend stock, buying the put and selling the call as a strategy that doesn’t involve that much daily time on my part but can “juice” my annual returns. I don’t see any resources devoted to that trade. Are there any? Is there a way of calculating the risk and return on this type of trade. I’m not seeing it; however, I do see the suggested high dividend stock report but that’s about it.

Thank you for your time on this.

Philip

Philip,

In the past, I have published articles on the collar trade. In our upcoming book, “Covered Call Writing Alternative Strategies”, the collar will be highlighted in detail with specific examples, charts and graphs. The book will also cover “Portfolio Overwriting” and “The Poor Man’s Covered Call” See the screenshot below.

3 new calculators will also be available to measure the risk/reward information for all 3 strategies.

CLICK ON IMAGE TO ENLARGE & USE THE BACK ARROW TO RETURN TO BLOG

Alan

Philip –

In a standard long stock collar, you sell an OTM call and use the proceeds to buy an OTM put for every 100 shares that you own. Effectively, it’s a covered call with put protection.

Equidistant collars can be structured for no/low cost unless there is a sizable dividend pending, in which case, the put’s premium inflates and the call premium deflates, resulting in a higher collar cost.

To repeat, collared long stock is synthetically equal to a long stock with a covered call and a long put. A covered call is synthetically equal to a short put. So via substitution, a long stock collar is equivalent to a bullish put vertical spread (short put plus long more OTM put). Synthetically equal means that they will provide a similar yield. Therefore, if you are simultaneously executing the 3 legs of a collar, you can save on opening (and possibly closing) commissions by doing the spread instead.

The P&L for a vertical spread is easy. If selling it to open, the potential profit is the credit received. The potential loss is the difference in strikes less the premium received. Calculating the P&L for a collar involves 3 legs instead of 2. The potential profit is the call’s strike less the cost of the stock, plus the premium received for the option collar (or minus if it’s a debit). The potential loss is the difference in strikes less that number. If you prefer software that does this for you, Google “Option Collar Calculator”. The OIC, as well as many other web sites offer them.

I bought Alan’s ‘stock investing for students’ book and loved it and I am ready to get started. I am from the UK though so I’m just wondering if this still applies here and if so, if you could shed any light on a brokerage for me to use here?

Many thanks,

Luke.

Luke,

Download our file of “online discount brokers” from the “Free Resources” link on the top black bar of these web pages. If your plan is to use either of the mutual fund families highlighted in the book, check those first.

You’re off to a great start!

Alan