Sep 19, 2015 | Investment Basics, Option Trading Basics, Options Calculations, Stock Option Strategies

When we sell covered calls or cash-secured puts we understand the factors that go into the premiums we receive: The option’s exercise price The current price of the underlying The risk-free interest rate over the life of the option Dividends, when applicable The...

Jun 6, 2015 | Investment Basics, Option Trading Basics, Options Calculations, Put-selling, Stock Option Strategies

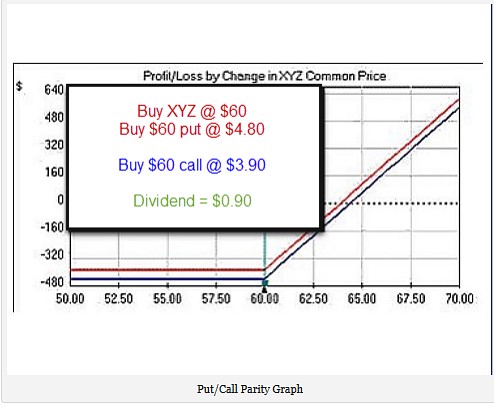

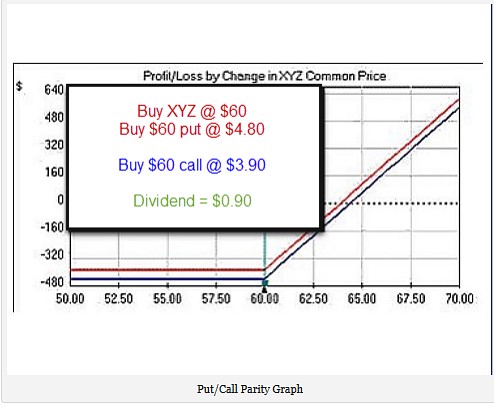

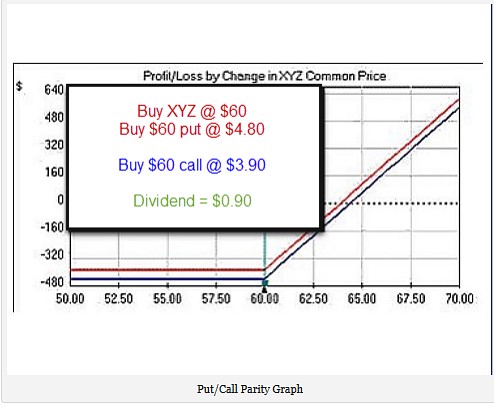

When studying covered call and put-selling option prices we learn that the market will correct any potential arbitrage opportunities. Arbitrage is the simultaneous purchase and sale of an option in order to profit from a difference in the price. It exploits price...

Feb 23, 2013 | Exchange-Traded Funds

Covered call writers can use individual stocks or exchange-traded funds as the underlying securities. Each has its own set of advantages and disadvantages. In this article we will explore the mechanism behind ETFs and evaluate the pros and cons of incorporating them...

Jan 26, 2013 | Option Trading Basics, Stock Option Strategies

One of the mission statements of The Blue Collar Investor is to share information so that we can master option trading basics and become better investors. Many times I will research and write an article based on inquiries from our members and that is why I am able to...

Nov 24, 2012 | Investment Basics, Stock Investing

Many covered call writers start their day by tuning in to CNBC. They look to the lower right side of the TV screen and see: The S&P Futures are UP 5 points…..GREAT!!!!!!!!!! Fair Value is + 10…….what’s that mean? The market is expected to open DOWN…….ughhhh……why?...